|

市场调查报告书

商品编码

1472063

嵌入式闆卡模组系统Embedded Boards, Modules & Systems |

||||||

价格

简介目录

本报告分析了各种硬体外形尺寸(例如模组计算机、模组系统、主机板、单板计算机、整合计算系统和伺服器)的主要市场趋势和竞争格局。 它还提供各个细分市场的市场份额、对影响商业市场的最大发展和供应商以及当前和未来供应商生态系统的分析。

本报告中介绍的组织

|

|

目录

执行摘要

- 主要发现

世界市场概览

- 近期趋势

- 边缘人工智慧吸引大规模投资

- 模组系统、主机板和边缘 PC 吸引了新公司

竞争格局

- 竞争格局概览

- 供应商见解

- AMETEK Abaco Systems

- ADLINK Technology

- Advantech

- Avnet (Avnet Embedded)

- congatec

- Dell Technologies

- Eurotech

- Hewlett Packard Enterprise (HPE)

- Kontron

- Raspberry Pi

- Supermicro Computer

- Toradex

最终使用者见解

- 供应商流失率较低,但供应商仍有很大的进步空间

- 软体需求因所使用的硬体规格而异。

- 选择 AI/ML 硬体供应商时,效能和安全性非常重要

关于 VDC 研究

报告图表

- 依外型尺寸细分:2022-2027 年(十亿美元)

简介目录

This research study analyzes leading market trends and the competitive landscape for a variety of hardware form factors, including computer-on-modules, system-on-modules, motherboards, single-board computers, and integrated computing systems and servers. Accompanied by numerous market share segmentations, this report delivers research-driven commentary on the largest developments and vendors influencing commercial markets and the current and future supplier ecosystem.

SAMPLE VIEW

Organizations Listed in This Report:

|

|

Table of Contents

Executive Summary

- Key Findings

Global Market Overview

- Recent Developments

- Edge AI Draws Significant Financial Investments

- System-on-Modules, Motherboards & Edge PCs Attract New Players

Competitive Landscape

- Competitive Landscape Overview

- Vendor Insights

- AMETEK Abaco Systems

- ADLINK Technology

- Advantech

- Avnet (Avnet Embedded)

- congatec

- Dell Technologies

- Eurotech

- Hewlett Packard Enterprise (HPE)

- Kontron

- Raspberry Pi

- Supermicro Computer

- Toradex

End-User Insights

- Vendor Churn is Low but Plenty Room for Improvement for Suppliers

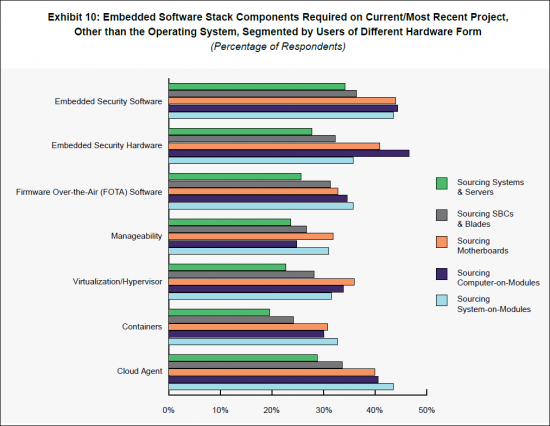

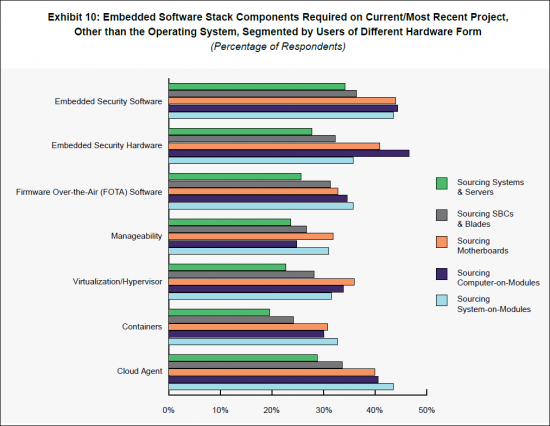

- Software Needs Vary by Hardware Form Factor Use

- AI/ML Hardware Vendor Selection Spotlights Performance & Security

About VDC Research

Report Exhibits

- Exhibit 1: Forecasted Global Shipments of Embedded Boards, Modules & Systems

- Segmented by Form Factor, 2022-2027 (Billions of Dollars)

- Exhibit 2: Global Vendor Shares of Desktop Class Motherboards, 2022 (Millions of Dollars)

- Exhibit 3: Global Vendor Shares of ITX Class Motherboards, 2022 (Millions of Dollars)

- Exhibit 4: Global Vendor Shares of Embedded/Stackable Class Motherboards, 2022 (Millions of Dollars)

- Exhibit 5: Global Vendor Shares of Slot SBCs & Blades, 2022 (Millions of Dollars)

- Exhibit 6: Global Vendor Shares of Computer-on-Modules, 2022 (Millions of Dollars)

- Exhibit 7: Global Vendor Shares of System-on-Modules, 2022 (Millions of Dollars)

- Exhibit 8: Global Vendor Shares of Embedded Integrated Computer Systems & Servers, 2022 (Millions of Dollars)

- Exhibit 9: Likelihood of Using the Same Embedded Hardware Vendor Three Years From Now & Satisfaction with Current Suppliers (Percentage of Respondents; Average Rating)

- Exhibit 10: Embedded Software Stack Components Required on Current/Most Recent Project, Other than the Operating System, Segmented by Users of Different Hardware Form Factors (Percentage of Respondents)

- Exhibit 11: Most Important Elements When Considering AI/ML Vendors/Integrators Segmented by Users of Different Hardware Form Factors (Percentage of Respondents)

02-2729-4219

+886-2-2729-4219