|

年间契约型资讯服务

商品编码

1459444

全球蜂窝物联网模组和晶片组市场:追踪和预测 - 市场数据专用详细分析工具Global Cellular IoT Module and Chipset Market Tracker & Forecast - A Purpose-built Tool to Slice and Dice Market Data for the Cellular IoT Module and Chipset Market |

||||||

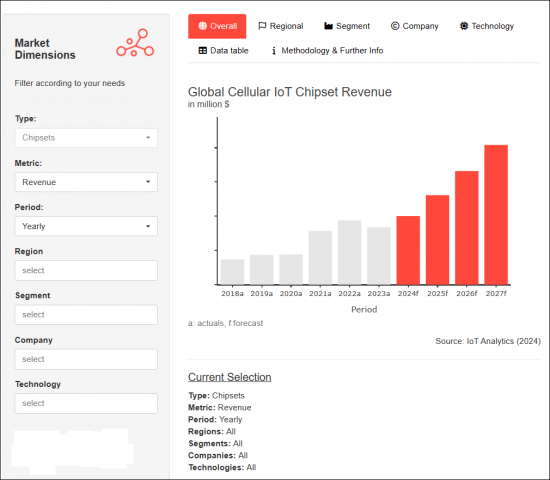

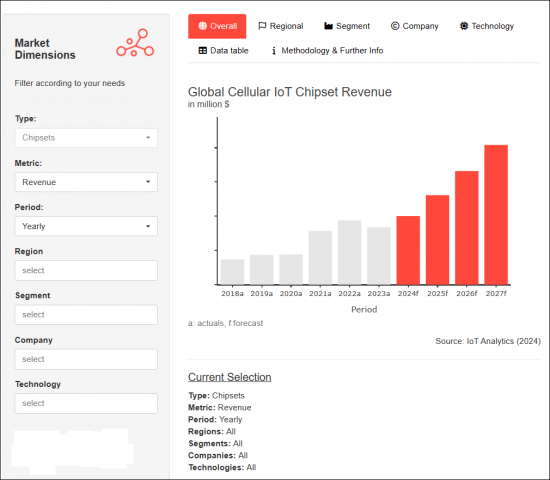

该工具追踪全球蜂窝物联网模组和晶片组市场的最新趋势,提供2018年至2023年的出货量、收入和ASP趋势、2024年至2027年的预测、技术、行业等信息,您可以依各种方式查看详细数据品牌和公司等类别。

包括:

追踪和预测包括以下全球数据:

- 38个蜂窝物联网模组品牌

- 13家蜂窝物联网晶片公司

- 10个地区

- 10种技巧

- 依16个行业

- 150型号级晶片组

- 737模型级模组

互动式网路工具

全球蜂窝模组和晶片组仪表板

资料库结构

模组和晶片组型号等级:模组和晶片组型号等级出货量、收入、ASP(嵌套资料库)

- 38个蜂窝物联网模组品牌(嵌套)、13个蜂窝物联网晶片组

- 2018年第一季至2023年第四季(实际)

- 连接技术:2G、3G、LTE-Cat 1、LTE Cat 1 bis、4G、LTE-M、NB-IoT、LPWA 双模、5G RedCap(包括每种技术的后备和类别)

- 10个地区:中国、北美、西欧、东欧、中东和非洲、拉丁美洲、日本、印度、韩国、亚洲等

- 737 个模组型号和 150 个晶片组型号

产业/预测:企业级模组和晶片组出货量/收入/ASP(嵌套资料库)

- 38个蜂窝物联网模组品牌(嵌套)、13个蜂窝物联网晶片组

- 2018年第一季至2023年第四季(实际)

- 季度预测:2024年第一至第四季度

- 年度预测:2025-2027

- 连接技术:2G、3G、LTE Cat 1、LTE Cat 1 bis、4G、LTE-M、NB-IoT、LPWA 双模、5G RedCap

- 10个地区:中国、北美、西欧、东欧、中东/非洲、拉丁美洲、日本、印度、韩国、亚洲等

- 16个行业

上市公司

|

|

追踪和预测涵盖的行业细分:

|

|

Discover in-depth data on global IoT module and chipset

- In-depth look at the quarterly market for cellular IoT modules and chipsets.

