|

市场调查报告书

商品编码

1552532

全球防卫光电市场(2024-2034)Global Defense Optronics Market 2024-2034 |

||||||

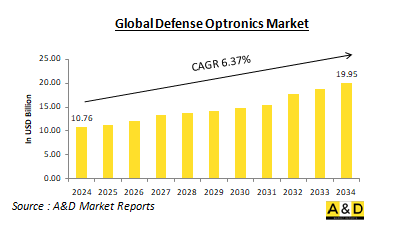

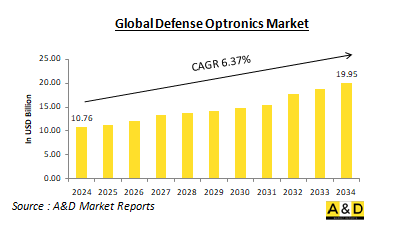

2024年全球防卫光电市场规模预估为107.6亿美元,预计2034年将成长至199.5亿美元,年复合成长率(CAGR)为6.37%。

全球防卫光电市场概况

全球防卫光电学是一个重要领域,它将光学和电子学相结合,建构用于军事应用的先进系统。这些系统能够增强视觉、瞄准、通讯和导航能力,这对现代战争非常重要。光电又称电光,整合了热成像、夜视、雷射测距仪、热成像系统等技术。军方使用这些设备在各种条件下获得战术优势,包括能见度不佳、极端天气和复杂的战场环境。光电技术在国防中的整合透过提高态势感知、精确瞄准和增强监视,彻底改变了军事行动。光电系统用于各种军事平台,包括地面车辆、飞机、船舶和手持设备。在恶劣环境下远距离侦测、识别和追踪物体和挑战的能力已成为世界各地国防军的重要资产。因此,全球防卫光电市场持续成长,增加了各地区对先进成像和感测器技术的需求。

科技对全球防卫光电市场的影响

技术进步大幅改变了防卫光电领域的格局,使其成为军事技术中最具活力的领域之一。人工智慧(AI)、机器学习(ML)和扩增实境(AR)等尖端技术的整合彻底改变了光电系统的开发和部署方式。这些技术不仅提高了光电器件的性能,而且扩大了其应用范围。防卫光电领域的主要技术影响之一是夜视设备的发展。传统的夜视设备依赖影像增强技术,但现代系统结合了热成像和红外线感测器。这些进步使士兵能够在完全黑暗和能见度较低的环境(例如烟或雾)中有效作战。红外线热像仪可检测生物体和设备中的热反应,这使其对于夜间或能见度较差的区域的操作非常有用。此外,能够撷取多个波长资料的多光谱成像系统对于侦测隐藏或伪装的目标变得越来越重要。

人工智慧和机器学习在提高光电系统的能力方面发挥着非常重要的作用。这些技术支援即时资料分析和决策,能够更快、更准确地识别威胁。例如,人工智慧演算法可以处理来自光电感测器的大量资料,并以比人类操作员更高的准确度自动侦测和分类目标。这导致了无需人工干预即可运行的自主监视和侦察系统的发展。另一个重要的技术影响是光电元件的小型化。材料科学和製造过程的进步使得生产更小、更轻、更节能的设备成为可能。这导致光电系统被纳入更广泛的平台,从无人机(UAV)到单兵装备。光电器件的小型化也促进了穿戴式装置的发展,例如智慧头盔和扩增实境护目镜,可提高战场上士兵的态势感知能力。此外,基于雷射的系统日益用于国防应用。雷射测距仪、雷射指示器和雷射导引系统已成为精确瞄准和导引武器的重要工具。这些系统使国防军能够准确捕捉远距离目标,减少附带损害并提高任务效率。高能量雷射武器虽然仍处于实验阶段,但可以为飞弹防御和反无人机作战提供新的能力,并指出防卫光电技术的未来方向。

