|

市场调查报告书

商品编码

1498833

ALD/high-k金属前驱体(重要材料)的全球市场,2024-2025ALD / High K Metal Precursors Market Report 2024-2025 (Critical Materials Report) |

||||||

价格

简介目录

本报告涵盖了半导体装置製造中使用的前驱物的市场前景和供应链。它还包括有关主要供应商的资讯,材料供应链中的问题和趋势,供应商市场占有率的估计和预测以及材料细分市场的预测。

范例视图

目录

第1章 执行摘要

第2章 研究范围、目的与方法

第3章 半导体产业:市场现况与展望

- 世界经济与展望

- 半导体产业与全球经济的联繫

- 半导体销售额成长

- 台湾外包厂商每月销售趋势

- 晶片销售趋势:以电子产品领域划分

- 电子产品的前景

- 汽车产业的前景

- 智慧型手机前景

- 电脑展望

- 伺服器/IT 市场

- 半导体製造业的成长与扩张

- 在晶片扩张方面投入巨资

- 美国新厂

- 全球工厂扩编推动成长

- 资本投资趋势

- 先进逻辑技术路线图

- 工厂投资评估

- 政策/贸易趋势及其影响

- 半导体材料概述

- 引进的晶圆数量:未来预测(~2028年)

- 材料市场预测(~2028年)

第4章 材料市场趋势

- CVD/ALD 金属/high-k/先进电介质前驱体的市场趋势

- 前驱市场(2023年):与2024年的联繫

- 前驱体市场前景

- 金属和high-k前驱物的出货量预测:依细分市场(未来 5年)

- 前驱供应能力、需求与投资

- 主要供应商金属及high-k前驱体产能

- 金属/high-k产量:依地区划分

- 扩大 ALD/CVD 材料产能

- 投资公告:概述

- 前驱供需平衡:概述

- 价格趋势

- 技术趋势/技术推广因素:概述

- 前驱体的整体技术概述:技术趋势

- 客户驱动的技术

- NAND 路线图与挑战:堆迭/分层 3D NAND 级别

- 3D NAND 製程需要进步

- 新材料和蚀刻化学物质可实现 3D NAND 微缩-PF3(G)和 MOO2CL2(S)

- 钼:基于 Lam 研究的半导体金属化新前沿

- 需要在 DRAM 製程方面取得进展

- DRAM 未来的技术问题

- Micron推出突破性 NVDRAM:双层 32 GB 非挥发性铁电记忆体,具有类似 DRAM 的效能

- 先进逻辑路线图与挑战:逻辑电晶体EST.Roadmap

- 高阶逻辑(Foundry)节点 HVM 估算

- 需要改进 ADV 逻辑流程

- 高阶逻辑:未来的技术挑战

- 光刻技术进步的影响

- CFET 架构:CFET 扩展的优势

- 无机 EUV 光阻:ALD 沉积

- 分子层沉积(MLD)

- 区域选择性沉积(ASD)

- 特殊/新兴金属及其用途

- 特殊/新兴HIGH-K及其应用

- 区域考虑因素:金属/high-k

- 区域因素与驱动因素

- EHS 与贸易/物流问题:金属、high-k、电介质

- ESH金属

- ESH high-k

- ESH 回收

- 贸易/物流问题:金属材料

- 贸易/物流问题:high-k材料

- 分析师对high-k市场趋势的评估

- 分析师对金属市场趋势的评估

第5章 供给面市场情势

- 前驱体材料的市占率

- 最新季活动:MERCK

- 最新季活动:AIR LIQUIDE

- 最新季活动:ENTEGRIS

- ADEKA

- 併购(M&A)活动与合作伙伴关係

- 工厂关闭

- 新进入公司

- MSP 推出 TURBO II(TM)蒸发器:半导体製造的下一代效率

- 新型 ZR 前驱体晶圆级二氧化锆薄膜

- 钼薄膜的进展:新型液体前驱体促进气相沉积

- Hanwha为记忆体应用提供钼沉积 ALD 设备

- 供应商或零件/产品线面临停产风险

- 分析师对领先供应商的评估

第6章 下游供应链:前驱物

- 下游(次级)供应链:供应商与市场概览

- 下游供应链:供应商和市场概述-二级范例:NOURYON 和 GELEST

- 下游供应链:供应商和市场概况-化学品和气体管理系统

- 下游供应链:供应商与市场概况-化学品配送柜

- 下游供应链:供应商和市场概览-阀门歧管盒(VMB)

