|

市场调查报告书

商品编码

1398376

Mini LED背光显示器趋势,OLED技术的竞争的分析(2025年)2025 Mini LED Backlight Display Trend and OLED Technology Competition Analysis |

|||||||

信息图形

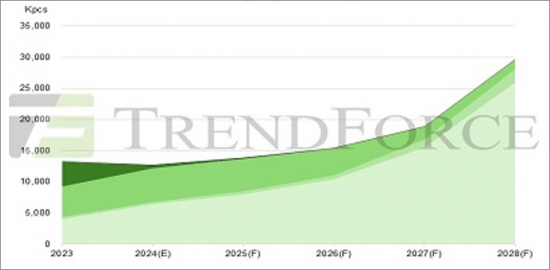

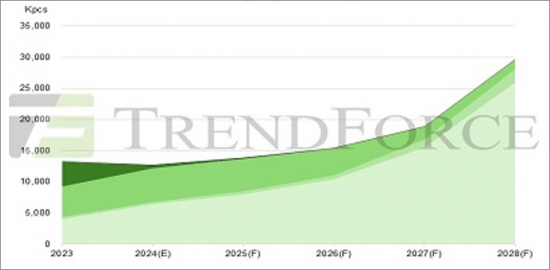

2024-2028年Mini LED背光应用出货量预测

第一章产业趋势:Mini LED与OLED零和博弈,大中小显示器激烈竞争

搭载Mini LED背光源的液晶面板出货量在各个细分领域都在增加,与OLED的对抗在所难免。在大、中、小面板的各种应用中,Mini LED背光的优势正在被OLED牺牲,反之亦然,这是一场零和游戏。有趣的是,这并不是科技发展史上常见的典型单向替代模式。相反,这两种技术都有自己的优点和缺点,并且彼此之间存在着密切的竞争。

2024年Mini LED背光电视市场将呈现显着成长,但品牌投资Mini LED背光技术的热情却较低,部分原因是OLED技术在IT市场的利多影响。 TrendForce预计,2024年各类应用的总出货量将为1,270万台,较2023年下降5%。

Mini LED 在电视、汽车和未来 MNT 市场上比 OLED 更具优势。虽然Mini LED背光电视节省的成本显着,但OLED技术在大型电视市场的实力有限。为了加强产品差异化、增加品牌竞争力,Mini LED背光技术是升级产品规格的合适解决方案。从长远来看,这一趋势也将对MNT市场产生正面影响,成为提高MNT渗透率的推动因素。在汽车市场,Mini LED背光在可靠性方面具有优势,出货量占有率高于OLED。

不过,在笔记型电脑、平板电脑和VR领域,Mini LED的竞争力不如OLED。苹果在其NB和平板电脑产品中采用OLED将改变整体市场格局,导致Mini LED背光技术在这两个应用领域的渗透率持续下降。

第二章技术聚焦:Mini LED以降低成本为目标,OLED以效能提升为目标

2024年Mini LED背光最大的变化是解决方案逐渐成熟,从上游到下游各细分领域的厂商对于如何降低成本已经达成共识。全产业共识将加速产品标准化,鼓励供应商规模化,进一步提高成本竞争力。由此,Mini LED背光发展的最大障碍可望被消除。

第三章电视市场:由于成功的市场区隔,全球Mini LED电视销售将首次超过OLED电视。

2024年,Mini LED背光电视预计出货量为642万台。中国品牌製造商正在主导市场。随着Mini LED背光供应链的完善以及企业逐步实施成本降低策略,全球出货量将较2023年成长59%,呈现强劲成长。

OLED有77吋、83吋70至80吋显示器等产品,但其在G8.5生产中的成本竞争力较低,并且在超大尺寸和灵活布局方面无法赶上LCD。由于供应相对集中、面板价格不灵活、品牌策略不断变化以及经济切割尺寸集中在55英寸和65英寸,OLED将无法像LED背光电视那样实现理想的市场细分。因此,就2024年总出货量而言,Mini LED背光电视有望史上首次超越OLED电视。

长期来看,Mini LED背光电视的定价仍将低于OLED电视,部分产品将与高阶液晶显示器价格重迭,进一步提高Mini LED产品的渗透率。

在本报告中,我们对Mini LED背光显示产业进行了研究和分析,提供了出货量和渗透率、技术发展趋势以及电视、IT和汽车三大市场发展趋势的预测。

目录

第1章 Mini LED背光/OLED应用出货量及渗透率预测

- 消费者电子产品Mini LED背光的出货台数(2024年~2028年)

