|

市场调查报告书

商品编码

1880930

资料中心、微电网和住宅应用的长期储能(LDES):技术趋势和市场展望(2026-2036)Long Duration Energy Storage for Datacenters, Microgrids, Houses: Technologies, Markets 2026-2036 |

||||||

电网以外的众多应用都需要延迟供电。本报告预测,到2046年,该市场规模将达到970亿美元,占新兴长期储能(LDES)市场总额的36%。 此处的目标应用领域包括离网和 "边缘电网" 应用,这些应用的需求与电网截然不同。虽然所需的储能单元数量是电网的100倍,但每个单元都必须体积小、占用空间有限、安全可靠,适合室内使用、可堆迭且占地面积小,并且寿命长、可靠性高,能够满足偏远地区的应用需求。本报告预测,到2046年之前,长期储能将在太阳能住宅中广泛应用,其中许多住宅将是离网的。这份内容详尽的报告包含 10 个章节、17 项 SWOT 分析以及 2026 年至 2046 年的 24 条预测线,涵盖 100 多家公司以及截至 2025 年的研究趋势。

目录

第一章:摘要整理与结论

- 本报告的目标和独特范围

- 本分析的研究方法

- 目前离网型低能耗系统 (LDES) 及类似案例

- 技术基础

- 关于电气化和低能耗系统 (LDES) 的定义、需求和候选方案的 18 个关键结论

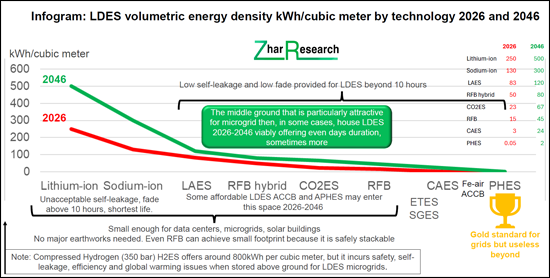

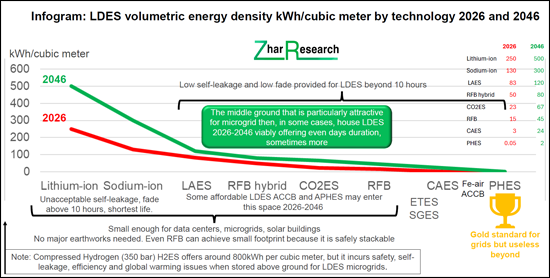

- 资讯图表:以技术划分的低能耗系统 (LDES) 体积能量密度(2026 年和 2046 年)

- 资讯图表:微电网及类似 LDES 替代方案(2026-2046 年)

- 资讯图表:离网太阳能住宅 + 2036-2046 年全电动 LDES 系统

- LDES 用户类型及潜在能源服务

- 19 种类型和 10 种技术的潜在 LDES 效能

- 三种 LDES 规模类别的技术优势(2026-2046 年,基于现有证据)

- 依技术划分的可用站点数量(2026-2046 年):微电网机会指标

- 依技术划分的 LDES 需求计算及其影响

- 当前和未来 LDES 的持续时间和电力可用性

- 九项广泛微型电网 LDES 技术的 SWOT 评估

- LDES 路线图(2026-2046)

- 2026-2046 年市场预测(24 条预测线、图表和评论)

第二章:低能耗储能系统 (LDES) 的需求与设计原则

- 能源基础知识

- 固定式储能和低能耗储能系统 (LDES) 基础知识

- 2025-2026 年低能耗储能系统 (LDES) 专案(展示关键技术子集)

- 以科学类别划分的低能耗储能系统:8 个参数的比较

- 电化学低能耗储能系统 (LDES) 方案详解

- 许多电池在续航时间超过 10 小时后失去竞争优势

- 2026-2046 年低能耗储能系统 (LDES) 总体概述报告

第三章:微电网低能耗储能系统 (LDES) 替代方案

- 概述

- 资讯图表:13低密度能源系统 (LDES) 替代方案 (2026-2046)

- 全球案例:丹麦、新加坡、中国和美国

- 风能、太阳能或低密度能源系统 (LDES) 不足或无能情况下的容量係数选择

- 2025 年前低密度能源系统 (LDES) 替代方案的广泛研究

- 2025 年前间歇性电源家庭能源管理系统 (HEMS) 研究

第四章:先进抽水蓄能 (APHES)