- 下游供应链:供应商和市场概况-散装规格气体系统

- 下游供应链:供应商和市场概况-气柜

- 下游供应链:供应商和市场概况-成型气体和掺杂剂气体混合器

- 下游供应链:供应商和市场概览:化学品-监测和分析系统

- 底层材质:CVD/ALD 前驱体的趋势

- 底层材质:工业级与半导体级

- 半导体级底层材料供应商的国际网络:Merck

- 半导体级底层材料供应商的国际网路:Air Liquide

- 半导体级下层材料供应商最新讯息

- 下游供应链中断

- 下游供应链工厂最新讯息

- 下游供应链工厂的最新资讯:HAFNIA 和 REO(DUBBO PROJECT)

- 对半导体产业所使用的矿物的依赖

- 下游供应链的趋势:钴

- 下游供应链的趋势:锆/铪

- 下游供应链的趋势:铪

- 下游供应链的趋势:镓

- 铝

- 钛

- 钨

- 钼

- 铌钽

- 稀土

- 下游供应链的趋势:PGM

- 下游供应链的趋势:锗

- 下游供应链:分析师评估

第7章 供应商简介

- ADEKA CORPORATION

- AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- 20家以上其他公司

简介目录

This report covers the market landscape and supply-chain for Precursors used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 PRECURSORS BUSINESS - MARKET OVERVIEW

- 1.2 PRECURSORS MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT: METAL AND HIGH-K PRECURSORS

- 1.4 PRECURSOR TRENDS

- 1.5 PRECURSOR TECHNOLOGY TRENDS

- 1.6 COMPETITIVE LANDSCAPE METAL & HIGH-K PRECURSORS

- 1.7 PRECURSOR EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.8 ANALYST ASSESSMENT OF METAL AND HIGH-K PRECURSORS

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 MATERIAL MARKET TRENDS

- 4.1 CVD, ALD METAL & HIGH-K AND ADVANCED DIELECTRIC PRECURSORS MARKET TRENDS

- 4.1.1 2023 PRECURSOR MARKET LEADING INTO 2024

- 4.1.2 PRECURSOR MARKET OUTLOOK

- 4.1.3 METAL AND HIGH-K PRECURSORS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 4.2 PRECURSORS SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.1 METAL & HIGH-K PRECURSOR PRODUCTION CAPACITY OF TOP SUPPLIERS

- 4.2.2 METAL & HIGH-K PRODUCTION BY REGION

- 4.2.3 ALD/CVD MATERIAL PRODUCTION CAPACITY EXPANSIONS

- 4.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2.5 PRECURSORS SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.3 PRICING TRENDS

- 4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.4.1 PRECURSOR GENERAL TECHNOLOGY OVERVIEW & TECHNOLOGY TRENDS

- 4.4.2 CUSTOMER DRIVEN TECHNOLOGIES

- 4.4.3 NAND ROADMAPS AND CHALLENGES - 3D NAND LEVELS W/ STACKS/TIERS

- 4.4.4 3D NAND PROCESS ADVANCES REQUIRED

- 4.4.5 NEW MATERIALS AND ETCH CHEMISTRIES ENABLE 3D NAND SCALING - PF3(G) AND MOO2CL2(S)

- 4.4.6 MOLYBDENUM: THE NEW FRONTIER IN SEMICONDUCTOR METALLIZATION ACCORDING TO LAM RESEARCH

- 4.4.7 DRAM PROCESS ADVANCES REQUIRED

- 4.4.8 DRAM FUTURE TECHNOLOGY CHALLENGES

- 4.4.9 MICRON UNVEILS BREAKTHROUGH NVDRAM: A DUAL-LAYER 32GBIT NON-VOLATILE FERROELECTRIC MEMORY WITH NEAR-DRAM PERFORMANCE

