|

市场调查报告书

商品编码

1812617

工业网路技术:2029年前的商机与预测Industrial Networking Technologies: Opportunities & Forecasts Through 2029 |

||||||

数位化和工业物联网 (IIoT) 使工业企业能够实现前所未有的生产效率和灵活性、供应链控制和工人安全,从而大幅提升获利能力。为了实现这些目标,工业企业必须对其网路基础设施进行现代化升级和扩展,以提供安全、及时、准确、相关且可操作的资料存取。工业网路解决方案不仅对于满足当今不断发展的连接需求至关重要,而且对工业企业的整体绩效也至关重要。本报告涵盖了全球工业网路基础设施组件市场,包括按产品类别、地区、通路和行业划分的细分市场和预测。

本报告探讨的关键问题:

- 哪些技术、地区和产业将在未来五年推动市场成长?

- 哪些类型的无线和有线网路在 OT 环境中变得越来越普遍?

- MQTT 和 OPC UA 等工业物联网 (IIoT) 协议的持续采用将如何影响供应商策略?

- 预测性维护等工业物联网 (IIoT) 相关应用将如何影响市场成长?

- 哪些供应商正在推动该市场的创新?

- 不断发展的网路安全要求将如何影响供应商策略?

本报告的调查交易厂商

|

|

报告摘录

区域细分及预测

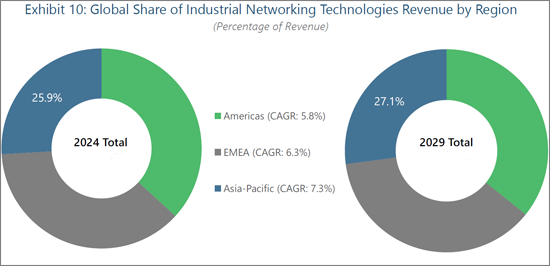

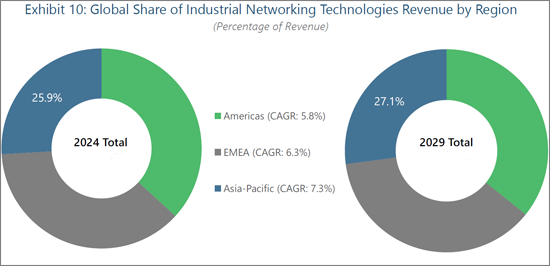

预计2024年,欧洲、中东和非洲(图10)将在工业网路技术方面支出最大。这主要是由于NIS2指令(一项欧盟特定法规,明确要求製造商投资安全的网路硬体和软体)提高了对网路安全的重视。亚太地区将成为工业网路组件供应商收入成长最快的地区。这反映了该地区许多国家在工业和製造技术创新方面所做的更广泛努力,包括政府主导的计划,例如中国的 "中国製造2025" 和日本的 "社会5.0" 。同时,美洲地区在2024年工业无线技术收入中所占占有率最大,但与其他地区相比,其受关税相关经济挑战的影响将更大。此外,巴西、印度和塞内加尔等快速发展的工业经济体的绿地计画预计将在整个预测期内为各地区提供充足的成长机会。

本报告探讨了全球工业网路技术趋势,并提供了市场规模预测、有线/无线、产业和地区的详细分析、市场影响因素分析、竞争格局以及主要供应商概况。

目录

该报告的内容

本报告探讨的主要问题

本报告的读者对象

本报告涵盖的供应商

- 摘要整理

- 主要调查结果

全球市场概要

- 市场概要

- 数位转型推动市场成长

- 竞争情形

- Cisco先导

- 课题

- 机会

- 全面的促进因素与策略

- 网路安全仍然是首要关注点优先级

- 最终用户需要互通性

- 改进的工业无线性能加速工业物联网 (IIoT) 的采用

世界市场区隔

- 产品区隔与预测

- 无线产品与网路

- 有线产品与网路

- 网路管理软体

- 各地区市场区隔与预测

- 各产业市场区隔与预测

- 各流通管道市场区隔与预测

供应商亮点

- Belden

- Cisco

- HMS Networks

- Huawei

- Moxa

- Siemens

- 其他

- Digi International

- Kyland Technology

- Nokia

- Phoenix Contact

- Rockwell Automation

- Schneider Electric

范围和定义

相关调查

关于作者

图表 (部分)