- 概述

- 概述

- 利用废弃矿场

- 加压地下:Quidnet Energy USA

- 利用山体与重流体:RheEnergise UK

- 利用海水和盐水

- Sizeable Energy(义大利)、StEnSea(德国)、Ocean Grazer(荷兰)

- 混合技术:研究2024 年和 2025 年进展

- 2024 年与 2025 年研究进展

- APHES SWOT 评估

第五章:用于微电网低压配电系统的氢能储存 (H2ES) 和压缩空气储能 (CAES)

- 氢能储存 (H2ES)

- 用于微电网的压缩空气储能 (CAES)

第六章:氧化还原液流电池 (RFB)

- 概述

- 研究转向低压配电系统 (LDES)

- 液流电池 (RFB) 在低压配电系统 (LDES) 的应用前景(2026-2046 年)

- 液流电池 (RFB) 在低压配电系统 (LDES) 的 SWOT 分析与参数比较

- 基于 8 项标准(名称、品牌、技术、成熟度、非电网应用)对 45 家液流电池 (RFB) 公司进行比较LDES 重点内容及评论)

- RFB 技术(包括 2025 年前的研究)

- 依材料分类的具体设计:钒、铁及其变体、其他金属配体、卤素基、有机、锰、2025 年研究、三项 SWOT 分析

- RFB 製造商简介

- 2025 年的进一步研究

第七章:固体重力储能 (SGES)

- 概述(包括 2025 年前的研究)

- 美国 ARES 公司

- 瑞士、美国、中国和印度的 Energy Vault 授权商

- Gravitricity 公司

- 澳洲 Green Gravity 公司

- 法国 SinkFloatSolutions 公司

第八章:先进的传统结构电池(ACCB)

- 概述

- 8 家 ACCB 製造商的 8 项标准比较

- 参数评估和 SWOT 分析(ACCB 用于 LDES)

- 金属空气电池

- 高温电池

- 金属离子电池,包括 Inlyte、Altris、HiNa、Tiamat、Natron 和 Faradion

- 镍氢电池:EnerVenue USA SWOT 分析

第 9 章 液化气体储能 (LGES):液态空气 (LAES) 或二氧化碳

- 概述

- 液态空气储能 (LAES) LDES

- 液态与压缩二氧化碳储能 (LDES)

第 10 章 用于延迟的热能储存 (ETES)电力

- 2025 年概览及研究进展

- 2025 年与 2024 年的研究进展

- 从失败中学到的教训:西门子歌美飒、Azelio、Steisdal、Lumenion

- 热机方法的进展:Echogen USA

- 利用极端温度和光伏转换

- 单厂延迟供热和供电的销售

Summary

Delayed electricity is needed for much more than grids. The new 451-page Zhar Research report, "Long Duration Energy Storage for Datacenters, Microgrids, Houses: Technologies, Markets 2026-2036" forecasts a $97 billion market for this in 2046, 36% of the total LDES market emerging. The requirements are very different in this world that includes off-grid and fringe-of-grid (only rare use of grid for backup). Expect 100 times the number needed for grids but smaller, space constrained units, variously safe even in buildings, stacked for small footprint and long-life, highly-reliable for remote locations. The authors even predict LDES in large numbers of solar houses before 2046, many off-grid. Unusually thorough, the report has 10 chapters, 17 SWOT appraisals, 24 forecast lines 2026-2046, examining over 100 companies and research advances through 2025.

The Executuve Summary and Conclusions (37 pages) is the quick read with the roadmap 2026-2046 in three lines - market, company, technology - 18 key conclusions, six of the SWOT appraisals and the 24 forecasts as tables and graphs with explanation. See many new infograms. Chapter 2. LDES Need and Design Principles (15 pages) is mostly graphics introducing stationary energy storage and LDES fundamentals, actual and proposed types of LDES, nine LDES technologies that can follow the market trend to longer duration with subsets compared. Learn how the off-grid solar house LDES is the toughest challenge but coming 2036-46, understand LDES metrics and LDES projects in 2025-6 with leading technology subsets for microgrid and similar applications. See scientific categories of LDES compared by 8 parameters, electrochemical LDES options compared but why most batteries will stay uncompetitive above 10-hour duration.

The report is balanced, realistic and independent so it has as Chapter 3. Microgrid LDES Escape Routes with 7 pages, mostly infograms and charts, covering the ways in which the demand for LDES in microgrids and similar applications down to houses will be reduced or avoided. That includes 2025 research advances including Home Energy Management Systems coping with intermittent supply.