- 4.4.10 ADVANCED LOGIC ROADMAPS AND CHALLENGES - LOGIC TRANSISTOR EST. ROADMAP

- 4.4.11 ADVANCED LOGIC (FOUNDRY) NODE HVM ESTIMATE

- 4.4.12 ADV LOGIC PROCESS ADVANCES REQUIRED

- 4.4.12.1 THE SEMICONDUCTOR SHOWDOWN: SAMSUNG AND TSMC'S GAA FETS VS. INTEL'S RIBBONFET

- 4.4.13 ADV LOGIC FUTURE TECHNOLOGY CHALLENGES

- 4.4.14 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY

- 4.4.14.1 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY - DSA

- 4.4.14.2 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: CENTURA SCULPTA BY APPLIED MATERIALS: SHAPING THE FUTURE OF SEMICONDUCTOR MANUFACTURING

- 4.4.14.3 ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: LINE EDGE ROUGHNESS REDUCTION THRU DEPOSITION

- 4.4.15 CFET ARCHITECTURE: CFET SCALING ADVANTAGE

- 4.4.15.1 CFET ARCHITECTURE: COMPLEMENTARY FETS (CFETS)

- 4.4.15.2 CFET ARCHITECTURE: CFET FUTURE PROSPECTS

- 4.4.16 INORGANIC EUV RESIST - ALD DEPOSITED

- 4.4.17 MOLECULAR LAYER DEPOSITION (MLD)

- 4.4.17.1 TREND IS MLD COMBINED WITH ALD

- 4.4.17.2 DIFFERENT TYPES OF MLD PRECURSORS AND MATERIALS

- 4.4.17.3 MLD APPLICATIONS

- 4.4.18 AREA SELECTIVE DEPOSITION (ASD)

- 4.4.18.1 AREA SELECTIVE DEPOSITION (ASD) - ADEKA PRESENT ASD HF-PRECURSOR

- 4.4.18.2 AREA SELECTIVE DEPOSITION (ASD) - TU EINDHOVEN SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- 4.4.20 SPECIALTY/EMERGING METAL AND APPLICATIONS

- 4.4.21 SPECIALTY/EMERGING HIGH-K AND APPLICATIONS

- 4.5 REGIONAL CONSIDERATIONS - METAL AND HIGH-K

- 4.5.1 REGIONAL ASPECTS AND DRIVERS

- 4.6 EHS AND TRADE/LOGISTIC ISSUES - METALS, HIGH-K AND DIELECTRICS

- 4.6.1 ESH METALS

- 4.6.2 ESH HIGH-K

- 4.6.3 ESH RECYCLING

- 4.7 TRADE/LOGISTICS ISSUES - METAL MATERIALS

- 4.7.1 TRADE/LOGISTICS ISSUES - HIGH-K MATERIALS

- 4.8 ANALYST ASSESSMENT OF HIGH-K MARKET TRENDS

- 4.8.1 ANALYST ASSESSMENT OF METAL MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 PRECURSOR MATERIAL MARKET SHARE

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.1.1.1 MERCK

- 5.1.2 CURRENT QUARTER ACTIVITY - AIR LIQUIDE

- 5.1.2.1 AIR LIQUIDE

- 5.1.3 CURRENT QUARTER ACTIVITY -ENTEGRIS

- 5.1.3.1 ENTEGRIS

- 5.1.4 ADEKA

- 5.1.4.1 ADEKA

- 5.1.1 CURRENT QUARTER ACTIVITY - MERCK

- 5.2 M&A ACTIVITY AND PARTNERSHIPS

- 5.3 PLANT CLOSURES

- 5.4 NEW ENTRANTS

- 5.4.1 MSP LAUNCHES TURBO II(TM) VAPORIZERS: NEXT-GEN EFFICIENCY FOR SEMICONDUCTOR FABRICATION

- 5.4.2 A NEW ZR PRECURSOR WAFER-SCALE ZIRCONIUM DIOXIDE FILMS

- 5.4.3 ADVANCES IN MOLYBDENUM THIN FILMS: NEW LIQUID PRECURSORS BOOST VAPOR PHASE DEPOSITION

- 5.4.4 HANWHA TO SUPPLY ALD EQUIPMENT FOR MOLYBDENUM DEPOSITION FOR MEMORY APPLICATIONS

- 5.5 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.6 TECHCET ANALYST ASSESSMENT OF PRECURSOR SUPPLIERS

6 SUB-TIER SUPPLY-CHAIN, PRECURSORS

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - TIER 2 EXAMPLES NOURYON AND GELEST

- 6.1.2 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL & GAS MANAGEMENT SYSTEMS

