|

市场调查报告书

商品编码

1587946

MBSE 解决方案和软体/系统建模工具:20242024 MBSE Solutions & Software/System Modeling Tools |

||||||

MBSE(基于模型的系统工程)的使用在嵌入式工程中不断成熟,使开发组织能够采取整体方法来应对现代开发专案日益复杂的问题。工程师正在标准和专有的基于语言的软体/系统建模解决方案中寻找有价值的用例,以实现他们的 MBSE 目标。

本报告调查了基于标准语言的建模工具(例如 SysML 和 UML)以及基于专用语言的建模工具(例如 SCADE 和 Simulink)的市场,以确定新趋势、技术、标准和法规的详细信息、最终使用者行为和竞争策略。

本报告中介绍的组织

|

|

目录

本报告的内容

将涵盖哪些问题?

谁该阅读本报告?

本报告中介绍的组织

执行摘要

- 主要发现

世界市场概览

- 嵌入式与企业市场

- 基于标准语言的建模工具市场

- 基于语言的专有建模工具市场

简介

- 跨域工程

- MBSE 和数位主线

- 增强 MBSE 智能

近期市场趋势

- 标准/法规

- 统一建模语言 (UML)

- 系统建模语言 (SysML) v2

- ISO/IEC/IEEE 15288:2023

- DoDAF/MoDAF 的统一设定檔 (UPDM)

- 统一架构框架 (UAF)

- 生命週期协作开放服务 (OSLC)

- 组织

- 物件管理群组 (OMG)

- 国际系统工程理事会 (INCOSE)

- 合作/收购

- Synopsys:收购 Ansys

- 博世:重组 ETAS 以支援软体定义车辆 (SDV)

- Siemens Digital Industries/IBM:系统工程联盟

垂直市场

- 航空航太/国防

- 汽车

- 医疗设备

区域市场

- 美洲

- 欧洲/中东/非洲

- 亚太地区

竞争格局

- 主要供应商见解

最终使用者见解

- 生成式人工智慧的使用体验

- 越来越多采用云端原生开发

- 不断变化的利害关係人格局

- 采用最新的软体设计方法

范围/调查方法

关于作者

关于 VDC 研究

Inside this Report

The use of model-based systems engineering (MBSE) practices has continued to mature within embedded engineering, allowing development organizations to holistically approach the rising complexity of modern development projects. Engineers have found valuable use cases for both standard language-based as well as proprietary language-based software/system modeling solutions in order to achieve their MBSE goals.

INFOGRAPHICS

This report analyzes the market and emerging trends for standard language-based modeling tools (e.g., SysML, UML), as well as proprietary language-based modeling tools (e.g., SCADE, Simulink). It includes detailed discussion of emerging trends and technologies, standards and regulations, end-user behaviors, and competitive strategies that are impacting the market for MBSE solutions and software/system modeling tools.

What Questions are Addressed?

- How large is the global market for MBSE solutions and software/system modeling tools?

- How are advancements in development practices and methodologies as well as standards fueling new demand for software/system modeling tools?

- What factors are most important to current users of modeling tools, and how do these factors differ when selecting between standard language-based and proprietary language-based solutions?

- How can artificial intelligence aid in the use of software/system modeling tools, and which vendors are poised to provide these capabilities?

- Which vendors are rated highest by engineers for their support and service?

Who Should Read this Report?

This research program is written for those making critical business decisions regarding product, market, channel, and competitive strategy and tactics. This report is intended for senior decision-makers who are developing embedded technology, including:

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

- Embedded and Enterprise Markets

- Standard Language-based Modeling Tool Market

- Proprietary Language-based Modeling Tool Market

Introduction

- Cross-domain Engineering

- MBSE Weaving the Digital Thread

- Enhancing the Intelligence of MBSE

Recent Market Developments

- Standards & Regulations

- Unified Modeling Language (UML)

- Systems Modeling Language (SysML) v2

- ISO/IEC/IEEE 15288:2023

- Unified Profile for DoDAF/MoDAF (UPDM)

- Unified Architecture Framework (UAF)

- Open Services for Lifecycle Collaboration (OSLC)

- Organizations

- Object Management Group (OMG)

- International Council on Systems Engineering (INCOSE)

- Partnerships & Acquisitions

- Synopsys to Acquire Ansys

- Bosch Restructures ETAS to Support Software-defined Vehicles (SDVs)

- Siemens Digital Industries and IBM Partner on Systems Engineering

Vertical Markets

- Aerospace & Defense

- Automotive In-Vehicle

- Medical Devices

Regional Markets

- The Americas

- Europe, the Middle East & Africa (EMEA)

- Asia-Pacific (APAC)

