|

市场调查报告书

商品编码

1815982

NVIDIA 2026 年第二季资料中心销售额成长近 88%,GB 机架销售额在 2025 年下半年激增,而 H20 对中国的出口仍存在不确定性。NVIDIA Near 88% in FY2Q26 Data Center Revenue with GB Racks Ramping Up in 2H25; Export of H20 to China Remains Uncertain |

|||||||

价格

简介目录

Oracle 的 GB 机架需求激增,但由于生产复杂,初期出货缓慢,而 NVIDIA H20 儘管面临地缘政治课题,仍保持成长潜力。

样品view

主要亮点

- Oracle 与富士康的合作显着增加了对 GB 机架的需求。

- 由于组装复杂,初期几个月的出货速度会比较慢。

- GB200 仍将是旗舰型号,而 GB300 将逐步扩展并取代 GB200。

- 新的 VR200 系统目前正在设计中,预计今年稍后将实现量产。

- NVIDIA H20 将受到中美紧张局势的影响,但其 AI 生态系统优势将得以保留。

- H20 的未来将取决于地缘政治谈判和本地 ASIC 开发进展。

目录

第1章 简介

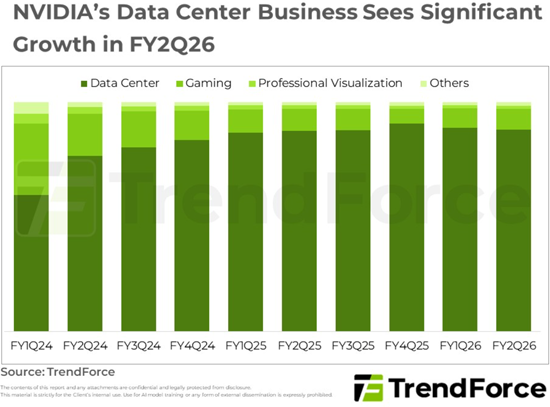

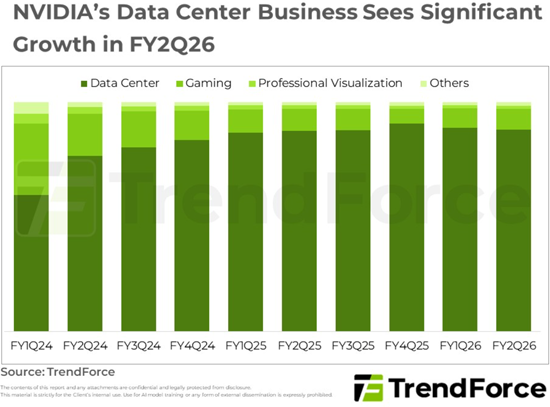

- NVIDIA 资料中心业务在 2026 财年第二季实现显着成长

第二章:受北美主要 CSP 需求推动,预计 2025 年下半年 GB 机架需求将成长

- 主要客户的 GB 机架出货量占比预测

第三章:受地缘政治环境变迁影响,2020 年 H10 市场或将面临下滑风险,但将推动 RTX PRO 6000 的成长机会

第四章:预计 2026 年 NVIDIA AI 解决方案的需求将持续成长,CoWoS 市场将强劲成长技术。

- 2026 年台积电与 NVIDIA CoWoS 需求预测

第五章:NVIDIA 的机架解决方案(包括 GB 和 VR 系列)预计将在 2025 年至 2026 年期间推动液冷供应链的成长。

- GB 和 VR 系列机架出货量的增加预计将推动 AI 晶片液冷系统的普及。

第六章:Blackwell 晶片是 HBM 市场的主要需求驱动力,GB300 的发布显着增加了对 HBM3e 12-hi 的需求。

- HBM 出货量依产品类型分布(2025-2026 年)

简介目录

Product Code: TRi-0084

Oracle's demand for GB Rack surges; production complexity slows early shipments; NVIDIA H20 faces geopolitical challenges but retains growth potential.

SAMPLE VIEW

Key Highlights:

- Oracle significantly increases GB Rack demand, mainly through Foxconn collaboration

- Complex assembly slows shipments in early months, expecting major output later

- GB200 remains main model; GB300 gradually expands and will replace GB200

- New VR200 system under design, mass production expected later

- NVIDIA H20 impacted by US-China tensions but retains AI ecosystem benefits

- Future of H20 depends on geopolitical negotiations and local ASIC development progress.

Table of Contents

1. Introduction

- NVIDIA's Data Center Business Sees Significant Growth in FY2Q26

2. Increased Volume Anticipated for GB Racks in the Second Half of 2025, Driven by Major North American CSP Demand

- Projection on Shipment Ratio of GB Racks to Major Clients

3. H20 May be Prone to Risks of Reduction from Fluctuating Status of Geopolitics but Would Facilitate Growth Opportunities of RTX PRO 6000

4. Demand for NVIDIA's AI Solutions Expected to Continue Growing in 2026, With Strong Forecast for CoWoS Technologies

- Projection on TSMC's and NVIDIA's Respective CoWoS Demand Volumes in 2026

5. NVIDIA's Rack Solutions, Including GB and VR Series, Are Expected to Drive Growth of Liquid Cooling Supply Chain in 2025-2026

- Projected Increase in Liquid Cooling Adoption for AI Chips as Shipments Rise for GB and VR Series Racks

6. Blackwell Chips Are Primary Demand Driver in HBM Market, and Release of GB300 Has Led to Significant Demand Growth for HBM3e 12-hi

- Distribution of HBM Shipments by Product Type, 2025-2026

02-2729-4219

+886-2-2729-4219