- Mini 对LED背光的消费者电子产品的普及(2024年~2028年)

- Mini LED背光/OLED TV的出货台数(2024年~2028年)

- Mini LED背光/OLED TV的普及率(2024年~2028年)

- Mini LED背光/OLED MNT的出货台数(2024年~2028年)

- Mini LED背光/OLED MNT的普及率(2024年~2028年)

- Mini LED背光/OLED NB的出货台数(2024年~2028年)

- Mini LED背光/OLED NB的普及率(2024年~2028年)

- Mini LED背光/OLED平板电脑的出货台数(2024年~2028年)

- Mini LED背光/OLED平板电脑的普及率(2024年~2028年)

- Mini LED背光VR的出货台数与普及率(2024年~2028年)

- Mini LED背光TV种类与LED的需求(2024年~2028年)

- Mini LED背光MNT种类与LED的需求(2024年~2028年)

- Mini LED背光NB种类与LED的需求(2024年~2028年)

- Mini LED背光平板电脑种类与LED的需求(2024年~2028年)

- Mini LED背光VR种类与LED的需求(2024年~2028年)

- Mini LED背光用途所需的LED(COB)

- Mini LED背光用途所需的LED(POB)

- Mini LED背光用途的LED(COB)的收益

- Mini LED背光用途的LED(POB)的收益

- Mini LED背光用途的LED(COB/POB)的收益

第二章Mini LED背光技术发展趋势

- COB技术的成本降低分析

- PCB成本降低分析

- LED晶片成本降低分析

- Mini LED背光驱动架构分析

- 驱动IC成本降低分析

- AM驱动IC市场分析

- 主流8频道AM驱动IC对比

- 製程和材料的成本降低分析

- 8.x代OLED面板厂投资计划

- 计划将 Apple 的 OLED 技术整合到其产品中

- OLED技术路线图

- 提高 OLED 效率 - 华星光电喷墨 VS UDC 干式列印

- OLED 效率提升 - JDI eLEAP VS 维信诺 ViP。

第三章Mini LED背光/OLED电视市场

- Mini LED 背光/OLED 电视供货状况:依地区

- Mini LED 背光/OLED 电视价格差异:按地区划分

- 超大型电视的需求 - 75 吋和 80 吋(2022-2024 年)

- 超大型电视的需求 - 98 吋和 100 吋(2023-2024 年)

- Mini LED 背光电视价格变动:依地区

- 中国Mini LED背光电视规格与价格变化

- 中国低价Mini LED背光电视规格及价格变化

- 低区电视背光源成本分析

- 中区电视背光成本分析

- 高区电视背光源成本分析

- 品牌:Mini LED背光型号概述(2023/2024)

- Mini LED 背光电视出货量:依品牌划分(2023-2024 年)

- Mini LED背光电视供应链分析

- 主流Mini LED背光电视售价对比

- OLED电视出货量及渗透率(2023-2024年)

- 电视面板价格比较:55 吋 OLED 与 LCD Open Cell

第四章Mini LED背光/OLED IT市场

1.MNT市场

- Mini LED 背光/OLED MNT 供货状况:依地区

- 中国Mini LED背光MNT数量变化

- Mini LED 背光/OLED MNT 价格差异:依地区

- Mini LED 背光 MNT 价格变动:依地区

- 中国Mini LED背光MNT规格及价格变化

- 美国Mini LED背光MNT规格及价格变化

- 英国Mini LED背光MNT规格及价格变化

- 中国玻璃基Mini LED背光MNT规格及价格变化

- Mini LED 背光 MNT 出货量:依品牌划分(2023-2024 年)

- 主流OLED MNT售价比较(2024年)

- OLED MNT面板供应状况(2023-2025)

- OLED MNT 占有率:按品牌划分(2023-2024 年)

2.NB市场

- Mini LED 背光/OLED NB 供货数量:依地区

- Mini LED背光/OLED NB价格差异:按地区

- Mini LED 背光 NB 价格变动:依地区

- NB LTPS LCD面板出货量(2023-2025)

- NB OLED面板出货量预测(2022-2027)

- OLED笔记型电脑出货量预测(2022-2027)