Chapter 4. Advanced Pumped Hydro APHES (46 pages) combs through the many options avoiding pumping water up mountains. Here is pumping heavy, loaded water up mere hills, use of mines, the ocean and more. Many are suitable for the larger microgrid and similar applications but never solar buildings.

Chapter 5. Hydrogen H2ES and compressed air CAES for microgrid LDES (22 pages) examines these important options for grid LDES that are less impressive beyond but there are some microgrid projects appraised that use them. Learn the issues.

Chapter 6. Redox flow batteries RFB is 154 pages because this is currently the gold standard for microgrid and similar LDES, having the most installations, manufacturers and the strongest appropriate research pipeline, including for the more-compact hybrid RFBs. 45 manufacturers are appraised.

Chapter 7. Solid Gravity Energy Storage SGES has only 36 pages because it is a weaker contestant but five manufacturers examined and the various subsets have some prospects. Chapter 8. Advanced conventional construction batteries ACCB (48 pages) examines many emerging chemistries using conventional construction not flow battery principles. Much 2025 research is appraised. Many are fundamentally too expensive or too poor in certain performance parameters but there are possibilities too and successes to report.

Chapter 9. Liquefied Gas Energy Storage LGES: Liquid Air LAES or CO2 (43 pages) looks at this middle ground where extremely safe options using established technologies can provide LDES that has many competitive advantages for large microgrids and similar applications. LGES is more compact but pressurised carbon dioxide avoids the cryogenics. See appropriate projects, manufacturer intentions. The report then closes with Chapter 10. Thermal Energy Storage for Delayed Electricity ETES (22 pages). Delayed heat is a great success but there is less enthusiasm for thermally delayed electricity due to leakage, size and other issues. Nonetheless there is a project in Alaska and there are companies pursuing exotic forms such as thermophotovoltaics that are appraised. Learn the lessons of failures as well.

The Zhar Research report, "Long Duration Energy Storage for Datacenters, Microgrids, Houses: Technologies, Markets 2026-2036" is your essential reading for the latest research and balanced analysis of this large new opportunity. For these applications, it finds that redox flow batteries, liquid gas energy storage and some other options are the best compromises but different ones win at the extremes of AI datacenters and private houses 2026-2046.

CAPTION: LDES volumetric energy density kWh/cubic meter by technology 2026 and 2046. Source: Zhar Research report, "Long Duration Energy Storage for Datacenters, Microgrids, Houses: Technologies, Markets 2026-2036".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose and unique scope of this report

- 1.2. Methodology of this analysis

- 1.3. Examples of current beyond-grid LDES and similar

- 1.4. Technology basics

- 1.5. 18 key conclusions concerning electrification and LDES definitions, needs, candidates

- 1.6. Infogram: LDES volumetric energy density kWh/cubic meter by technology 2026 and 2046

- 1.7. Infogram: Escape routes from microgrid and similar LDES 2026-2046

- 1.8. Infogram: Off-grid solar house with LDES in 2036-46 - all-electric

- 1.9. Some customer types and potential energy services from LDES

- 1.10. Potential LDES performance by ten technologies in 19 columns

- 1.11. Three LDES sizes, with different technology winners 2026-2046 on current evidence

- 1.12. Acceptable sites: numbers by technology 2026-2046 showing microgrid opportunity

- 1.13. Calculations of LDES need by technology with implications

- 1.14. Current and emerging LDES duration vs power deliverable

- 1.14.1. Current LDES situation in green and trend in grid need in blue: simplified version

- 1.14.2. Duration hours vs power delivered by project and 12 technologies in 2026

- 1.15. Nine SWOT appraisals of potential broadly-defined microgrid LDES technologies for 2026-2046

- 1.16. Long Duration Energy Storage LDES roadmap 2026-2046

- 1.17. Market forecasts in 24 lines 2026-2046 with graphs and explanation

- 1.17.1. LDES total value market showing beyond-grid gaining share 2024-2046

- 1.17.2. LDES market in 9 technology categories $ billion 2026-2046 table, graphs, explanation

- 1.17.3. Total LDES value market % in three size categories 2026-2046 table, graph, explanation

- 1.17.4. Regional share of LDES value market % in four regions 2026-2046 table, graph, explanation