全球防卫光电市场的关键驱动因素

几个主要因素推动全球防卫光电市场的成长和发展。其中包括现代战争日益复杂、地缘政治紧张局势加剧以及增强态势感知和精确瞄准的需要。主要驱动因素之一是战争性质的演变。随着衝突变得更加复杂和多方面,对能够提供即时资讯和态势感知的先进感测器技术的需求日益成长。现代军事行动经常包括不对称威胁,例如叛乱、恐怖主义和非常规战术。即使在恶劣的环境中,光电系统也能提供高解析度影像和资料,使国防军能够更有效地侦测和消除这些威胁。快速情报收集和处理能力对于在动态战斗情况下保持优势非常重要。地缘政治紧张局势和区域衝突也刺激了对光电系统的需求。东欧、南海和中东等地区日益紧张的局势日益增加军事开支,因为各国投资先进的国防技术来保护自己的利益。光电系统在边境监视、侦察和飞弹防御系统中发挥关键作用,这使其对于寻求保护其领土完整的国家非常重要。另一个重要的驱动因素是对精确定位和减轻附带损害的日益关注。现代军事行动的重点是尽量减少平民伤亡和基础设施损坏,这需要高精度的瞄准系统。雷射导引和热成像等光电技术使国防军能够高精度识别和攻击目标,降低意外损坏的风险。技术创新也是光电市场的主要驱动因素。人工智慧、机器学习和先进感测器技术的快速发展为国防部队增强作战能力创造了新的机会。随着这些技术的不断发展,全球防卫光电市场预计将进一步成长。

全球防卫光电市场的区域趋势

防卫光电的需求因地区而异,并受到国防支出、技术采用和区域安全问题等因素的驱动。主要区域趋势包括北美、欧洲、亚太地区和中东、非洲的发展。在北美,特别是在美国,防卫光电市场是由高额国防预算和对技术优势的关注所推动的。美国国防部(DoD)继续大力投资用于情报、监视和侦察(ISR)任务的光电系统以及精确导引武器。将人工智慧和机器学习整合到光电系统中是美国军方的重点,以实现更先进的瞄准和自主决策能力。在欧洲,北约国家日益增加对防卫光电的投资,以应对俄罗斯和其他地区威胁带来的安全挑战。包括英国、德国和法国在内的欧洲国家正致力于利用先进的光电系统实现军队现代化,以增强其情监侦侦能力并改善北约盟国之间的协调。由于南海、朝鲜半岛和中印边境紧张局势加剧,亚太地区防卫光电领域强劲成长。中国、日本和印度等国家投资先进的光电系统,以增强其防御能力。尤其是中国,已成为全球光电市场的主要参与者,致力于开发军事和民用应用的本土技术。在中东,沙乌地阿拉伯、以色列和阿拉伯联合大公国等国家是防卫光电的主要消费者。这些国家投资用于边境安全、飞弹防御和关键基础设施监控的光电系统。以色列尤其以其在开发先进光电技术方面的专业知识而闻名,该技术被国防军广泛使用,并出口到其他国家。在非洲和拉丁美洲,由于预算限制和技术基础设施挑战,光电技术的采用更加有限。然而,人们对取得这些技术用于边境安全、反恐行动和维和任务的兴趣越来越大。

防卫光电主要计画

携带式光电设备将交付给澳洲国防军。Safran Defencee & Electronics作为 Land 17 第2 阶段数位终端控制系统(DTCS)能力保证计画的一部分,澳洲宣布已获得Collins Aerospace的一份向澳洲供货的合约。国防军(ADF)拥有全套尖端携带式光电设备。该公司表示,Collins Aerospace将把三脚架和Safran的JIM Compact、Moskito TI 和 Sterna 系统纳入 ADF 的下一代 DTCS。Safran Defencee & Electronics的携带式光电设备被世界各地的联合火力观察员(JFO)、联合终端攻击控制器(JTAC)和特种部队所使用。这些设备包括多光谱双筒望远镜、目标定位器和雷射测距仪。官员表示,这些是数位软体小工具,可以与普通的战斗管理系统一起用于徒步战斗。

HENSOLDT 光电产品线的最新产品将在沙乌地阿拉伯举行的世界防务展上亮相。用于目标定位和稳定监视的中程、紧凑、强大的多感测器系统被称为 Bushbaby 100。该系统的轻型和可调节设计使其适合各种应用,包括固定安装、移动部署和携带式三脚架配置。 Bushbaby 100 是一款物超所值的产品,以合理的价格提供无与伦比的性能。 Bushbaby 100 的陀螺仪稳定 2 轴技术确保即使在恶劣条件下也能稳定可靠的效能。该系统专为承受最恶劣的条件而设计,符合 MIL-STD 对坚固性和使用寿命的要求,确保在任何条件下都能实现可靠的功能。

目录

防卫光电市场:报告定义

防卫光电市场细分

- 依地区

- 依技术

- 依平台

防卫光电市场分析(未来10年)