3. 平板电脑市场

- Mini LED 背光/OLED 平板电脑供货状况:依地区

- Mini LED 背光/OLED 平板电脑价格差异:按地区划分

4.其他地区的应用

- 印度Mini LED背光/OLED应用的可用数量

- 印度Mini LED背光/OLED应用的价格差异

- 巴西Mini LED背光/OLED应用的可用数量

- 巴西Mini LED背光/OLED应用的价格差异

第五章Mini LED车载显示市场

- 智慧座舱的趋势

- 车载显示技术概述

- 汽车显示面板出货量及渗透率(2024-2028)

- 车用背光LED市场价值分析(2024-2028)

- Mini LED/HDR 汽车显示器趋势 - 面板尺寸(2022-2023 年)

- Mini LED/HDR 汽车显示器趋势 - 调光区(2022-2023 年)

- Mini LED/HDR 汽车显示器 - 规格与供应链(2022 年)

- Mini LED/HDR 汽车显示器 - 规格与供应链 (2023)

- COB/COG/POG 技术分析

- Mini LED/HDR 汽车显示器时间表和规格(2022-2028 年)

- NIO ET7/ET5/ES7 车载显示器 - 规格与成本分析

- 荣威 RX5 汽车显示器 - 规格和成本分析

- 凯迪拉克 LYRIQ 汽车显示器 – 规格与成本分析

- Minc Electra E5 汽车显示器 - 规格与成本分析

- 林肯 Nautilus 汽车显示器 - 规格与成本分析

- 凯迪拉克 Celestic 汽车显示器 - 规格与成本分析

- LCD(边缘式/直下式)与OLED汽车显示器规格比较

- 汽车显示器成本分析 - 边缘/直下式(2024 年)

- 车用背光LED产品规格及价格分析(2024年)

- Mini LED车用显示器-驱动IC规格分析

- Mini LED车用显示器-Direct/Scan驱动IC优缺点分析

- OLED 汽车显示器时间表和规格(2022-2024 年)

- 车上背光显示器市场现况分析

- HUD 市场出货量 - 产品与区域市场分析(2024-2028 年)

- HUD 产品规格分析(2024 年)

- AR-HUD技术分析

- HUD 产品价格分析(2023-2024 年)

- 全景平视显示器(P-HUD)与透明显示器

- AR-HUD OEM 供应链与产品规格分析

- HUD市场情势分析

第6章 Mini LED背光产业的动态,Mini LED背光市场供应链

- LED晶片厂商:HC Semitek

- LED晶片厂商:Aucksun

- 驱动 IC厂商:HYASiC

- 驱动 IC厂商:X-Signal Integrated

- 设备企业:Kulicke & Soffa

- 设备供应商:HOSON

- LED构装供应商:Everlight

- LED构装供应商:Lextar

- LED构装供应商:Jufei

- LED构装供应商:APT Electronics

- LED构装供应商:Hongli Display

- LED构装供应商:Nationstar

- LED模组厂商:Core Photoelectric Technology

- LED构装供应商:HGC

- LED构装供应商:ESPACE

- LED构装供应商:COREACH

- LED玻璃基材厂商:WG Tech

- 用途企业:BOE

- 用途企业:Tianma

- 用途企业:TCL

- 用途企业:Hisense

- 用途企业:小米

INFOGRAPHICS

2024-2028 Mini LED Backlight Applications Shipments Forecast

Chapter 1 Industry Trends: Mini LED and OLED in Zero-sum Game, with Fierce Competition between Large-, Mid-, and Small-size Displays

With expanded shipments of LCD panels engineered with Mini LED backlight for various segments, the confrontation with OLED is inevitable. In various application across large, medium, and small panels, it has become a zero-sum game: gains for Mini LED backlight come at the expense of OLED, and vice versa. Interestingly, this is not the typical one-way replacement mode usually seen in the history of technological development. Instead, both technologies have their own strengths and weaknesses, competing closely with each other.

Although the Mini LED backlight TV market makes a significant increase in 2024, the positive impact of OLED technology in the IT market has also suppressed the enthusiasm of brands in investing in Mini LED backlight technology. TrendForce estimates that the total shipment of each application will be 12.7Mpcs in 2024, a decrease of 5% compared to 2023.

