|

市场调查报告书

商品编码

1399821

TrendForce 2024:红外线感测应用领域的市场与品牌策略2024 Infrared Sensing Application Market and Branding Strategies |

||||||

鑑于其多样性,预计2023年至2028年全球红外线感测应用市场将以6%的复合年增长率成长,到2028年达到30.9亿美元的规模。

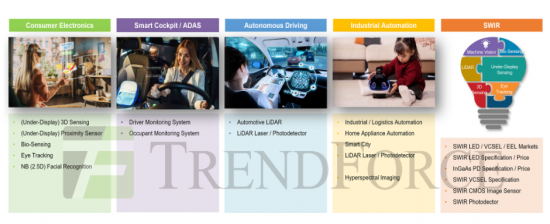

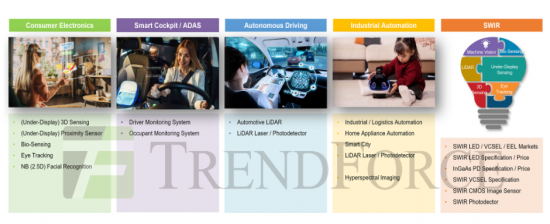

本报告分析了全球红外线感测技术市场规模、机会、产品规格、价格、供应链等,并确定了快速成长的主要应用领域((1)消费性电子产品,(2)我们专注于智慧座舱/ADAS (DMS/OMS)、(3)自动驾驶、(4)工业/物流/家电自动化)。此外,随着SWIR光源(LED/VCSEL/EEL)和SWIR CMOS影像感测器/光电侦测器技术的成熟,我们正在探索商机,我们也在研究相关的技术规格。

目录

第一章红外线感测:市场规模分析

- 分析范围

- 红外线感测应用领域市场:产品分析概述(2024年)

- 红外线感测市场规模分析:IR LED/VCSEL/EEL (2024-2028)

- 红外线感测企业收入:IR LED/VCSEL/EEL(2021-2023)

- 消费性 3D 感测市场:模组与 VCSEL(2024-2028)

- 汽车/工业光达市场:LiDAR与LiDAR雷射(2024-2028)

第二章 消费性电子市场趋势

- 消费性电子市场:红外线感测技术概述

- 苹果/三星消费性电子路线图

- 3D感测市场

- 3D感测技术概述

- 直接/间接 Tof(飞行时间)技术分析

- iPhone 14 Pro 结构光深度相机成本与供应链

- iPhone 15 结构光深度相机成本与供应链

- iPhone 15 Pro 雷射雷达扫描器 - 产品设计/成本/供应链

- VCSEL技术路线图

- 屏下3D感测技术:进度与可行性分析

- Apple Vision Pro:3D感测技术分析

- 消费性电子产品中 3D 感测的市场机遇

- 穿戴式装置(手錶)市场中的 3D 感测

- 透过3D感测应用领域的创新推广VCSEL/EEL技术

- 3D感测产品规格与供应链(2018-2023)

- VCSEL 市场规模:消费性电子产品 3D 感测(2024-2028)

- VCSEL价格分析(2018-2028)

- 接近感测器

- 接近感测器产品规格及价格分析(2024年)

- NIR/SWIR萤幕下接近感测器:优缺点分析

- iPhone 14 Pro 萤幕下接近感应器拆解分析

- iPhone 14/17 Pro 的萤幕下接近感应器分析

- 接近感测器和1D/2D ToF市场规模分析(2024-2028)

- 生物感

- 生理参数测量与疾病分析

- 心率和血氧:光学感测原理

- 血压与体内水分:光学感测原理

- PPG测量和位置分析

- Apple Watch Series 9/X:PPG 规格/成本/供应链

- Apple AirPods 3/Pro 2:皮肤侦测感应器产品/成本/供应链

- 苹果:Micro LED 手錶 (2026)

- Apple Micro LED Watch:规格和成本分析

- 三星 Galaxy Watch 6/7:PPG 规格/成本/供应链

- 新兴生物感测市场:品牌/产品/供应链分析(2024)

- Google Pixel Watch 2:PPG 规格和供应链

- PPG系统架构及市场格局分析

- 生物感测市场规模分析:Apple/Samsung PPG(2024-2028)

- 生物感测市场规模分析:PPG分立LED(2024-2028)

- 生物感测的潜在市场

- 眼球追踪

- AR/VR 显示/光学感测技术

- 眼动追踪对 AR/VR 的好处分析

- 眼动追踪市场现况分析

- 眼动追踪产品规格及供应链(2019-2024)

- Meta Quest Pro

- Sony PlayStation VR 2

- HTC VIVE Focus 3/Pico 4 Pro

- Apple Vision Pro:眼球追踪和虹膜识别

- IR LED产品规格及价格分析

- VCSEL 技术中会包含眼动追踪吗?

