|

市场调查报告书

商品编码

1542848

石英设备零件的全球市场:2024~2025年 (Critical Materials Report)Quartz Equipment Components Market Report 2024-2025 (Critical Materials Report) |

||||||

本报告分析了半导体装置製造中使用的石英製造零件的市场以及支援该市场的供应链。本报告包括 TECHCET 资料库的数据和分析、高级分析师经验以及一手和二手研究。主题包括高纯度石英加工零件市场、潮模砂/粉末、基材等供应链。它还包括按供应商和地区划分的供应和市场趋势预测。预测基于半导体晶圆增长、设备系统预测、技术发展和区域趋势。

信息图形

目录

第1章 摘要整理

第2章 调查范围·目的·手法

第3章 半导体产业市场现状与展望

- 世界经济和产业整体展望

- 半导体产业和世界经济的连锁

- 半导体的销售增加率

- 台湾的外包製造商月销售趋势

- 晶片的销售:电子产品的各市场区隔

- 电子产品的展望

- 汽车产业的展望

- 智慧型手机的展望

- PC的展望

- 伺服器/IT市场

- 半导体製造的成长与扩大

- 在晶片扩张方面投入巨资

- 美国新厂

- 全球工厂扩编推动成长

- 资本投资趋势

- 先进逻辑技术路线图

- 工厂投资评估

- 政策/贸易趋势与影响

- 半导体材料概述

- TECHCET晶圆输入数量预测(至2028年)

- TECHCET材料市场预测(至2028年)

第四章石英零件市场趋势

- 石英加工件业务:市场概况

- 石英加工零件市场的趋势(2023 年):2024 年之前的趋势

- 石英加工件市场前景

- 石英加工零件收入预测:按细分市场(5 年)

- 石英加工件产能:依主要供应商划分

- 石英加工件产量:依地区划分

- 扩大石英加工零件的产能

- 投资公告:概述

- 石英加工零件的供需平衡:概述

- 物价水平趋势

- 石英加工零件的一般技术概述

- 石英加工零件的一般技术概述

- 石英加工零件的应用

- 石英加工零件总结

- 石英製造零件:对晶圆尺寸和石英需求的影响

- 石英加工件的技术趋势

- 石英预製件:区域考量因素

- 区域因素与驱动因素

- EHS(环境、健康与安全)和贸易/物流问题

- 俄罗斯入侵乌克兰

- 也门胡塞武装在红海和亚丁湾的罪行扰乱了全球航运

- 新兴的中东衝突可能会扰乱全球技术供应链和英特尔的扩张计划

- 巴拿马运河历史性干旱

- EHS 问题:环境影响

- 贸易/物流问题

- 分析师对石英加工件市场趋势的评估

第五章供给面市场状况

- 石英加工件的市占率:加工市场

- 石英加工零件市场占有率:冷加工(机械加工)

- 石英加工件的市场占有率:热加工(熔化)

- 当前供应商当前活动和报告收入:Quartz(季度)

- 4家主要供应商的财务状况(2024年第一季)

- 最新季度活动:SHIN-ETSU

- 最新季度活动:TOSOH QUARTZ

- 最新季度活动:FERROTEC

- 最新季度活动:WONIK

- 最新活动:贺利氏

- 併购 (M&A) 活动与合作伙伴关係

- 工厂关闭 - 无

- 新进入者

- 石英或零件/产品线面临停产风险

- TECHCET 分析师对石英供应商的评估

第 6 章次级供应链,Quartz

- 细分供应链:供应来源与市场概述

- 石英次级供应链:市场背景

- 石英次级供应链:市场趋势

- 石英基材收入预测:按细分市场(5 年)

- 细分供应链:石英玻璃基板市场占有率

- 次级供应链:石英玻璃基板 - 管/棒市场占有率

- Subtier 供应链:石英玻璃基板 - 锭/晶锭市场占有率

- Subtier 供应链:石英基材 - 砂/粉市场占有率

- 半导体级石英二级供应商的最新讯息

- 次级供应链:颠覆

- 次级供应链併购或合作活动

- 次级供应链中的 EHS 与物流问题

- 次级供应链中的 "新" 进入者 - 无

- 次级供应链工厂的最新讯息

- 关闭下游供应链工厂 - 未报告

- 细分供应链趋势

- TECHCET 分析师对供应链进行细化评估

第 7 章供应商简介(製造商)

