|

市场调查报告书

商品编码

1774033

稀土产业趋势:中国对美国及2025年的全球展望Rare Earth Industry Dynamics: China vs US and 2025 Global Outlook |

|||||||

价格

简介目录

概述

稀土製成的关键零件和材料几乎无所不在:消费性电子、通讯、汽车、工业自动化、机器人、再生能源、核能、医疗保健、军事、航空航太和航空领域。它们的重要性毋庸置疑。

样品

本报告对稀土供应链的上游、中游和下游环节进行了全面分析。报告也探讨了中国在该行业的主导地位,并探讨了美国及其盟友的应对措施。

重点

- 稀土在电子、能源和国防等多个领域发挥关键作用。

- 本报告考察了整个价值链:上游、中游和下游。

- 我们也分析了中国在该产业的主导地位。

- 我们探讨了美国及其盟友的因应措施。

目录

第一章:稀土用途广泛,与石油同等重要

第二章:中国稀土产量和储量居世界首位,是稀土主要供应国

第三章:中国在稀土上中游供应链中拥有显着优势

第四章:中国稀土出口限制将产生深远影响,美国需3-5年时间弥补供应链缺口

第5章 TRI的观点

简介目录

Product Code: TRi-145

Overview

Key components and materials made from rare earth elements are virtually ubiquitous-found across consumer electronics, telecommunications, automotive, industrial automation, robotics, renewable energy, nuclear power, healthcare, military, aerospace, and aviation sectors. Their importance is beyond question.

SAMPLE VIEW

This report provides a comprehensive analysis of the upstream, midstream, and downstream segments of the rare earth supply chain. It also examines China's dominant role within this industry and explores how the US and its allies are strategizing to respond.

Key Highlights:

- Rare earth elements are critical in diverse sectors, including electronics, energy, and defense.

- The report examines the entire value chain: upstream, midstream, and downstream.

- China's dominance in the industry is discussed.

- Strategies from the US and allies in response are explored.

Table of Contents

1. Rare Earth Elements Are Widely Used and No Less Critical Than Oil

- Figure 1: Rare Earth Elements Include Scandium, Yttrium, and the Lanthanide Series

- Table 1: Rare Earth Element-Based Components, Materials, and Their End Applications

2. China Leads the Way in Rare Earth Production and Reserves, and Is the Primary Supplier of Heavy Rare Earth Elements

- Table 2: Rare Earth Deposit Types and Production Sites

- Figure 2: Share of Global Rare Earth Production by Country/Region in 2024

- Table 3: 2024 Rare Earth Production by Country/Region

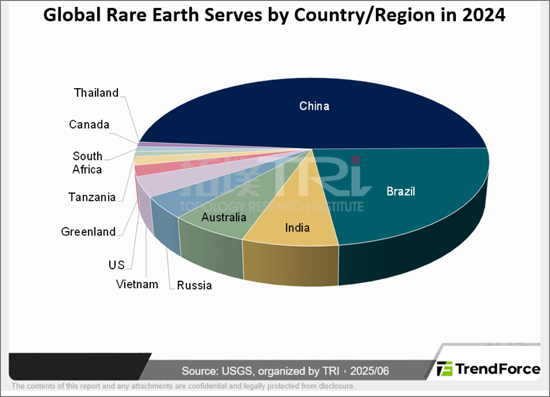

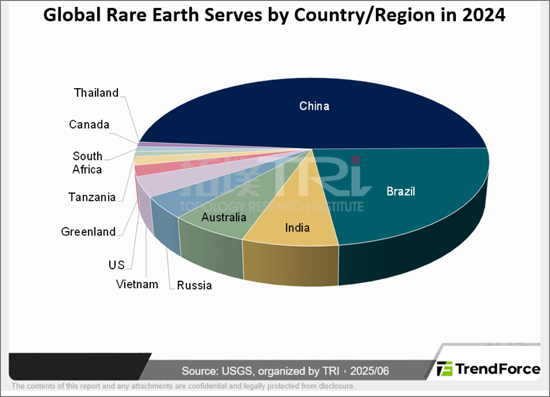

- Figure 3: Share of Global Rare Earth Reserves by Country/Region in 2024

- Table 4: Rare Earth Reserves by Country/Region

3. China Holds Significant Advantages in the Upstream and Midstream Rare Earth Supply Chain

- Figure 4: Overview of the Global Rare Earth Supply Chain

4. China's Rare Earth Export Controls Have Far-Reaching Impacts; US Will Need 3-5 Years to Fill Supply Chain Gaps

- Figure 5: Restricted Items under China's Ministry of Commerce and General Administration of Customs Announcement No. 18

- Table 5: Rare Earth Resources Response Strategies of the US and Its Allies

- Table 6: Estimated Timeline of the Impact of China's Rare Earth Export Controls on the Global Downstream Supply Chain

5. TRI's View

02-2729-4219

+886-2-2729-4219