|

市场调查报告书

商品编码

1706272

DevSecOps、OTA 和可观察性:实现安全且可扩展的物联网DevSecOps, OTA & Observability: Enabling Secure, Scalable IoT |

||||||

软体 DevSecOps、部署、可观察性和 OTA 解决方案正在不断发展,以跟上物联网设备和系统不断变化的软体开发和发布方法。随着物联网市场竞争的加剧,开发组织需要更快地将软体从开发转移到部署,这需要尽可能实现流程自动化,以缩短上市时间。此外,越来越多的标准和法规将设备安全和健康的责任转移到製造商身上,推动了对能够持续监控设备群并提供持续软体维护和更新的强大商业解决方案的需求。

本报告研究了物联网软体 DevSecOps、部署、可观察性和 OTA 解决方案市场,研究了市场规模趋势、关键趋势、新兴市场、区域市场和主要供应商,并为嵌入式设备工程师和研究人员提供了精选见解。

您回答了哪些问题?

- 物联网软体 DevSecOps、部署、可观察性和 OTA 解决方案市场规模?到 2029 年将成长多少?

- 哪些产业和地理市场成长最快?

- 主要合作伙伴关係、收购、标准化和监管对这个市场有何影响?

- 哪些市场适合广泛采用 OTA 解决方案?

- 如何使用 AI 和 ML(机器学习)来实现软体开发和部署的自动化?

- 哪些供应商在物联网系统的软体 DevSecOps、部署、可观察性和 OTA 解决方案方面处于市场领先地位?

主要发现:

- 各行各业的设备製造商和营运商越来越多地选择 OTA 作为部署增强功能和修补程式的主要方法,这一趋势正在引起政府和标准机构加强监管和审查。

- 19.3% 的开发组织正在考虑使用容器技术作为向物联网设备和嵌入式系统部署软体和无线更新的一种手段。

- 软体 DevSecOps、部署、可观察性和 OTA 解决方案市场正在经历越来越多的併购活动,主要参与者正在进行整合。这种工具和功能的融合极大地提高了整个平台的性能和功能。

- 欧洲网路弹性法案 (CRA) 等法规正在推动对物联网系统的软体 DevSecOps、部署、可观察性和 OTA 解决方案的巨大需求。

目录

本报告的内容

怎样的问题能拿起?

应该读本报告人是谁?

在本报告被刊登的组织

摘要整理

- 主要调查结果

简介

- 有许多不同的实作方法

- 成功实施可建立强大的软体开发生命週期

- 可观察性

- 生命週期管理注意事项

全球市场概要

垂直市场

- 航太及防卫

- 汽车汽车

- CE产品

- 工业自动化

- 医疗设备

- 运输

地区市场

- 南北美洲

- 欧洲·中东·非洲

- 亚太地区

最近的市场趋势

- 人工智慧驱动的更新活动管理

- 成熟的方法简化了流程

- 设备群的使用寿命越来越长

- 应用程式可扩展性:推动物联网市场关注容器技术

- 收购、合作与市场转型

- 组织

- 架构和框架

- 相关标准

- 鼓励采用 OTA 的法规

竞争情形

- 主要供应商的洞察

- Aeris

- Balena

- CloudBees

- Elektrobit (Continental)

- Excelfore

- GitLab

- HARMAN

- JFrog

- Memfault

- Sibros

- Telit Cinterion

- Vector Informatik

- Wind River

终端用户的洞察

- 远端物联网应用的采用持续成长

- 安全性问题推动 OTA 购买决策

- SDLC 集成

关于作者

Inside this Report

Software DevSecOps, deployment, observability, and over-the-air (OTA) solutions are evolving to keep pace with the changing methods of building and releasing software for IoT devices and systems. As competition in IoT markets intensifies, developer organizations must accelerate the transition of software from development to deployment, automating as many processes as possible to achieve rapid time-to-market. Rising standards and regulations have shifted the responsibility for device security and health to manufacturers, creating a demand for robust commercial solutions that continuously monitor device fleets and provide ongoing software maintenance and updates.

This report explores and sizes the IoT market for software DevSecOps, deployment, observability, and OTA solutions. It discusses trends, vertical and regional markets, leading vendors, and provides selected insights from VDC Research's survey of embedded device engineers and developers.

What Questions are Addressed?

- What is the size of the IoT market for software DevSecOps, deployment, observability, and OTA solutions and how fast will it grow through 2029?

- Which vertical and regional markets are growing the fastest?