防卫光电市场的市场技术

全球防卫光电市场预测

防卫光电市场:区域趋势与预测

- 北美

- 促进/抑制因素和挑战

- PEST分析

- 市场预测与情境分析

- 主要公司

- 供应商层级状况

- 企业基准比较

- 欧洲

- 中东

- 亚太地区

- 南美洲

防卫光电市场:国家分析

- 美国

- 防御规划

- 最新趋势

- 专利

- 该市场目前的技术成熟度等级

- 市场预测与情境分析

- 加拿大

- 义大利

- 法国

- 德国

- 荷兰

- 比利时

- 西班牙

- 瑞典

- 希腊

- 澳洲

- 南非

- 印度

- 中国

- 俄罗斯

- 韩国

- 日本

- 马来西亚

- 新加坡

- 巴西

防卫光电市场:市场机会矩阵

防卫光电市场:专家对调查的看法

结论

关于航空和国防市场报告

The Global Defense Optronics Market is estimated at USD 10.76 billion in 2024, projected to grow to USD 19.95 billion by 2034 at a Compound Annual Growth Rate (CAGR) of 6.37% over the forecast period 2024-2034

Introduction to Global Defense Optronics Market:

Global defense optronics is a critical field that combines optics and electronics to create advanced systems used in military applications. These systems enable enhanced vision, targeting, communication, and navigation capabilities, which are essential in modern warfare. Optronics, also referred to as electro-optics, integrates technologies such as infrared imaging, night vision devices, laser range finders, thermal imaging systems, and more. These devices are used by military forces to gain a tactical advantage in various conditions, including low visibility, extreme weather, and complex battlefield environments. The integration of optronics in defense has revolutionized military operations, allowing for improved situational awareness, precision targeting, and enhanced surveillance. Optronics systems are used in a wide array of military platforms, including ground vehicles, aircraft, naval vessels, and handheld devices. The ability to detect, identify, and track objects or threats at long distances and in challenging environments has become an indispensable asset for defense forces worldwide. As a result, the global defense optronics market continues to grow, with increasing demand for advanced imaging and sensor technologies across different regions.

Technology Impact in Global Defense Optronics Market:

Technological advancements have significantly transformed the landscape of defense optronics, making it one of the most dynamic areas in military technology. The integration of cutting-edge technologies, such as artificial intelligence (AI), machine learning (ML), and augmented reality (AR), has revolutionized the way optronics systems are developed and deployed. These technologies have not only enhanced the performance of optronic devices but also expanded their range of applications. One of the major technological impacts in defense optronics is the evolution of night vision systems. Traditional night vision devices relied on image intensification technology, but modern systems now incorporate thermal imaging and infrared sensors. These advancements allow soldiers to operate effectively in complete darkness or obscured environments, such as smoke or fog. Thermal imaging systems, which detect heat signatures from living beings and equipment, provide a significant tactical advantage in nighttime and low-visibility operations. Additionally, multi-spectral imaging systems, which can capture data across multiple wavelengths, have become increasingly important for detecting concealed or camouflaged targets.

AI and ML are playing a pivotal role in improving the capabilities of optronics systems. These technologies enable real-time data analysis and decision-making, allowing for quicker and more accurate identification of threats. For example, AI algorithms can process large volumes of data from optronic sensors, automatically detecting and classifying targets with greater precision than human operators. This has led to the development of autonomous surveillance and reconnaissance systems, which can operate without human intervention. Another important technological impact is the miniaturization of optronics components. Advances in materials science and manufacturing processes have enabled the production of smaller, lighter, and more energy-efficient devices. This has allowed optronics systems to be integrated into a wider range of platforms, from unmanned aerial vehicles (UAVs) to individual soldier equipment. The miniaturization of optronics has also led to the development of wearable devices, such as smart helmets and augmented reality goggles, which enhance soldiers' situational awareness on the battlefield. Furthermore, laser-based systems are increasingly being used in defense applications. Laser range finders, laser designators, and laser guidance systems have become essential tools for precision targeting and guided weaponry. These systems enable defense forces to accurately engage targets at long distances, reducing collateral damage and increasing mission effectiveness. High-energy laser weapons, though still in the experimental phase, represent a future direction for defense optronics, with the potential to provide new capabilities for missile defense and anti-drone operations.

