|

年间契约型资讯服务

商品编码

1585848

世界OEM电解槽专案资料库Global OEM Electrolyzer Projects Database |

|||||||

"全球 OEM 电解器专案资料库" 是 Global Insight Services 的一项新订阅服务,提供有关新氢电解器专案的追踪资讯。透过订阅我们的服务,您将可以存取每月更新的最新项目资料库。

电解槽是一种利用电力促进非自发性化学反应的装置,通常会将水电解成氢气和氧气。该过程涉及使电流通过水,使其在一个电极处分解成氢气 (H2),在另一个电极处分解成氧气 (O2)。电解槽在各种工业应用、能源储存和作为车辆清洁燃料来源的氢气生产中发挥重要作用。

随着专案格局的快速变化和发展, "全球 OEM 电解槽计画资料库" 已成为整个氢价值链参与者的重要市场资讯来源。

该资料库涵盖300多个製造设施,并提供有关电解槽产能、生产、技术、融资细节、参与公司、专案状态和时间表的详细数据。规划和分析。

- 全面的製造商资讯:跨多个地区和技术的领先原始设备製造商的详细资料

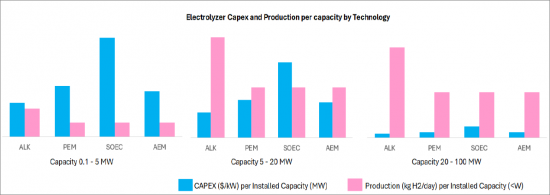

- 绩效指标:有关容量、效率、资本投资和专案成本的详细数据

- 专案追踪资讯:有关世界各地正在进行/计划的电解槽专案的数据

- 竞争基准:原始设备製造商之间在技术、价格和产能的比较

- 技术进步:追踪新技术(PEM、碱金属、固体氧化物等)的趋势并发现趋势和创新。

- 区域市场分析:使客户能够根据区域氢渗透趋势瞄准特定市场。

- 业务联盟和合作数据:有关与 OEM 和其他感兴趣方的策略联盟和合资企业的资讯。

- 融资和激励措施:有关电解槽项目的政府补贴、激励措施和融资选项的资讯。

每月通讯

我们服务的订阅者还会收到一份每月简讯,概述了该领域的主要发展:

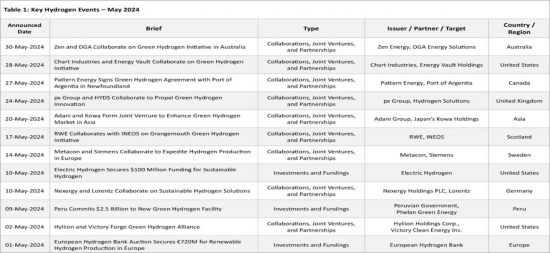

- 专案公告/审核趋势

- 投资与融资

- 业务合作、合资、业务伙伴关係

- 氢能政策

- 电解槽的製造趋势

印度 OEM 电解槽资料库:分析师见解

截至 2024 年 10 月, "2024 年 OEM 电解器计画资料库" 记录了印度约 41 个氢电解器计画。这些项目仍然鱼龙混杂,但前景光明:

- 正在运营的项目:这些设施中约有 15% 正在运营,生产氢气并成为商业和工业应用的基准。

- 新公告:仅 2024 年就宣布了 11 个新项目,总容量超过 6,600 兆瓦。该计画的激增凸显了该产业发展和投资步伐的加快。

这些专案的主要参与者包括Sterling and Wilson Private Limited、Tecnicas Reunidas, S.A.、HET Hydrogen(Horizon Fuel Cell Technologies 的子公司)和Avaada Group,各公司将在2024 年交付两个重大专案.专案.这些电解槽产生的氢气中约 55% 用于能源部门,36% 用于工业用途。

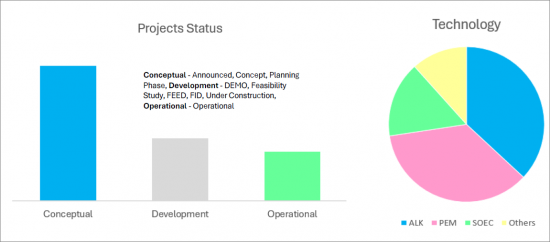

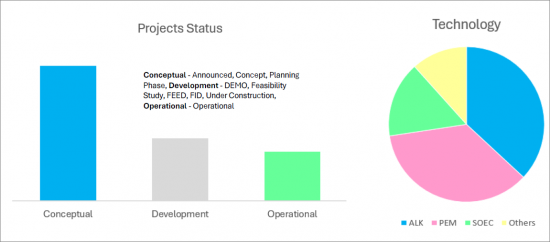

印度氢电解槽市场的技术分布目前以碱性技术领先,占专案的32%。质子交换膜 (PEM) 技术紧随其后,占 24.4%,而固体氧化物电解槽 (SOEC) 技术虽然仍处于起步阶段,但占据了 7.3% 的市场占有率。