In the TV, automotive, and future MNT markets, Mini LED holds more advantages over OLED. The cost reduction effect of Mini LED backlight TV is significant, while OLED technology shows limited strength in the large-sized TV market. To enhance product differentiation and increase brand competitiveness, Mini LED backlight technology is the preferred solution for upgrading product specifications. In the long term, this trend will also have a positive impact on the MNT market, driving an increase in its penetration rate. In the automotive market, Mini LED backlight have won the reliability advantage, resulting in a higher share of shipments than OLED.

However, in the NB , Tablet, and VR sectors, Mini LED is not as competitive as OLED.Apple's embrace of OLED for NB and Tablet products will change the entire market landscape, leading to a continuous reduction in the penetration rate of Mini LED backlight technology in these two application areas.

Chapter 2 Technical Focus: Mini LED Strives for Cost Down, while OLED Aims at Better Performance

The biggest change in Mini LED backlight in 2024 is that the solutions are gradually becoming more mature, and manufacturers throughout the upstream and downstream segments have reached a consensus on ways to reduce costs. This chapter explores the cost reduction strategies that the industry is focusing on, including various strategies related to PCB, LED chips, driver IC, and process materials. The industry-wide consensus helps accelerate the standardization of products, which encourages suppliers to boldly scale up and further enhance cost competitiveness. As a result, the biggest obstacle to the development of Mini LED backlight is expected to be removed. According to TrendForce's analysis, cost reduction strategies for Mini LED that have achieved high consensus are as follows:

1. PCB Cost Down Analysis

- The form of PCB has transitioned from FR4 to single-sided aluminum substrates, comb boards, and light bars, which are applied to products with high, medium, and low dimming zone count, respectively.

- The harpoon board design enhances PCB material utilization, reducing the cost by more than 30%.

- Reduced material usage, increased single-board utilization, and decreased precision requirements have lowered PCB manufacturing costs but introduced reliability challenges.

- The key opportunity for cost reduction lies in whether the size of individual light boards can be standardized.

2. LED Chip Cost Down Analysis

- Increasing the pitch or optimizing the light emission angle through optical design to reduce the number of LEDs can achieve cost reduction.

- Using high-voltage chips(18V/24V/36V) not only reduces the number of LED per zone but also offers higher luminous efficiency, lower driving current, and simpler routing overall.

3. Driver IC Cost Down Analysis

- Among the two driving modes, Passive Matrix (PM) and Active Matrix (AM), the AM scheme is widely adopted due to its simple wiring and the ability to drive each zone separately.

- The AM driver IC is paired with a single-layer aluminum substrate and high-voltage LED chips to reduce the number of LED series connections, maximize driving efficiency, and lower PCB wiring complexity.

- As the number of dimming zones increases, more driver IC are needed.

- The material costs of using an AM driver IC are significantly reduced by over 70% compared to a PM driver IC, and increasing the number of channels further expands the cost reduction advantage.

4. Process and Materials Cost Down Analysis

- Currently, mainstream COB products are engineered with dispensing technology, which reduces material and manufacturing process costs while improving light uniformity.

- some manufacturers have replaced QD diffusion films with QD diffusion plates, reducing the cost by 20% in a single-channel process. However, high-temperature reliability challenges may still be encountered.

This chapter also discusses how, under the significant cost reduction pressure from Mini LED players, OLED manufacturers are advancing their technology to make their solutions increasingly refined, thereby defending against the threat posed by Mini LED.

Chapter 3 TV Market: Successful Market Segmentation Allows Mini LED TVs to Surpass OLED TVs in Global Sales for the First Time

From this chapter to Chapter 5, we will analyze the development trends of Mini LED backlight in the three major markets: TV, IT, and automotive.

In 2024, the estimated shipment of Mini LED backlight TV is 6,420K units. Chinese brand manufacturers have gained dominance in the market. With the improvement of the Mini LED backlight supply chain and the gradual implementation of cost reduction strategies by various companies, there has been significant growth, with global shipments increasing by 59% compared to 2023.

Although OLED has products such as 77-inch and 83-inch displays for the 70-80 inch range, its cost competitiveness in G8.5 production is poor, leading to OLED's inability to keep up with LCD in flexible layouts for extra-large sizes.Given the relatively concentrated supply, inflexible panel prices, changes in branding strategy, and the concentration of economic cutting size at 55 and 65 inches, OLED cannot achieve desirable market segmentation like Mini LED backlight TV through a diversified coverage strategy. Therefore, for the first time in history, Mini LED backlight TV will surpass OLED TV in total shipments for 2024.

