|

市场调查报告书

商品编码

1581989

边缘网关、工业 PC、嵌入式/OEM OT 伺服器:最新边缘运算的基础Edge Gateways, Industrial PCs & Embedded/OEM OT Servers: The Foundation of Modern Edge Computing |

||||||

随着处理器技术、高速连接和软体定义架构 (SDA) 的快速发展,操作技术 (OT) 系统及其市场的发展速度比以往任何时候都快。该领域对复杂边缘运算解决方案和服务的需求不断增长,正在推动各类系统市场的扩张。从小型边缘网关到即时工业 PC 和高效能伺服器,OEM、整合商、服务供应商和最终用户需要多种不同的硬体解决方案才能在竞争中保持领先地位。因此,嵌入式和边缘系统目前在各个细分市场都经历了强劲成长。

本报告调查了全球边缘网关、工业PC (IPC) 和嵌入式/OEM OT 伺服器市场,并提供了市场趋势、市场规模趋势和预测、按垂直细分市场和区域进行的详细分析以及竞争力。

研究问题:

- 边缘人工智慧、网路安全、工业物联网和工作负载加速等趋势如何影响边缘系统市场及其预测?

- 随着各种边缘系统外形因素的发展,最大的成长机会在哪里?

- 边缘网关、IPC 和嵌入式/OEM OT 伺服器的主要供应商有哪些?

- 晶片提供者、作业系统供应商等在边缘运算生态系统中扮演什么角色?

- 边缘系统架构如何发展以更好地支援和扩展部署要求?

- 对于 OEM 和其他采购嵌入式和边缘运算系统的公司来说,哪些选择标准和考虑因素最重要?

发布的组织

|

|

目录

本报告的内容

已发布的作业

谁应该读它

发布的组织

执行摘要

- 主要调查结果

世界市场概览

- 边缘运算

- 边缘人工智慧:在整个市场中获得动力

- 工程组织注意事项:购买与构建

- 边缘运算:需要强大的软体框架

- 硅技术的进步推动边缘硬体市场的发展

- 通路伙伴:仍是进入市场的重要途径

- 无线技术的发展:推动边缘硬体的需求

区域预测

- 美洲

- 欧洲/中东/非洲

- 亚太地区

垂直市场预测

- 航空航太/国防

- 汽车/车队/公共安全

- 通讯/网络

- 工业自动化/控制

- 交通

竞争格局

- ADLINK

- Advantech

- Beckhoff Automation

- Cisco

- Dell Technologies

- Digi

- Eurotech

- HPE

- OnLogic

- Siemens

- Semtech

- Supermicro

最终使用者见解

- 边缘系统继续加强

- 边缘网关硬体平台:必须根据客户类型进行客製化

- IPC 外形尺寸:极大影响各种供应商选择标准的重要性

- OT伺服器:需要高阶安全功能

关于作者

关于 VDC 研究

报表图表清单(部分)

市场数据图表清单(部分)

边缘网关

工业电脑

嵌入式/OEM OT 伺服器

物联网与嵌入式工程调查

Inside this Report :

Driven by rapid advances in processor technology, high-speed connectivity, and software-defined architectures, operational technology (OT) systems and markets are evolving faster than ever before. Ramping demand for sophisticated edge computing solutions and services in the field are fueling market expansion for a variety of system types. Ranging from small-footprint edge gateways to real-time industrial PCs and high-performance servers, several distinct hardware solutions are needed by OEMs, integrators, service providers, and end users to keep pace with their own competition. As a result, embedded and edge systems are currently riding strong growth across a variety of different market segments.

INFOGRAPHICS

This report examines the global market for edge gateways, industrial PCs (IPCs), and embedded/OEM OT servers, including extensive market sizing and a deep dive into key regional and vertical market trends, competitive landscape analysis, and demand-side findings.

What Questions are Addressed?

- How are trends like edge AI, cybersecurity, industrial IoT, and workload acceleration impacting edge system markets and their forecasts?