- 应用陶瓷有限公司

- 北京凯德石英有限公司

- 东海市宏伟石英製品有限公司

- 迪斯科技有限公司

- FERROTEC 控股公司

- …其他20多项

第 8 章附录

- 技术趋势/技术推广因素 - 概述

- 3D NAND 製程需要进步

This report covers the market and supply-chain for Quartz Fabricated Parts used in semiconductor device fabrication, and the supporting supply chain. The report contains data and analysis from TECHCET's data base and Sr. Analyst experience, as well as that developed from primary and secondary market research. Topics include High Purity Fabricated Quartz Parts market, supply chain from raw sand/powder, and base materials. Effort has been made to provide breakdown of the supply and market by supplier as well as region. Forecasts are based on semiconductor wafer starts growth and equipment systems forecast as well as technology developments and regional dynamics.

INFOGRAPHICS

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. QUARTZ FABRICATED PARTS BUSINESS - MARKET OVERVIEW

- 1.1.1. QUARTZ FABRICATED PARTS BUSINESS - MARKET STRUCTURAL OVERVIEW

- 1.2. MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3. QUARTZ FABRICATED PARTS 5-YEAR UNIT SHIPMENT FORECAST BY SEGMENT

- 1.4. QUARTZ FABRICATED PARTS SEGMENT TRENDS

- 1.5. TECHNOLOGY TRENDS - QUARTZ FABRICATED PARTS

- 1.6. COMPETITIVE LANDSCAPE - QUARTZ FABRICATED PARTS

- 1.7. FIRST QUARTER 2024 FINANCIALS OF TOP-4 SUPPLIERS

- 1.8. EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS - QUARTZ FABRICATED PARTS

- 1.9. ANALYST ASSESSMENT OF QUARTZ FABRICATED PARTS

2. SCOPE, PURPOSE AND METHODOLOGY

- 2.1. SCOPE

- 2.2. PURPOSE & METHODOLOGY

- 2.3. OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3. SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1. WORLDWIDE ECONOMY AND OVERALL INDUSTRY OUTLOOK

- 3.1.1. SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2. SEMICONDUCTOR SALES GROWTH

- 3.1.3. TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2. CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1. ELECTRONICS OUTLOOK

- 3.2.2. AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1. ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2. INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3. SMARTPHONE OUTLOOK

- 3.2.4. PC OUTLOOK

- 3.2.5. SERVERS / IT MARKET

- 3.3. SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1. IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2. NEW FABS IN THE US

- 3.3.3. WW FAB EXPANSION DRIVING GROWTH

- 3.3.4. EQUIPMENT SPENDING TRENDS

- 3.3.5. ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1. DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2. 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6. FAB INVESTMENT ASSESSMENT

- 3.4. POLICY & TRADE TRENDS AND IMPACT

- 3.5. SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1. TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2. TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4. QUARTZ PARTS MARKET TRENDS

- 4.1. QUARTZ FABRICATED PARTS BUSINESS - MARKET OVERVIEW

- 4.1.1. 2023 QUARTZ FABRICATED PARTS MARKET LEADING INTO 2024

- 4.1.2. QUARTZ FABRICATED PARTS MARKET OUTLOOK

- 4.1.3. QUARTZ FABRICATED PARTS 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4. QUARTZ FABRICATED PARTS PRODUCTION CAPACITY OF TOP SUPPLIERS

- 4.1.5. QUARTZ FABRICATED PARTS PRODUCTION BY REGION

- 4.1.6. QUARTZ FABRICATED PARTS PRODUCTION CAPACITY EXPANSIONS

- 4.1.7. INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.1.8. QUARTZ FABRICATED PARTS SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.1.8.1. SUPPLY VS. DEMAND BALANCE - QUARTZ FABRICATED PARTS