- 6.1.3 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - CHEMICAL DELIVERY CABINETS

- 6.1.4 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW VALVE MANIFOLD BOXES (VMB)

- 6.1.5 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - BULK SPEC GAS SYSTEMS

- 6.1.6 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - GAS CABINETS

- 6.1.7 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW - FORMING GAS & DOPANT GAS BLENDERS

- 6.1.8 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW CHEMICAL - MONITORING AND ANALYTICAL SYSTEMS

- 6.2 SUB-TIER MATERIAL CVD & ALD PRECURSOR TRENDS

- 6.3 SUB-TIER MATERIAL INDUSTRIAL VS. SEMICONDUCTOR-GRADE

- 6.4 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK MERCK

- 6.5 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER GLOBAL NETWORK AIR LIQUIDE

- 6.6 SEMICONDUCTOR-GRADE SUB-TIER MATERIAL SUPPLIER NEWS

- 6.7 SUB-TIER SUPPLY-CHAIN: DISRUPTIONS

- 6.8 SUB-TIER SUPPLY-CHAIN PLANT UPDATES

- 6.9 SUB-TIER SUPPLY-CHAIN PLANT UPDATES - HAFNIA AND REO FROM THE DUBBO PROJECT

- 6.10 MINERAL USED IN THE SEMICONDUCTOR INDUSTRY DEPENDENCIES

- 6.11 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - COBALT

- 6.12 SUB-TIER SUPPLY-CHAIN PRICING TRENDS: ZIRCONIUM AND HAFNIUM

- 6.13 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - HAFNIUM

- 6.14 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - GALLIUM

- 6.15 ALUMINUM

- 6.16 TITANIUM

- 6.17 TUNGSTEN

- 6.18 MOLYBDENUM

- 6.19 NIOBIUM AND TANTALUM

- 6.20 RARE EARTHS

- 6.21 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - PGM

- 6.22 SUB-TIER SUPPLY-CHAIN PRICING TRENDS - GERMANIUM

- 6.23 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- ADEKA CORPORATION

- AIR LIQUIDE (MAKER, PURIFIER, SUPPLIER)

- AZMAX CO., LTD

- CITY CHEMICAL LLC

- DNF CO., LTD

- ...AND 20+ MORE

FIGURES

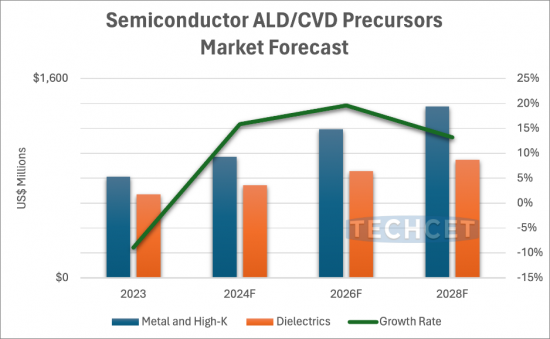

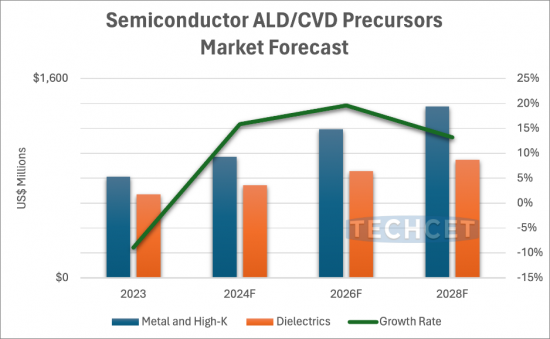

- FIGURE 1.1: METAL & HIGH-K PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 1.2: WW MARKET SHARE - METAL & HIGH-K PRECURSORS 2023 (U$ 811 M)

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: METAL & HIGH-K PRECURSOR REVENUE (M USD) FORECAST BY SEGMENT

- FIGURE 4.2: MEMORY SUPPLY/DEMAND SITUATION 2024

- FIGURE 4.3: WW MARKET SHARE - METAL & HIGH-K PRECURSORS 2023 (U$ 811 M)