- IR LED 市场规模分析:眼动追踪 (2024-2028)

- NB(2.5D)人脸辨识

- 2.5D人脸辨识的优势

- NB人脸辨识:IR LED规格与供应链分析

- IR LED产品规格及价格分析

- 笔记本2.5D脸部辨识会搭载VSCEL技术吗?

- IR LED市场规模分析:NB(2.5D)脸部辨识(2024-2028)

第三章车载感测:驾驶/乘员监控系统市场

- 驾驶员/乘员监控系统 (DMS/OMS):关键要素分析

- 驾驶/乘员监控系统:主动/被动感测分析

- 驾驶员监控系统:法规与政策

- 驾驶员/乘员监控系统:功能分析

- 驾驶员监控系统:安装位置

- 驾驶员监控系统:产品趋势

- 乘员监控系统:产品趋势

- 驾驶员/乘员监控系统:感测器融合分析

- 驾驶员/乘员监控系统:2D 规格分析

- 驾驶/乘员监控系统:3D感测规格分析

- 驾驶员/乘员监控系统:OEM 策略与供应链

- General Motors

- BMW

- Tesla

- Ford

- Volkswagen

- Stellantis

- Toyota

- Nissan

- Mazda

- Honda

- Subaru

- Hyundai

- XPeng Motors

- NIO

- Li Auto

- 驾驶员/乘员监控系统:市场情势分析

- IR LED 产品规格分析:ams OSRAM

- VCSEL产品规格分析:ams OSRAM

- IR LED/VCSEL 产品规格分析:Stanley

- VCSEL的优势分析

- IR LED/VCSEL 市场规模分析:DMS/OMS (2024-2028)

第四章 LiDAR市场趋势

- 定义光达应用领域的市场

- LiDAR影像技术的矩阵分析

- LiDAR影像技术概述

- LiDAR成像技术分析

- LiDAR企业营收规模分析(2022-2023年)

- LiDAR产品规格及价格分析

- LiDAR分析:Valeo/Luminar/Innoviz/Hesai/Continental/Aeva

- 905/1,550nm LiDAR优缺点分析

- FMCW LiDAR

- LiDAR系统架构与价格/成本分析

- LiDAR市场情势分析

- 汽车LiDAR市场

- LiDAR市场趋势分析:Gartner技术成熟度曲线

- 汽车LiDAR市场规模分析(2024-2028)

- ADAS/自动驾驶:OEM策略联盟分析

- ADAS/自动驾驶路线图和供应链(2021-2025)

- 4~5级自动驾驶市场状况分析

- 汽车感测分析:LiDAR、雷达、摄影机

- LiDAR产品需求:驾驶场景分析

- 4D成像雷达技术趋势

- 工业LiDAR市场

- 工业LiDAR市场规模分析(2024-2028)

- 工业LiDAR应用领域市场

- 家电LiDAR(扫地机器人/伴侣机器人)市场

- 工业LiDAR产品分析

- LiDAR雷射/光电探测器市场

- LiDAR市场规模:产品分析(2024-2028)

- LiDAR光电探测器市场规模:产品分析(2024-2028)

- EEL/VCSEL LiDAR:综合分析

- EEL LiDAR 雷射产品分析:ams OSRAM

- VCSEL LiDAR 雷射产品分析:ams OSRAM 与 Lumentum

- LiDAR公司分析

- LiDAR光电探测器分析

- LiDAR光电探测器产品规格分析

- LiDAR雷射和光电探测器公司名单

第五章 SWIR/MWIR技术/市场趋势

- 短波红外线 (SWIR)/中波红外线 (MWIR) 定义

- SWIR LED产品规格分析

- SWIR LED/光电二极体产品价格分析(2023)