- 4.2. PRICING TRENDS

- 4.3. QUARTZ FABRICATED PARTS GENERAL TECHNOLOGY OVERVIEW

- 4.3.1. QUARTZ FABRICATED PARTS GENERAL TECHNOLOGY OVERVIEW

- 4.3.2. QUARTZ FABRICATED PARTS APPLICATIONS

- 4.3.3. QUARTZ FABRICATED PARTS GENERAL DESCRIPTION

- 4.3.4. QUARTZ FABRICATED PARTS - WAFER SIZE AND EFFECT ON QUARTZ REQUIREMENTS

- 4.3.5. QUARTZ FABRICATED PARTS TECHNOLOGY TRENDS

- 4.4. REGIONAL CONSIDERATIONS - QUARTZ FABRICATED PARTS

- 4.4.1. REGIONAL ASPECTS AND DRIVERS

- 4.5. EHS AND TRADE/LOGISTIC ISSUES

- 4.5.1. RUSSIA INVASION OF UKRAINE

- 4.5.2. YEMEN'S HOUTHI ATTACKS IN THE RED SEA AND GULF OF ADEN DISRUPT GLOBAL SHIPPING

- 4.5.3. NEW MIDDLE EAST CONFLICT COULD DISRUPT GLOBAL TECH SUPPLY CHAIN AND INTEL'S EXPANSION PLANS

- 4.5.4. PANAMA CANAL HISTORIC DROUGHT

- 4.5.5. EHS ISSUES - ENVIRONMENTAL IMPACT

- 4.5.6. TRADE/LOGISTICS ISSUES

- 4.6. ANALYST ASSESSMENT OF QUARTZ FABRICATED PARTS MARKET TRENDS

5. SUPPLY-SIDE MARKET LANDSCAPE

- 5.1. QUARTZ FABRICATED PARTS MARKET SHARE - FABRICATION MARKET

- 5.1.1. QUARTZ FABRICATED PARTS MARKET SHARE - COLD FABRICATION (MACHINING)

- 5.1.2. QUARTZ FABRICATED PARTS MARKET SHARE - HOT FABRICATION (FUSED)

- 5.1.3. CURRENT QUARTER - SUPPLIERS' ACTIVITIES & REPORTED REVENUES - QUARTZ

- 5.1.4. FIRST QUARTER 2024 FINANCIALS OF TOP-4 SUPPLIERS

- 5.1.5. CURRENT QUARTER ACTIVITY - SHIN-ETSU

- 5.1.6. CURRENT QUARTER ACTIVITY - TOSOH QUARTZ

- 5.1.7. CURRENT QUARTER ACTIVITY - FERROTEC

- 5.1.8. CURRENT QUARTER ACTIVITY - WONIK

- 5.1.9. CURRENT ACTIVITY - HERAEUS

- 5.2. M&A ACTIVITY AND PARTNERSHIPS

- 5.3. PLANT CLOSURES - NONE

- 5.4. NEW ENTRANTS

- 5.5. SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.6. TECHCET ANALYST ASSESSMENT OF QUARTZ SUPPLIERS

6. SUB-TIER SUPPLY-CHAIN, QUARTZ

- 6.1. SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1. QUARTZ SUB-TIER SUPPLY-CHAIN MARKET BACKGROUND

- 6.1.2. QUARTZ SUB-TIER SUPPLY-CHAIN MARKET TRENDS

- 6.1.3. QUARTZ BASE MATERIALS 5-YEAR REVENUE FORECAST BY SEGMENT

- 6.1.4. SUB-TIER SUPPLY CHAIN: FUSED QUARTZ BASE MATERIALS MARKET SHARE

- 6.1.5. SUB-TIER SUPPLY CHAIN: FUSED QUARTZ BASE MATERIALS - TUBES AND RODS MARKET SHARE

- 6.1.6. SUB-TIER SUPPLY CHAIN: FUSED QUARTZ BASE MATERIALS - INGOTS AND BOULES MARKET SHARE

- 6.1.7. SUB-TIER SUPPLY CHAIN: QUARTZ BASE MATERIALS - SAND/POWDER MARKET SHARE

- 6.1.8. SEMICONDUCTOR-GRADE QUARTZ SUB-TIER SUPPLIER NEWS

- 6.2. SUB-TIER SUPPLY-CHAIN - DISRUPTIONS

- 6.3. SUB-TIER SUPPLY-CHAIN M&A OR PARTNERSHIP ACTIVITY

- 6.4. SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES - SEE SECTION 4.5

- 6.5. SUB-TIER SUPPLY-CHAIN "NEW" ENTRANTS - NONE

- 6.6. SUB-TIER SUPPLY-CHAIN PLANT UPDATES

- 6.7. SUB-TIER SUPPLY-CHAIN PLANT CLOSURES - NONE REPORTED

- 6.8. SUB-TIER SUPPLY-CHAIN PRICING TRENDS

- 6.9. SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7. SUPPLIER PROFILES (FABRICATORS)

- APPLIED CERAMICS, INC.