《2024-2033年氢电解器市场报告》揭示:

- 碱性电解槽:2023年市场规模为1,110万美元,预估2024年至2033年复合年增长率为33.3%。

- PEM 电解器:该细分市场预计将实现更高的收入成长,同期复合年增长率为 38.2%,预计到 2033 年将达到 2.249 亿美元。

地区领导者:古吉拉特邦和卡纳塔克邦主导印度的氢电解槽市场,反映了地区战略重点和能源资源的可用性:

- 古吉拉特邦:该邦是重要的氢气生产中心,占已备案项目的 27%,并拥有约 1,500 兆瓦的装置容量。

- 卡纳塔克邦:该州总装置容量最大,已安装电解槽超过 12,500 兆瓦,其中 83% 采用 PEM 技术。特别值得注意的是Ceres Power与壳牌共同开发的大型SOEC技术专案。该项目于 2022 年宣布,预计于 2024 年开始建设,并于 2026 年投入运营,由 Ceres Power 提供 1 亿美元资金。

印度所有项目的电解槽总容量超过35,000兆瓦,体现了该国扩大氢气生产和积极推动脱碳的承诺。

"Global OEM Electrolyzer Projects Database" is a new subscription offering from Global Insight Services that offers tracking of new hydrogen electrolyzer projects. Subscribers to this service receive access to updates to projects database on a monthly basis.

INFOGRAPHICS

An electrolyzer is a device that uses electricity to drive a non-spontaneous chemical reaction, typically the electrolysis of water into hydrogen and oxygen. In this process, an electric current is passed through water, causing it to decompose into its constituent elements: hydrogen gas (H2) at one electrode and oxygen gas (O2) at the other electrode. Electrolyzers play a key role in the production of hydrogen for various industrial applications, energy storage, and as a clean fuel source for vehicles.

Given the rapidly changing and evolving nature of project landscape, Global OEM Electrolyzer Projects Database is an essential source of market information for participants across the hydrogen value chain.

Covering 300+ manufacturing facilities, this database delivers detailed data on electrolyzer capacity, production volumes, technology, funding details, participants, project status, and timelines for efficient hydrogen project planning and analysis across industries, aiding clients in tracking manufacturing progress from inception to completion for informed decision-making.

- Comprehensive Manufacturer Coverage: Detailed profiles of leading OEMs across regions and technologies

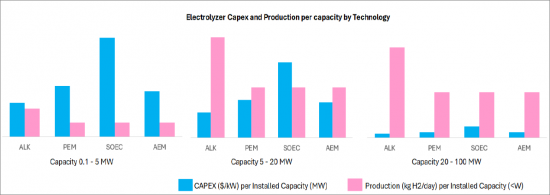

- Performance Metrics: In-depth data on capacity, efficiency, Capex and project costs

- Project Tracking: Data on ongoing and planned Electrolyzer projects globally

- Competitive Benchmarking: Comparisons across OEMs for technology, price, and production capacity

- Technology Advancements: Tracks emerging technologies, such as PEM, Alkaline, and Solid Oxide, to identify trends and innovations

- Geographic Analysis: Regional breakdowns, enabling clients to target specific markets based on hydrogen adoption trends.

- Partnership and Collaboration Data: Information on strategic alliances and joint ventures between OEMs and other stakeholders.

- Financing and Incentives: Information on government subsidies, incentives, and financing options for Electrolyzer projects.