- SWIR VCSEL技术分析

- SWIR VCSEL规格分析

- SWIR CMOS影像感测器分析

- InGaAs/GeSi光电侦测器产品规格分析

- 硅锗光子技术

- SWIR LED/VCSEL/EEL 的市场机会和潜在客户列表

- 中波红外线 (MWIR) 市场机会和公司名单

- 机器视觉(高光谱成像)市场机会

- 机器视觉(高光谱成像)规格分析

- 食品产业中的机器视觉(高光谱成像)

- 机器视觉(高光谱成像)市场案例研究

- 机器视觉(高光谱成像)市场格局分析

‘TrendForce 2024 Infrared Sensing Application Market and Branding Strategies’ focuses on four fast-growing application segments, namely the 1) Consumer Electronics, 2) Smart Cabin / ADAS (DMS / OMS), 3) Autonomous Driving, and 4) Industrial / Logistics / Home Appliance Automation. Additionally, TrendForce will explore business opportunities and analyze technical specifications associated with SWIR light sources (LED / VCSEL / EEL) and SWIR CMOS image sensors / photodetectors as their technologies become increasingly mature.

According to the report " TrendForce 2024 Infrared Sensing Application Market and Branding Strategies" , several topics will be the focus between 2024 and 2028, as end-market brands' plans showed. These topics are: (under-display) 3D sensing, under-display proximity sensors, bio-sensing (skin-detect sensors and PPG), smart cockpit / ADAS- DMS / OMS, autonomous driving, industrial / logistics / home appliance automation, and smart city.

Consumer Electronics

Both Apple and Samsung will improve bio-sensing accuracy for their watches starting in 2024. Specifically, Samsung will install skin-detect sensors in its TWS, the Galaxy Buds, in 2024, while Apple is likely to adopt Micro LED and next-gen bio-sensing technology in 2026.

As for smartphones, Apple will adopt MetaLens technology to reduce the size of structured light in 2024, reapply under-display proximity sensors to the iPhone 17 Pro in 2025 and under-display 3D sensing in 2027. Both under-display proximity sensors and under-display 3D sensing will be powered by SWIR VCSELs, which help reduce sunlight / ambient light interference and the probability of white spot formation. According to TrendForce's survey, the PCE of 1,130nm VCSEL reached the level of >30% in 2H23. Specifically, ams OSRAM's 1,130nm VCSEL delivers absolutely outstanding product performance.

Moreover, leading brands including Apple, Sony, Meta, Microsoft, Google will continue announcing AR/VR products, giving rise to 3D sensing and eye tracking.

Smart Cockpit / ADAS- DMS / OMS

The EU's General Safety Regulation recommends the installation of ADDW systems in new passenger cars, trucks, and buses starting on July 7, 2024 and mandates the system installation in all such new vehicles starting on July 7, 2026. The US NHTSA requests automakers, tier 1 suppliers, and autonomous driving technology developers to provide reports on crashes involving ADAS / autonomous driver Level 2 and above, which will prompt businesses to install event data recorders and DMS in L2 vehicles. Car makers' compliance with proposed policies will give rapid rise to the DMS / OMS market.

ADAS / Autonomous Driving

Car makers plan to continue using LiDAR in 2024-2025 for ADAS / autonomous driving Level 3 (Highway Pilot), aiming to enhance driving safety and AEB performance. Leading players include Volvo, General Motors, Audi, Stellantis, Volkswagen, BMW, Hyundai, Hongqi, Changan, and Li Auto.

Industrial / Logistics / Home Appliance Automation and Smart City

Considering the existing labor shortage, manufacturers in Europe, the US, and Japan have been targeting at industrial automation. Installing LiDAR traffic flow systems in smart cities enables transportation authorities to collect accurate real-time road use data, analyze them, and figure out how to improve traffic flow for four wheelers, thereby ensuring safety for scooter riders and pedestrians. Businesses have also installed LiDAR systems in home appliances (i.e., robot vacuums and companion robots) to realize SLAM.

The diversity of said topics will expand the market scale of infrared sensing applications, which is likely jumping to USD 3.090 billion in 2028 with a 6% CAGR between 2023-2028, as TrendForce forecast. Based on the branding strategies, TrendForce analyzes the market scale, opportunities, challenges, product specifications and prices as well as supply chains related to infrared sensing applications. This report provides comprehensive insights that help our readers to develop marketing strategies for the infrared sensing market.

