|

市场调查报告书

商品编码

1664193

战斗用无人机的全球市场:2025-2035年Global Combat Drone Market 2025-2035 |

||||||

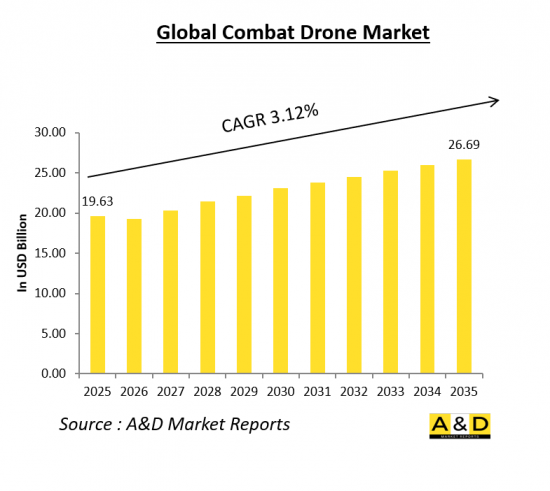

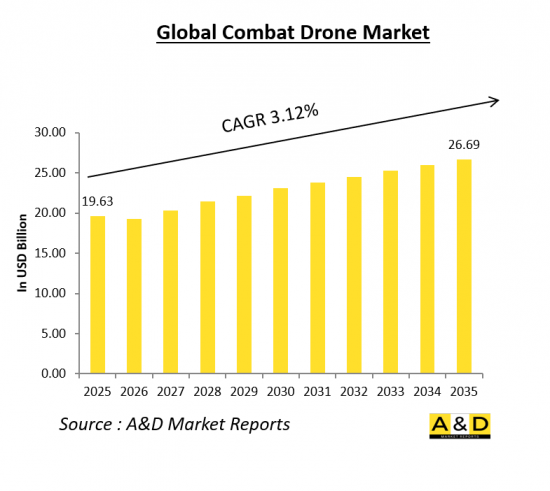

全球战斗无人机市场规模预计将从 2025 年的 196.3 亿美元增长到 2035 年的 266.9 亿美元,预测期内的复合年增长率为 3.12%。

这一增长是由军事现代化力度的加大以及无人机(UAV)在作战行动中的日益广泛采用所推动的。作战无人机正在推动全球国防部队的需求,因为它们可以增强态势感知能力、实现精确打击并降低作战风险。

战斗无人机市场:简介

作战无人机市场已成为现代战争的重要领域,它以先进的无人机能力彻底改变了军事行动。战斗无人机,也称为无人作战飞机(UCAV),专为情报、监视、侦察 (ISR) 和打击行动而设计,减少了在高风险战区直接参与的需要。这些无人机已在非对称战争、反恐和常规军事行动中证明了其有效性,促使全球需求激增。

随着军队越来越依赖自动化系统进行精确打击和战场感知,战斗无人机产业的技术进步日新月异,投资不断增加。人工智慧、隐身技术和增强的有效载荷能力的整合进一步扩展了其作战效用。世界各国都在开发和取得作战无人机,以增强国防能力并在现代战争中取得战略优势。

科技对战斗无人机市场的影响

技术创新是战斗无人机发展的关键驱动力,它塑造了其能力并扩大了其在战场上的作用。人工智慧和机器学习的进步使无人机能够更自主地运行,增强决策能力并减少对偏远地区人类操作员的依赖。人工智慧驱动的目标识别和自动导航系统使战斗无人机能够更精确、更有效率地执行任务。

隐身技术的融入,大幅提升了作战无人机的战场生存能力。现代无人战斗机具有躲避雷达的设计、低能见度涂层和减弱的红外线特征,使得敌方防空系统更难发现它们。这使得其在深度攻击行动和高风险的作战环境中非常有效。

另一个重大技术进步是机车弹药(也称为自杀无人机)的发展。该无人机将侦察无人机的功能与精确打击武器相结合,使其能够在目标区域上空盘旋并在必要时打击高价值资产。路透社的弹药在最近的衝突中得到了广泛使用,证明了其在现代战争中的战术效能。

