|

市场调查报告书

商品编码

1709980

全球海军光电市场:2025-2035Global Naval Optronics Market 2025-2035 |

||||||

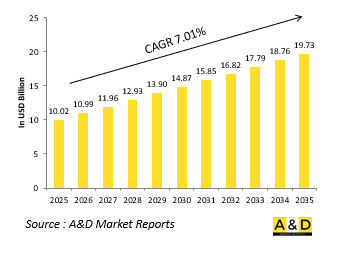

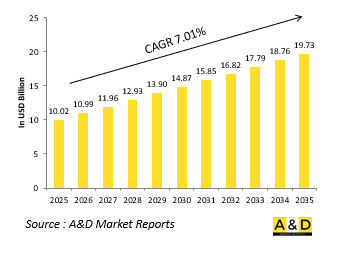

2025 年全球舰船光电市场规模估计为 100.2 亿美元,预计到 2035 年将成长至 197.3 亿美元,2025-2035 年预测期内的复合年增长率 (CAGR) 为 7.01%。

海军光电市场简介

国防海军光电市场在现代海上作战中发挥核心作用,为海军平台提供先进的态势感知、监视、目标获取和威胁侦测能力。海军光电系统结合了光学和电子技术,是水面舰艇、潜水艇和海岸防御设施的关键部件。这些系统包括光电感测器、热像仪、红外线摄影机、雷射测距仪和夜视设备等多种技术。这些结合起来,可以在低能见度环境下提供即时数据和视觉清晰度,提高航行安全、搜索救援行动和战斗力。随着海战朝向更复杂的隐形作战发展,对高解析度、远程、多光谱感测解决方案的需求持续成长。海军越来越依赖光电技术进行持续监视和精确瞄准,特别是在复杂的沿海和争议水域。这些系统对于反海盗、探雷和登船行动也至关重要,使操作员能够在交战前直观地评估威胁。从非法贩运到领土入侵等海上安全威胁的全球性,进一步加速了对强大的海军光电能力的投资。随着国防战略转向网路化、感测器丰富的平台,海军光电设备正成为原始环境数据和可操作海军情报之间的关键桥樑。

科技对海军光电市场的影响:

技术进步正在重塑海军光电技术的能力和战略作用,将海军光电技术转变为更大的海上指挥和控制生态系统中的重要节点。最新的感测器具有多光谱成像功能,使其能够在可见光、红外线和微光光谱范围内无缝运作。这种多功能性为海军部队在恶劣天气、夜间和混乱环境中作战提供了更大的灵活性。感测器解析度和影像处理的改进显着提高了检测精度,使得在更远的距离内识别较小和部分隐藏的威胁成为可能。此外,人工智慧和机器学习的整合增强了目标识别和异常检测能力,减少了人类操作员的认知负荷,同时提高了操作速度。当今的许多光电系统都采用模组化设计,以便于与雷达、声纳和电子战系统轻鬆整合。增强的稳定技术即使在高海况下也能确保稳定成像,而安全的高频宽资料链可实现分散式海军资产的即时传输和分析。小型化也是一项重大进步,使得小型高性能感测器能够部署在无人地面和水下航行器上。这些技术变革正在改变海军任务的计划、执行和改进方式,不仅提高了单一系统的效能,而且促进了更大的互通性和资料整合。

海军光电市场的关键推动因素:

海军任务日益复杂以及海上威胁的动态性正在推动全球国防军对先进光电系统的需求。主要动机是对加强监视和更早发现威胁的需求日益增长,特别是在拥挤和有争议的水域,在那里不对称威胁和隐形战术很常见。多领域作战的转变使得海军必须具备水面之上和之下的即时态势感知能力。光电技术提供了一种非辐射的雷达和声纳替代品,使船舶能够静默地观察其位置而不暴露。这对于旨在避免被发现的潜艇和隐形船来说尤其有价值。此外,无人平台的兴起推动了对能够在远端环境中独立运作的小型、强大和自主的感测系统的更大需求。边境安全、反海盗和反走私等任务也将受益于持续的高清成像和远端识别能力。在海上环境监测、人道援助等活动中,光电技术常用于导航和目视确认。随着地缘政治紧张局势加剧和海上领域竞争加剧,海军优先考虑能够在一系列任务中有效运作的系统,而光电系统在和平时期行动和高强度衝突场景中都发挥着核心作用。

