|

市场调查报告书

商品编码

1615494

锂离子电容以及其他的电池超级电容混合:市场·技术 (2025-2045年)Lithium-ion Capacitors and Other Battery Supercapacitor Hybrids: Markets, Technology, 2025-2045 |

||||||

热核反应器、电磁武器、土木工程设备和智慧电錶有什么共通点?所有这些都使用锂离子电容器(LIC)。它们介于超级电容器和电池之间,通常兼具两全其美的优点。

这一点的重要性经常被混合超级电容器和超级电池等令人困惑的术语所忽视,但世界正在朝着LIC 的方向发展,例如强调功率和可靠性的AI 数据中心,一个例子就是它已经成为了。这里,LIC用作不间断电源,更安全、寿命更长、运作和恢復更快。儘管LIC的市场规模预计不会达到金属离子电池的规模,但相信LIC将超越超级电容器。包括其他电池超级电容器混合动力车(BSH)在内,预计20年内销售额将每年超过100亿美元。

本报告提供锂离子电容 (LIC) 以及其他的电池超级电容混合 (BSH) 的市场及技术,技术类型和概要调查,彙整市场需求和变化,市场影响因素的分析,技术蓝图·研究开发趋势,各用途的展望,用途·各技术的市场预测,主要企业的分析等资讯。

目录

第1章 摘要整理·结论

- 本报告的目的

- 此分析的研究方法

- 定义

- 储能工具包

- 13 个主要结论:包括 LIC 在内的 BSH 市场

- 资讯图表:最具影响力的市场需求

- 资讯图表:BSH 和赝电容器的相对商业重要性

- EDLC 和 BSH(包括 LIC)的价值和应用

- EDLC 和 BSH 技术的使用范例:应用领域

- 大型设备用LIC和EDLC的供应和潜力分析

- 18 主要结论:技术与製造商

- 资讯图表:能量密度、功率密度、寿命、尺寸和重量折衷方案

- 减少储存容量的策略会增加采用 BSH 的可能性

- 需要改变研究方向:5 列、7 行

- 2024 年 BSH 和 EDLC 研究活动:按国家和技术分类

- SWOT 评估/路线图

- 市场驱动的博西家电活动路线图:技术、产业、市场

- 电池超级电容器混合动力:30条线预测

第2章 电池超级电容混合 (BSH):需求,Toolkit,製造概要

- 储能工具包

- 储能市场

- 技术优化与技术竞争问题:简介

- LIC、锂离子电池、超级电容器:比较34个参数

- LIC 格式与相邻技术的比较

- 了解更多

第3章 未来的锂离子电容器的设计和竞争上的地位

- 概要

- 设计上的问题

- 研究的进步的分析

- 专利范例

- 并且读

第4章 其他的金属离子电容器的设计和进步:铅离子,镍离子,钾离子,钠离子,锌离子电容器

- 概要

- 铅离子电容器:历史,原理,研究

- 镍离子电容器:2024年的进步

- 钾离子电容器:2024年的进步

- 钠离子电容器:2024年的进步

- 锌离子电容器:2024年的进步

第5章 适合电池超级电容混合储存的其他的新的化学物质

- 概要

- 根据

- 研究开发平台(管线)