From a long-term perspective, the pricing of Mini LED backlight TVs is expected to remain lower than that of OLED TVs, with some products even overlapping in pricing with high-end LCD, further increasing the penetration rate of Mini LED products.

Chapter 4 IT Market: As OLED Solidifies Its High-End Status, Mini LED is Likely to Become a "Wall Breaker"

Shipment of Mini LED backlight MNT in 2024 is estimated to be 347K units, which is only a 48% growth rate compared to 2023, lower than initially expected. This is mainly because of the positive response to OLED technology in the high-end market, leading brands to invest more actively in OLED product lines, resulting in Samsung's market share shrinking to 46%. However, Chinese brands continue to enter the mid-to-low-end market, but due their limited recognition and promotion efforts, benefits are limited.

Chinese brands such as Taidu and Titan Army continue to advance the specifications of

OLED MNT are currently in high demand and are almost a standard configuration product for all brands targeting the high-end market.In 2024, the supply capacity of OLED MNT will double compared to 2023. SDC's QD OLED, accounting for 75%, remains mainstream, while LGD's WOLED supply scale is also gradually increasing.Due to the strong demand, the supply of OLED MNT panels is expected to climb to 2.4 million pieces in 2025, with CSOT also joining the supply ranks.With the increasing availability of OLED MNT panels, the willingness of brands to adopt Mini LED backlight will also be correspondingly weakened.Brands almost universally allocate their high-end MNT resources to the promotion of OLED, causing a significant crowding-out effect on similarly positioned Mini LED backlight products.

In the long run, we still have faith in the development of Mini LED applications in the IT sector. As the shipments of Mini LED backlight TV increase, the cost reduction benefits are expected to extend to MNT applications, once again demonstrating the strategic advantage of diversified coverage for Mini LED products. Mini LED could overcome the current situation where high-end MNT products are primarily confined to the gaming market.

The rest of this chapter includes analyses of the price differences between Mini LED backlight and OLED products in the NB market, as well as shipment analysis. In addition to analyzing product specifications in the major markets, namely the US, Europe, and China, this report also offers insights into India and Brazil by analyzing the models available and the local price trends of new Mini LED backlight and OLED displays.

Chapter 5 Automotive Market: Smart Cockpit Transitions from Concept to Mass Production, Allowing Mini LED to Benefit from Increased Display Number and Size

With the trend towards digitalization in smart cockpit, automotive displays have become a crucial interface for connecting vehicles and driver interaction. Automotive displays include instrument clusters, central displays, rear view mirrors, HUD, rear-seat entertainment applications, and more. With an increasing number of vehicles incorporating a variety of automotive display products, larger sizes, wider aspect ratios, more displays, and freer placement methods are becoming the development direction for in-car displays. Additionally, the continuous improvement of performance parameters such as High Dynamic Range (HDR), Local Dimming, Wide Color Gamut, etc., coupled with the increasing demand for automotive displays, indicates a sustained rapid growth trend in the automotive display market.According to TrendForce analysis, the shipment of automotive display panels is expected to reach 257 million units in 2028. Mini LED displays will reap the benefits, with a penetration rate of 5.9%, surpassing OLED's 4.1%.

Chapter 6 Industry Dynamics: From a Competitive Landscape of Numerous Businesses to Major Manufacturers, Elite Mini LED Players Have Emerged

As Mini LED backlight products gradually enter the mass production stage, there have been significant changes in the list of highly active manufacturers. Different players have bet on various technologies and product solutions. By 2024, mainstream technologies and solutions become clear throughout the market. Manufacturers who have made the right bets are now enjoying the winners' dividends and returns, while those who missed out are gearing up for another round of intense investments.

This chapter outlines the main supply chain for the Mini LED backlight market, focusing on the dynamics of leading manufacturers in chips, driver IC, transfer equipment, packaging and modules, and applications regarding their products, technologies, revenues, and supply chain activities in the Mini LED sector.

Compared to the conventional backlight, Mini LED backlight represents a major technological innovation, bringing significant changes to the industry landscape. Conventional backlight supply chain companies have strong first-mover advantages and incumbent benefits. However, new players are also fully benefiting from these changes, breaking the previous monopoly and rising to prominence. By 2024, powerful players have begun to take center stage in the industry arena.

