|

市场调查报告书

商品编码

1364098

全球物联网和嵌入式作业系统(OS)市场:即时和安全运算推动商业作业系统市场The Global Market for IoT & Embedded Operating Systems: Real-Time & Secure Computing Revitalizes Commercial OS Market |

||||||

由于物联网和智慧型装置的激增以及对高阶即时功能的需求不断增长,嵌入式作业系统 (OS) 和物联网市场预计将出现强劲成长。 远端监控、预测性维护和自治系统等高价值嵌入式运算应用的特点是低延迟和其他应用要求,例如灵活的 I/O 支援、多核心效能和加速工作负载处理。需要支援的作业系统。

物联网 (IoT) 和工业 4.0 的出现显着增加了对智慧连网设备的需求,导致嵌入式作业系统的采用和要求迅速增加。 随着系统复杂性的增加和多核心处理器的使用,即时应用程式的要求和对(多)操纵系统功能的需求不断增长。 此外,随着软体变得越来越复杂,许多传统作业系统供应商正在其产品的基础上提供其他软体,例如支援更高连接性和安全性的软体。 嵌入式作业系统市场在部署机会、要求和竞争格局方面正在经历快速变化。

开源作业系统因其灵活性、成本效益和软体工具的普遍可用性而变得越来越流行。 儘管有这些优势,开源作业系统仍面临安全挑战。 然而,人们对认证开源作业系统以增加安全关键产业的采用非常感兴趣。 虚拟机器管理程式透过支援多作业系统系统,成为安全关键产业采用开源作业系统的最大推动者。 混合关键嵌入式系统在汽车、A&D 和工业自动化领域变得越来越重要,我们预计 Android/Linux 将在远端监控、预测性维护和自主系统中进一步采用。

进入 2023 年,随着银行倒闭、利率上升和全球紧张局势加剧,经济不确定性不断增加。 儘管遇到这些挫折,汽车、国防和通讯等某些产业仍可能实现稳定成长。 由于全球紧张局势加剧,全球国防预算正在增加,并可能推动该领域对商业嵌入式作业系统的需求。 此外,由于自动驾驶系统和软体定义车辆的竞争,汽车产业将在未来五年内经历显着成长。 在电信业,政府补贴的 5G 站的部署增加将推动边缘运算的采用,从而导致虚拟机器管理程序和容器的使用增加。 鑑于物联网和嵌入式运算应用程式和软体开发的发展,嵌入式作业系统市场可能会发生巨大变化。

目录

执行摘要

世界市场概览

- 近期趋势

按地区预测比较

- 美洲

- 欧洲/中东/非洲

- 亚太地区

产业比较预测

- 航空航太/国防

- 汽车/铁路/交通

- 通讯/网络

- 工业自动化

供应商见解

- BlackBerry QNX

- Canonical

- Enea

- eSOL

- Foundries.io

- Green Hills Software

- Lynx

- Microsoft

- PX5

- Red Hat

- Siemens EDA

- SYSGO

- TenAsys

- Wind River

最终使用者见解

关于 VDC 研究

附件

INSIDE THIS REPORT:

The embedded operating system (OS) and IoT market will experience steady growth, driven by the increasing adoption of IoT and smart devices and the growing need for advanced real-time capabilities. High-value embedded computing applications such as remote monitoring and control, predictive maintenance, and autonomous systems feature low latency and other application requirements for flexible I/O support, multicore performance, and accelerated workload processing, demanding a well-supported OS. This report defines and examines the market for IoT and embedded operating systems, quantifying and qualifying market dynamics through an in-depth discussion of recent events, engineering trends, and vendor strategies. This report also analyzes market dynamics according to leading vendors, geographic regions, and vertical markets.

WHAT QUESTIONS ARE ADDRESSED?

- Which industries and regions are set to emerge the strongest and will be drivers of growth over the next five years?

- How should OS vendors capitalize on increasing safety and security concerns?

- Which software capabilities should OS vendors enable to offer a more complete software platform?

- Will the increased adoption of open-source solutions affect OS vendor strategies?

- How will future safety certifications for Linux affect safety-critical markets?

- Which industries will be affected the most because of emerging global economic concerns?

WHO SHOULD READ THIS REPORT?