- 1.17.5. Number of LDES actual and putative manufacturers: RFB vs Other showing shakeout 2026-2046

- 1.17.6. Vanadium vs iron vs other RFB LDES market % value sales with technology strategies 2026-2046

- 1.17.7. RFB achievements and aspirations 2026-2046

2. LDES need and design principles

- 2.1. Energy fundamentals

- 2.2. Stationary energy storage and LDES fundamentals

- 2.2.1. General

- 2.2.2. Actual and proposed types of LDES

- 2.2.3. Nine LDES technologies that can follow the market trend to longer duration with subsets compared

- 2.2.4. Three sizes of grid and similar generator-user systems showing LDES potential

- 2.2.5. Off-grid solar house LDES is toughest challenge but coming 2036-46

- 2.2.6. LDES metrics

- 2.3. LDES projects in 2025-6 showing leading technology subsets

- 2.4. Scientific categories of LDES compared by 8 parameters

- 2.5. Electrochemical LDES options explained

- 2.6. Most batteries uncompetitive above 10-hour duration

- 2.7. Grand overview report on all LDES 2026-2046

3. Microgrid LDES escape routes

- 3.1. General situation

- 3.2. Infogram: 13 escape routes from LDES 2026-2046

- 3.3. Examples across the world: Denmark, Singapore, China, USA

- 3.4. Capacity factor of wind, solar and options that need little or no LDES

- 3.5. Extensive 2025 research on LDES escape routes

- 3.6. Research in 2025 on Home Energy Management Systems coping with intermittent supply

4. Advanced pumped hydro APHES

- 4.1. Overview

- 4.2. Using mining sites

- 4.2.1. Potential

- 4.2.2. Research advances in 2025

- 4.3. Pressurised underground: Quidnet Energy USA

- 4.4. Using heavier water up mere hills: RheEnergise UK

- 4.4.1. General

- 4.4.2. RheEnergise installation progress 2025-6

- 4.4.3. Power for mines and other targets with appraisal of prospects

- 4.5. Using seawater or other brine

- 4.5.1. General

- 4.5.2. Brine in salt caverns Cavern Energy USA

- 4.5.3. SWOT appraisal of seawater pumped hydro on land

- 4.6. Sizeable Energy Italy, StEnSea Germany, Ocean Grazer Netherlands

- 4.6.1. General

- 4.6.2. Sizable Energy Itay

- 4.6.3. StEnSea Germany

- 4.6.4. Ocean Grazer Netherlands

- 4.6.5. SWOT appraisal of underwater energy storage for LDES

- 4.7. Hybrid technologies: research advances in 2024 and 2025

- 4.8. Research advances in 2024 and 2025

- 4.9. SWOT appraisal of APHES

5. Hydrogen H2ES and compressed air CAES for microgrid LDES

- 5.1. Hydrogen H2ES

- 5.1.1. Overview

- 5.1.2. Calistoga Resiliency Centre USA 48-hour microgrid

- 5.1.3. Ulm University microgrid trial Germany 2025-2027

- 5.1.4. China plans 2025 and 2026

- 5.1.5. New hydrogen storage methods and LDES relevance

- 5.2. Compressed air CAES for microgrids

- 5.2.1. Overview

- 5.2.2. Augwind Energy Israel

- 5.2.3. Keep Energy Systems UK

- 5.2.4. LiGE Pty Ltd South Africa

6. Redox flow batteries RFB

- 6.1. Overview

- 6.2. RFB research pivoting to LDES

- 6.2.1. Overview of RFB and its potential for LDES

- 6.2.2. Infogram: RFB achievements and aspirations 2026-2046

- 6.2.3. 72 RFB research advances in 2025

- 6.2.4. 18 examples of RFB research advances in 2024

- 6.3. Winning LDES redox flow battery technologies 2026-2046

- 6.4. SWOT appraisal and parameter comparison of RFB for LDES

- 6.5. 45 RFB companies compared in 8 columns: name, brand, technology, tech. readiness, beyond grid focus, LDES focus, comment

- 6.6. RFB technologies with research advances through 2025

- 6.6.1. Regular or hybrid, their chemistries and the main ones being commercialised

- 6.6.2. SWOT appraisals of regular vs hybrid options

- 6.7. Specific designs by material: vanadium, iron and variants, other metal ligand, halogen-based, organic, manganese with 2025 research, three SWOT appraisals