Competitive Landscape

- Selected Vendor Insights

End-User Insights

- Experienced Use of Generative AI

- Increased Adoption of Cloud-native Development

- An Evolving Stakeholder Landscape

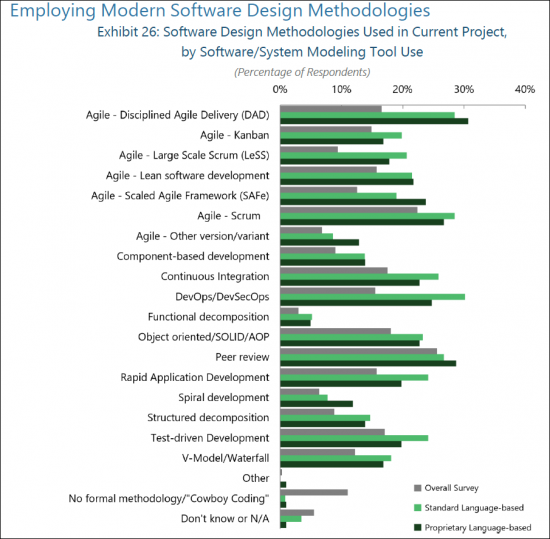

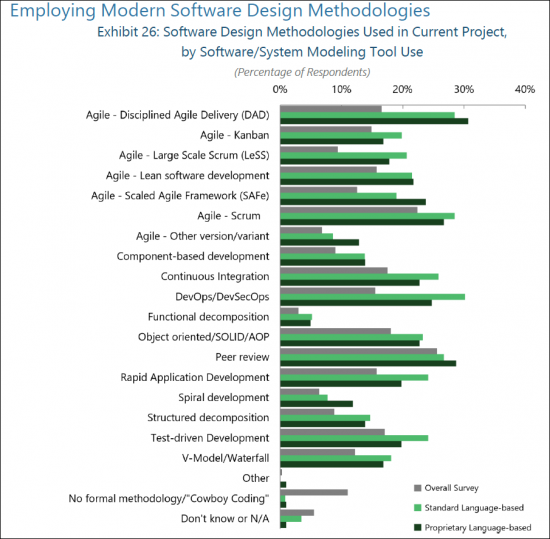

- Employing Modern Software Design Methodologies

Scope & Methodology

About the Authors

About VDC Research

List of Exhibits

- Exhibit 1:Worldwide Shipments of Embedded Software/System Modeling Tools and Related Services, 2023 - 2028

- Exhibit 2:Worldwide Shipments of Standard Language-Based, Enterprise/IT Software/System Modeling Tools and Related Services, 2023 - 2028

- Exhibit 3:Worldwide Shipments of Standard Language-Based Software/System Modeling Tools and Related Services, 2023 - 2028

- Exhibit 4:Worldwide Shipments of Proprietary Language-Based Software/System Modeling Tools and Related Services, 2023 - 2028

- Exhibit 5:Adoption of Cross-domain Engineering Integrations, by Software/System Modeling Tool Use

- Exhibit 6:Estimated Percent of Engineering Tasks/Domains Development Costs Spent on Specific Tasks

- Exhibit 7: Greatest Advantages/Benefits of Cross-domain Engineering Integrations, by Software/System Modeling Tool Use

- Exhibit 8: Language(s) Used to Develop Software for Current and Future Projects

- Exhibit 9: Estimated Percent of In-house Developed Software Code for Current Project, by Origin

- Exhibit 10: Worldwide Shipments of Embedded Software/System Modeling Tools and Related Services, Segmented by Vertical Market; 2023 & 2028

- Exhibit 11: Aerospace & Defense Shipments of Embedded Software/System Modeling Tools, 2023 - 2028

- Exhibit 12: Current Project's Schedule by Software/System Modeling Tool Use

- Exhibit 13: Automotive In-Vehicle Shipments of Embedded Software/System Modeling Tools and Related Services, 2023 - 2028

- Exhibit 14: Biggest Obstacles to the Development and Growth of the Connected/Software-defined Vehicle Industry

- Exhibit 15: Medical Devices Shipments of Embedded Software/System Modeling Tools and Related Services, 2023 - 2028

- Exhibit 16: The Americas Shipments of Software/System Modeling Tools and Related Services, 2023 - 2028

- Exhibit 17: EMEA Shipments of Software/System Modeling Tools and Related Services, 2023 - 2028

- Exhibit 18: APAC Shipments of Software/System Modeling Tools and Related Services, 2023 - 2028

- Exhibit 19: Worldwide Shipments of Embedded Software/System Modeling Tools, Segmented by Leading Vendors; 2023

- Exhibit 20: Worldwide Shipments of Standard Language-Based, Enterprise/IT Software/System Modeling Tools, Segmented by Leading Vendors; 2023

- Exhibit 21: Most Important Factors in Selection of Software/System Modeling Tool Being Used in Current Project, by Product Category

- Exhibit 22: Perceived Difficulty/Ease to Learn the Use of a Software/System Modeling Tool, by Tool Supplier

- Exhibit 23: Perceived Value of Supplier Support and Services from Software/System Modeling Tool Used, by Tool Supplier

- Exhibit 24: Consideration/Use of AI-generated Software/Code, by Software/System Modeling Tool Use

- Exhibit 25: Plans to Use Cloud-based Solutions to Develop Software, by Software/System Modeling Tool Use

- Exhibit 26: Tools Being Used in the Cloud

- Exhibit 27: Typical Decision Maker for Software/System Modeling Tools Used by Respondent's Engineering Team

- Exhibit 28: Software Design Methodologies Used on Current Project, by Software/System Modeling Tool Use