- Includes over 6.9 million data points, that allow for detailed drill-down options per region, technology, industry, and company.

- The tracker gets updated with the most recent data every quarter.

WHAT IS INCLUDED

The tracker & forecast includes these global data points

- 38 cellular IoT module brands

- 13 cellular IoT chipset companies

- 10 regions

- 10 technology splits

- 16 industry verticals

- 150 unique model-level chipsets

- 737 unique model-level modules

THE ACCOMPANYING INTERACTIVE WEB TOOL

Discover the Global Cellular Module and Chipset Dashboard

THE UPDATE PROCESS

How we update the data

Constant monitoring of investor relations documents and press releases of hundreds of IoT companies-specifically, the companies that are part of this tracker.

Industry-level forecasts based on revenue estimates of chipset vendors, module manufacturers, and network operations.

Numerous interviews with senior IoT experts from chipset vendors, module manufacturers, and network operations.

Integrating financial and operational data modeling from model level to brand, technology, and region.

PRODUCT SPECIFICATIONS

The "Global Cellular IoT Module and Chipset Market Tracker & Forecast" represents the updated view of the cellular IoT module and chipset market for the 2018-2023 period, including a forecast for the 2024-2027 period.

The forecast is based on the information and data available until March 8, 2024. This analysis considers significant macro and micro-events, such as the global economic situation, the recovery scenarios for general chip shortages, and the rise of AI chip shortage. Additionally, we have considered technological advancements, such as LTE-Cat 1, Cat 1 bis, 5G, and 5G RedCap. We have included 5G RedCap as a distinct technology in this projection. We have conducted over 45+ meetings with module, chipset, and mobile network operators during MWC 2024 for feedback on our forecast. This research focuses only on cellular IoT chipsets embedded within IoT modules. It does not include cellular IoT chipsets embedded standalone in a device.

Find out

- What is the global cellular IoT module and chipset market size in terms of shipment, revenue, and ASP (wholesale average selling price)?

- Who are the leading players globally?

- What are the ASP trends by cellular connectivity technology and region?

- Which cellular IoT player is strong across 4G?

- Which cellular connectivity technology is leading globally?

- How is LTE-Cat 1 performing in China and the rest of the world?

- Which regions are leading the market in terms of growth and in terms of market share?

- Which companies are leading the market, and what are their market shares?

- Which industry vertical has the highest demand for cellular IoT connectivity chipsets and modules, and which is growing the fastest?

Database structure

Module & Chipset Model level: Modules & Chipset Shipments, Revenue and ASP at Model level (nested database)

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- 1Q 2018-4Q 2023 (actuals)

- Connectivity technologies: 2G, 3G, LTE-Cat 1, LTE Cat 1 bis, 4G, LTE-M, NB-IoT, LPWA dual mode, 5G RedCap, and 5G. Including fallback and categories for each technology

- Ten regions: China, North America, Western Europe, Eastern Europe, the Middle East and Africa, Latin America, Japan, India, Korea, Asia, and Other

- 737 unique module models and 150 unique chipset models

Industry Vertical & Forecast: Modules & Chipset Shipments, Revenue and ASP at Company level (nested database)

- 38 cellular IoT module brands, nested, with 13 cellular IoT chipset companies

- 1Q 2018-4Q 2023 (actuals)

- Quarterly forecast 1Q 2024-4Q 2024

- Annual forecast 2025-2027

- Connectivity technologies: 2G, 3G, LTE-Cat 1, LTE Cat 1 bis, 4G, LTE-M, NB-IoT, LPWA dual mode, 5G RedCap, and 5G

- 10 regions: China, North America, Western Europe, Eastern Europe, the Middle East and Africa, Latin America, Japan, India, Korea, Asia, and Other

- 16 industry verticals

Companies mentioned in the tracker & forecast

|

|

Industry verticals covered in the tracker & forecast

|

|