- 6.7.1. Vanadium RFB design and SWOT appraisal

- 6.7.2. All-iron and variants RFB design and SWOT appraisal

- 6.8. RFB manufacturer profiles

- 6.9. Further research in 2025

7. Solid gravity energy storage SGES

- 7.1. Overview including research in 2025

- 7.1.1. General

- 7.1.2. Three stages of operation

- 7.1.3. Three geometries

- 7.1.4. Pumped hydro gravity storage compared to the three SGES options

- 7.1.5. Basics

- 7.1.6. SWOT appraisal of solid gravity storage SGES for LDES

- 7.1.7. Parameter appraisal of solid gravity energy storage SGES for LDES

- 7.1.8. CAPEX challenge

- 7.1.9. Challenge of ongoing expenses

- 7.1.10. Possibility of pumping sand

- 7.1.11. Hydraulic piston lift instead of cable: 2025 modelling

- 7.1.12. Appraisal of other SGES research through 2025 and 2024

- 7.2. ARES USA

- 7.3. Energy Vault Switzerland, USA and China, India licensees

- 7.4. Gravitricity

- 7.5. Green Gravity Australia

- 7.6. SinkFloatSolutions France

8. Advanced conventional construction batteries ACCB

- 8.1. Overview

- 8.2. Eight ACCB manufacturers compared: 8 columns: name, brand, technology, tech. readiness, beyond-grid focus, LDES focus, comment

- 8.3. Parameter appraisal and SWOT appraisal of ACCB for LDES

- 8.3.1. Parameter appraisal

- 8.3.2. SWOT appraisal of ACCB for LDES

- 8.3.3. Research appraisal published in 2025

- 8.4. Metal-air batteries

- 8.4.1. Iron-air with SWOT and 2025 research: Form Energy USA

- 8.4.2. Aluminium-air : Phinergy Israel

- 8.4.3. Zinc-air with SWOT: E-Zinc, AZA battery, Zinc8 (Abound)

- 8.5. High temperature batteries

- 8.5.1. Molten calcium antimony: Ambri USA out of business, SWOT

- 8.5.2. Sodium or lithium sulfur: NGK/ BASF Japan/ Germany, others, research in 2025, SWOT

- 8.6. Metal-ion batteries including Inlyte, Altris, HiNa, Tiamat, Natron, Faradion

- 8.6.1. Sodium-ion with SWOT

- 8.6.2. Zinc halide Eos Energy Enterprises USA with SWOT

- 8.6.3. Zinc-ion Enerpoly, Urban Electric Power USA, NextEra USA

- 8.7. Nickel hydrogen batteries: EnerVenue USA with SWOT

9. Liquefied gas energy storage LGES: Liquid air LAES or CO2

- 9.1. Overview

- 9.2. Liquid air LAES LDES

- 9.2.1. Technology and research advances through 2025

- 9.2.2. Parameter comparison of LAES for LDES

- 9.2.3. SWOT appraisal of LAES for LDES

- 9.2.4. Indicative LAES systems, footprints and operating parameters

- 9.2.5. Research advances in 2025 and 2024

- 9.2.6. CGDG, Zhongli Zhongke Energy Storage Technology Co China

- 9.2.7. Highview Energy UK and partners Sumitomo, Centrica, Rio Tinto and others

- 9.2.8. MIT study of LAES viability in USA

- 9.2.9. Phelas Germany

- 9.3. Liquid and compressed carbon dioxide LDES

- 9.3.1. Overview

- 9.3.2. Parameter comparison of CO2 for LDES

- 9.3.3. SWOT appraisal of liquid CO2 for LDES

- 9.3.4. Research advances in 2025

- 9.3.5. Energy Dome Italy

- 9.3.6. China and Kazakhstan

10. Thermal energy storage for delayed electricity ETES

- 10.1. Overview and research advances in 2025

- 10.2. Research advances in 2025 and 2024

- 10.3. Lessons of failure: Siemens Gamesa, Azelio, Steisdal, Lumenion

- 10.4. The heat engine approach proceeds: Echogen USA

- 10.5. Use of extreme temperatures and photovoltaic conversion

- 10.5.1. Antora USA

- 10.5.2. Fourth Power USA

- 10.6. Marketing delayed heat and electricity from one plant

- 10.6.1. Overview

- 10.6.2. MGA Thermal Australia

- 10.6.3. Malta Inc Germany