|

市场调查报告书

商品编码

1799624

自主系统验证Verification for Autonomous Systems |

||||||

在航空航太与国防、汽车与交通运输以及工业自动化领域,以自主系统取代人类的趋势正在迅速发展。为确保这些系统的安全性、可靠性和合规性,需要强大可靠的验证解决方案,这构成了一项重大的技术挑战,尤其是在人为干预极少或完全不存在的情况下。此外,自主系统的应用场景不断演变、运作设计领域日益多样化,以及国家和地区法规的差异,都进一步加剧了验证过程的复杂性。

传统的验证方法已不足以应付自主系统的测试。为了应对这些挑战,业界正在转向先进的基于模拟的验证解决方案,以支援系统整个生命週期的验证。这些平台能够在各种复杂场景下对感测器资料、感知演算法和控制逻辑进行虚拟测试。将人工智慧整合到这些工具中,能够帮助开发人员加速学习、自动化验证工作流程并产生逼真的环境,从而提高自主系统开发的准确性和可扩展性。

本报告分析了目前自主系统专用验证工具的现状,重点介绍了领先解决方案的功能、应用领域和市场趋势。报告还指出了基于模拟的验证技术的新兴趋势,并提出了实现高可靠性自主系统的最佳实践。此外,报告还包含了基于VDC "工程师之声" 调查的最终使用者见解。

本报告解答了哪些问题?

- 自主系统验证解决方案的市场规模有多大?到2029年,其成长速度将如何?

- 哪些垂直产业和地区成长最快?

- 主要的合作关係、收购、标准化和法规如何影响市场?

- 预计自主系统将在哪些地区广泛应用?

- 人工智慧如何用于自动化自主系统验证?

- 哪些供应商在自主系统验证市场中处于领先地位?

本报告中提及的机构

|

|

|

报告摘录

验证和确认活动的时机

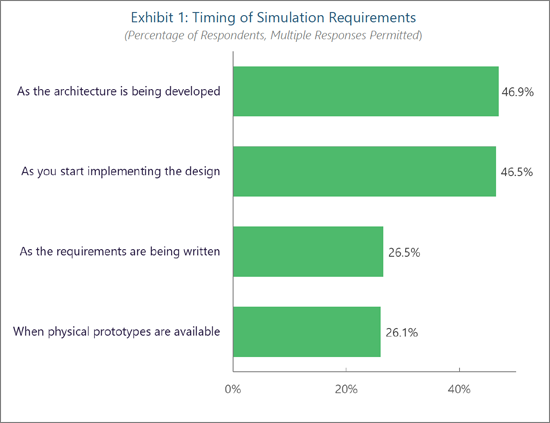

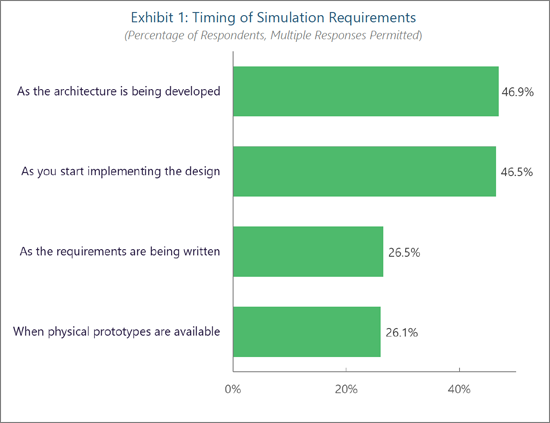

据受访者称,许多工程组织在产品生命週期的早期就开始製定模拟需求。近一半 (46.9%) 的组织在架构设计阶段就开始这些流程,另有相当一部分 (46.5%) 的组织在设计实现阶段就开始。这种早期做法反映了业界的共识:在开发早期识别和解决潜在问题可以显着降低后期流程的成本和风险。

然而,只有少数组织在概念设计阶段就开始製定模拟需求,只有 26.5% 的组织在创建需求文件时才开始。此外,26.1% 的组织会将流程推迟到实体原型可用时才开始,这种做法效率低下,并且往往会增加变更所需的成本和时间。这些结果表明,在开发过程早期整合模拟技术的重要性日益凸显,这与基于模型的设计、模拟驱动的验证以及虚拟原型设计策略相一致,这些策略正逐渐成为领先的自主系统工程专案的标准做法。

样品预览

目录

本报告探讨的关键问题

本报告的读者对象

本报告中提及的主要组织一览

摘要整理

- 主要调查结果

简介

- 市场成长的要素

- 新兴技术新的方法

- 课题与市场缺口

全球市场概要

垂直市场

- 航太·防卫

- 汽车系统

- CE产品

- 工业自动化

- 医疗设备

- 运输

地区市场

- 南北美洲

- 欧洲·中东·非洲

- 亚太地区

- 自规则系统相关全球法规情形

最近的市场趋势

- 收购,联盟,市场转换

- 组织·架构

- Autonomous Vehicle Computing Association

- The Autoware Foundation

- CARLA

- Future Airborne Capability Environment

- Cloud Native Computing Foundation

- IEEE Robotics & Automation Society

- NASA

- SOAFEE

- 相关规格

- RTCA/EUROCAE DO-178C

- ASAM

- EN 50128

- ISO/IEC TR 5469 (2024)