- How are key partnerships, acquisitions, standards, and regulations shaping the market?

- Which markets are primed for widespread adoption of OTA solutions?

- How are Artificial Intelligence and Machine Learning used to automate software development and deployment?

- Which vendors are leading the software DevSecOps, deployment, observability, and OTA solutions for IoT systems market?

Who Should Read this Report?

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

|

Executive Summary

As DevSecOps methodologies and continuous integration/continuous delivery (CI/CD) practices mature, developers integrate faster feedback loops into the earlier stages of the software and device development lifecycle, improving time to market, product quality, and software deployment in IoT. This blending of development processes is evident in the commercial market for deployment and maintenance solutions, where platforms now combine software testing with deployment features, offering developers a unified solution for automation across the design, build, test, and deploy phases.

DevSecOps observability enables teams to continuously monitor, measure, and analyze the health, performance, and security of applications and infrastructure throughout the software development lifecycle. It includes a combination of metrics, logs, and traces to provide insights into the system's operational and security aspects, allowing teams to detect issues early and respond quickly. The secure wireless distribution of software updates supports the continuous delivery aspect of the CI/CD pipeline.

OTA updates, initially introduced for mobile phones, expanded into the consumer electronics and automotive sectors. Vendors help fuel the wider adoption of updates by integrating OTA solutions across diverse IoT industries, offering both specialized solutions for specific applications and versatile platforms designed to serve multiple IoT market segments. The combination of regulations mandating the updatability of connected devices and the growing adoption of CI/CD and DevSecOps practices within development organizations is increasing the demand for commercial solutions to replace in-house developed alternatives.

Key Findings

- Device manufacturers and operators across multiple industries are choosing OTA updates as their primary means to deliver enhanced features and rollout patches, a trend which is bringing increased scrutiny and regulations from governments and standardization bodies.

- 19.3% of developer organizations are looking toward container technology as an emerging method of deploying software and delivering OTA updates to IoT devices and embedded systems.

- Merger and acquisition activity in the software DevSecOps, deployment, observability, and OTA solutions market has led to increased consolidation among key players. This convergence of tool domains and functionalities has significantly enhanced platform capabilities.

- Regulations like the European Cyber Resilience Act (CRA) are significantly driving the demand for software DevSecOps, deployment, observability, and OTA solutions for IoT systems.

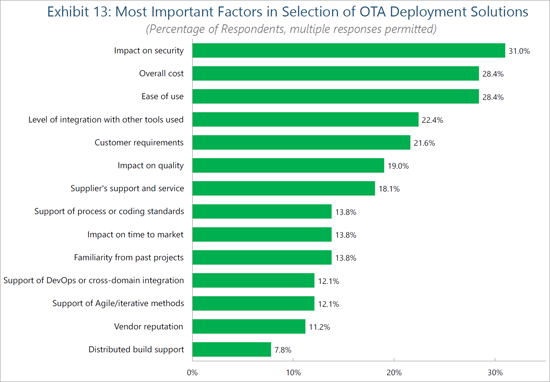

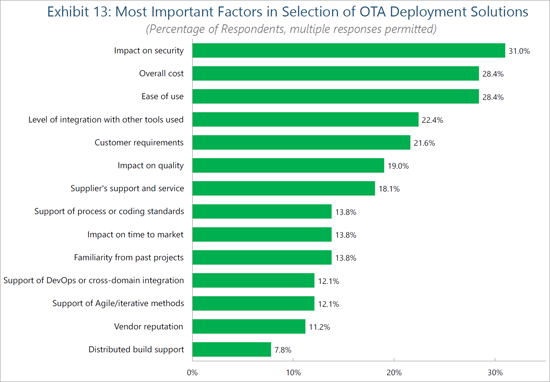

Security Concerns Driving OTA Purchasing Decision

Tied with cost sensitivity, ease of use ranks as the second-most important factor influencing the selection of OTA deployment solutions [See Exhibit 13]. The deployment of OTA update campaigns is oftentimes a very manual task, requiring engineers to weigh multiple factors including rollout timing, device downtime, and potential versioning issues. This is one area where AI-driven OTA campaigns and the pairing of monitoring solutions can introduce increased ease of use to OTA solutions. By intelligently connecting update campaigns to real-time device status and analytics, device manufacturers/fleet managers can minimize the potentially costly consequences of failed update campaigns. Vendor reputation noticeably ranks amongst the lowest purchasing decision factors, suggesting a yet-to-be-determined competitive positioning of embedded OTA solution vendors. This consumer sentiment offers a considerate opportunity for new entrants seeking to deliver OTA capabilities to embedded markets. For those seeking to enter or increase their positioning within this segment of the IoT, focus should be dedicated towards enabling seamless yet confident deployment capabilities, bolstered by real-time capabilities and insights into campaign rollouts.

