|

市场调查报告书

商品编码

1713736

全球LED植物生长灯市场:至2025年的发展趋势及主要应用领域2025 Development Trends in LED Grow Lights and Major Application Sectors |

|||||||

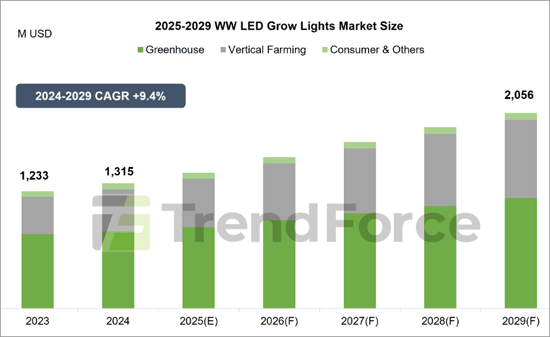

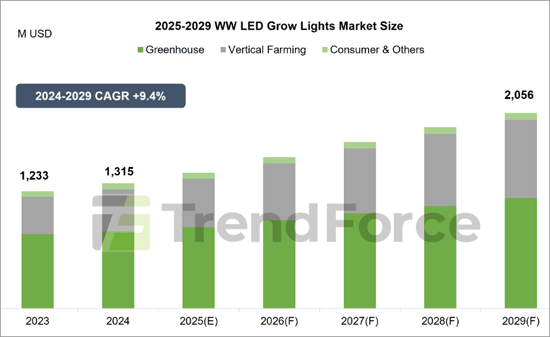

预计到 2029 年,全球 LED 生长灯市场规模将达到 20.56 亿美元。

由于水果和蔬菜温室需求的復苏以及中小型垂直农场投资的恢復,LED 生长灯市场预计将在 2024 年復苏。预计 2024 年 LED 生长灯市值将达到 13.15 亿美元。展望未来,LED 的普及率不断提高、以具有更高光合光子效率 (PPE) 和光合光子通量密度 (PPFD) 的高效产品取代旧技术、以及可调和多通道照明的进步等因素预计将推动成长。对新兴农业技术的大量投资也鼓励农民采用 LED 解决方案,预计到 2029 年该领域市场规模将达到 20.56 亿美元,2024 年至 2029 年的复合年增长率为 9.4%。

报告强调,温室(包括非堆迭室内农业)占据 LED 生长照明市场的最大占有率,其次是垂直农场和消费者领域。到2024年,温室将占据60%以上的市场占有率,垂直农场将占据30%以上的市场。随着对农业创新的持续投资,垂直农场的需求预计将在未来几年内持续增长。

温室机会(包括非堆迭式室内农业)

该应用市场的需求仍以 LED 取代高压钠灯 (HPS) 为主,这主要是因为 LED 技术具有显着的节能效果。市场焦点正朝向600W以上的更高功率解决方案转移,600W至1500W的产品逐渐成为主流配置。光合光子效率(PPE)整体水准提高到3.0-4.5 μmol/J,不仅提高了植物的生长效率,也降低了整体生产成本。

2024 年,室内大麻种植对 LED 生长灯的需求正在下降,但人们对番茄、草莓、葡萄和鲜花等高价值作物的兴趣却在飙升。 2024年LED植物生长灯市场中温室应用的比例将为61.5%,较2023年略有下降,但仍占主导地位。预计到 2029 年,该领域规模将成长至 11.58 亿美元,2024 年至 2029 年的复合年增长率为 7.5%。

Philips、Fluence、Gavita、Agrolux、Acuity、Lumatek、Hortilux、Heliospectra、California Lightworks等领先品牌正在利用这一趋势,提供具有优化光谱配方和可调节多通道控制的产品。除了标准的 120 度光束角度外,140 度和 150 度的宽光束角度也越来越受欢迎。

中小型垂直农场的市场机会

经过两年的调整期,垂直农业领域在 2024 年显示出復苏的迹象,中小型农场将引领成长。对当地种植的需求不断增长、对新鲜健康农产品的关注以及政府补贴等因素支持了该领域的获利能力。这些农场包括小规模农场、为城市社区服务的货柜农场以及超市和零售商经营的店内农场,所有这些都促进了永续需求的成长。

货柜农场在城市、海岛度假村(如斯里兰卡)、学校以及阿拉斯加等资源贫乏的地区越来越受欢迎。店内农场的范围已扩大到包括商店、酒店、餐馆,甚至包括使用 Agwa Farms 产品的 Synergy Marine Group 管理的油轮等船隻。除了叶类蔬菜外,草莓、洋葱等高价值作物的种植以及育种植物的种植也在增加。预计到 2029 年,该细分市场规模将达到 8.22 亿美元,2024 年至 2029 年的复合年增长率为 13.1%。