第6章 用研究开发平台分析所使用的新兴材料

- 摘要

- 影响超级电容器主要参数并推动销售的因素

- 一般材料选择

- 超级电容器改良策略

- 石墨烯在超级电容器及其变体中的重要性

- 超级电容器的其他二维及相关材料和研究实例

- 超级电容器电极材料与结构研究

- 之前的重要范例

- 超级电容器及其变体的电解质

- 膜的难度和用途以及建议的材料

- 减少自放电:需求大,研究很少

第7章 新兴BSH市场:能源、汽车、航太、军事、电子等产业基本趋势与最佳前景比较

- 对市场的影响

- 摘要

- 超级电容器的相对商业重要性

- 最有前途的超级电容器系列的价值主张

- 市场潜力与製造规模不匹配

- 大型设备供应及潜力分析

第8章 能源领域的新兴BSH市场

- 摘要:2024-2044 年展望

- 融合发电

- 减少间歇性电网发电:波浪能、潮流能、高空风力发电

- 离网超级电容器:新的巨大机遇

- 水力发电

第9章 陆地车辆与海洋应用的兴起:汽车、巴士、卡车列车、越野建筑、农业、采矿、林业、物料搬运、船隻

- 超级电容器在陆上交通的应用概述

- 道路应用正在下降,但越野应用正在蓬勃发展

- 陆地车辆中的超级电容器及其衍生产品:从公路到越野的过渡

- 配备大型超级电容器的新车和相关设计

- 復兴电车和无轨电车并解决架空电线间隙问题

- 物料搬运(内部物流)超级电容器

- 大型超级电容器在采矿和采石业的应用

- 车用大型超级电容器研究

- 用于火车和轨旁再生的大型超级电容器

- 海洋利用及大型超级电容器研究管线

第10章 6G通讯,电子产品,小型电子设备的新用途

- 概要

- 小型BSH和超级电容器的应用显着扩展

- 穿戴式装置、智慧手錶、智慧型手机和笔记型电脑等装置中的博西家电和超级电容器

- 6G 通讯:2030 年博西家电的新市场

- 资产追踪成长市场

- 电池支援和备用电源超级电容器

- 手持终端BSH和超级电容器

- 使用物联网节点、无线感测器、BSH 和超级电容器的能量收集模式

- 资料传输、锁、螺线管启动、电子墨水更新和 LED 闪光灯的峰值功率

- 智慧电錶

第11章 新军事及航太用途

- 概要

- 军事用途:电动力学武器和电磁武器大的焦点

- 军事用途:无人飞机,通讯设备,雷达,飞机,船舶,坦克,卫星,诱导飞弹,弹药点火设备,电磁装甲

- 航太:卫星,飞机电动化 (MEA),其他的成长机会

第12章 BSH(含LIC)、超级电容器、赝电容器、116家CSH公司评估

- 116企业对比指标分析

- 116家超级电容器、赝电容器、BSH(包括LIC)製造商

Summary

What do thermonuclear reactors, electromagnetic weapons, earthmoving machines and smart meters have in common? They all use lithium-ion capacitors LIC, something between a supercapacitor and a battery and often the best of both worlds. The new Zhar Research 476-page report, "Lithium-ion capacitors and other battery supercapacitor hybrids: markets, technology, 2025-2045" explains.

Their importance is often missed by confusing terms like hybrid supercapacitor and superbattery, but the world is going their way, an example being artificial intelligence data centers becoming power and reliability-oriented. Consequently, they appear there as safer, longer lived, uninterrupted power supplies that act and recover faster. While they will not match the market size of metal ion batteries, they will overtake supercapacitors. Include other battery-supercapacitor hybrids BSH and the analysis predicts over $10 billion yearly sales within 20 years.

Here are some of the questions answered:

- Gaps in the market?

- Next winners and losers?

- Full list of technology options?

- SWOT appraisals by technology?

- Evolving market needs 2025-2045?

- Where should research be redirected?

- Market forecasts by technology 2025-2045?

- Deep analysis of research advances in 2024?

- What follows LIC of the BSH choices and why?

- Technology readiness and potential improvement?

- Market drivers and forecasts of background parameters?

- Potential winners and losers by company and technology?

- Detailed technology parameter comparisons with comment?

- Detailed appraisal of all the leading proponents and their strategies?

- New applications and technology milestones in roadmaps by year 2025-2045?

This commercially-oriented report is both lucid and thorough, involving:

6 SWOT appraisals, 12 Chapters, 30 Forecast lines 2025-2045, 30 Key conclusions, 107 New infograms, over 116 Companies and 153 best research papers from 2023/4 reviewed.

The Executive summary and conclusions (38 pages) is sufficient in itself including roadmaps and those 30 forecasts. Chapter 2. Covers "Battery supercapacitor hybrids BSH: introduction to need, toolkit and manufacture" in 25 pages putting them in context of all evolving storage with many examples including e-bikes, wind turbines, trains, trams. Learn the chemistry and structure involved in tailoring them to be supercapacitor-like, battery-like or something in-between because there are commercial successes beginning for all of those options.

