|

市场调查报告书

商品编码

1794797

全球电子产品领域的需求概要(2025年)Overview of Global Electronics Sector's Demand in 2025 |

|||||||

价格

简介目录

2025 年,电子产业将呈现混合趋势:人工智慧需求强劲,消费设备需求疲软,早期拉动将消除季节性因素,导致未来成长放缓。

信息图形

重点

- 2025 年,人工智慧需求将激增,而消费性电子产品(智慧型手机、笔记型电脑和电视)的成长将停滞或微乎其微。

- 关税和补贴将导致库存提前消化,扰乱传统的销售高峰,并增加下半年的风险。

- 云端服务供应商将增加对受关税影响较小的AI伺服器的资本投入,这将对通用伺服器预算带来压力。 “AI将独自成功。”

- 边缘AI将失去动力,终端设备将缺乏引人注目的AI应用,无法推动升级和消费者兴趣。

- 到2026年,该产业将进入低成长整合阶段,大多数产品将保持低迷,AI伺服器也将失去动力。

- 关税的不确定性将影响PC OEM厂商和供应商的生产策略。

目录

第一章:关税和补贴拉动需求前期成长,扰乱传统旺季

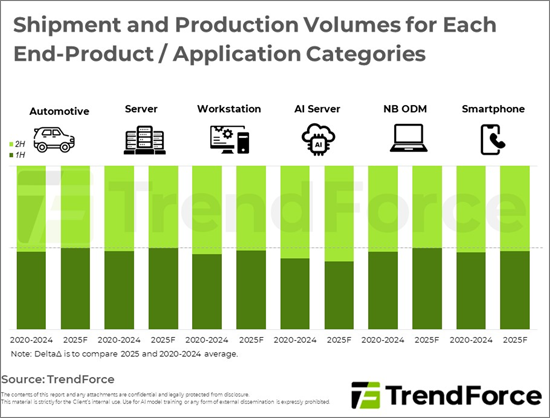

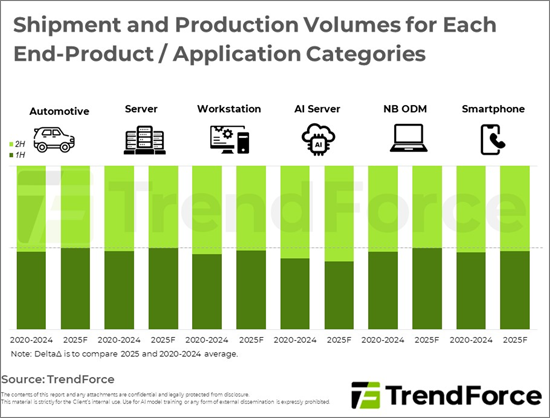

- 以最终产品和应用划分的出货量和产量-2025年上半年和下半年年度出货量分布与五年平均值的比较

第二章:AI伺服器的需求正在稳定成长。与其他应用相比,AI伺服器不易受到价格不确定性的影响,并受益于云端运算服务供应商(CSP)资本投资的增加。

第三章:边缘AI的热潮正在逐渐消退,但替代浪潮尚未出现。杀手级应用暂时搁置。

第四章:展望2026年-成长放缓将导致产业成长放缓与整合。

简介目录

Product Code: TRi-0082

In 2025, the electronics industry sees diverging trends: strong AI demand, weak consumer devices, early pull-in erases seasonality, and future growth slows.

INFOGRAPHICS

Key Highlights:

- In 2025, AI demand surges while consumer electronics-smartphones, laptops, TVs-see stagnant or minimal growth.

- Tariff and subsidy impacts cause early inventory pull-in, disrupting traditional sales peaks and raising risks in the year's latter half.

- Cloud providers grow capital spending on AI servers, with less tariff impact, squeezing budgets for general servers. "AI alone thrives."

- Edge AI loses momentum; end devices lack compelling AI applications, failing to drive upgrades or noticeable consumer interest.

- By 2026, the industry enters a consolidation phase with slow growth, most products remain weak, and AI server momentum eases; breakthroughs needed for future cycles.

- Tariff uncertainty impacts PC OEMs' and suppliers' production strategies; DRAM supply-demand and other components merit close watch.

Table of Contents

1. Tariffs and Subsidies Have Caused Demand to Be Pulled Forward and Disrupts Traditional Peak Season

- Shipment and Production Volumes for Each End-Product / Application Categories - Distribution of Annual Shipments Between 1H25 and 2H25 vs. Averages of Previous Five Years

2. Demand Grows Steadily for AI Servers, Which Are Less Affected by Tariff-Related Uncertainties Compared with Other Applications and Have Benefited from CSPs' Increasing Capital Expenditure

3. Subsiding Topic of Edge AI Yet to Ignite Replacement Wave; Killer Applications Pending for the Time Being

4. Looking Ahead to 2026: Industry Enters Low-Speed Growth and Consolidation under Decelerating Increment

02-2729-4219

+886-2-2729-4219