- Where are the largest future growth opportunities for different edge system form factors?

- Who are the leading suppliers of edge gateways, IPCs, and embedded/OEM OT servers?

- What roles do silicon providers, OS vendors, and others play in the edge computing ecosystem?

- How are edge system architectures evolving to better support and scale with deployment requirements?

- Which selection criteria and considerations are most important to OEMs and others sourcing embedded and edge computing systems?

Who Should Read this Report?

This report was written for those making critical decisions regarding product, market, channel, and competitive strategy and tactics. This report is intended for senior decision-makers who are developing embedded and edge computing solutions, including:

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development/strategy leaders

- Channel management/strategy leaders

Organizations Mentioned in this Report:

|

|

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Mentioned in this Report

Executive Summary

- Key Findings

Global Market Overview

- Edge Computing

- Edge AI is Gathering Momentum Across Markets

- Engineering Organizations are Leaning Further into Buy vs. Build

- Edge Computing Requires a Robust Software Framework

- Advances in Silicon are Opening Up the Edge Hardware Market

- Channel Partners Remain Critical Paths to Market

- Wireless Evolution Pushes Edge Hardware Demand

Regional Forecasts

- Americas

- Europe, Middle East, Africa

- Asia-Pacific

Vertical Market Forecasts

- Aerospace & Defense

- Automotive/Fleet & Public Safety

- Communications & Networking

- Industrial Automation & Control

- Transportation

Competitive Landscape

- ADLINK

- Advantech

- Beckhoff Automation

- Cisco

- Dell Technologies

- Digi

- Eurotech

- HPE

- OnLogic

- Siemens

- Semtech

- Supermicro

End-User Insights

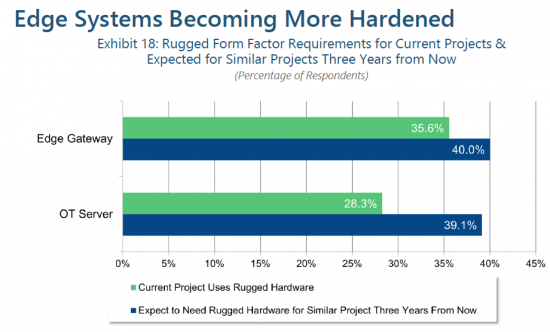

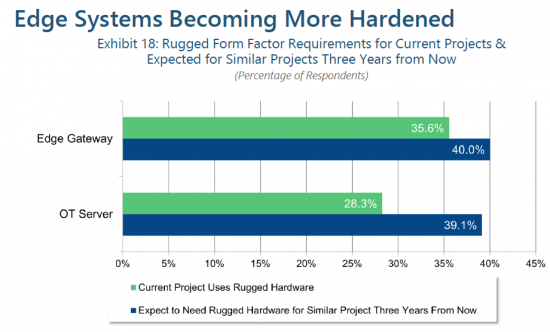

- Edge Systems Becoming More Hardened

- Edge Gateway Hardware Platforms Need to be Tailored for Different Customer Types

- IPC Form Factor Greatly Influences the Importance of Different Vendor Selection Criteria

- OT Servers Demand High-end Security Capabilities

About the Authors

About VDC Research

List of Report Exhibits(Partial)

- Exhibit 1: Forecasted Global Shipments of Edge Gateways, Industrial PCs & Embedded/OEM OT Servers, 2023-2028

- Exhibit 2: Global Shipments of Intelligent and M2M Gateways, 2023-2028

- Exhibit 3: Global Shipments of IPCs Segmented by Form Factor, 2023-2028

- Exhibit 4: Global Shipments of Embedded/OEM OT Servers Segmented by Form Factor, 2023-2028

- Exhibit 5: Global Shipments of Edge Systems Segmented by Embedded CPU Architecture, 2023

- Exhibit 6: Global Shipments of Edge Systems Segmented by Embedded Operating System, 2023

- Exhibit 7: Global Shipments of Edge Systems Segmented by Distribution Channel, 2023