海军光电市场的区域趋势:

海军光电市场的区域动态反映了不同的海上安全需求、产业能力和投资重点。在北美,强劲的采购计划和正在进行的设备现代化努力继续推动对尖端光电解决方案的需求。尤其是美国海军,正在将先进的感测器套件整合到其航空母舰舰队、驱逐舰和无人海上系统中,以保持在深海和沿海水域的技术优势。作为多国海军计划和沿海安全活动的一部分,欧洲正在经历综合光电系统的开发和部署热潮。地中海和波罗的海沿岸国家非常重视高解析度监视,以应对日益增多的海上活动和地区紧张局势。受中国、印度、日本和澳洲等国家海军实力增强的推动,亚太地区正在经历显着成长。随着领土争端加剧和对海洋意识的重视程度不断提高,该地区各国海军正大力投资加强其水面和水下光电设备。在中东,海岸防御和海军现代化计画正在支持采用光电技术进行监视、拦截和船舶保护。在这些地区,透过感测器驱动的情报增强海上态势感知是一个共同的目标,从而加强了光电技术在不断发展的国防格局中的战略价值。

主要海军光电项目

Safran将为埃及海军的十艘近海巡逻舰(OPV)提供先进的光电和导航系统。NVL Egypt 是德国造船厂 Lurssen 和埃及政府的合资企业,该公司选择了Safran的 VIGY 4 光学瞄准镜和 Argonyx 惯性导航系统。VIGY 4 是一种紧凑、稳定、远端全景观察和瞄准系统,旨在在具有课题性的海军环境中提供卓越的态势感知和准确性。

本报告研究了全球海军光电市场,并提供了按细分市场、技术趋势、机会分析、公司概况和国家数据划分的 10 年市场预测。

目录

全球海军光电市场 - 目录

全球海军光电市场报告定义

全球海军光电市场细分

- 按类型

- 按平台

- 按技术

- 按地区

未来10年全球舰艇光电市场分析

对全球海军光电市场十多年的分析提供了全球海军光电市场成长、变化趋势、技术采用概况和整体市场吸引力的详细概述。

全球海军光电市场技术

本部分涵盖了预计将影响该市场的十大技术以及这些技术可能对整个市场产生的影响。

全球海军光电市场预测

针对该市场未来十年的全球海军光电市场预测已详细涵盖上述各个细分领域。

全球海军光电市场趋势及区域预测

本部分涵盖无人机市场的区域趋势、推动因素、阻碍因素、课题以及政治、经济、社会和技术方面。它还提供了详细的区域市场预测和情境分析。区域分析包括主要公司概况、供应商格局和公司基准测试。目前市场规模是根据正常业务情境估算的。

- 北美

- 推动因素、阻碍因素与课题

- PEST

市场预测与情境分析

- 大公司

- 供应商层级状况

- 企业基准

- 欧洲

- 中东

- 亚太地区

- 南美洲

全球海军光电市场(按国家/地区)分析

本章重点介绍该市场的主要防御计划,并介绍该市场的最新新闻和专利。它还提供国家级的 10 年市场预测和情境分析。

- 美国

- 国防计划

- 最新消息

- 专利

- 该市场目前的技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳大利亚

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

全球海军光电市场机会矩阵

全球海军光电市场专家意见

结论

关于航空和国防市场报告

The Global Naval Optronics market is estimated at USD 10.02 billion in 2025, projected to grow to USD 19.73 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.01% over the forecast period 2025-2035.