- BEIJING KAIDE QUARTZ CO., LTD

- DONGHAI HONGWEI QUARTZ PRODUCTS CO., LTD.

- DS TECHNO CO., LTD.

- FERROTEC HOLDINGS CORPORATION

- ...AND 20+ MORE

8. APPENDIX

- 8.1. TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 8.1.1. QUARTZ GENERAL TECHNOLOGY OVERVIEW & TECHNOLOGY TRENDS

- 8.1.2. CUSTOMER DRIVEN TECHNOLOGIES

- 8.1.3. NAND ROADMAPS AND CHALLENGES - 3D NAND LEVELS W/ STACKS/TIERS

- 8.1.4 3D NAND PROCESS ADVANCES REQUIRED

- 8.1.5. MICRON UNVEILS BREAKTHROUGH NVDRAM: A DUAL-LAYER 32GBIT NON-VOLATILE FERROELECTRIC MEMORY WITH NEAR-DRAM PERFORMANCE

- 8.1.6. ADVANCED LOGIC ROADMAPS AND CHALLENGES - LOGIC TRANSISTOR EST. ROADMAP

- 8.1.7. ADVANCED LOGIC (FOUNDRY) NODE HVM ESTIMATE

- 8.1.7.1. THE SEMICONDUCTOR SHOWDOWN: SAMSUNG AND TSMC'S GAA FETS VS. INTEL'S RIBBONFET

- 8.1.8. ADV LOGIC FUTURE TECHNOLOGY CHALLENGES

- 8.1.9. ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY

- 8.1.9.1. ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY - DSA

- 8.1.9.2. ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: CENTURA SCULPTA BY APPLIED MATERIALS: SHAPING THE FUTURE OF SEMICONDUCTOR MANUFACTURING

- 8.1.9.3. ADVANCING TECHNOLOGIES IMPLICATION TO PHOTOLITHOGRAPHY: LINE EDGE ROUGHNESS REDUCTION THRU DEPOSITION

- 8.1.10. CFET ARCHITECTURE: CFET SCALING ADVANTAGE

- 8.1.10.1. CFET ARCHITECTURE: COMPLEMENTARY FETS (CFETS)

- 8.1.10.2. CFET ARCHITECTURE: CFET FUTURE PROSPECTS

- 8.1.11. INORGANIC EUV RESIST - SPIN ON DEPOSITION

- 8.1.11.1. INORGANIC EUV RESIST - ALD DEPOSITED

- 8.1.12. SELF ALIGNED MULTI PATTERNING - SADP

- 8.1.12.1. SELF ALIGNED MULTI PATTERNING - SAQP

- 8.1.12.2. SELF ALIGNED MULTI PATTERNING - PEALD EQUIPMENT

- 8.1.12.3. SELF ALIGNED MULTI PATTERNING - CAN SAQP BYPASS EUV BEYOND 7 NM?

- 8.1.13. EUV, MULTI PATTERNING AND GEOPOLITICS

- 8.1.14. AREA SELECTIVE DEPOSITION (ASD)

- 8.1.14.1. AREA SELECTIVE DEPOSITION (ASD) - TU EINDHOVEN SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- 8.1.15. SPECIALTY/EMERGING DIELECTRIC AND APPLICATIONS

FIGURES

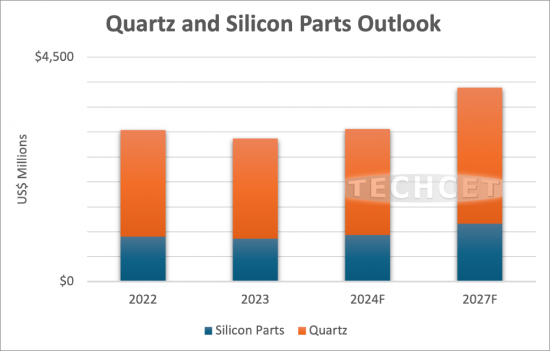

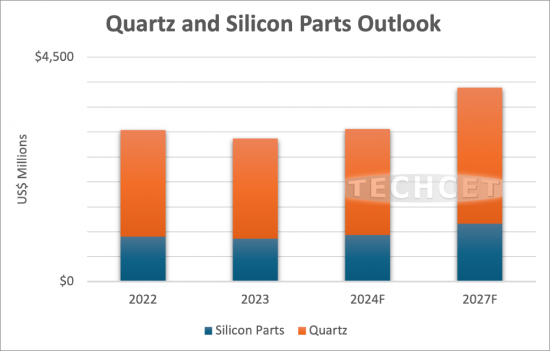

- FIGURE 1.1: QUARTZ FABRICATED PARTS REVENUE FORECAST BY SEGMENT

- FIGURE 1.2: 2023 QUARTZ SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 1.3: TOP-4 QUARTZ MAKERS' QUARTERLY COMBINED SALES (US$M)