Chapter 3. "Future lithium-ion capacitor design and competitive position" takes 25 information-packed pages to reveal these specific constructions from the smallest electronics components to heavy engineering. Here are the issues and new market to be addressed. Chapter 4. "Other metal-ion capacitors design and progress: Lead-ion, nickel-ion, potassium-ion, sodium-ion, zinc-ion capacitors" , in 20 pages clarifies the best research and targetted markets for these with much advance in 2024. Why most work on sodium-ion capacitors? Why is nickel-ion capacitor NIC, particularly with cobalt receiving equal attention? Why considerable work on potassium-ion and zinc-ion capacitors? Involvement of graphene?

15 pages of Chapter 5. "Other emerging chemistries for battery-supercapacitor hybrid storage" concerns wild cards such as Zeolite Ionic Frameworks, MXene and MOFs composites for BSH and the relevance of metal alloys and manganese compounds. After these simpler chapters, you are ready for the dep dive of Chapter 6. "Emerging materials employed with 2024, 2023 research pipeline analysis" going closely into electrodes, electrolytes and membranes in 50 pages with a flood of new research analysed and many infograms clarifying choices and trends.

Because BSH can be tailored to such a wide range of size and performance, the emerging applications and competitive positioning needs careful investigation and that is provided in Chapter 7. Emerging BSH markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other. This is 11 pages because many applications have already been covered and more lie ahead.

Chapter 8. Energy sector emerging BSH markets (49 pages) reveals an extraordinary breadth of opportunity from recent adoption for the Japan Tokamak thermonuclear reactor, wind turbines and many uses in grids and microgrids, even electric vehicle fast chargers. This survey also includes supercapacitor applications likely to switch to BSH, initially LIC. Chapter 9. "Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships" (50 pages) is equally broad in reach. Chapter 10. Emerging applications in 6G Communications, electronics and small electrics (29 pages) is mainly revealing opportunities for small LIC. Chapter 11, "Emerging military and aerospace applications" (20 pages) often involves hand-held to very large equipment, even aircraft.

Chapter 12. "116 BSH (including LIC), supercapacitor, pseudocapacitor, CSH companies assessed in 10 columns and 112 pages" looks at most supercapacitor manufacturers because they are either making LIC or eyeing that opportunity. With many pictures, parameters and news items, you can see the commercial activities and objectives in detail.

Whether you wish to supply materials, devices or systems incorporating BSH, the report, "Lithium-ion capacitors and other battery supercapacitor hybrids: markets, technology, 2025-2045" is your essential reading.

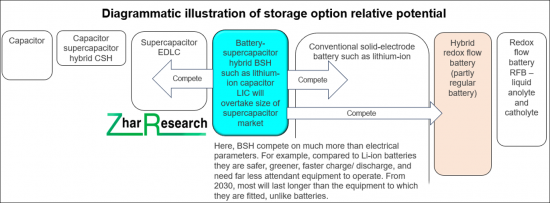

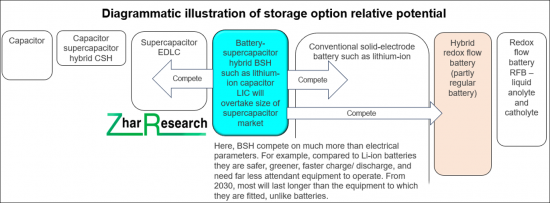

CAPTION: Diagrammatic illustration of storage option relative potential. Source Zhar Research report, "Lithium-ion capacitors and other battery supercapacitor hybrids: markets, technology, 2025-2045".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Definitions

- 1.4. Energy storage toolkit

- 1.4.1. The basic options

- 1.4.2. BSH have some of superlatives of a supercapacitor combined with those of a battery

- 1.4.3. BSH and in particular LIC create some valuable tipping points

- 1.4.4. The many advantages of lithium-ion capacitors LIC and the energy density choices

- 1.4.5. How strategies for improving supercapacitors will benefit BSH including LIC

- 1.4.6. Prioritisation of active electrode-electrolyte pairings

- 1.5 13 Primary conclusions: BSH markets including LIC

- 1.6. Infogram: the most impactful market needs

- 1.7. Infogram: relative commercial significance of BSH and pseudocapacitors 2024-2044