Introduction to Naval Optronics Market:

The defense naval optronics market plays a central role in modern maritime operations, enabling advanced situational awareness, surveillance, target acquisition, and threat detection for naval platforms. Naval optronics systems-combining optical and electronic technologies-are critical components aboard surface vessels, submarines, and coastal defense installations. These systems include a range of technologies such as electro-optical sensors, thermal imagers, infrared cameras, laser rangefinders, and night vision devices. Together, they provide real-time data and visual clarity in low-visibility environments, enhancing navigation safety, search-and-rescue operations, and combat effectiveness. As naval warfare evolves toward more sophisticated and stealth-based engagements, the demand for high-resolution, long-range, and multispectral sensing solutions continues to rise. Naval forces are increasingly relying on optronics for persistent surveillance and precision targeting, especially in complex littoral zones and contested waters. These systems are also essential for counter-piracy, mine detection, and boarding operations, allowing operators to assess threats visually before engagement. The global nature of maritime security threats-from illicit trafficking to territorial incursions-has further accelerated investments in robust naval optronic capabilities. As defense strategies pivot toward networked and sensor-rich platforms, naval optronics stand as a vital bridge between raw environmental data and actionable naval intelligence.

Technology Impact in Naval Optronics Market:

Technological advancements are reshaping the capabilities and strategic role of naval optronics, turning them into integral nodes within larger maritime command-and-control ecosystems. Modern sensors are now equipped with multi-spectral imaging, allowing them to operate seamlessly across visible, infrared, and low-light spectrums. This versatility gives naval forces greater flexibility when operating in adverse weather, nighttime, or heavily cluttered environments. Improvements in sensor resolution and image processing have significantly boosted detection accuracy, enabling identification of smaller or partially concealed threats from longer distances. Additionally, the integration of artificial intelligence and machine learning enhances target recognition and anomaly detection, reducing the cognitive load on human operators while increasing operational speed. Many of today's optronic systems are also being designed for modularity, allowing for easy integration with radar, sonar, and electronic warfare systems. Enhanced stabilization technologies ensure steady imaging even in high-sea conditions, while secure, high-bandwidth data links allow for real-time transmission and analysis across distributed naval assets. Miniaturization is another major breakthrough, enabling compact, high-performance sensors to be deployed on unmanned surface and underwater vehicles. These technological shifts are not only improving individual system performance but also fostering greater interoperability and data fusion, thereby transforming how naval missions are planned, executed, and refined.

Key Drivers in Naval Optronics Market:

The growing complexity of naval missions and the dynamic nature of maritime threats are driving demand for advanced optronic systems across global defense forces. A key motivation is the increasing need for enhanced surveillance and early threat detection, particularly in congested or contested waters where asymmetric threats and stealth tactics are common. The shift toward multi-domain operations has made it essential for navies to possess real-time situational awareness, both above and below the surface. Optronics offer a non-emissive alternative to radar and sonar, allowing silent observation without giving away a ship's position. This is particularly valuable for submarines and stealth ships aiming to avoid detection. Moreover, the rise of unmanned platforms has further spurred the need for compact, ruggedized, and autonomous sensing systems capable of operating independently in remote environments. Border security, anti-piracy operations, and anti-smuggling missions also benefit from persistent, high-clarity imaging and long-range identification capabilities. Environmental monitoring and humanitarian efforts at sea often rely on optronics for navigation and visual confirmation. With geopolitical tensions rising and maritime domains becoming more contested, naval forces are prioritizing systems that can operate effectively across a range of mission profiles, giving optronics a central role in both peace-time operations and high-intensity conflict scenarios.

Regional Trends in Naval Optronics Market:

Regional dynamics in the naval optronics market reflect diverse maritime security needs, industrial capabilities, and investment priorities. In North America, robust procurement programs and ongoing fleet modernization efforts continue to drive demand for state-of-the-art optronic solutions. The U.S. Navy, in particular, is integrating advanced sensor suites across its carrier groups, destroyers, and unmanned maritime systems to maintain technological superiority in both blue-water and littoral zones. Europe has seen a surge in development and deployment of integrated optronic systems as part of multi-nation naval programs and coastal security operations. Countries bordering the Mediterranean and the Baltic Sea have emphasized high-resolution surveillance to address increased maritime activity and regional tensions. The Asia-Pacific region is witnessing significant growth, fueled by the expansion of naval capabilities in countries like China, India, Japan, and Australia. With growing territorial disputes and increased focus on maritime domain awareness, regional navies are investing heavily in both surface and subsurface optronic enhancements. In the Middle East, coastal defense and naval modernization programs are supporting the adoption of optronics for surveillance, interdiction, and ship protection roles. Across these regions, the shared objective is to bolster maritime situational awareness through sensor-driven intelligence, reinforcing the strategic value of optronics in the evolving defense landscape.