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY HAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSII) IN 000'S OF NTD

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: QUARTZ FABRICATED PARTS REVENUE FORECAST BY SEGMENT

- FIGURE 4.2: FABRICATED QUARTZ COMPONENTS MARKET SHARE % BY SUPPLIER

- FIGURE 4.3: 2023 FABRICATED QUARTZ COMPONENTS BY REGION

- FIGURE 4.4: QUARTZ FABRICATED PARTS CAPACITY/DEMAND FORECAST

- FIGURE 4.5: QUARTZ PRODUCTS FOR SEMICONDUCTOR APPLICATIONS

- FIGURE 4.6: QUARTZ PRODUCTS FOR SEMICONDUCTOR APPLICATIONS

- FIGURE 4.7: QUARTZ PRODUCTS FOR DRY ETCH APPLICATIONS

- FIGURE 4.8: QUARTZ PRODUCTS FOR EPI APPLICATIONS

- FIGURE 4.9: 2023 QUARTZ FABRICATED PARTS REVENUE SHARE BY REGION

- FIGURE 4.10: ASSESSED CONTROL OF TERRAIN AROUND DONETSK

- FIGURE 4.11: YEMEN'S HOUTHI ATTACKS DISRUPTING GLOBAL SHIPPING

- FIGURE 4.12: MIDDLE EAST CONFLICT

- FIGURE 4.13: PANAMA CANAL SHIPPING

- FIGURE 4.14: GREENHOUSE GAS PROTOCOL, DETAILED CATEGORIES

- FIGURE 4.15: SCOPE 3 EMISSIONS FOR SEMICONDUCTOR COMPANIES

- FIGURE 5.1: 2023 QUARTZ SUPPLIER MARKET SHARE BY REVENUE (HOT & COLD)

- FIGURE 5.2: 2023 QUARTZ SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 5.3: 2023 QUARTZ SUPPLIER MARKET SHARE BY REVENUE

- FIGURE 5.4: TOP-4 QUARTZ MAKERS' QUARTERLY COMBINED SALES (US$M)

- FIGURE 5.5: TOSS CORP 2024 FINANCIALS

- FIGURE 5.6: WONIK CURRENT QUARTER FINANCIALS

- FIGURE 5.7: #2 HERAEUS CONSOLIDATED 2023 FINANCIALS

- FIGURE 6.1: QUARTZ PRODUCTS FOR SEMICONDUCTOR APPLICATIONS

- FIGURE 6.2: QUARTZ BASE MATERIALS REVENUE FORECAST BY SEGMENT

- FIGURE 6.3: ESTIMATED 2023 FUSED QUARTZ BASE MATERIALS UPPLIER RANKING- BASE MATERIAL

- FIGURE 6.4: ESTIMATED 2023 FUSED QUARTZ BASE MATERIALS SUPPLIER RANKING- TUBES AND RODS

- FIGURE 6.5: ESTIMATED 2023 FUSED QUARTZ BASE MATERIALS SUPPLIER RANKING- INGOT/BOULE

- FIGURE 6.6: ESTIMATED 2023 FUSED QUARTZ BASE MATERIALS SUPPLIER RANKING- 2023 QUARTZ POWDER

- FIGURE 8.1: END USE APPLICATIONS DRIVING NEW DEVICE PROCESSES

- FIGURE 8.2: 3D NAND STACKING DRIVES DIELECTRICS AND METALS PRECURSOR VOLUME

- FIGURE 8.3: 3D NAND PROGRESSION

- FIGURE 8.4: 32 GB NVDRAM WITH 1T 1C MEMORY LAYERS

- FIGURE 8.5: GATE STRUCTURE ROADMAP

- FIGURE 8.6: ADVANCED LOGIC (FOUNDRY) NODE ROAD MAP

- FIGURE 8.7: RIBBON FET

- FIGURE 8.8: MONO LAYER NANO SHEETS CHANNELS

- FIGURE 8.9: NANO IMPRINT LITHOGRAPHY PROCESS FLOW

- FIGURE 8.10: ALD/ALE ENHANCEMENT OF NANO IMPRINT LITHOGRAPHY

- FIGURE 8.11: DIRECTED SELF-ASSEMBLY

- FIGURE 8.12: DSA PATENT FILING BY COMPANY

- FIGURE 8.13: DSA PATEN FILING SINCE 2023

- FIGURE 8.14: WHAT IS PATTERN SHAPING?

