|

市场调查报告书

商品编码

1567375

硅设备零组件市场:2024年~2025年 (Critical Materials Report)Silicon Equipment Components Market Report 2024-2025 (Critical Materials Report) |

||||||

价格

简介目录

本报告调查了硅设备零件市场,重点关注半导体加工设备中使用的硅部件市场,例如半导体装置製造中使用的晶圆加工工具的硅基板以及硅设备零件。这些部件属于消耗品,重复使用后需要更换。包括高纯度多晶硅、基板製造商和硅加工製造商的供应链详细资讯。

资讯图表

目录

第1章 摘要整理

第2章 调查范围,目的,手法

第3章 半导体产业市场现况与展望

- 全球经济与整个产业的展望

- 以电子产品细分市场划分的晶片销售额

- 半导体製造业的成长与扩张

- 政策和贸易趋势及影响

- 半导体材料概述

第4章 硅零件市场形势和趋势

第5章 OEM设备市场趋势

第6章 关注的供应商

- 硅零件生产实际成果

- 全球趋势-新工厂/新投资

- 全球趋势-SILFEX

- 全球趋势-MITSUBISHI MATERIALS

- 全球趋势-SHIN-ETSU CHEMICAL的新工厂

- 全球趋势-FERROTEC的新工厂

- 全球趋势-SK ENPULSE的销售事业

- 新供应商市场进入:SHANGHAI SYC

第7章 次级供给:硅锭製造商

- 为基础的材料- 硅锭製造商/供应商

- SINO AMERICAN SILICON - SAS

- THINKON SEMI

- 中国硅锭製造商-THINKON SEMI最新资讯

第8章 多晶硅

- 原料来源及现况-多晶硅

- 放大-瓦克有机硅

- 放大- Hemlock SEMICONDUCTOR

- 扩张 - OCI KOREA 和 TAKUYAMA

- 工厂关闭-REC

- 原料供应来源及状况-多晶硅需求

- 半导体级多晶硅供应商

- 多晶硅 - 能源成本

- 太阳能级多晶硅-价格

- 多晶硅 - 评估

- 多晶硅和单晶硅

第9章 次级材料供应链

- 供应链的混乱/阻碍因素

- 其他的产业用途

- 硅零件的生产据点- 分析

第10章 TECHCET分析师评估

第11章 供应商简介

- ADDISON ENGINEERING

- ALLIANCE PRECISION/API

- APPLIED CERAMICS

- BCNC CO., LTD.

- BULLEN ULTRASONICS

- 其他25公司以上

简介目录

This Critical Materials ReportTM primarily focuses on the markets of silicon parts used in semiconductor process equipment, including silicon base materials and silicon equipment components for wafer process tools used for semiconductor device manufacturing. These parts are considered consumables, given that they are eventually require replacing after repeated use. Details on the supply-chain from high purity poly-silicon, base material manufacturers, and silicon fabricators are provided.

INFOGRAPHICS

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 OVERVIEW OF THE GLOBAL SEMICONDUCTOR INDUSTRY

- 1.2 OVERVIEW OF THE 2023 SILICON PARTS MARKET

- 1.3 OVERVIEW OF POLYSILICON & SILICON INGOTS

- 1.4 TOP CONCERNS ABOUT SUPPLY AVAILABILITY

- 1.5 SILICON PARTS MARKET ASSESSMENT

2 SCOPE, PURPOSE, METHODOLOGY

- 2.1 SCOPE, PURPOSE AND METHODOLOGY

- 2.2 OVERVIEW OF OTHER TECHCET CMR(TM) REPORTS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OVERALL INDUSTRY OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 SILICON PARTS MARKET LANDSCAPE & TRENDS