- 1.8. Some market propositions and uses of EDLC and BSH including LIC 2024-2044

- 1.9. Technology uses by applicational sector for EDLC vs BSH - examples

- 1.10. Analysis of supply and potential of LIC and EDLC for large devices

- 1.11 18 primary conclusions: technologies and manufacturers

- 1.12. Infogram: the energy density-power density, life, size and weight compromise

- 1.13. How strategies to require less storage make BSH more adoptable

- 1.14. How research needs redirecting: 5 columns, 7 lines

- 1.17. BSH and EDLC research activity by country and technology 2024

- 1.18. SWOT appraisals and roadmap 2025-2045

- 1.18.1. SWOT appraisal of supercapacitors and BSH

- 1.18.2. SWOT appraisal of LIC and other BSH

- 1.18.3. SWOT appraisal of graphene LIC

- 1.18.4. SWOT appraisal of batteryless storage technologies generally

- 1.19. Roadmap of market-moving BSH events - technologies, industry and markets 2025-2045

- 1.20. Battery supercapacitor hybrids: forecasts by 30 lines 2025-2045

- 1.20.1. Competitors RFB beyond grid, EDLC, Pseudocapacitor and BSH $ billion 2025-2045

- 1.20.2. Battery supercapacitor hybrid storage BSH by type: BSH, Non-lithium, LIC, banks $ billion 2025-2045

- 1.20.3. Battery supercapacitor hybrids BSH value market percent by four regions 2025-2045

- 1.20.4. BSH value market percent by three performance categories 2025-2045

- 1.20.5. Battery supercapacitor hybrid BSH value market % by two Wh categories 2025-2045

- 1.20.6. BSH value market % by three electrode morphologies 2025-2045

- 1.20.7. BSH product life years and life of equipment to which it is fitted years 2014-2045

- 1.20.8. Market for seven types of equipment fitting BSH $ billion 2025-2045

- 1.20.9. Energy storage device market battery vs batteryless $ billion 2025-2045

2. Battery supercapacitor hybrids BSH: introduction to need, toolkit and manufacture

- 2.1. Energy storage toolkit

- 2.1.1. The basic options

- 2.1.2. How BSH will compete with other technologies

- 2.1.3. Electrochemical vs electrostatic storage

- 2.1.4. Examples of competition between capacitor, supercapacitor and battery technologies

- 2.1.5. Supercapacitors and BSH replacing batteries in ebikes

- 2.2. Energy storage market

- 2.2.1. Overview

- 2.2.2. Energy harvesting creates markets for BSH storage

- 2.2.3. The beyond-grid opportunity for large BSH

- 2.2.4. Need for conventional BSH formats but also structural electrics and electronics

- 2.3. Introduction to technology optimisation and technology competition issues

- 2.3.1. Overview

- 2.3.2. BSH internal design compared to others

- 2.3.3. Hot topics include LIB and graphene

- 2.3.4. BSH voltage, charge retention and ageing issues compared to competition

- 2.3.5. BSH competitive position on energy density vs power density

- 2.3.6. Days storage vs rated power return MW for storage technologies

- 2.4. 34 parameters for LIC, Li-ion battery and supercapacitor compared

- 2.5. LIC formats compared with adjacent technologies

- 2.6. Further reading

3. Future lithium-ion capacitor design and competitive position

- 3.1. Overview

- 3.2. Design issues

- 3.2.1. Basic structure

- 3.2.2. Current applications to optimise

- 3.2.3. Future applications to optimise

- 3.2.4. Performance issues being addressed

- 3.2.5. Lithium-ion capacitor LIC market positioning by energy density spectrum

- 3.3. Analysis of research advances through 2024

- 3.4. Examples of patents

- 3.5. Further reading -Zhar Research report putting LIB in supercapacitor context