Database Coverage:

| Projects | 250+ |

| Region | Global |

| Electrolyzer Manufacturers | 100+ |

| Project Information | Project name, Project location, Project category, Project participants, Plant status, Funding provider, Funding value, Project cost, Type of renewable energy, Electrolyzer manufacturer, Technology, Electrolyzer Capacity, Hydrogen Production Capacity, Hydrogen End-Users, Supply Source Asset Capacity, Project Announcement Year, Project Construction Start Year, Project Construction End Year |

| Electrolyzer Technology | Alkaline Water Electrolysis, Proton Exchange Membrane, Solid Oxide Electrolysis Cell, Anion Exchange Membrane, Capillary-fed Electrolysis and Membrane-Free Electrolysis |

| Project Status | Under Construction, Announced, Operational, Planning Phase, Concept, FID, Feasibility Study, DEMO, FEED |

| Hydrogen End-Users | Ammonia, Cement, Chemicals, E-commerce, e-fuels, Electric Vehicles, Energy, Energy Storage, Fertilizer Production, Food Value Chain, Fuel Cells, Heating, Hydrogen Fuelling System, Logistics, Manufacturing, Methanol, Mobility, Refineries, Steel, Synfuels, Telecommunications |

| Key Hydrogen Companies | H2 Energy, orsted, ENGIE, BP, Infinite Green Energy Ltd, Fortescue Future Industries, ScottishPower |

| Key Electrolyzer Manufacturers | Nel ASA, Siemens, McPhy Energy, ITM Power Plc, Gaztransport & Technigaz (Elogen), Green Hydrogen Systems, iGas Energy GmbH, Next Hydrogen, Asahi Kasei, thyssenkrupp, Cummins (Hydrogenics), Toshiba Corporation, Plug Power, John Cockerill, Enagas (H2Greem), Sunfire GmbH, Bloom Energy, Air Liquide, Volkswagen AG (H-TEC SYSTEMS), Enapter AG |

Monthly Newsletter

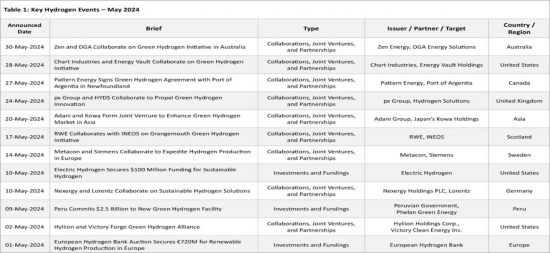

Subscribers to the service also receive a monthly newsletter summarizing key developments in the sector by:

- Project Announcements & Approvals

- Investments and Fundings

- Collaborations, Joint Ventures, and Partnerships

- Hydrogen Policy

- Electrolyzer Manufacturing

Analyst Insights on India OEM Electrolyzers Database

As of October 2024, the "OEM Electrolyzer Projects Database 2024" records around 41 hydrogen electrolyzer projects in India. The status of these projects is a mixed but promising landscape:

- Operational Projects: Approximately 15% of these facilities are active, producing hydrogen and setting the benchmark for commercial and industrial applications.

- New Announcements: In 2024 alone, 11 new projects were announced, collectively exceeding a capacity of 6,600 MW. This influx of projects highlights the accelerated pace of development and investment in the sector.

Major participants in these projects include Sterling and Wilson Private Limited, Tecnicas Reunidas, S.A., HET Hydrogen (a subsidiary of Horizon Fuel Cell Technologies), and the Avaada Group, each of which has announced two significant projects in 2024. Approximately 55% of the hydrogen produced from these electrolyzers is dedicated to energy sector applications, while 36% is earmarked for industrial use, emphasizing the diverse potential of hydrogen across different sectors.

The technological distribution in India's hydrogen electrolyzer market is currently led by Alkaline technology, which accounts for 32% of projects. Proton Exchange Membrane (PEM) technology follows closely at 24.4%, and Solid Oxide Electrolyzer Cell (SOEC) technology, while still in its nascent stage, makes up 7.3% of the market.

The "Hydrogen Electrolyzer Market Report 2024-2033" reveals that:

- Alkaline Electrolyzers: Valued at $11.1 million in 2023, this segment is expected to grow at a CAGR of 33.3% from 2024 to 2033.

- PEM Electrolyzers: With a higher revenue growth potential, this segment is forecasted to grow at a CAGR of 38.2% over the same period, reaching $224.9 million by 2033.

Regional Leaders: The states of Gujarat and Karnataka dominate India's hydrogen electrolyzer landscape, reflecting regional strategic priorities and energy resource availability:

- Gujarat: With 27% of documented projects, Gujarat is a critical hub for hydrogen production, supported by an installed capacity of approximately 1,500 MW.

- Karnataka: This state leads in total capacity, with over 12,500 MW of electrolyzers, 83% of which are based on PEM technology. Notable among these is a significant SOEC technology project, jointly developed by Ceres Power and Shell. Announced in 2022 and supported with $100 million in funding from Ceres Power, construction commenced in 2024, with operations expected by 2026.

The combined electrolyzer capacity from all projects in India exceeds 35,000 MW, a testament to the country's aggressive push to scale hydrogen production and support decarbonization.