Table of Contents

Chapter I. Infrared Sensing Market Scale Analysis

- Scope of the Report

- 2024 Infrared Sensing Application Market- Product Analysis Overview

- 2024-2028 Infrared Sensing Market Scale Analysis- IR LED / VCSEL / EEL

- 2021-2023(E) Infrared Sensing Player Revenue- IR LED / VCSEL / EEL

- 2024-2028 Consumer Electronics 3D Sensing Market- Module vs. VCSEL

- 2024-2028 Automotive / Industrial LiDAR Market- LiDAR vs. LiDAR Laser

Chapter II. Consumer Electronics Market Trend

- Consumer Electronics Market- Infrared Sensing Technology Overview

- Apple / Samsung Consumer Electronics Roadmap

- 2.1. 3D Sensing Market

- 3D Sensing Technology Overview

- Direct / Indirect Time of Flight Technology Analysis

- iPhone 14 Pro Structured Light Depth Camera Cost and Supply Chain

- iPhone 15 Structured Light Depth Camera Cost and Supply Chain

- iPhone 15 Pro LiDAR Scanner- Product Design / Cost / Supply Chain

- VCSEL Technology Roadmap

- Under-Display 3D Sensing Technology- Schedule and Feasibility Analysis

- Apple Vision Pro- 3D Sensing Technology Analysis

- Consumer Electronics 3D Sensing Market Opportunities

- 3D Sensing in Wearable Devices (Watch) Market

- 3D Sensing Application Innovation Drives VCSEL / EEL Technologies

- 2018-2023 3D Sensing Product Specification and Supply Chain

- 2024-2028 VCSEL Market Scale- Consumer Electronics 3D Sensing

- 2018-2028 VCSEL Price Analysis

- 2.2. Proximity Sensor

- 2024(E) Proximity Sensor Product Specification and Price Analysis

- NIR / SWIR Under-Display Proximity Sensor- Pros and Cons Analysis

- iPhone 14 Pro Under-Display Proximity Sensor- Teardown Analysis

- iPhone 14 / 17 Pro Under-Display Proximity Sensor Analysis

- 2024-2028 Proximity Sensor vs. 1D/2D ToF Market Scale Analysis

- 2.3. Bio-Sensing

- Physiological Parameter Measurement and Disease Analysis

- Heart Rate vs. Blood Oxygen- Optical Sensing Principle

- Blood Pressure vs. Body Hydration- Optical Sensing Principle

- PPG Measurement Location Analysis

- Apple Watch Series 9 / X- PPG Specification / Cost / Supply Chain

- Apple AirPods 3 / Pro 2- Skin-Detect Sensor Product / Cost / Supply Chain

- 2026 Apple Micro LED Watch

- Apple Micro LED Watch Specification and Cost Analysis

- Samsung Galaxy Watch 6 / 7- PPG Specification / Cost / Supply Chain

- 2024 New Bio-Sensing Market- Brand / Product / Supply Chain Analysis

- Google Pixel Watch 2- PPG Specification and Supply Chain

- PPG System Architecture vs. Market Landscape Analysis

- 2024-2028 Bio-Sensing Market Scale Analysis- Apple / Samsung PPG

- 2024-2028 Bio-Sensing Market Scale Analysis- PPG Discrete LED

- Bio-Sensing Potential Markets

- 2.4. Eye Tracking

- AR/VR- Display and Optical Sensing Technologies

- AR/VR- Eye Tracking Advantage Analysis

- Eye Tracking Market Landscape Analysis

- 2019-2024 Eye Tracking Product Specification and Supply Chain

- Meta Quest Pro

- Sony PlayStation VR 2

- HTC VIVE Focus 3 / Pico 4 Pro

- Apple Vision Pro- Eye Tracking vs. Iris Recognition

- IR LED Product Specification and Price Analysis

- Will Eye Tracking Come with VCSEL Technology?

- 2024-2028 IR LED Market Scale Analysis- Eye Tracking

- 2.5. NB (2.5D) Facial Recognition

- 2.5D Face ID Advantages

- NB Facial Recognition- IR LED Specification and Supply Chain Analysis

- IR LED Product Specification and Price Analysis

- Will Notebook 2.5D Facial Recognition Come with VSCEL Technology?

