|

市场调查报告书

商品编码

1873717

云端运算AI展望(2026):北美超大规模云端服务商瞄准GPU与ASIC2026 Cloud AI Outlook: NA Hyperscalers Target GPU & ASICs |

|||||||

价格

简介目录

领先的北美云端服务商正在大幅增加资本支出,显示未来两年内对AI基础设施的投资将达到顶峰。随着他们转向大规模、长期策略,他们正专注于高阶GPU机架,并加速自主研发AI专用ASIC,从而巩固市场领导地位,并推动AI伺服器的快速成长。

样品预览

主要亮点:

- 加速人工智慧投资:北美主要云端服务供应商 (CSP) 正在大幅增加资本支出,并转向大规模、长期的人工智慧基础设施策略。预计这一趋势将在未来几年持续。

- 专注于 GPU 机架:投资主要集中在高阶 NVIDIA GPU 机架解决方案(GB/VR 系列)上,北美供应商占领先的市场占有率。 AMD 也推出了与之竞争的解决方案。

- 客製化ASIC的崛起: 为了降低依赖性并提高成本效益,Google、AWS和Meta等领先公司正在加速开发自有AI ASIC晶片,以增强其技术自主性。

- 强劲的市场前景: 在GPU和ASIC双通路投资以及新兴国家主导的AI专案的推动下,AI伺服器出货量预计将继续上调。

目录

第一章:2025年CSP资本支出预测再次上调,2026年投资动能仍强劲

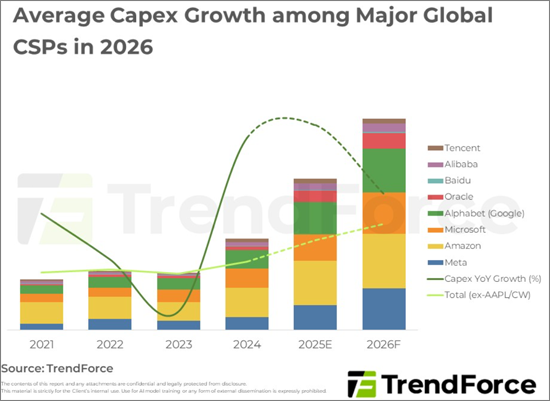

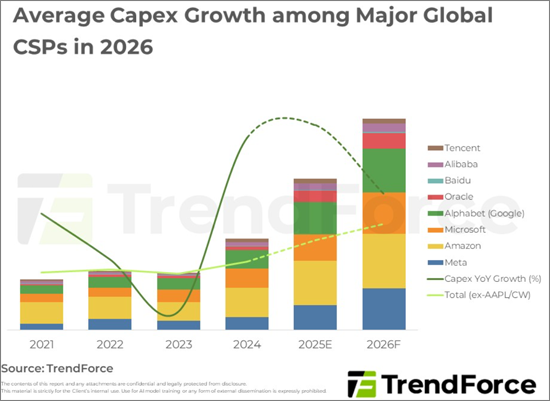

- 2026年全球主要CSP平均资本支出成长率

第二章:五大北美CSP推动2026年GB300与VR200 GPU机架出货量成长

- 预计到2026年,北美五大CSP将主导GB和VR机架总出货量,其中Oracle将占最大占有率

第三章:AI晶片自主研发成为趋势,美国CSP加速内部ASIC开发

加强关键技术的管控- 通讯服务供应商 (CSP) 正在采用人工智慧来提高运算独立性并提升差异化竞争力,同时加强 ASIC 的研发。

简介目录

Product Code: TRi-0100

North American cloud giants are substantially increasing Capex, signaling an investment peak in AI infrastructure over the next two years. Shifting to large-scale, long-term strategies, they are focusing on high-end GPU Racks and accelerating in-house AI ASIC development to secure market leadership and drive rapid AI server growth.

Sample preview

Key Highlights:

- Accelerated AI Investment: Major North American CSPs are significantly raising Capex, shifting to large-scale, long-cycle AI infrastructure strategies with strong momentum expected to continue for years.

- Focus on GPU Racks: Investment is heavily concentrated on high-end NVIDIA GPU rack solutions (GB/VR series), with NA providers taking a dominant share; AMD is also introducing competing solutions.

- Rise of Custom ASICs: To reduce reliance and improve cost efficiency, giants like Google, AWS, and Meta are accelerating in-house AI ASIC development, enhancing their technological autonomy.

- Strong Market Outlook: AI server shipment growth is projected to continue its upward revision, driven by the dual investment tracks (GPU + ASIC) and emerging sovereign AI projects.

Table of Contents

1. CSPs' Outlook on Capex Upward Revised Once Again for 2025; Investment Momentum Remains Strong for 2026

- Average Capex Growth among Major Global CSPs in 2026

2. Five Major North American CSPs to Drive Growth of GB300 and VR200 GPU Rack Shipments in 2026

- North America's Top Five CSPs Expected to Dominate Total GB and VR Rack Shipments by 2026, with Oracle Having Largest Share

3. AI Chip Self-Sufficiency Is a Rising Trend, and US-Based CSPs Are Expediting In-House ASIC Development and Strengthen Control over Key Technologies

- CSPs Ramp Up AI ASIC Development to Achieve a Greater Degree of Computing Self-Sufficiency and Differentiation Competitiveness

02-2729-4219

+886-2-2729-4219