- 4.1 SILICON PARTS VALUE CHAIN

- 4.2 SI PARTS MARKET SIZE & FORECAST

- 4.3 SILICON - FAB MATERIAL INTRODUCTION & MARKET TREND

- 4.4 SILICON PARTS BY APPLICATION

- 4.5 NON-SEMICONDUCTOR APPLICATIONS SHARING SI PARTS SUPPLY-CHAIN

- 4.6 TECHNOLOGY TRENDS - SILICON PARTS VS. SILICON CARBIDE PARTS

- 4.7 SUB-TIER /SILICON INGOT COSTS TRENDS

- 4.8 SILICON FABRICATOR MARKET SHARE BY SUPPLIER

- 4.9 REGIONAL TRENDS - SILICON PARTS USAGE BY REGION

- 4.9.1 REGIONAL TRENDS - TRADE & GEOPOLITICS

- 4.9.2 REGIONAL TRENDS - PARTS SUPPLIER MARKET DYNAMICS

5 OEM EQUIPMENT MARKET TRENDS

- 5.1 OEM ETCH EQUIPMENT MARKET SHARES ESTIMATE

- 5.2 FABRICATION - SILICON PARTS FABRICATORS BY REGION

- 5.3 TOP 3 OEMS - LAM RESEARCH, TEL, AMAT

- 5.4 OEM ACTIVITIES - LAM RESEARCH AND AMAT

- 5.5 OEM ACTIVITIES - LAM RESEARCH

- 5.6 TOP 3 OEMS -TEL

- 5.7 OEM ACTIVITIES - AMEC

- 5.8 OEM INFLUENCE & CONTROL

- 5.9 POLICY & TRADE TRENDS AND IMPACT

6 SUPPLIERS OF INTEREST

- 6.1 SILICON PARTS PRODUCTION PERFORMANCE

- 6.2 GLOBAL TRENDS- NEW PLANTS/NEW INVESTMENTS

- 6.3 GLOBAL TRENDS - SPOTLIGHT ON SILFEX

- 6.4 GLOBAL TRENDS - SPOTLIGHT ON MITSUBISHI MATERIALS

- 6.5 GLOBAL TRENDS - SHIN-ETSU CHEMICAL NEW PLANT

- 6.6 GLOBAL TRENDS -FERROTEC NEW PLANT

- 6.7 GLOBAL TRENDS - SK ENPULSE SELLING BUSINESS

- 6.8 NEW SUPPLIER ENTERING THE MARKET: SHANGHAI SYC

7 SUB-TIER SUPPLY: SILICON INGOT GROWERS

- 7.1 BASE MATERIAL - SILICON INGOT MANUFACTURERS/SUPPLIERS

- 7.1.1 SINO AMERICAN SILICON - SAS

- 7.1.2 THINKON SEMI

- 7.2 CHINA SILICON INGOT MANUFACTURER - THINKON SEMI UPDATE

8 POLYSILICON

- 8.1 RAW MATERIAL SOURCE AND STATUS - POLYSILICON

- 8.2 EXPANSION - WACKER SILICONES

- 8.3 EXPANSION - HEMLOCK SEMICONDUCTOR

- 8.4 EXPANSION - OCI KOREA AND TAKUYAMA

- 8.5 PLANT CLOSURE - REC

- 8.6 RAW MATERIAL SOURCE AND STATUS - POLYSILICON DEMAND

- 8.7 SEMICONDUCTOR-GRADE POLYSILICON SUPPLIERS

- 8.8 POLYSILICON - ENERGY COST

- 8.9 SOLAR GRADE POLYSILICON - PRICING

- 8.10 POLYSILICON - ASSESSMENT

- 8.11 POLYSILICON VS. MONOCRYSTALLINE SILICON

9 SUB-TIER MATERIAL SUPPLY CHAIN

- 9.1 SUPPLY CHAIN DISRUPTIONS/CONSTRAINTS

- 9.3 OTHER INDUSTRIAL USES

- 9.4 SILICON PARTS PRODUCTION LOCATION - ANALYSIS

10 TECHCET ANALYST ASSESSMENT

- 10.1 TECHCET ANALYST ASSESSMENT

- 10.2 MATERIALS MARKET LANDSCAPE TRENDS

11 SUPPLIER PROFILES

- ADDISON ENGINEERING

- ALLIANCE PRECISION/API

- APPLIED CERAMICS

- BCNC CO., LTD.

- BULLEN ULTRASONICS

- ...AND 25+ MORE

FIGURES

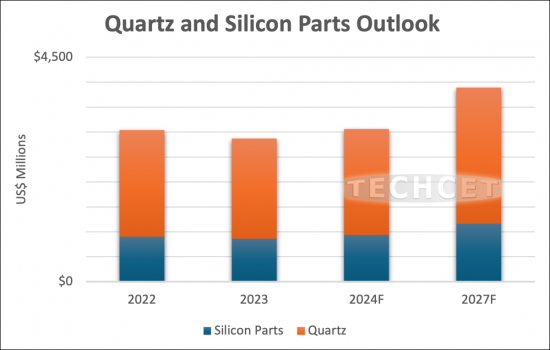

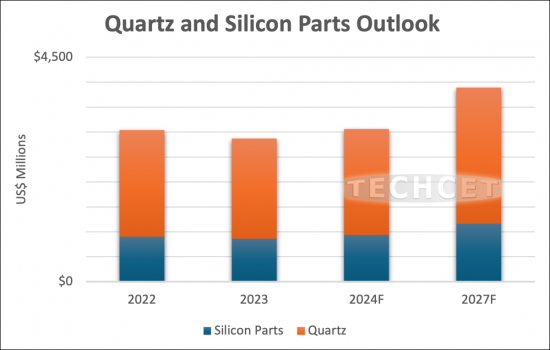

- FIGURE 1.1: 2023 SILICON FABRICATED PARTS REVENUES AND FORECAST ESTIMATES (M USD)