消费应用领域的市场机会

最新数据显示,欧洲和美洲对室内园艺和观赏植物的需求不断增长,推动了消费性 LED 生长灯销量的成长。到 2024 年,该细分市场将占整个市场的 4.8%。

预计到 2029 年,市场规模将成长至 7,600 万美元,2024 年至 2029 年的复合年增长率为 3.7%。

本报告调查了全球 LED 植物生长灯市场,并总结了市场趋势、细分趋势、地区趋势以及主要供应链的竞争状况。

目录

第一章 全球LED植物生长灯市场趋势

- LED 在园艺照明中的表现

- LED 在园艺照明的主要应用

- 主要LED园艺照明应用分析

- LED园艺照明主要应用技术需求

- LED植物生长灯:目前产品技术发展与趋势分析

- 园艺照明市场主要作物分布

- 最有前景的植物照明应用

- LED园艺照明市场的成长因素

- 政策和法规

- 2025 年至 2029 年全球 LED 生长灯市场规模分析

- 2025-2029 年全球 LED 植物生长灯市场规模分析 - 基于价值:按应用

- 2025-2029 年 LED 植物生长灯市场规模分析 - 依地区价值分析

第二章 温室生长灯趋势分析

- LED温室植物生长灯市场规模分析

- LED温室生长灯区市场分析

- LED 温室照明规格与价格:水果、蔬菜、花卉

- 室内种植用 LED 照明规格与价格:大麻

- 案例研究:欧洲温室应用

- 案例研究:北美温室应用

第三章 垂直农场植物生长灯趋势分析

- 垂直农场LED植物生长灯市场规模分析

- 垂直农场LED植物生长灯区域市场分析

- 垂直农场LED植物生长灯产品规格及价格分析

- 垂直农业市场的最新趋势

- 中小型垂直农场的应用类型和主要市场分析

- 案例研究:北美的垂直农业应用

- 案例研究:欧洲的垂直农业应用

- 案例研究:亚洲的垂直农业应用

第四章 消费农业中植物生长灯的趋势分析

- 消费农业领域LED植物生长灯市场规模分析

- 2024-2025 年消费农业用 LED 生长灯区域市场分析

- 消费性LED生长灯的产品规格与价格分析

第五章 主要供应链市场分析

- 2025 年至 2029 年农业照明 LED 市场价值

- 各大厂商LED园艺照明产品规格分析

- 2025年分析:园艺照明LED规格及价格 660nm红光产品

- 2025年分析:园艺照明LED规格与价格白光产品

- 园艺LED照明市场的供应链更新

- 2023-2024年农业照明LED製造商收入排名

- 2023-2024 年农业照明 LED 製造商市场占有率

- LED园艺照明製造商状况

[Insight] TrendForce: Global LED Grow Light Market Size Projected to Reach USD 2.056 Billion by 2029

According to TrendForce's " 2025 Development Trends in LED Grow Lights and Major Application Sectors" report, the LED grow light market is rebounding in 2024, driven by recovering demand for greenhouse of fruits and vegetables and renewed investments in small and medium-sized vertical farms. The market size for LED grow lights in 2024 is estimated at USD 1.315 billion. Looking ahead, factors such as increasing LED adoption, replacement of older technologies with high-efficiency products boasting improved Photosynthetic Photon Efficacy (PPE) and Photosynthetic Photon Flux Density (PPFD), and advancements in adjustable multi-channel lighting are expected to fuel growth. Significant investments in emerging agricultural technologies are also encouraging growers to adopt LED solutions, pushing the market to a projected USD 2.056 billion by 2029, with a compound annual growth rate (CAGR) of 9.4% from 2024 to 2029.

The report highlights that greenhouse (including non-stacked indoor farming) account for the largest share of LED grow light applications, followed by vertical farms and the consumer segment. In 2024, greenhouses represent over 60% of the market, while vertical farms contribute more than 30%. With ongoing investments in agricultural innovation, vertical farms are expected to see a growing share of demand in the coming years.

01. Market Opportunities in Greenhouse Applications (including non-stacked indoor Farming)

Demand in this application market is still dominated by the replacement of High-Pressure Sodium (HPS) lamps with LEDs, primarily due to the significant energy-saving benefits of LED technology. The market focus has shifted towards high-power solutions above 600W, with products in the 600W to 1500W range gradually becoming the mainstream configuration. The overall level of Photosynthetic Photon Efficacy (PPE) has increased to 3.0-4.5 micro-mol/J, which not only boosts plant growth efficiency but also lowers overall production costs.

In 2024, demand for LED grow lights in indoor cannabis cultivation has declined, but interest in high-value crops like tomatoes, strawberries, grapes, and flowers has surged. These crops, which require strict freshness standards, are increasingly grown locally to minimize transportation costs. TrendForce estimates that greenhouse applications accounted for 61.5% of the LED grow light market in 2024, down slightly from 2023 but still dominant. This segment is projected to grow to USD 1.158 billion by 2029, with a CAGR of 7.5% from 2024 to 2029.