- FIGURE 8.15: REFINING EUV PATTERNING BY APPLIED MATERIALS

- FIGURE 8.16: COMPLEMENTARY FET (CFET)

- FIGURE 8.17: CFET IMPROVES PERFORMANCE IN TRACK SCALING

- FIGURE 8.18: MONOLITHIC CFET PROCESS FLOW EXAMPLE

- FIGURE 8.19: MCFET NEW FEATURE- MIDDLE DIELECTRIC ISOLATION

- FIGURE 8.20: LOW TEMPERATURE GATE STACK OPTION EXAMPLES

- FIGURE 8.21: LOW TEMPERATURE SD/CONTACT OPTION EXAMPLES

- FIGURE 8.22: BSPDN ADVANTAGE- IR DROP REDUCTION

- FIGURE 8.23: INCREASING NUMBER OF ALD STEPS REQUIRED BY NEXT GENERATION GAA-FET AND CFET

- FIGURE 8.24: IMEC SUB-1NM TRANSISTOR ROADMAP, 3D-STACKED CMOS 2.0 PLANS

- FIGURE 8.25: INPRIA EUV MOR

- FIGURE 8.26: INPRIA SPIN ON INORGANIC RESIST IS MUCH THINNER THAN STANDARD STACKS OF PHOTO RESIST

- FIGURE 8.27: PATENT FILING FOR MLD DEPOSITED EUV RESIST SEARCH PERFORMED IN PATBASE

- FIGURE 8.28: SADP PROCESS FLOW USING ALD SPACER

- FIGURE 8.29: ONE OF MANY FLAVORS OF SAQP PROCESS FLOW

- FIGURE 8.30: SELECTIVE ALD ENABLED BY PLASMA PRETREATMENT

- FIGURE 8.31: SPECIALTY/EMERGING DIELECTRIC APPLICATIONS FOR HETEROGENOUS INTEGRATIONS (APPLIED MATERIALS)

TABLES

- TABLE 1.1: BREAKOUT OF FABRICATED QUARTZ MARKET BY HOT AND COLD FABRICATION

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: BREAKOUT OF FABRICATED QUARTZ MARKET BY HOT AND COLD FABRICATION

- TABLE 4.2: ESTIMATED FABRICATED QUARTZ COMPONENTS SHARE BY SUPPLIER

- TABLE 4.3: QUARTZ FABRICATED PARTS SUPPLIER MANUFACTURING LOCATIONS

- TABLE 4.4: OVERVIEW OF ANNOUNCED 2023/2024 QUARTZ FABRICATED PARTS SUPPLIER INVESTMENTS

- TABLE 4.5: COMPARISON OF TUBES AND BOATS ATTRIBUTES FOR 200MM AND 300MM PROCESSES

- TABLE 4.6: REGIONAL QUARTZ MARKET ATTRIBUTES AND EXPANSION ACTIVITY, (1 OF 2)

- TABLE 4.7: REGIONAL QUARTZ MARKET ATTRIBUTES AND EXPANSION ACTIVITY, (2 OF 2)

- TABLE 5.1: MOST RECENT QUARTERLY QUARTZ SUPPLIER SALES (IN US$M)

- TABLE 5.2: SHIN-ETSU CURRENT QUARTER FINANCIALS (ANNUAL RESULTS)

- TABLE 5.3: FERROTEC YOY FINANCIALS

- TABLE 5.4: FERROTEC ANNUAL (ENDING 3/2024) FINANCIALS

- TABLE 8.1: LEADING EDGE LOGIC DESCRIPTIONS BY NODE (TSMC, INTEL)

- TABLE 8.2: MULTIPATTERNING AT 7NM BY TSMC

- TABLE 8.3: SELECTIVE DEPOSITION - SELECTIVELY DEPOSITED MATERIALS