- IEEE 7009-2024

- IEEE 7001-2021

- ISO/PAS 8800及ISO 21448

- NIST

- UL 4600

竞争情形

- 主要供应商的洞察

- Apex.AI

- Applied Intuition

- Cadence

- dSPACE

- Elektrobit (Continental)

- ETAS

- Hexagon

- MathWorks

- NVIDIA

- Siemens

- Synopsys/Ansys

- Vector Informatik

终端用户洞察

- 市场优先事项及自主系统验证的重要性

- 工程工程延误的推动因素

- 验证和确认活动的时机安排

关于作者

Inside this Report

The aerospace/defense, automotive/transportation, and industrial automation industries are increasingly using autonomous systems to replace human or human-controlled operations. The need for robust and dependable verification solutions to ensure the safety, reliability, and compliance of these solutions, especially in use cases where human intervention is minimal or nonexistent, presents a critical technical challenge. The complex verification process is compounded by the rapid advancement of autonomous use-cases, operational design domains and varying country- or region- specific regulations.

Traditional verification approaches are increasingly inadequate for the testing autonomous systems. To address these challenges, the industry is turning to advanced, simulation-based validation solutions that support verification throughout the system's lifecycle. Advanced simulation platforms are increasingly enabling virtual testing of sensor data, perception systems, and control algorithms across diverse and complex scenarios. By integrating AI into these tools, developers can accelerate training, automate validation workflows, and generate more realistic environments, enhancing the accuracy and scalability of autonomous system development.

This report explores the current landscape of verification tools tailored for autonomous systems. It analyzes the capabilities and applications of leading solutions, highlights emerging trends in simulation-based validation, and provides insights into best practices for achieving high-assurance autonomy. As part of VDC's continued efforts to engage with the technology markets we research, this report includes end user insights from VDC's "Voice of the Engineer" survey.

What Questions are Addressed?

- What is the size of the market for autonomous systems verification solutions and how fast will it grow through 2029?

- Which vertical and regional markets are growing the fastest?

- How are key partnerships, acquisitions, standards, and regulations shaping the market?

- Which markets are primed for widespread adoption of autonomous systems?

- How is Artificial Intelligence used to automate autonomous system verification?

- Which vendors are leading the autonomous system verification market?

Organizations Listed in this Report:

|

|

|

Who Should Read this Report?

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and strategy leaders

- Channel management and channel strategy leaders

Executive Summary

The rapid advancement of autonomous system technologies, related multi-sensor interfaces and complex edge- case scenarios, is creating a mix of test challenges and opportunities. As systems adopt increasingly sophisticated AI algorithms for sensing and perception, decision-making and environmental adaptation, each technological advancement requires an assessment of the verification and validation (V&V) processes to ensure safety and performance. Verification is an objective set of tests that confirm that the product meets requirement's metrics, while validation seeks to demonstrate that the product meets its original intent.

Verifying the performance, safety and reliability of autonomous systems remains a fundamentally difficult problem. The complexity of multiple sensor inputs, dynamic real-world environments, AI decision-making trust, and the lack of standardized verification practices generate friction points that can potentially slow an autonomous system's time-to-market timeline and increase risk.

The aforementioned factors, along with increased regulatory oversight, recent mergers and acquisition activity and partnerships, are driving change in the traditional makeup of the software and hardware development supply chain, creating increased opportunities for companies offering verification solutions for autonomous systems.

Key Findings:

- Advanced simulation solutions are used in the verification and validation of autonomous systems, alleviating many of the limitations of real-world testing.

- Engineering organizations begin simulation verification and validation requirements early in the product lifecycle during architecture development and nearly the same proportion at design implementation.

- Merger and acquisition activity in the autonomous system verification market has led to increased consolidation among key players. This convergence of simulation and verification tool domains and functionalities has significantly enhanced platform capabilities.

- Fatal accidents involving autonomous vehicles in the U.S and China have increased regulatory scrutiny and will significantly drive demand for autonomous system verification solutions.

Report Excerpt

Timing of Verification and Validation Activities

Respondents indicate that most engineering organizations initiate simulation requirement activities early in the product lifecycle. Nearly half of respondents (46.9%) report beginning these processes as the architecture is being developed, closely followed by 46.5% who start as the design is being implemented. This early engagement reflects the industry's recognition that identifying and addressing potential issues during foundational stages can significantly reduce downstream costs and risks.

By contrast, fewer organizations initiate simulation requirements during the earliest conceptual stage, with 26.5% starting as the requirements are being written. Similarly, 26.1% delay the process until physical prototypes are available, a stage where changes are typically more expensive and time-consuming to implement. These findings underscore the growing emphasis on integrating simulation earlier in the development pipeline, aligning with model-based design, simulation-driven validation, and virtual prototyping strategies that are becoming standard in advanced autonomous engineering programs.

