|

市场调查报告书

商品编码

1618862

汽车网路安全的全球市场:软体定义车辆的保护The Global Market for Automotive Cybersecurity: Safeguarding the Software-Defined Vehicle |

||||||

汽车产业正在经历前所未有的向软体定义汽车 (SDV) 概念的转变,这从根本上改变了汽车网路安全要求。

本报告涵盖汽车网路安全市场,包括远端资讯处理和 V2X(车对万物)通讯、车载支付、车辆充电、资讯娱乐系统功能、开源架构和其他行业软体的举措和进展。产生影响的技术和趋势。作为 VDC 与研究目标技术市场持续合作的一部分,本报告还介绍了 VDC 的 "工程师之声" 调查的最终用户调查结果。最后,本报告重点介绍了数十家正在塑造市场的主要汽车网路安全供应商。

信息图形

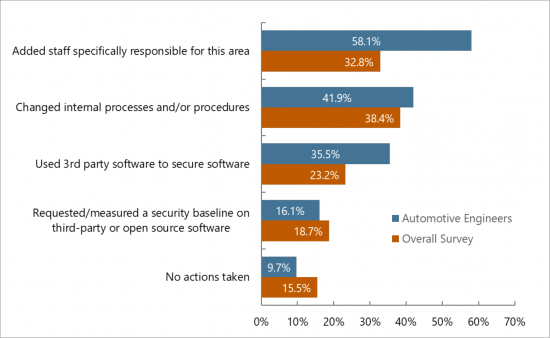

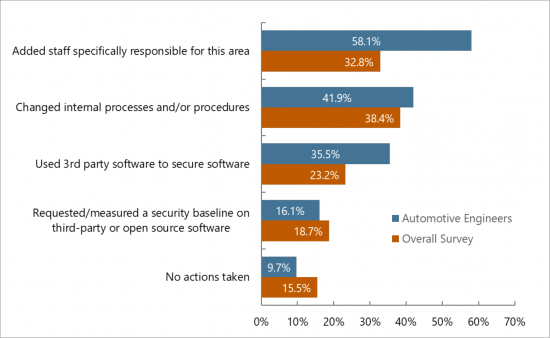

表 9:回应组织针对安全要求采取的行动

(受访者百分比,允许多个答案)

对应的问题:

- 软体和连线的大规模采用对汽车网路安全有何影响?

- 哪些领域成长最快:安全软体、SaaS 和专业服务?

- 汽车网路安全监管的未来以及透过了解监管的未来可以获得什么?

- 到 2028 年,哪个地区将推动汽车网路安全市场的成长?

- 物联网工程师和汽车工程师如何解决网路安全问题?

- 哪些公司正在塑造汽车网路安全市场以及如何塑造?

在本报告被刊登的组织:

|

|

目录

本报告的内容

被拿起的问题

应该读本报告人

在本报告被刊登的组织

摘要整理

- 主要调查结果

简介

- 软体定义车辆暴露漏洞

- 网路安全在向 SDV 的过渡中将扮演什么角色?