Leading brands such as Philips, Fluence, Gavita, Agrolux, Acuity, Lumatek, Hortilux, Heliospectra, and California Lightworks are capitalizing on this trend by offering products with optimized spectral recipes and adjustable multi-channel controls. In addition to the standard 120-degree beam angle, wider angles of 140 and 150 degrees are gaining popularity.

02. Market Opportunities in Small and Medium-Sized Vertical Farming Applications

After a two-year period of recalibration, the vertical farming sector showed signs of recovery in 2024, with small and medium-sized farms driving growth. Factors such as rising demand for localized cultivation, a focus on fresh and healthy produce, and government subsidies are supporting profitability in this segment. These farms include smaller-scale operations, container farms serving urban communities, and in-store farms operated by supermarkets and retailers, all contributing to sustainable demand growth.

Container farms are gaining traction in urban areas, island resorts (e.g., Sri Lanka), schools, and resource-scarce regions like Alaska. In-store farms are expanding into shops, hotels, restaurants, and even maritime vessels, such as tankers using Agwa Farm products managed by Synergy Marine Group. Beyond leafy greens, high-value crops like strawberries and onions, as well as plants for breeding, are increasingly cultivated. TrendForce projects this market segment to reach USD 822 million by 2029, with a CAGR of 13.1% from 2024 to 2029.

03. Market Opportunities in Consumer Applications

According to TrendForce's latest data, the rising demand for indoor residential gardening and decorative plants across Europe and the Americas has driven increased sales of consumer LED grow lights., combined with accessible e-commerce platforms, has boosted sales of consumer-grade LED grow lights. In 2024, this segment accounted for 4.8% of the total market.

Looking ahead, continued passion for residential gardening in Europe and the Americas and the launch of innovative LED grow light products are set to drive further market growth. TrendForce forecasts this market to grow to USD 76 million by 2029, with a CAGR of 3.7% from 2024 to 2029.

Table of Contents

Chapter 1: Global LED Grow Lights Market Trend

- LED Performance for Horticultural Lighting

- LED Main Applications for Horticultural Lighting

- Analysis on Major LED Horticultural Lighting Applications

- Technical Requirements for Main Applications of LED Horticultural Lighting

- LED Grow Lights: Analysis on Current Product Technology Developments and Trends

- Distribution of Major Crops in the Horticultural Lighting Market

- The Most Promising Plant-Based Lighting Applications

- Drivers of Growth in the LED Horticultural Lighting Market

- Policy and Regulations

- 2025-2029 Global LED Grow Lights Market Size Analysis

- 2025-2029 Global LED Grow Lights Market Size Analysis- Value Based: By Application

- 2025-2029 LED Grow Lights Market Size Analysis- Value Based: by Region

Chapter 2: Trend Analysis on Grow Lights in Greenhouse

- Market Size Analysis of LED Grow Lights in Greenhouse

- Regional Market Analysis of LED Grow Lights for Greenhouse

- LED Lighting Specs and Prices for Greenhouses: Fruits, Vegetables, and Floral Crops

- LED Lighting Specs and Prices for Indoor Farming: Cannabis

- Case Study: Applications for Greenhouses across Europe

- Case Study: Applications for Greenhouses across North America

Chapter 3: Trend Analysis on Grow Lights in Vertical Farming

- Market Size Analysis of LED Grow Lights in Vertical Farming

- Regional Market Analysis of LED Grow Lights for Vertical Farming

- Product Specs and Price Analysis of LED Grow Lights for Vertical Farming

- Current Developments of the Vertical Farming Market

- Types of Small- and Medium-Scale Vertical Farming Applications and Major Market Analysis

- Case Study: Applications for Vertical Farming across North America

- Case Study: Applications for Vertical Farming across Europe

- Case Study: Applications for Vertical Farming across Asia

Chapter 4: Trend Analysis on Grow Lights in Consumer Farming

- Market Size Analysis of LED Grow Lights in Consumer Farming

- 2024-2025 Regional Market Analysis of LED Grow Lights for Consumer Farming

- Product Specs and Price Analysis of LED Grow Lights for Consumer

Chapter 5: Key Supply Chain Market Analysis

- 2025-2029 Agricultural Lighting LED Market Value

- Specification Analysis of Horticultural Lighting LED Products from Major Manufacturers

- 2025 Analysis: Horticultural Lighting LED Specifications and Prices 660nm Red Light Products

- 2025 Analysis: Horticultural Lighting LED Specifications and Prices White Light Products

- Horticultural LED Lighting Market Supply Chain Update

- 2023-2024 Agricultural Lighting LED Manufacturers Revenue Ranking

- 2023-2024 Agricultural Lighting LED Manufacturer Market Share

- LED Horticultural Lighting Manufacturer Landscape