- FIGURE 4.4: REGIONAL MARKET SHARES

- FIGURE 4.5: END USE APPLICATIONS DRIVING NEW DEVICE PROCESSES

- FIGURE 4.6: 3D NAND STACKING DRIVES DIELECTRICS AND METALS PRECURSOR VOLUME

- FIGURE 4.7: 3D NAND PROGRESSION

- FIGURE 4.8: ETCH DEPTH PERFORMANCE

- FIGURE 4.9: TOKYO ELECTRON'S NEW CRYOGENIC ETCH TOOL

- FIGURE 4.10: DRAM MESH BY MICRON

- FIGURE 4.11: IMEC CAPACITORLESS IGZO CELL FOR 3D STACKED DRAM

- FIGURE 4.12: TRANSITION FROM 2D TO 3D DRAM

- FIGURE 4.13: 32 GB NVDRAM WITH 1T 1C MEMORY LAYERS

- FIGURE 4.14: GATE STRUCTURE ROADMAP

- FIGURE 4.15: ADVANCED LOGIC (FOUNDRY) NODE ROAD MAP

- FIGURE 4.16: LOGIC TRANSISTOR PROGRESSION

- FIGURE 4.17: RIBBON FET

- FIGURE 4.18: MONO LAYER NANO SHEETS CHANNELS

- FIGURE 4.19: NANO IMPRINT LITHOGRAPHY PROCESS FLOW

- FIGURE 4.20: ALD/ALE ENHANCEMENT OF NANO IMPRINT LITHOGRAPHY

- FIGURE 4.21: DIRECTED SELF-ASSEMBLY

- FIGURE 4.22: DSA PATENT FILING BY COMPANY

- FIGURE 4.23: DSA PATEN FILING SINCE 2023

- FIGURE 4.24: WHAT IS PATTERN SHAPING?

- FIGURE 4.25: REFINING EUV PATTERNING BY APPLIED MATERIALS

- FIGURE 4.26: COMPLEMENTARY FET (CFET)

- FIGURE 4.27: CFET IMPROVES PERFORMANCE IN TRACK SCALING

- FIGURE 4.28: MONOLITHIC CFET PROCESS FLOW EXAMPLE

- FIGURE 4.29: MCFET NEW FEATURE: MIDDLE DIELECTRIC ISOLATION

- FIGURE 4.30: LOW TEMPERATURE GATE STACK OPTION EXAMPLES

- FIGURE 4.31: LOW TEMPERATURE SD/CONTACT OPTION EXAMPLES

- FIGURE 4.32: BSPDN ADVANTAGE: IR DROP REDUCTION

- FIGURE 4.33: INCREASING NUMBER OF ALD STEPS REQUIRED BY NEXT GENERATION GAA-FET AND CFET

- FIGURE 4.34: IMEC SUB-1NM TRANSISTOR ROADMAP, 3D-STACKED CMOS 2.0 PLANS

- FIGURE 4.35: PATENT FILING FOR MLD DEPOSITED EUV RESIST - SEARCH PERFORMED IN PATBASE

- FIGURE 4.36: MOLECULAR LAYER DEPOSITION VS ATOMIC LAYER DEPOSITION

- FIGURE 4.37: INCREASING TREND OF ALD/MLD PUBLICATIONS

- FIGURE 4.38: ADEKA ASD-HF PRECURSORS

- FIGURE 4.39: SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- FIGURE 4.40: SPECIALTY/EMERGING METAL APPLICATIONS

- FIGURE 4.41: SPECIALTY/EMERGING HIGH-K APPLICATIONS - NVM DRAM (MICRON IEDM2023)

- FIGURE 4.42: 2023 METAL & HIGH-K REVENUE SHARE BY REGION

- FIGURE 4.43: EHS ISSUES - HIGH-K: MINING IN CHINA

- FIGURE 4.44: SK HYNIX'S RECYCLED AND RENEWABLE MATERIALS TARGETS

- FIGURE 5.1: 2023 PRECURSOR MATERIAL SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 5.2: MERCK ELECTRONICS REVENUE 2022-2023 (M EUR), LEFT - SEMICONDUCTOR SOLUTIONS ANNUAL REVENUE FORECAST (M EUR), RIGHT

- FIGURE 5.3: AIR LIQUIDE ELECTRONICS REVENUE FORECAST (M EUR)

- FIGURE 5.4: THE MS (MATERIAL SOLUTIONS) DIVISION OF ENTEGRIS REVENUE FORECAST

- FIGURE 5.5: ADEKA REVENUE ELECTRONICS REVENUE FORECAST (100M JPY)