Key Naval Optronics Program:

Safran has been chosen to provide its advanced optronic and navigation systems for integration aboard the Egyptian Navy's fleet of ten offshore patrol vessels (OPVs), in a move aimed at strengthening Egypt's maritime defense capabilities. NVL Egypt-a joint venture between German shipbuilder Lurssen and the Egyptian government-selected Safran's VIGY 4 optronic sights and Argonyx inertial navigation systems for the vessels. The VIGY 4 is a compact, stabilized, long-range panoramic observation and targeting system, designed to deliver superior situational awareness and precision in demanding naval environments.

Table of Contents

Global Naval optronics market- Table of Contents

Global Naval optronics market Report Definition

Global Naval optronics market Segmentation

By Type

By Platform

By Technology

By Region

Global Naval optronics market Analysis for next 10 Years

The 10-year Global Naval optronics market analysis would give a detailed overview of Global Naval optronics market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Naval optronics market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Naval optronics market Forecast

The 10-year Global Naval optronics market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Naval optronics market Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Naval optronics market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Naval optronics market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Naval optronics market

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By Platform, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Technology, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Technology, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Type, 2022-2032

List of Figures

- Figure 1: Global Naval Optronics Market Forecast, 2022-2032

- Figure 2: Global Naval Optronics Market Forecast, By Region, 2022-2032

- Figure 3: Global Naval Optronics Market Forecast, By Platform, 2022-2032

- Figure 4: Global Naval Optronics Market Forecast, By Technology, 2022-2032

- Figure 5: Global Naval Optronics Market Forecast, By Type, 2022-2032

- Figure 6: North America, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 7: Europe, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 8: Middle East, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 9: APAC, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 10: South America, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 11: United States, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 12: United States, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 13: Canada, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 14: Canada, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 15: Italy, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 16: Italy, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 17: France, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 18: France, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 19: Germany, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 20: Germany, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 21: Netherlands, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 23: Belgium, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 24: Belgium, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 25: Spain, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 26: Spain, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 27: Sweden, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 28: Sweden, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 29: Brazil, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 30: Brazil, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 31: Australia, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 32: Australia, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 33: India, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 34: India, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 35: China, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 36: China, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 39: South Korea, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 40: South Korea, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 41: Japan, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 42: Japan, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 43: Malaysia, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 45: Singapore, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 46: Singapore, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Naval Optronics Market, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Naval Optronics Market, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Naval Optronics Market, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Naval Optronics Market, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Naval Optronics Market, By Technology (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Naval Optronics Market, By Technology (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Naval Optronics Market, By Platform (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Naval Optronics Market, By Platform (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Naval Optronics Market, By Type (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Naval Optronics Market, By Type (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Naval Optronics Market, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Naval Optronics Market, Global Market, 2022-2032

- Figure 59: Scenario 1, Naval Optronics Market, Total Market, 2022-2032

- Figure 60: Scenario 1, Naval Optronics Market, By Region, 2022-2032

- Figure 61: Scenario 1, Naval Optronics Market, By Platform, 2022-2032

- Figure 62: Scenario 1, Naval Optronics Market, By Technology, 2022-2032

- Figure 63: Scenario 1, Naval Optronics Market, By Type, 2022-2032

- Figure 64: Scenario 2, Naval Optronics Market, Total Market, 2022-2032

- Figure 65: Scenario 2, Naval Optronics Market, By Region, 2022-2032

- Figure 66: Scenario 2, Naval Optronics Market, By Platform, 2022-2032

- Figure 67: Scenario 2, Naval Optronics Market, By Technology, 2022-2032

- Figure 68: Scenario 2, Naval Optronics Market, By Type, 2022-2032

- Figure 69: Company Benchmark, Naval Optronics Market, 2022-2032