Key Drivers in Global Defense Optronics Market:

Several key factors are driving the growth and development of the global defense optronics market. These include the increasing complexity of modern warfare, rising geopolitical tensions, and the need for enhanced situational awareness and precision targeting. One of the primary drivers is the evolving nature of warfare. As conflicts become more complex and multifaceted, there is a growing need for advanced sensor technologies that can provide real-time intelligence and situational awareness. Modern military operations often involve asymmetric threats, such as insurgencies, terrorism, and unconventional warfare tactics. Optronics systems enable defense forces to detect and neutralize these threats more effectively by providing high-resolution imagery and data even in challenging environments. The ability to gather and process information quickly is crucial for maintaining an advantage in dynamic combat situations. Geopolitical tensions and regional conflicts are also fueling the demand for optronics systems. Rising tensions in regions such as Eastern Europe, the South China Sea, and the Middle East have led to increased military spending, with countries investing in advanced defense technologies to safeguard their interests. Optronics systems play a key role in border surveillance, reconnaissance, and missile defense systems, making them essential for nations seeking to protect their territorial integrity. Another important driver is the growing focus on precision targeting and reduced collateral damage. Modern military engagements emphasize minimizing civilian casualties and infrastructure damage, which requires highly accurate targeting systems. Optronics technologies, such as laser guidance and thermal imaging, enable defense forces to identify and engage targets with a high degree of accuracy, reducing the risk of unintended damage. Technological innovation is also a major driver in the optronics market. The rapid development of AI, machine learning, and advanced sensor technologies has created new opportunities for defense forces to enhance their operational capabilities. As these technologies continue to evolve, they are expected to drive further growth in the global defense optronics market.

Regional Trends in Global Defense Optronics Market:

The demand for defense optronics varies across different regions, driven by factors such as defense spending, technological adoption, and regional security concerns. Some of the key regional trends include developments in North America, Europe, Asia-Pacific, the Middle East, and Africa. In North America, particularly the United States, the defense optronics market is driven by high defense budgets and a focus on technological superiority. The U.S. Department of Defense (DoD) continues to invest heavily in optronics systems for intelligence, surveillance, and reconnaissance (ISR) missions, as well as for precision-guided weapons. The integration of AI and machine learning into optronics systems is a key focus for the U.S. military, allowing for more advanced targeting and autonomous decision-making capabilities. In Europe, NATO countries are increasing their investments in defense optronics in response to security challenges posed by Russia and other regional threats. European nations, including the United Kingdom, Germany, and France, are focusing on modernizing their military forces with advanced optronics systems to enhance their ISR capabilities and improve coordination among NATO allies. The Asia-Pacific region is experiencing significant growth in defense optronics due to rising tensions in the South China Sea, the Korean Peninsula, and along the India-China border. Countries such as China, Japan, and India are investing in advanced optronics systems to bolster their defense capabilities. China, in particular, is emerging as a major player in the global optronics market, with a focus on developing indigenous technologies for both military and civilian applications. In the Middle East, countries such as Saudi Arabia, Israel, and the UAE are major consumers of defense optronics. These nations are investing in optronics systems for border security, missile defense, and surveillance of critical infrastructure. Israel, in particular, is known for its expertise in developing advanced electro-optics technologies, which are widely used in its defense forces and exported to other nations. In Africa and Latin America, the adoption of optronics technology is more limited due to budgetary constraints and technological infrastructure challenges. However, there is growing interest in acquiring these technologies for border security, counter-terrorism efforts, and peacekeeping missions.

Key Global Defense Optronics market program:

Portable optronics to be delivered to Australian Defense Force. Defence & Safran Electronics As part of the Land 17 Phase 2 Digital Terminal Control Systems (DTCS) Capability Assurance Program, Australasia has announced that it has been awarded a contract by Collins Aerospace to supply the Australia. Defence Force (ADF) with its whole suite of cutting-edge portable optronics.Collins Aerospace will include tripods and Safran's JIM Compact, Moskito TI, and Sterna systems into the ADF's next generation of DTCS, the business claims. Portable optronics from Safran Electronics & Defence are used by Joint Fires Observers (JFOs), Joint Terminal Attack Controllers (JTACs), and Special Forces all around the world. These devices include multi-spectral binoculars, target locators, and laser rangefinders. According to officials, they are digital software gadgets that can be used with normal battle management systems for dismounted fighting.