- FIGURE 1.2: SILFEX SILICON INGOT

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSII) IN 000'S OF NTD

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.6: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.7: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.8: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.9: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.10: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.11: ESTIMATED GLOBAL FAB SPENDING 2023-2028

- FIGURE 3.12: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.13: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.14: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.15: ADVANCED LOGIC DEVICE TECHNOLOGYROADMAP OVERVIEW

- FIGURE 3.16: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.18: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.19: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.20: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: SILICON PARTS FROM SILFEX

- FIGURE 4.2: SILICON PARTS VALUE CHAIN

- FIGURE 4.3: 2023 SILICON FABRICATED PARTS REVENUES AND FORECAST ESTIMATES (M USD)

- FIGURE 4.4: 2022 SILICON PARTS BY WAFER SIZE

- FIGURE 4.5: 2023 SILICON PARTS BY WAFER SIZE

- FIGURE 4.6: OLED SUPPLY/DEMAND FOR MOBILE PANELS 2021-2028

- FIGURE 4.7: 2023 SILICON FABRICATOR MARKET SHARE BY SUPPLIER

- FIGURE 4.8: 2023 SILICON PARTS CONSUMPTION BY END USE LOCATION ESTIMATE

- FIGURE 5.1: 2023 ETCH EQUIPMENT MARKET SHARE

- FIGURE 5.2: 2023 SILICON PARTS CONSUMPTION BY END USE LOCATION STIMATE

- FIGURE 5.3: 2023 LAM RESEARCH VS. APPLIED MATERIALS BUSINESS SEGMENT REVENUES (M USD)

- FIGURE 5.4: LAM RESEARCH FACILITIES

- FIGURE 5.5: LAM'S NEW WAREHOUSE IN BATU KAWAN, MALAYSIA

- FIGURE 5.6: TEL'S NEW ETCH SYSTEM BUILDING, COMPLETION SCHEDULED FOR SPRING 2025

- FIGURE 5.7: RENDERING: NEW PRODUCTION FACILITY OF AMEC IN SHANGHAI, CHINA

- FIGURE 6.1: SIFUSION FERROTEC LOCATION IN CHINA

- FIGURE 6.2: SILFEX SPRINGFIELD MANUFACTURING LOCATION

- FIGURE 6.3: MITSUBISHI MATERIALS SANDA PLANT

- FIGURE 6.4: IMAGE OF THE SHIN-ETSU NEW PLANT

- FIGURE 6.5: FERROTEC MAJOR PLANT WITH SIX MAIN MANUFACTURING BUILDINGS

- FIGURE 6.6: SK ENPULSE CHINA PLANT INSIDE

- FIGURE 6.7: SYC HEADQUARTER IN SHANGHAI

- FIGURE 7.1: SAS

- FIGURE 7.2: THINKONSEMI HQ IN JINZHOU, CHINA

- FIGURE 7.3: THINKONSEMI 550MM SILICON WAFER (2020)

- FIGURE 8.1: GROUNDBREAKING CEREMONY IN THE CZECH REPUBLIC

- FIGURE 8.2: GROUNDBREAKING CEREMONY IN SAGINAW COUNTY

- FIGURE 8.3: OCI IKSAN PLANT I KOREA

- FIGURE 8.4: REC POLYSILICON PLANT IN BUTTE, MONTANA

- FIGURE 8.5: POLYSILICON DEMAND FORECAST FOR SEMICONDUCTOR WAFERS

- FIGURE 8.6: ENERGY COST TRENDS (REPORTED BY WACKER IN ITS 1Q 2023 REPORT)

- FIGURE 8.7: GPM AND CHINA POLYSILICON PRICE TREND

- FIGURE 9.1: MONOCRYSTALLINE SILICON AND POLYSILICON SOLAR PANELS

- FIGURE 9.2: US EXCHANGE RATE TRENDS 1/2021 TO 7/2024

TABLES

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.3: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: 2023 VS. 2022 SILICON FABRICATOR MARKET SHARE BY SUPPLIER

- TABLE 5.1: 2023 OEM SYSTEM PUBLICLY REPORTED SALES BY REGION

- TABLE 5.2: TEL REVENUES BY END USER

- TABLE 6.1: LEADING SILICON PARTS FABRICATION REVENUES

- TABLE 7.1: SI PARTS SUPPLIERS THAT MAKE AND/OR SELL SILIC ON INGOT FOR SILICON PARTS FABRICATION

- TABLE 8.1: SEMICONDUCTOR -GRADE POLYSILICON SUPPLIERS

- TABLE 11.1: SILICON MATERIAL AND PARTS FABRICATOR LISTING, PAGE 1 OF 2

- TABLE 11.2: SILICON MATERIAL AND PARTS FABRICATOR LISTING, PAGE 2 OF 2

02-2729-4219

+886-2-2729-4219