In this report, we have added the analyses of niche businesses benefiting from Mini LED backlight, such as Aucksun, HYASiC, X-Signal Integrated, APT Electronics, Core Photoelectric Technology, HGC, COREACH, and ESPACE. We have also added an analysis focusing on the current development of WG Tech, a company with a comprehensive presence in LED glass substrates manufacturing.

Table of Contents

Chapter I. Mini LED Backlight/OLED Application Shipment and Penetration Rates Forecast

- 2024-2028 Mini LED Backlight Shipment for Consumer Electronics Applications

- 2024-2028 Mini LED Backlight Penetration for Consumer Electronics Applications

- 2024-2028 Mini LED Backlight/OLED TV Shipment

- 2024-2028 Mini LED Backlight/OLED TV Penetration Rate

- 2024-2028 Mini LED Backlight/OLED MNT Shipment

- 2024-2028 Mini LED Backlight /OLED MNT Penetration Rate

- 2024-2028 Mini LED Backlight/OLED NB Shipment

- 2024-2028 Mini LED Backlight /OLED NB Penetration Rate

- 2024-2028 Mini LED Backlight/OLED Tablet Shipment

- 2024-2028 Mini LED Backlight /OLED Tablet Penetration Rate

- 2024-2028 Mini LED Backlight VR Shipment and Penetration Rate

- 2024-2028 Mini LED Backlight TV Types and LED Demand

- 2024-2028 Mini LED Backlight MNT Types and LED Demand

- 2024-2028 Mini LED Backlight NB Types and LED Demand

- 2024-2028 Mini LED Backlight Tablet Types and LED Demand

- 2024-2028 Mini LED Backlight VR Types and LED Demand

- LED (COB) Demanded for Mini LED Backlight Applications

- LED (POB) Demanded for Mini LED Backlight Applications

- LED (COB) Revenue for Mini LED Backlight Applications

- LED (POB) Revenue for Mini LED Backlight Applications

- LED (COB/POB) Revenue for Mini LED Backlight Applications

Chapter II. Mini LED Backlight Technology Development Trend

- COB Technology Cost Down Analysis

- PCB Cost Down Analysis

- LED Chip Cost Down Analysis

- Mini LED Backlight Driving Architecture Analysis

- Driver IC Cost Down Analysis

- AM Driver IC Market Analysis

- Mainstream 8-Channel AM Driver IC Comparison

- Process and Materials Cost Down Analysis

- 8.x Generation OLED Panel Factory Investment Plan

- Apple's Plan for Integrating OLED Technology into Its Products

- OLED Technology Roadmap

- OLED Efficacy Improvement - CSOT Ink-jet VS. UDC Dry Printed

- OLED Efficacy Improvement - JDI eLEAP VS. Visionox ViP

Chapter III. Mini LED Backlight/OLED TV Market

- Quantity of Available Mini LED Backlight/OLED TV in Different Regions

- Mini LED Backlight/OLED TV Price Differences in Different Regions

- 2022-2024(E) Demand for Super-Large Sized TV - 75" and 80"

- 2023-2024(E) Demand for Ultra-Large Sizes TV - 98" and 100"