- FIGURE 5.6: NEW ZIRCONIUM PRECURSOR CLASS

- FIGURE 5.7: ADVANCES IN MOLYBDENUM THIN FILMS: NEW LIQUID PRECURSORS BOOST VAPOR PHASE DEPOSITION

- FIGURE 6.1: FORMING GAS BLENDER CONFIGURATION

- FIGURE 6.2: TOP COUNTRIES/REGIONS THAT SUPPLY VERSUM MATERIALS US LLC (PANJIVA APRIL 2024)

- FIGURE 6.3: TOP COUNTRIES/REGIONS THAT SUPPLY AIR LIQUIDE AMERICA CORP. (PANJEIVA APRIL 2024)

- FIGURE 6.4: TOP COUNTRIES/REGIONS THAT SUPPLY H.C. STARCK INC. (USA)

- FIGURE 6.5: PRICE TREND IN COBALT

- FIGURE 6.6: HAFNIUM 5-YEAR PRICING

- FIGURE 6.7: GALLIUM PRICE, 5 YEAR HISTORICAL

- FIGURE 6.8: RUTHENIUM AND PLATINUM, 5-YEAR HISTORICAL PRICING

- FIGURE 6.9: GERMANIUM PRICE, 5-YEAR HISTORICAL

TABLES

- TABLE 1.1: METAL AND HI-K PRECURSORS REVENUES AND GROWTH RATES

- TABLE 1.2: ESTIMATED METAL AND HIGH-K PRECURSOR MARKET SHARE BY SUPPLIER 2023

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: PRECURSORS REVENUE AND GROWTH RATES

- TABLE 4.2: METAL AND HI-K PRECURSORS REVENUES AND GROWTH RATES

- TABLE 4.3: ESTIMATED METAL AND HIGH-K PRECURSOR MARKET HARE BY SUPPLIER 2023

- TABLE 4.4: METAL & HIGH-K PRECURSOR MARKET REGIONAL ASSESSMENT 2023

- TABLE 4.5: OVERVIEW OF ANNOUNCED 2023/2024 MATERIAL SUPPLIER INVESTMENTS

- TABLE 4.6: LEADING EDGE LOGIC DESCRIPTIONS BY NODE (TSMC, INTEL)

- TABLE 4.7: SELECTIVE DEPOSITION - SELECTIVELY DEPOSITED MATERIALS

- TABLE 4.8: REGIONAL PRECURSOR MATERIAL MARKETS

- TABLE 4.9: REGIONAL PRECURSOR MATERIAL MARKETS, CONTINUED

- TABLE 5.1: MERCK QUARTER FINANCIALS

- TABLE 5.2: AIR LIQUIDE CURRENT QUARTER FINANCIALS

- TABLE 5.3: ENTEGRIS SUPPLIER CURRENT QUARTER FINANCIALS

- TABLE 6.1: CVD AND ALD PRECURSOR

- TABLE 6.2: ORIGIN OF MINERALS USED TO MAKE PRECURSORS

- TABLE 6.3: COBALT MINING AND PRODUCTION BY LOCATION

- TABLE 6.4: ZIRCONIUM AND HAFNIUM MINERAL PRODUCTION BY LOCATION

- TABLE 6.5: GALLIUM MINERAL PRODUCTION DESCRIPTION AND DEPENDENCIES

- TABLE 6.6: ALUMINUM MINERAL REFINING AND PRODUCTION BY LOCATION

- TABLE 6.7: TITANIUM ORE (ILMENITE AND RUTILE) PRODUCTION LOCATIONS

- TABLE 6.8: TUNGSTEN ORE PRODUCTION BY LOCATION

- TABLE 6.9: MOLYBDENUM PRODUCTION AND IMPORT AND EXPORTS

- TABLE 6.10: MOLYBDENUM PRODUCTION DESCRIPTIONS

- TABLE 6.11: NIOBIUM AND TANTALUM PRODUCTION BY LOCATION

- TABLE 6.12: RARE EARTHS PRODUCTION BY LOCATION, I.E. LANTHANUM

- TABLE 6.13: PGM PRODUCTION BY LOCATION

- TABLE 6.14: GERMANIUM APPLICATIONS BY PERCENTAGE VOLUME

02-2729-4219

+886-2-2729-4219