- Exhibit 8: Global Shipments of Edge Gateways Segmented by Connectivity Support, 2023 & 2028

- Exhibit 9: Global Shipments of Embedded & Edge Systems Segmented by Geography, 2023

- Exhibit 10: Global Shipments of Edge Gateways Segmented by Vertical Market, 2023

- Exhibit 11: Global Shipments of Industrial PCs Segmented by Vertical Market, 2023

- Exhibit 12: Global Shipments of Embedded/OEM OT Servers Segmented by Vertical Market, 2023

- Exhibit 13: Global Shipments of Embedded & Edge Hardware Segmented by Leading Vendors, 2023

- Exhibit 14: Rugged Form Factor Requirements for Current Projects & Expected for Similar Projects Three Years from Now

- Exhibit 15: Most Important Product Requirements in Selecting Edge Gateway Hardware

- Exhibit 16: Most Important Selection Criteria When Considering Suppliers for Embedded and Edge Hardware

- Exhibit 17: Factors Driving OT Server Users/Developers to Adopt Virtualization/Hypervisor and Container Technology

- Exhibit 18: Actions OT Server Users/Developers Have Taken in Response to Security Requirements

List of Market Data Exhibits(Partial)

Edge Gateway

- Exhibit 1: Edge Gateway, Device Type, Dollar Volume Shipments, 2023-2028

- Exhibit 2: Edge Gateway, Device Type, Unit Shipments, 2023-2028

- Exhibit 3: Edge Gateway, Device Type, Average Selling Prices, 2023-2028

- Exhibit 4: Edge Gateway, Vertical Market, Dollar Volume Shipments, 2023-2028

- Exhibit 5: Edge Gateway, Geographic Region, Dollar Volume Shipments, 2023-2028

- Exhibit 6: Edge Gateway, Customer Class, Dollar Volume Shipments, 2023-2028

- Exhibit 7: Edge Gateway, Ruggedization, Dollar Volume Shipments, 2023-2028

- Exhibit 8: Edge Gateway, Connectivity Support, Unit Shipments, 2023-2028

- Exhibit 9: Edge Gateway, Embedded Processor Architecture, Dollar Volume Shipments, 2023-2028

- Exhibit 10: Edge Gateway, Embedded Operating System, Dollar Volume Shipments, 2023-2028

- Exhibit 11: Edge Gateway, Global Vendor Share, Dollar Volume Shipments, 2023

- Exhibit 12: Intelligent Gateway, Global Vendor Share, Dollar Volume Shipments, 2023

- Exhibit 13: M2M Gateway, Global Vendor Share, Dollar Volume Shipments, 2023

Industrial PC

- Exhibit 1: Industrial PC, Form Factor, Dollar Volume Shipments, 2023-2028

- Exhibit 2: Industrial PC, Form Factor, Unit Shipments, 2023-2028

- Exhibit 3: Industrial PC, Form Factor, Average Selling Prices, 2023-2028

- Exhibit 4: Industrial PC, Vertical Market, Dollar Volume Shipments, 2023-2028

- Exhibit 5: Industrial PC, Geographic Region, Dollar Volume Shipments, 2023-2028

- Exhibit 6: Industrial PC, Customer Class, Dollar Volume Shipments, 2023-2028

- Exhibit 7: Industrial PC, Embedded Processor Architecture, Dollar Volume Shipments, 2023-2028

- Exhibit 8: Industrial PC, Embedded Operating System, Dollar Volume Shipments, 2023-2028

- Exhibit 9: Industrial PC, Global Vendor Share, Dollar Volume Shipments, 2023

- Exhibit 10: Box Industrial PC, Global Vendor Share, Dollar Volume Shipments, 2023

- Exhibit 11: DIN Rail Industrial PC, Global Vendor Share, Dollar Volume Shipments, 2023

- Exhibit 12: Rackmount Industrial PC, Global Vendor Share, Dollar Volume Shipments, 2023

- Exhibit 13: Panel Industrial PC, Global Vendor Share, Dollar Volume Shipments, 2023