This research report is written for those making critical business decisions regarding products, markets, channels, and competitive strategies and tactics. This report is intended for senior decision-makers who are developing and using embedded, IoT, and cloud services technology, including those in the following roles:

- CEO and other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

VENDORS LISTED IN THIS REPORT:

|

|

|

EXECUTIVE SUMMARY:

With the advent of the Internet of Things (IoT) and Industry 4.0, the demand for intelligent and interconnected devices has grown significantly, leading to a surge in deployments and requirements for embedded OSs. Realtime application requirements and increasing demand for (multi-)OS capabilities are growing alongside system complexity and multicore processor use. Additionally, many traditional OS vendors are using their products as a foundation for providing other software offerings, such as those that support greater connectivity and security, as software complexity increases. The embedded OS market is in a state of rapid change for deployment opportunities and requirements as well as the composition of its competitive landscape.

Open-source OSs are becoming increasingly popular for their flexibility, cost effectiveness, and generally greater availability of software tools. Despite these benefits, open-source OSs still face mounting safety and security challenges. Yet, there is significant interest in certifying open-source OS to increase adoption in safety-critical industries. Hypervisors are the biggest enablers for driving open-source OS deployments in safety-critical industries by supporting multi-OS systems. Mixed-criticality embedded systems are becoming more important in automotive, A&D, and industrial automation verticals and will fuel further Android/Linux adoption in remote monitoring and control, predictive maintenance, and autonomous systems.

Economic uncertainty is increasing as 2023 progresses, with bank failures, increasing interest rates, and global tensions rising. Despite these setbacks, certain industries, including automotive, defense, and telecommunications, will see stable growth. Defense budgets are increasing worldwide in response to rising global tensions, which will in turn drive demand for commercial embedded OSs in the sector. Additionally, the automotive industry will experience significant growth over the next five years driven by autonomous systems and the race towards the software-defined vehicle. For telecommunications, increased 5G station deployments subsidized by governments will drive edge computing adoption, and hypervisor and container usage as a result. The embedded OS market is set for a dramatic change given the evolution in IoT and embedded computing applications and software development.

KEY FINDINGS:

- Comprising more than half of global OS revenues combined, the market is led by the automotive, A&D, communications, and industrial automation verticals.

- Multi-OS systems are gaining popularity, particularly in automotive, as a means of using operating systems that support different safety-critical standards and/or application requirements, such as RTOSs and Linux.

- Open-source OSs for embedded applications continue to grow in use, and projects run by The Linux Foundation, such as the Enabling Linux In Safety Applications (ELISA) project, the Zephyr project, and Automotive Grade Linux (AGL), are working to extend Linux within safe and secure applications.

- OS vendors should look to expand their software stack beyond OSs by adding components such as hypervisors and cloud agents to help OEMs shorten development times, as developers will be able to focus on building applications and services on top of a reliable OS platform.

REPORT EXCERPT:

EXPANDING THE SOFTWARE STACK CAN CREATE NEW VALUE FOR OS VENDORS

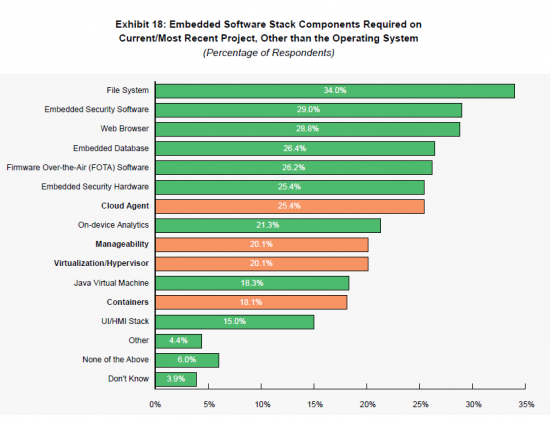

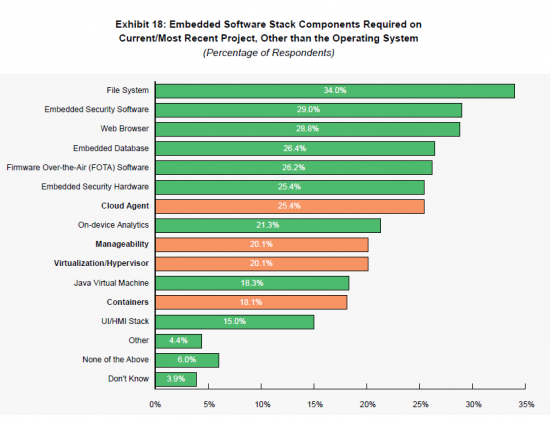

Outside of operating systems, vendors are looking to support other aspects of the software stack, as the complexity and sophistication of embedded software continues to grow. OS vendors need to incorporate or add other aspects of software development, such as security features, file systems, web browsers, cloud agents, and embedded databases. By integrating these components into a cohesive software stack, OS providers can offer a complete solution for OEMs and other engineering houses.