Inside this Report

Digitalization and the Industrial Internet of Things (IIoT) have enabled industrial organizations to dramatically increase profitability by realizing unprecedented levels of production efficiency and flexibility, supply chain control, and worker safety. To pursue such objectives, these organizations must modernize and extend their network infrastructure to facilitate secure, timely access to data that is accurate, relevant, and usable. Industrial networking solutions are not only critical to enable today's evolving connectivity requirements but are also vital to the performance of the entire industrial enterprise. This report covers the global market for industrial networking infrastructure components, including segmentations and forecasts by product category, geographic region, channel, and industry.

What Questions are Addressed?

- Which technologies, regions, and industries will drive market growth over the next five years?

- Which wireless and wireline network types have gained traction in OT environments?

- How will the continued adoption of IIoT enabling protocols such as MQTT and OPC UA affect supplier strategies?

- How have IIoT-related applications such as predictive maintenance affected market growth?

- Which suppliers are driving innovation in this market?

- How have evolving cybersecurity requirements affected supplier strategies?

Who Should Read this Report?

This report is intended for those making critical decisions regarding product development, partnerships, go-to- market planning, and competitive strategy and tactics. It is written for executives, senior managers, and other decision-makers involved in the development, deployment, marketing, management, or sales of industrial networking infrastructure components, including those in the following roles:

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Vendors Covered in this Report:

|

|

Executive Summary

Digital technologies for operational technology (OT) organizations require timely and accurate data from industrial assets to be effective. As the volume of connected industrial assets increases and analytics-driven strategies such as predictive maintenance gain momentum, industrial organizations have continued to modernize and expand their network infrastructures to keep pace. Demand for infrastructure components such as gateways, routers, and switches has risen steadily as industrial organizations continue scaling their OT networks to accommodate additional connected endpoints and interconnected enterprise systems.

Though macroeconomic uncertainty may dampen short-term growth, when total revenue will approach $58B. The continued proliferation of wireless industrial sensors coupled with the rise of industrial 5G networks will allow growth within the wireless segment to outstrip that of the wireline market, while increasing demand for customized configurations and robust network performance management capabilities will bolster demand for non-bundled network management software solutions.

The semiconductor industry will be the fastest growing vertical market sector through the end of the forecast period in 2029. Among the primary drivers spurring growth within this market are the unique requirements of the "cleanroom" environments needed to prevent wafer contamination during the manufacturing process. Continued deployments of high-resolution cameras and machine vision systems will drive further growth as manufacturers upgrade their networks to accommodate the intensive data processing requirements inherent in such systems.

The competitive landscape for industrial networking technologies comprises a diverse mix of networking companies, global automation suppliers, and niche competitors that offer a narrow range of networking technologies or serve select geographies, industries, or use cases.

Key Findings:

- OT/IT convergence, cybersecurity, and interoperability are critical growth drivers for this market.

- Competitors are likely to encounter lengthier sales cycles and the cancelation of capital-intensive projects as industrial organizations adjust their budgets and spending timelines in concert with the fickle economic landscape.

- Despite the maturity of this market, solution providers still have an opportunity to elevate their brand throughout the industrial community by becoming prominent advocates for emerging best practices, strategies, and techniques.

- The Asia-Pacific region will attain the highest growth rate through the end of the forecast period.

- Vendors overwhelmingly rely on vast distributor networks to engage with customers.