4. Other metal-ion capacitors design and progress: Lead-ion, nickel-ion, potassium-ion, sodium-ion, zinc-ion capacitors

- 4.1. Overview

- 4.2. Lead ion capacitors: history, rationale , research

- 4.3. Nickel-ion capacitors: advances in 2024

- 4.4. Potassium-ion capacitors: advances in 2024

- 4.5. Sodium-ion capacitors: advances in 2024

- 4.5. Zinc-ion capacitors: advances in 2024

5. Other emerging chemistries for battery-supercapacitor hybrid storage

- 5.1. Overview

- 5.2. Rationale

- 5.3. Research pipeline

- 5.3.1. Zeolite Ionic Frameworks for BSH

- 5.3.2. MXene and MOFs composites for BSH

- 5.3.2. Metal alloys and manganese compounds in BSH

6. Emerging materials employed with 2024, 2023 research pipeline analysis

- 6.1. Overview

- 6.2. Factors influencing key supercapacitor parameters driving sales

- 6.3. Materials choices in general

- 6.4. Strategies for improving supercapacitors

- 6.4.1. General

- 6.4.2. Prioritisation of active electrode-electrolyte pairings

- 6.5. Significance of graphene in supercapacitors and variants

- 6.5.1. Overview

- 6.5.2. Graphene supercapacitor SWOT appraisal

- 6.5.3. Vertically-aligned graphene for ac and improved cycle life

- 6.5.4. Frequency performance improvement with graphene

- 6.5.5. Graphene textile for supercapacitors and sensors

- 6.5.6. Eleven graphene supercapacitor material and device developers and manufacturers compared in five columns

- 6.6. Other 2D and allied materials for supercapacitors with examples of research

- 6.6.1. MOF and MXene and combinations are the focus

- 6.6.2. Tantalum carbide MXene hybrid as a biocompatible supercapacitor electrodes

- 6.6.3. CNT

- 6.7. Research on supercapacitor electrode materials and structures in 2024

- 6.8. Research on supercapacitor electrode materials and structures in 2023

- 6.9. Important examples from earlier

- 6.10. Electrolytes for supercapacitors and variants

- 6.10.1. General considerations including organic electrolytes

- 6.10.2. Supercapacitor electrolyte choices

- 6.10.3. Focus on aqueous supercapacitor electrolytes

- 6.10.4. Ionic liquid electrolytes in supercapacitor research

- 6.10.5. Focus on solid state, semi-solid-state and flexible electrolytes

- 6.10.6. Hydrogels as electrolytes for semi-solid supercapacitors

- 6.10.7. Supercapacitor concrete and bricks

- 6.11. Membrane difficulty levels and materials used and proposed

- 6.12. Reducing self-discharge: great need, little research

7. Emerging BSH markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other

- 7.1. Implications for the market 2025-2045

- 7.2. Overview

- 7.3. Relative commercial significance of supercapacitor variants 2025-2045

- 7.4. Market propositions of the most-promising supercapacitor families 2025-2045

- 7.5. Mismatch between market potential and sizes made

- 7.6. Analysis of supply and potential for large devices

- 7.6.1. Overview

- 7.6.2. Largest lithium-ion capacitors offered by manufacturer with parameters and uses

- 7.6.3. Markets for the largest BSH

- 7.6.4. Market analysis for the six most important applicational sectors

8. Energy sector emerging BSH markets

- 8.1. Overview: poor, modest and strong prospects 2024-2044

- 8.2. Thermonuclear power

- 8.2.1. Overview

- 8.3.2. Applications of supercapacitors in fusion research

- 8.3.3. Other thermonuclear supercapacitors

- 8.3.4. Hybrid supercapacitor banks for thermonuclear power: Tokyo Tokamak

- 8.3.5. Helion USA supercapacitor bank

- 8.3.6. First Light UK supercapacitor bank

- 8.3. Less-intermittent grid electricity generation: wave, tidal stream, elevated wind

- 8.3.1. Supercapacitors in utility energy storage for grids and large UPS

- 8.3.2. 5MW grid measurement supercapacitor

- 8.3.3. Tidal stream power applications

- 8.3.4. Wave power applications

- 8.3.5. Airborne Wind Energy AWE applications

- 8.3.6. Taller wind turbines tapping less-intermittent wind: protection, smoothing

- 8.4. Beyond-grid supercapacitors: large emerging opportunity

- 8.4.1. Overview

- 8.4.2. Beyond-grid buildings, industrial processes, minigrids, microgrids, other

- 8.4.3. Beyond-grid electricity production and management

- 8.4.4. The off-grid megatrend

- 8.4.5. The solar megatrend

- 8.4.6. Hydrogen-supercapacitor rural microgrid Tapah, Malaysia

- 8.4.7. Supercapacitors in other microgrids, solar buildings

- 8.4.8. Fast charging of electric vehicles including buses and autonomous shuttles