- 2024-2028 IR LED Market Scale Analysis- NB (2.5D) Facial Recognition

Chapter III.In-Cabin Sensing- Driver / Occupant Monitoring System Market

- Driver / Occupant Monitoring System- Key Factor Analysis

- Driver / Occupant Monitoring System- Active / Passive Sensing Analysis

- Driver Monitoring System- Regulations and Policies

- Driver / Occupant Monitoring System- Feature Analysis

- Driver Monitoring System- Installation Location

- Driver Monitoring System- Product Trend

- Occupant Monitoring System- Product Trend

- Driver / Occupant Monitoring System- Sensor Fusion Analysis

- Driver / Occupant Monitoring System- 2D Specification Analysis

- Driver / Occupant Monitoring System- 3D Sensing Specification Analysis

- Driver / Occupant Monitoring System- OEM Strategies and Supply Chain

- General Motors

- BMW

- Tesla

- Ford

- Volkswagen

- Stellantis

- Toyota

- Nissan

- Mazda

- Honda

- Subaru

- Hyundai

- XPeng Motors

- NIO

- Li Auto

- Driver / Occupant Monitoring System- Market Landscape Analysis

- IR LED Product Specification Analysis- ams OSRAM

- VCSEL Product Specification Analysis- ams OSRAM

- IR LED / VCSEL Product Specification Analysis- Stanley

- VCSEL Advantage Analysis

- 2024-2028 IR LED / VCSEL Market Scale Analysis- DMS / OMS

Chapter IV. LiDAR Market Trend

- LiDAR Application Market Definition

- LiDAR Imaging Technology Matrix Analysis

- LiDAR Imaging Technology Overview

- LiDAR Imaging Technology Analysis

- 2022-2023(E) LiDAR Player Revenue Scale Analysis

- LiDAR Product Specification and Price Analysis

- LiDAR Analysis- Valeo / Luminar / Innoviz / Hesai / Continental / Aeva

- 905 / 1,550nm LiDAR Pros and Cons Analysis

- FMCW LiDAR

- LiDAR System Architecture vs. Price Cost Analysis

- LiDAR Market Landscape Analysis

- 4.1. Automotive LiDAR Market

- LiDAR Market Trend Analysis- Gartner Hype Cycle

- 2024-2028 Automotive LiDAR Market Scale Analysis

- ADAS / Autonomous Driving- OEM Strategic Alliance Analysis

- 2021-2025 ADAS / Autonomous Driving Roadmap and Supply Chain

- Autonomous Driving Level 4-5 Market Landscape Analysis

- Automotive Sensing Analysis- LiDAR, Radar and Camera

- LiDAR Product Requirement- Driving Scenario Analysis

- 4D Imaging Radar Technology Trend

- 4.2. Industrial LiDAR Market

- 2024-2028 Industrial LiDAR Market Scale Analysis

- Industrial LiDAR Application Market

- Home Appliance LiDAR (Robot Vacuums / Companion Robots) Market

- Industrial LiDAR Laser Product Analysis

- 4.3. LiDAR Laser and Photodetector Market

- 2024-2028 LiDAR Laser Market Scale- Product Analysis

- 2024-2028 LiDAR Photodetector Market Scale- Product Analysis

- EEL / VCSEL LiDAR Laser Comprehensive Analysis

- EEL LiDAR Laser Product Analysis- ams OSRAM

- VCSEL LiDAR Laser Product Analysis- ams OSRAM vs. Lumentum

- LiDAR Laser Player Analysis

- LiDAR Photodetector Analysis

- LiDAR Photodetector Product Specification Analysis

- LiDAR Laser and Photodetector Player List

Chapter V. SWIR / MWIR Technology and Market Trend

- Short Wave Infrared (SWIR) / Middle Wavelength Infrared (MWIR) Definition

- SWIR LED Product Specification Analysis

- 2023 SWIR LED / Photodiode Product Price Analysis

- SWIR VCSEL Technology Analysis

- SWIR VCSEL Specification Analysis

- SWIR CMOS Image Sensor Analysis

- InGaAs / GeSi Photodetector Product Specification Analysis

- GeSi Photonic Technology

- SWIR LED / VCSEL / EEL Market Opportunities and Potential Client List

- Middle Wavelength Infrared (MWIR) Market Opportunities and Player List

- Machine Vision (Hyperspectral Imaging) Market Opportunities

- Machine Vision (Hyperspectral Imaging) Specification Analysis

- Machine Vision (Hyperspectral Imaging) in Food Industry

- Machine Vision (Hyperspectral Imaging) Market Case Study

- Machine Vision (Hyperspectral Imaging) Market Landscape Analysis