Report Excerpt

Regional Segmentation and Forecast

In 2024, industrial networking technology spending was greatest in EMEA [See Exhibit 10], driven in large part by the increasing focus on cybersecurity due to EU-specific regulations such as the NIS2 Directive, which specifically calls for manufacturers to invest in secure networking hardware and software. The Asia-Pacific region will provide the greatest revenue growth for industrial networking component vendors, with government-led initiatives such as "Made in China 2025" and "Society 5.0" in Japan underscoring the widespread commitment to the technological advancement of the industrial and manufacturing sectors by many countries in the region. The Americas, which generated the largest share of industrial wireless technology revenue in 2024, will be more significantly impacted by tariff-related economic challenges than the other regions. Greenfield projects in countries with quickly evolving industrial economies such as Brazil, India, and Senegal will provide ample growth opportunities across each region for the duration of the forecast period.

A significant portion of the revenue generated within the market for industrial networking components can be attributed to operators in major industrialized nations such as Germany, Japan, and the United States, among others. While such nations will continue to account for most market revenue, some of the most compelling growth opportunities will be generated within countries where economic growth is occurring at a much steeper trajectory. As countries such as Brazil, Egypt, India, Senegal, and others continue their economic and industrial progressions, resources from both the public and private sectors will be earmarked for projects such as improving transportation or utilities infrastructures and modernizing operations at local factories. Such initiatives will undoubtedly leverage connected OT networks to facilitate smart manufacturing and other advanced automation techniques, creating opportunities for industrial networking vendors. Suppliers with local ties will be best positioned to capitalize on the growth opportunities within these growing economies, though vendors with strong global brands will also perform well.

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Vendors Covered in this Report

- Executive Summary

- Key Findings

Global Market Overview

- Market Summary

- Digital Transformation Driving Market Growth

- Competitive Landscape

- Cisco Leads the Way

- Challenges

- Opportunities

- Overarching Drivers and Strategies

- Cybersecurity Remains a Leading Priority

- End Users Demand Interoperability

- Industrial Wireless Performance to Accelerate IIoT Adoption

Global Market Segmentations

- Product Segmentation and Forecast

- Wireless Products and Networks

- Wireline Products and Networks

- Network Management Software

- Regional Segmentation and Forecast

- Industry Segmentation and Forecast

- Channel Segmentation and Forecast

Vendor Highlights

- Belden

- Cisco

- HMS Networks

- Huawei

- Moxa

- Siemens

- Others

- Digi International

- Kyland Technology

- Nokia

- Phoenix Contact

- Rockwell Automation

- Schneider Electric

Scope & Definitions

- Scope

- Definitions

- Wireless Networking Components

- Wireline Networking Components

- Network Management Software

Related Research

About the Authors

List of Exhibits (Partial list)

An Excel workbook containing more than 65 exhibits is provided alongside this report. The following exhibits are presented here:

- Exhibit 1: Global Revenue for Industrial Networking Technologies by Connection Type

- Exhibit 2: Global Share of Revenue for Industrial Networking Technologies by Leading Vendors (2024)

- Exhibit 3: Global Revenue for Industrial Wireless Technologies by Product Type

- Exhibit 4: Global Share of Revenue for Industrial Wireless Technologies by Leading Vendors (2024)

- Exhibit 5: Global Share of Revenue for Industrial Wireless Technologies by Network

- Exhibit 6: Global Revenue for Industrial Wireline Technologies by Product Type

- Exhibit 7: Global Share of Revenue for Industrial Wireline Technologies by Leading Vendors (2024)

- Exhibit 8: Global Share of Revenue for Industrial Wireline Technologies by Network

- Exhibit 9: Global Share of Revenue for Industrial Network Management Software by Leading Vendors (2024)

- Exhibit 10: Global Share of Revenue for Industrial Networking Technologies by Region

- Exhibit 11: Global Share of Revenue for Industrial Networking Technologies by Industry

- Exhibit 12: Global Share of Revenue for Industrial Networking Technologies by Channel