The newest product in HENSOLDT's electro-optical line will be unveiled at the World Defence Show in Saudi Arabia. A medium-range, compact, and robust multisensor system for target geolocation and stabilised surveillance is called the Bushbaby 100. The system's lightweight and adjustable design makes it suitable for a range of uses, including static installations, mobile deployments, and man-portable tripod configurations. The Bushbaby 100 is an excellent value for the money, providing unmatched performance at a fair price range. The Bushbaby 100's gyrostabilized 2-axis technology guarantees consistent and dependable performance-even in demanding conditions. Constructed to endure the most severe circumstances, the system fulfils MIL-STD requirements for robustness and longevity, guaranteeing dependable functioning under any circumstances.

Table of Contents

Defense Optronics Market Report Definition

Defense Optronics Market Segmentation

By Region

By Technology

By Platform

Defense Optronics Market Analysis for next 10 Years

The 10-year Defense Optronics Market analysis would give a detailed overview of Defense Optronics Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Optronics Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Optronics Market Forecast

The 10-year Defense Optronics Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Optronics Market Trends & Forecast

The regional Defense Optronics Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Optronics Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Optronics Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Optronics Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2022-2032

- Table 20: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Technology, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2022-2032

List of Figures

- Figure 1: Global Defense Defense Optronics Market Forecast, 2022-2032

- Figure 2: Global Defense Defense Optronics Market Forecast, By Region, 2022-2032

- Figure 3: Global Defense Defense Optronics Market Forecast, By Technology, 2022-2032

- Figure 4: Global Defense Defense Optronics Market Forecast, By Platform, 2022-2032

- Figure 5: North America, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 6: Europe, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 7: Middle East, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 8: APAC, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 9: South America, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 10: United States, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 11: United States, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 12: Canada, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 13: Canada, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 14: Italy, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 15: Italy, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 16: France, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 17: France, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 18: Germany, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 19: Germany, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 20: Netherlands, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 21: Netherlands, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 22: Belgium, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 23: Belgium, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 24: Spain, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 25: Spain, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 26: Sweden, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 27: Sweden, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 28: Brazil, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 29: Brazil, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 30: Australia, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 31: Australia, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 32: India, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 33: India, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 34: China, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 35: China, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 36: Saudi Arabia, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 37: Saudi Arabia, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 38: South Korea, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 39: South Korea, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 40: Japan, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 41: Japan, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 42: Malaysia, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 43: Malaysia, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 44: Singapore, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 45: Singapore, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 46: United Kingdom, Defense Defense Optronics Market, Technology Maturation, 2022-2032

- Figure 47: United Kingdom, Defense Defense Optronics Market, Market Forecast, 2022-2032

- Figure 48: Opportunity Analysis, Defense Defense Optronics Market, By Region (Cumulative Market), 2022-2032

- Figure 49: Opportunity Analysis, Defense Defense Optronics Market, By Region (CAGR), 2022-2032

- Figure 50: Opportunity Analysis, Defense Defense Optronics Market, By Technology (Cumulative Market), 2022-2032

- Figure 51: Opportunity Analysis, Defense Defense Optronics Market, By Technology (CAGR), 2022-2032

- Figure 52: Opportunity Analysis, Defense Defense Optronics Market, By Platform (Cumulative Market), 2022-2032

- Figure 53: Opportunity Analysis, Defense Defense Optronics Market, By Platform (CAGR), 2022-2032

- Figure 54: Scenario Analysis, Defense Defense Optronics Market, Cumulative Market, 2022-2032

- Figure 55: Scenario Analysis, Defense Defense Optronics Market, Global Market, 2022-2032

- Figure 56: Scenario 1, Defense Defense Optronics Market, Total Market, 2022-2032

- Figure 57: Scenario 1, Defense Defense Optronics Market, By Region, 2022-2032

- Figure 58: Scenario 1, Defense Defense Optronics Market, By Technology, 2022-2032

- Figure 59: Scenario 1, Defense Defense Optronics Market, By Platform, 2022-2032

- Figure 60: Scenario 2, Defense Defense Optronics Market, Total Market, 2022-2032

- Figure 61: Scenario 2, Defense Defense Optronics Market, By Region, 2022-2032

- Figure 62: Scenario 2, Defense Defense Optronics Market, By Technology, 2022-2032

- Figure 63: Scenario 2, Defense Defense Optronics Market, By Platform, 2022-2032

- Figure 64: Company Benchmark, Defense Defense Optronics Market, 2022-2032