Sample preview

Table of Contents

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Introduction

- Drivers of Market Growth

- Emerging Technologies and Approaches

- Challenges and Market Gaps

Global Market Overview

Vertical Markets

- Aerospace and Defense

- Automotive In-Vehicle

- Consumer Electronics

- Industrial Automation

- Medical Devices

- Transportation

Regional Markets

- The Americas

- Europe, the Middle East & Africa (EMEA)

- Asia-Pacific (APAC)

- MIIT Tightens AV Testing Rules After Deadly Xiaomi SU7 Crash

- Global Regulatory Landscape for Autonomous Systems

Recent Market Developments

- Acquisitions, Partnerships and Market Pivots

- Synopsys Acquires ANSYS to Create a Silicon-to-Systems Platform

- From Simulation to Industrial AI - Siemens' $10.6B Move for Altair Engineering

- Applied Intuition Expands Simulation Capabilities with Mechanical Simulation Acquisition

- Organizations and Frameworks

- Autonomous Vehicle Computing Association

- The Autoware Foundation

- CARLA

- Future Airborne Capability Environment

- Cloud Native Computing Foundation

- IEEE Robotics & Automation Society

- NASA

- SOAFEE

- Relevant Standards

- RTCA/EUROCAE DO-178C

- ASAM

- EN 50128

- ISO/IEC TR 5469 (2024)

- IEEE 7009-2024

- IEEE 7001-2021

- ISO/PAS 8800 and ISO 21448

- NIST

- UL 4600

Competitive Landscape

- Selected Vendor Insights

- Apex.AI

- Applied Intuition

- Cadence

- dSPACE

- Elektrobit (Continental)

- ETAS

- Hexagon

- MathWorks

- NVIDIA

- Siemens

- Synopsys / Ansys

- Vector Informatik

End-User Insights

- Market Priorities and the Critical Role of Autonomous Systems Verification

- Attributions of Delays in Engineering Projects

- Timing of Verification and Validation Activities

About the Authors

List of Exhibits

- Exhibit 1: Worldwide Revenue for Autonomous System Verification Solutions

- Exhibit 2: Worldwide Revenue for Autonomous System Verification Solutions, by Vertical Market

- Exhibit 3: Percentage of Worldwide Revenue for Autonomous System Verification Solutions, by Vertical Market

- Exhibit 4: Worldwide Revenue for Autonomous System Verification Solutions 2024 & 2029, by Geographic Region

- Exhibit 5: Percentage of Worldwide Revenue for Autonomous System Verification Solutions 2024 & 2029, by Geographic Region

- Exhibit 6: Worldwide Autonomous System Verification Solutions, Share by Vendor

- Exhibit 7: Technologies Automotive Respondent's Organization is Most Interested in and/or Building for Future Customers

- Exhibit 8: Attributions of Delays to Automotive Projects

- Exhibit 9: Timing of Simulation Requirements

IoT & Embedded Engineering Survey (Partial)

- Exhibit 1: Primary Role Within Company/Organization

- Exhibit 2: Respondent's Organization's Primary Industry

- Exhibit 3: Total Number of Employees at Respondent's Organization

- Exhibit 4: Primary Region of Residence

- Exhibit 5: Primary Country of Residence

- Exhibit 6: Type of Most Current or Recent Project

- Exhibit 7: Involvement with Engineering of an Embedded/Edge, Enterprise/IT, HPC, AI/ML, or Mobile/System Device or Solution

- Exhibit 8: Type of Purchase by Respondent's Organization

- Exhibit 9: Primary Industry Classification of Project

- Exhibit 10: Type of Aerospace & Defense Application for Most Recent Project

- Exhibit 11: Type of Automotive In-Vehicle Application for Most Recent Project

- Exhibit 12: Type of Communications & Networking Application for Most Recent Project

- Exhibit 13: Type of Consumer Electronics Application for Most Recent Project

- Exhibit 14: Type of Digital Security Application for Most Recent Project

- Exhibit 15: Type of Digital Signage Application for Most Recent Project

- Exhibit 16: Type of Energy and Utilities Application for Most Recent Project

- Exhibit 17: Type of Gaming Application for Most Recent Project

- Exhibit 18: Type of Industrial Automation Application for Most Recent Project

- Exhibit 19: Type of Media & Broadcasting Application for Most Recent Project

- Exhibit 20: Type of Medical Device Application for Most Current Project

- Exhibit 21: Type of Mobile Phone

- Exhibit 22: Type of Office/Business Automation Application for Most Recent Project

- Exhibit 23: Type of Transportation Application for Most Recent Project

- Exhibit 24: Type of Retail Automation Application for Most Recent Project

- Exhibit 25: Type of Non-Manufacturing/Services Application for Most Recent Project

For the full list of the 416 IoT & Embedded Technology Voice of the Engineer Survey Exhibits available with this report.