- Mini LED Backlight TV Price Changes in Different Regions

- Mini LED Backlight TV Specifications and Price Changes in China

- Low-Priced Mini LED Backlight TV Specifications and Price Changes in China

- Low-Zones TV Backlight Cost Analysis

- Mid-Zones TV Backlight Cost Analysis

- High-Zones TV Backlight Cost Analysis

- Brands: 2023 and 2024 Mini LED Backlight Models Overview

- 2023-2024 Mini LED Backlight TV Shipments by Brand

- Mini LED Backlight TV Supply Chain Analysis

- Mainstream Mini LED Backlight TV Selling Price Comparison

- 2023-2024(E) OLED TV Shipment and Penetration Rate

- TV Panel Price Comparison: 55" OLED vs. LCD Open Cell

Chapter IV. Mini LED Backlight/OLED IT Market

4.1. MNT Market

- Quantity of Available Mini LED Backlight/OLED MNT in Different Regions

- Quantity Changes of Mini LED Backlight MNT in China

- Mini LED Backlight/OLED MNT Price Differences in Different Regions

- Mini LED Backlight MNT Price Changes in Different Regions

- Mini LED Backlight MNT Specifications and Price Changes in China

- Mini LED Backlight MNT Specifications and Price Changes in the US

- Mini LED Backlight MNT Specifications and Price Changes in the UK

- Glass-based Mini LED Backlight MNT Specifications and Price Changes in China

- 2023-2024 Mini LED Backlight MNT Shipments by Brand

- 1H24 Mainstream OLED MNT Selling Price Comparison

- 2023-2025(F) OLED MNT Panel Supply Status

- 2023-2024(E) OLED MNT Share by Brands

4.2. NB Market

- Quantity of Available Mini LED Backlight/OLED NB in Different Regions

- Mini LED Backlight/OLED NB Price Differences in Different Regions

- Mini LED Backlight NB Price Changes in Different Regions

- 2023-2025(F) NB LTPS LCD Panel Shipment

- 2022-2027(F) NB OLED Panel Shipment Forecast

- 2022-2027(F) OLED NB Set Shipment Forecast

4.3. Tablet Market

- Quantity of Available Mini LED Backlight/OLED Tablet in Different Regions

- Mini LED Backlight/OLED Tablet Price Differences in Different Regions

4.4. Applications in Other Regions

- Quantity of Available Mini LED Backlight/OLED Applications in India

- Mini LED Backlight/OLED Applications Price Differences in India

- Quantity of Available Mini LED Backlight/OLED Applications in Brazil

- Mini LED Backlight/OLED Applications Price Differences in Brazil

Chapter V. Mini LED Automotive Display Market

- Smart Cockpit Trend

- Automotive Display Technology Overview

- 2024-2028 Automotive Display Panel Shipment and Penetration Rate

- 2024-2028 Automotive Backlight LED Market Value Analysis

- 2022-2023 Mini LED / HDR Automotive Display Trend- Panel Size

- 2022-2023 Mini LED / HDR Automotive Display Trend- Dimming Zones

- 2022 Mini LED / HDR Automotive Display- Specification vs. Supply Chain

- 2023 Mini LED / HDR Automotive Display- Specification vs. Supply Chain

- COB / COG / POG Technology Analysis

- 2022-2028 Mini LED / HDR Automotive Display Schedule and Specification

- NIO ET7 / ET5 / ES7 Automotive Display- Specification and Cost Analysis

- Roewe RX5 Automotive Display- Specification and Cost Analysis

- Cadillac LYRIQ Automotive Display- Specification and Cost Analysis

- Buick Electra E5 Automotive Display- Specification and Cost Analysis

- Lincoln Nautilus Automotive Display- Specification and Cost Analysis

- Cadillac Celestiq Automotive Display- Specification and Cost Analysis

- LCD (Edge / Direct-Type) vs. OLED Automotive Display Specification

- 2024 Automotive Display Cost Analysis- Edge / Direct-Type

- 2024 Automotive Backlight LED Product Specification and Price Analysis

- Mini LED Automotive Display- Driver IC Specification Analysis

- Mini LED Automotive Display- Direct / Scan Driver IC Pros-Cons Analysis

- 2022-2024 OLED Automotive Display Schedule and Specification

- Automotive Backlight Display Market Landscape Analysis

- 2024-2028 HUD Market Shipment- Product vs. Regional Market Analysis

- 2024 HUD Product Specification Analysis

- AR-HUD Technology Analysis

- 2023-2024 HUD Product Price Analysis

- Panoramic Head-up Display (P-HUD) vs. Transparent Display

- AR-HUD OEM Supply Chain and Product Specification Analysis

- HUD Market Landscape Analysis

Chapter VI. Mini LED Backlight Industry DynamicsMini LED Backlight Market Supply Chain

- LED Chip Manufacturer: HC Semitek

- LED Chip Manufacturer: Aucksun

- Driver IC Manufacturer: HYASiC

- Driver IC Manufacturer: X-Signal Integrated

- Equipment Player: Kulicke & Soffa

- Equipment Provider: HOSON

- LED Package Provider: Everlight

- LED Package Provider: Lextar

- LED Package Provider: Jufei

- LED Package Provider: APT Electronics

- LED Package Provider: Hongli Display

- LED Package Provider: Nationstar

- LED Module Manufacturer: Core Photoelectric Technology

- LED Package Provider: HGC

- LED Package Provider: ESPACE

- LED Package Provider: COREACH

- LED Glass Substrate Manufacturer: WG Tech

- Application Player: BOE

- Application Player: Tianma

- Application Player: TCL

- Application Player: Hisense

- Application Player: Xiaomi