- V2X连接

- 车内付款

- 车辆充电

- 应用程式和API

- AI所扮演的角色

- 开放原始码和开放式架构

- 产品形势

全球市场概要

- 汽车网路安全产品的分类

催促成长的法规

- WP.29规则155及的156

- ISO/SAE 21434

- 美国的法规

- 中国的GB 44495-2024及GB 44496-2024

- 印度的AISC AIS-189及AIS-190

地区分析

产业联盟与标准化团体

- ASRG

- AUTO-ISAC

- COVESA

- digital.auto initiative

- Eclipse SDV

- eSync Alliance

- MIPI Alliance

- Uptane

业者情势

- 业者简介

- BlackBerry QNX

- Block Harbor

- Bosch/ETAS

- Continental/Elektrobit/PlaxidityX

- Green Hills Software

- Integrity Security Services

- Irdeto

- Karamba Security

- Kaspersky

- HARMAN

- Sonatus

- Thales

- VicOne

- Upstream

- Vector

终端用户的洞察

- 产业适应安全要求

- 供应商格局支持创新

- 嵌入式安全软体、硬体与 FOTA 实施

- 汽车科技的未来

关于作者

关于VDC Research

图表清单*

Inside this Report

The automotive industry is undergoing an unprecedented shift toward the software-defined vehicle (SDV) concept that is fundamentally changing the requirements for automotive cybersecurity. This report includes an overview of technologies and trends that influence the automotive cybersecurity market, including telematics and vehicle-to- everything (V2X) communication, payment by car, vehicle charging, infotainment system capabilities, open source architectures, and other industry software initiatives and advancements. As part of VDC's continued efforts to engage with the technology markets we research, this report includes end user insights from VDC's "Voice of the Engineer" survey. Lastly, this report highlights dozens of key automotive cybersecurity vendors that are shaping the market.

INFOGRAPHICS

Exhibit 9: Actions Taken by Respondents Organization

in Response to Security Requirements

(Percentage of Respondents, Multiple Responses Permitted)

What Questions are Addressed?

- How has the mass introduction of software and connectivity affected automotive cybersecurity?

- Which segment is growing the fastest - Security software, Security-as-a-service or Professional services?

- What is the future of automotive cybersecurity regulations and what can be gained by understanding the future of regulations?

- Which geographic regions are driving growth in the automotive cybersecurity market through 2028?

- How are IoT engineers and automotive engineers responding to cybersecurity concerns?

- Which firms are shaping the automotive cybersecurity market and how are they doing it?

Who Should Read this Report?

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Introduction

- Software-Defined Vehicles Expose Vulnerabilities

- Where does Cybersecurity Fit in the Transition to the SDV?

- V2X Connectivity

- In-Car Payments

- Vehicle Charging

- Apps and APIs

- The Role of Artificial Intelligence

- Open Source and Open Architecture

- Product Landscape

Global Market Overview

- Automotive Cybersecurity Product Segmentation

- Product Segmentations within the Automotive Cybersecurity Market

Regulations Driving Growth

- WP.29 Regulations 155 and 156

- ISO/SAE 21434

- Regulations in the United States

- China GB 44495-2024 and GB 44496-2024

- India AISC AIS-189 and AIS-190

Regional Analysis

Industry Consortia and Standards Organizations

- ASRG

- AUTO-ISAC

- COVESA

- digital.auto initiative

- Eclipse SDV

- eSync Alliance

- MIPI Alliance

- Uptane

Vendor Landscape

- Vendor Profiles

- BlackBerry QNX

- Block Harbor

- Bosch / ETAS

- Continental / Elektrobit / PlaxidityX

- Green Hills Software

- Integrity Security Services

- Irdeto

- Karamba Security

- Kaspersky

- HARMAN

- Sonatus

- Thales

- VicOne

- Upstream

- Vector

End User Insights

- Industry Adaptation to Security Requirements

- Vendor Landscape Favors Innovation

- Diminishing Influence of Established Tech and System Integrators

- Implementation of Embedded Security Software, Hardware, and FOTA

- The Future of Automotive Technology

About the Authors

About VDC Research

List of Exhibits*

- Exhibit 1 Biggest Obstacle to the Development and Growth of the Connected/Software-Defined Vehicle Industry

- Exhibit 2: Current Concerns About AI-generated Software Code

- Exhibit 3: Sample Table of Vendors Offering Automotive Cybersecurity Solutions

- Exhibit 4: Global Revenue of Automotive Cybersecurity Software and Services

- Exhibit 5: Global Revenue for Automotive Cybersecurity Software and Services by Product Category

- Exhibit 6: Global Revenue for Automotive Cybersecurity and Software, 2023 to 2028, Share by Product Category

- Exhibit 7: Global Revenue for Automotive Cybersecurity Software and Services by Region

- Exhibit 8: Global Revenue of Automotive Cybersecurity Software & Services by Geographic

- Exhibit 9: Actions Taken by Respondents Organization in Response to Security Requirements

- Exhibit 10: Current Major Competition in the Software-defined Space

- Exhibit 11: Use of Embedded Security Software, Hardware, & Firmware-Over-the-Air Updating in Current Automotive Projects vs. Overall IoT Projects

- Exhibit 12: Technologies Automotive Respondent's Organization is Most Interested in and/or Building for Future Customers

*This report also includes access to 416 Exhibits from our 2024 Voice of the Engineer Survey.