In particular, containers and hypervisor solutions have seen significant growth and are now crucial aspects of the software stack for OS vendors. Hypervisors are used to support multi-OS systems, while containers are being more commonly deployed in applications such as telecommunications to support cloud-native development. Containers are expected to grow in usage over the next three years to 22.4% from 18.1%.

ABOUT THE AUTHORS:

Dan Mandell

Dan Mandell supports a variety of syndicated market research programs and custom consulting engagements in the IoT and Embedded Technology practice. He leads VDC's annual research services for embedded processors, boards, integrated systems, edge gateways, and other computing hardware. Dan's insights help leading technology providers align their go-to-market planning and competitive strategies with the dynamic embedded landscape and its constantly evolving buyer behaviors, technology adoption, and application requirements. His working relationship with VDC dates back to 2005 and includes time supporting Business Development as well as the AutoID practice. Dan holds a B.S. in Information Systems Management from Bridgewater State University.

Chris Rommel

Chris Rommel leads VDC's syndicated research programs and consulting engagements focused on development and deployment solutions for intelligent systems. He has helped a wide variety of clients respond to and capitalize on the leading trends impacting nextgeneration industrial and device markets, such as security, the IoT, and engineering lifecycle management solutions. Chris has also led a range of proprietary consulting projects, including competitive analyses, strategic marketing initiative support, ecosystem development strategies, and vertical market opportunity assessments. Chris holds a B.A. in Business Economics and a B.A. in Public and Private Sector Organization from Brown University.

Table of Contents

Executive Summary

- Key Findings

Global Market Overview

- Recent Developments

- Embedded Linux Aims for Safety-Critical Systems

- RISC-V Emerges to Compete with Established Hardware Architectures

Comparative Forecasts by Region

- Americas

- EMEA Region

- APAC Region

Comparative Forecasts by Vertical Market

- Aerospace & Defense

- Automotive/rail/transport

- Communications and Networking

- Industrial Automation

Vendor Insights

- BlackBerry QNX

- Canonical

- Enea

- eSOL

- Foundries.io

- Green Hills Software

- Lynx

- Microsoft

- PX5

- Red Hat

- Siemens EDA

- SYSGO

- TenAsys

- Wind River

End User Insights

- Characteristics Influencing the Selection of Embedded Operating Systems

- Factors Affecting Engineering Organization OS Choices

- Expanding the Software Stack Can Create New Value for OS Vendors

About VDC Research

Report Exhibits

- Exhibit 1: Global Revenue of IoT & Embedded Operating Systems and Related Services

- Exhibit 2: Global Unit Shipments of IoT & Embedded Operating Systems

- Exhibit 3: Global Unit Shipments of IoT & Embedded Operating Systems by OS Type

- Exhibit 4: Global Revenue of IoT & Embedded Operating Systems and Related Services by OS Type

- Exhibit 5: Global Revenue of IoT & Embedded Operating Systems and Related Services by Geographic Region

- Exhibit 6: Global Revenue of IoT & Embedded Operating Systems and Related Services by Geographic Region (Excluding Microsoft)

- Exhibit 7: Global Revenue of IoT & Embedded Operating Systems and Related Services by Leading Vendors and Geography, 2022

- Exhibit 8: Global Revenue of IoT & Embedded Operating Systems and Related Services by Vertical Market, 2022

- Exhibit 9: Global Unit Shipments of IoT & Embedded Operating Systems and Related Services by Vertical Market

- Exhibit 10: Global Revenue of IoT & Embedded Operating Systems and Related Services by Leading Vendors and Vertical Market, 2022

- Exhibit 11: Global Revenue Share of IoT & Embedded Operating Systems and Related Services by Revenue Leaders, 2022

- Exhibit 12: Global Unit Share of IoT & Embedded Operating Systems by Revenue Leaders

- Exhibit 13: Global Unit Share of IoT & Embedded Operating Systems by Unit Leaders

- Exhibit 14: Global Revenue of RTOS and Related Services by Revenue Leaders

- Exhibit 15: Global Revenue of Commercial Linux and Related Services by Revenue Leaders

- Exhibit 16: Most Important Characteristics When Selecting the Primary Embedded Operating System for Current Project

- Exhibit 17: Likelihood of Using the Same Operating System on a Similar Project Three Years From Now

- Exhibit 18: Embedded Software Stack Components Required on Current/Most Recent Project, Other than the Operating System