Embedded/OEM OT Server

- Exhibit 1: Embedded/OEM OT Server, Form Factor, Dollar Volume Shipments, 2023-2028

- Exhibit 2: Embedded/OEM OT Server, Form Factor, Unit Shipments, 2023-2028

- Exhibit 3: Embedded/OEM OT Server, Form Factor, Average Selling Prices, 2023-2028

- Exhibit 4: Embedded/OEM OT Server, Vertical Market, Dollar Volume Shipments, 2023-2028

- Exhibit 5: Embedded/OEM OT Server, Geographic Region, Dollar Volume Shipments, 2023-2028

- Exhibit 6: Embedded/OEM OT Server, Customer Class, Dollar Volume Shipments, 2023-2028

- Exhibit 7: Embedded/OEM OT Server, Embedded Processor Architecture, Dollar Volume Shipments, 2023-2028

- Exhibit 8: Embedded/OEM OT Server, Embedded Operating System, Dollar Volume Shipments, 2023-2028

- Exhibit 9: Embedded/OEM OT Server, Global Vendor Share, Dollar Volume Shipments, 2023

IoT & Embedded Engineering Survey

- Exhibit 1: Primary Role Within Company/Organization

- Exhibit 2: Respondent's Organization's Primary Industry

- Exhibit 3: Total Number of Employees at Respondent's Organization

- Exhibit 4: Primary Region of Residence

- Exhibit 5: Primary Country of Residence

- Exhibit 6: Type of Most Current or Recent Project

- Exhibit 7: Involvement with Engineering of Embedded/Edge, Enterprise/IT, HPC, AI/ML, or Mobile/System Device or Solution

- Exhibit 8: Type of Purchase by Respondent's Organization

- Exhibit 9: Primary Industry Classification of Project

- Exhibit 10: Type of Aerospace & Defense Application for Most Recent Project

- Exhibit 11: Type of Automotive In-Vehicle Application for Most Recent Project

- Exhibit 12: Type of Communications & Networking Application for Most Recent Project

- Exhibit 13: Type of Consumer Electronics Application for Most Recent Project

- Exhibit 14: Type of Digital Security Application for Most Recent Project

- Exhibit 15: Type of Digital Signage Application for Most Recent Project

- Exhibit 16: Type of Energy and Utilities Application for Most Recent Project

- Exhibit 17: Type of Gaming Application for Most Recent Project

- Exhibit 18: Type of Industrial Automation Application for Most Recent Project

- Exhibit 19: Type of Media & Broadcasting Application for Most Recent Project

- Exhibit 20: Type of Medical Device Application for Most Current Project

- Exhibit 21: Type of Mobile Phone

- Exhibit 22: Type of Office/Business Automation Application for Most Recent Project

- Exhibit 23: Type of Transportation Application for Most Recent Project

- Exhibit 24: Type of Retail Automation Application for Most Recent Project

- Exhibit 25: Type of Non-Manufacturing/Services Application for Most Recent Project

- Exhibit 26: Certification/Approval Standards Required for Current Project

- Exhibit 27: Highest Design/Development Assurance Levels (DAL) Required for Project Software (Aerospace)

- Exhibit 28: Highest Software Integrity Levels (SIL) Certification Required for Project Software

- Exhibit 29: Highest Automotive Software Integrity Levels Required for Project Software

- Exhibit 30: Capabilities/Features of Current Project

- Exhibit 31: Capabilities/Features Expected in a Project Three Years From Now

- Exhibit 32: Type of Real-Time Deadlines for Current Project

- Exhibit 33: Application's Shortest Response Deadline to a Time-Critical Input or Event

- Exhibit 34: Consideration of Key Trends: Electrification of Combustion Fuel Sources

- Exhibit 35: Consideration of Key Trends: Software-defined Functionality

- Exhibit 36: Consideration of Key Trends: Bill-of-Material/Sub-System Consolidation

- Exhibit 37: Estimated Length for Current Project (In Months)