- 8.5. Hydro power

9. Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships

- 9.1. Overview of supercapacitor use in land transport

- 9.2. On-road applications face decline but off-road vibrant

- 9.3. How the value market for supercapacitors and their variants in land vehicles will move from largely on-road to largely off-road

- 9.4. Emerging vehicle and allied designs with large supercapacitors

- 9.4.1. Industrial vehicles: Rutronik HESS

- 9.4.2. Heavy duty powertrains and active suspension

- 9.5. Tram and trolleybus regeneration and coping with gaps in catenary

- 9.6. Material handling (intralogistics) supercapacitors

- 9.7. Mining and quarrying uses for large supercapacitors

- 9.7.1. Overview and future open pit mine and quarry

- 9.7.2. Mining and quarrying vehicles go electric

- 9.7.3. Supercapacitors for electric mining and construction

- 9.8. Research relevant to large supercapacitors in vehicles

- 9.9. Large supercapacitors for trains and their trackside regeneration

- 9.9.1. Overview

- 9.9.2. Supercapacitor diesel hybrid and hydrogen trains

- 9.9.3. Supercapacitor regeneration for trains on-board and trackside

- 9.9.4. Research pipeline relevant to supercapacitors for trains

- 9.10. Marine use of large supercapacitors and the research pipeline

10. Emerging applications in 6G Communications, electronics and small electrics

- 10.1. Overview

- 10.2. Substantial growing applications for small BSH and supercapacitors

- 10.3. BSH and supercapacitors in wearables, smart watches, smartphones, laptops and similar devices

- 10.3.1. General

- 10.3.2. Wearables needing BSH and supercapacitors

- 10.4. 6G Communications: new BSH market from 2030

- 10.4.1. Overview with needs

- 10.4.2. New needs and 5G inadequacies

- 10.4.3. 6G massive hardware deployment: proliferation but many compromises

- 10.4.4. Objectives of NTTDoCoMo, Huawei, Samsung and others

- 10.4.5. Progress from 1G-6G rollouts 1980-2044

- 10.4.6. 6G underwater and underground

- 10.5. Asset tracking growth market

- 10.6. Battery support and back-up power supercapacitors

- 10.7. Hand-held terminals BSH and supercapacitors

- 10.8. Internet of Things nodes, wireless sensors and their energy harvesting modes with BSH and supercapacitors

- 10.8.1. Overview

- 10.8.2. Sensor inputs and outputs

- 10.8.3. Ten forms of energy harvesting for sensing and power for sensors

- 10.8.4. Supercapacitor transpiration electrokinetic harvesting for battery-free sensor power supply

- 10.9. Peak power for data transmission, locks, solenoid activation, e-ink update, LED flash

- 10.10. Smart meters

- 10.11. Spot welding

11. Emerging military and aerospace applications

- 11.1. Overview

- 11.2. Military applications: electrodynamic and electromagnetic weapons now a strong focus

- 11.2.1. Overview: laser weapons, beam energy weapons, microwave weapons, electromagnetic guns

- 11.2.2. Electrodynamic weapons: coil and rail guns

- 11.2.3. Electromagnetic weapons disabling electronics or acting as ordnance

- 11.2.4. Pulsed linear accelerator weapon

- 11.3. Military applications: unmanned aircraft, communication equipment, radar, plane, ship, tank, satellite, guided missile, munition ignition, electromagnetic armour

- 11.3.1. CSH sales increasing

- 11.3.2. Force Field protection

- 11.3.3. Supercapacitor- diesel hybrid heavy mobility army truck

- 11.3.4 17 other military applications now emerging

- 11.4. Aerospace: satellites, More Electric Aircraft MEA and other growth opportunities

- 11.4.1. Overview: supercapacitor numbers and variety increase

- 11.4.2. More Electric Aircraft MEA

- 11.4.3. Better capacitors sought for aircraft

12. 116 BSH (including LIC), supercapacitor, pseudocapacitor, CSH companies assessed in 10 columns and 112 pages

- 12.1. Analysis of metrics from the comparison of 116 companies

- 12.2. 116 supercapacitor, pseudocapacitor and BSH (including LIC) manufacturers assessed in 10 columns across 108 pages