As with many areas of the IoT, the impact of integrating OTA solutions into toolchains and software stacks remains the topmost priority for development organizations. Failed software deployments can not only cause monetary and opportunity costs in the form of patches and downtime but also increase the attack surface for exploitation. Furthermore, an insecure OTA solution can enable threat actors to deploy malware alongside software packages to devices. Other opportunities for exploitation within the deployment process include hijacking and interrupting updates mid-deployment, leading to corrupted devices and systems. Partnerships with IoT security vendors (e.g., public key infrastructure (PKI) vendors) offer one avenue for OTA solution providers to bolster the security of their solutions (such as those between Excelfore/IIJ Global, Karma Automotive (Airbiquity)/QNX, and Telit Cinterion/Thales).

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Introduction

- Deployment Approaches Vary

- Successful Deployment Establishes a Robust Software Development Life Cycle

- Observability

- Lifecycle Management Considerations

Global Market Overview

Vertical Markets

- Aerospace and Defense

- Automotive In-Vehicle

- Consumer Electronics

- Industrial Automation

- Medical Devices

- Transportation

Regional Markets

- The Americas

- Europe, the Middle East & Africa (EMEA)

- Asia-Pacific (APAC)

Recent Market Developments

- AI-driven Update Campaign Management

- Maturing Practices Streamline Processes

- Device Fleet Longevity Increasing

- Application Scalability Driving Interest in Containers Within the IoT Market

- Acquisitions, Partnerships and Market Pivots

- Karma Automotive Acquires Airbiquity to Bring OTA In-house

- Aurora Labs Pivots Away From OTA

- Excelfore Partners With Microsoft to Deploy AI-driven Update Campaigns

- Qualcomm Acquires Foundries.io

- JFrog Acquires Qwak AI

- Sibros Partners with Harbinger Motors and ZM Trucks to Deploy OTA to Medium-Duty Vehicles

- CloudBees Acquires Launchable

- Organizations

- Cloud Native Computing Foundation

- Continuous Delivery Foundation

- eSync Alliance

- Architectures & Frameworks

- AUTOSAR

- SOAFEE

- Eclipse Kanto

- Pantavisor Linux

- Uptane

- Relevant Standards

- Regulations Driving OTA Adoption

- AUTOMOTIVE

- MEDICAL DEVICES

- OTHER IOT

Competitive Landscape

- Selected Vendor Insights

- Aeris

- Balena

- CloudBees

- Elektrobit (Continental)

- Excelfore

- GitLab

- HARMAN

- JFrog

- Memfault

- Sibros

- Telit Cinterion

- Vector Informatik

- Wind River

End-User Insights

- Sustained Increases in Remote IoT Application Deployments

- Security Concerns Driving OTA Purchasing Decision

- Unifying the SDLC

About the Authors

List of Exhibits

- Exhibit 1: Worldwide Revenue for Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems

- Exhibit 2: Worldwide Revenue for Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems 2024 & 2029, Share by Vertical Market

- Exhibit 3: Worldwide Revenue for Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems 2024 & 2029, Share by Geographic Region

- Exhibit 4: Software Design Methodologies Used and Expected to Be Used

- Exhibit 5: Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems Forecast Scope

- Exhibit 6: Estimated Number of Years of Useful Life for Product Once Deployed, 2022 & 2024

- Exhibit 7: Factors Driving Organization to Adopt Container Technology in Current Project

- Exhibit 8: Worldwide Revenue for Software DevSecOps, Deployment, Observability, and OTA Solutions for IoT Systems, Share by Vendor

- Exhibit 9: Over-the-air (OTA) Software/Firmware Deployment Solutions Used on Current Project

- Exhibit 10: Most Important Factors in Selection of OTA Deployment Solutions, by Solution Source

- Exhibit 11: Current & Expected Use of Remote Application Deployment & Management

- Exhibit 12: Current Use of Remote Deployment & Management by Vertical Market

- Exhibit 13: Most Important Factors in Selection of OTA Deployment Solutions

- Exhibit 14: Most Important Factors in Selection of Release Management/Continuous Deployment Tools