下一代推进系统(如混合动力引擎和太阳能设计)的整合正在延长战斗无人机的续航能力和作战范围。一些高阶型号可以在空中停留24小时以上,提供持续的监视和攻击能力。此外,无人机群技术,即多架无人机协同行动,压倒敌人的防御,正成为未来军事战略的改变者。

此外,通讯系统的进步使得战斗无人机和指挥中心之间能够进行即时资料传输,从而提高了态势感知能力和任务效率。安全的卫星通讯链路和加密的资料共享功能确保了无人机与其他军事资产之间的无缝协调,增强了它们在网路中心战中的作用。

战斗无人机市场的关键推动因素

多种因素正在刺激战斗无人机市场的扩张,使其成为国防工业中成长最快的领域之一。其中一个主要推动因素是越来越依赖无人系统来减少伤亡并最大限度地降低人为风险。作战无人机使军队能够执行目标攻击和侦察任务等高风险行动,而不会让飞行员面临危险。

不断演变的地缘政治紧张局势和战争也加速了世界各地的无人机采购。面临安全威胁和领土争端的国家正在投资先进的无人战斗机以增强其威慑能力。最近的衝突证明了战斗无人机在现代战争中的有效性,引起了国家和非国家行为者日益浓厚的兴趣。

与传统载人飞机相比,战斗无人机的成本效益也是推动其采用的一个主要因素。战斗机需要大量的训练、维护和运作成本,而无人战斗机则提供了更经济、维护要求更低的替代方案。这种经济实惠的价格使得战斗无人机对于希望加强空军力量的已开发国家和发展中国家都具有吸引力。

非国家行为者和叛乱组织广泛使用无人机技术也影响了军方对反无人机措施和先进无人战斗机的投资。随着对手越来越多地使用无人机进行不对称战争和恐怖活动,国防部队优先开发反无人机系统和电子战解决方案,以减轻潜在威胁。

此外,战斗无人机与人工智慧和自主能力的日益融合正在重塑军事理论。无人机与地面、海军和空中资产协同进行联网作战的能力已成为现代军事战略的关键要素。国防部队正积极寻求利用人工智慧驱动的能力来增强其无人机队,以应对新出现的威胁。

本报告提供全球战斗用无人机的市场调查,彙整世界及各地各国的主要趋势,市场影响因素的分析,主要技术的招聘情形,主要的防卫计划,市场情境·市场预测,主要企业的分析等资讯。

目录

战斗用无人机市场:报告定义

战斗用无人机市场:市场区隔

推动各种类

各地区

各终端用户

未来 10 年战斗无人机市场分析

本章详细概述了十年来战斗无人机市场的成长、变化趋势、技术采用概述和整体市场吸引力。

战斗无人机的市场技术

本部分涵盖预计会影响该市场的十大技术以及这些技术可能对整个市场产生的影响。

全球战斗无人机市场预测

上述部分详细介绍了 10 年战斗无人机市场预测。

各地区战斗无人机市场趋势及预测

本部分涵盖各地区战斗无人机市场的趋势、推动因素、阻碍因素、挑战、政治、经济、社会和技术面。它还详细介绍了各地区的市场预测和情境分析。区域分析的最后一部分包括重点公司的分析、供应商格局和公司基准测试。目前的市场规模是根据正常业务情境估算的。

北美

促进因素,规定,课题

PEST分析

市场预测·情境分析

主要企业

供应商层级的形势

企业基准

欧洲

中东

亚太地区

南美

各国战斗无人机市场分析

本章涵盖主要的国防计划,并包括最新的新闻和专利。本章也涵盖了国家级 10 年市场预测和情境分析。

美国

防卫计划

最新消息

专利

目前技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

战斗无人机市场机会矩阵

机会矩阵可帮助读者了解高机会细分。

战斗无人机市场报告专家意见

以下是我们专家对该市场的可能分析意见。

总论

关于市场报告

The global combat drones market is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.12% from 2025 to 2035. Valued at an estimated USD 19.63 billion in 2025, the market is projected to reach USD 26.69 billion by 2035. This growth is driven by increasing military modernization efforts and the growing adoption of unmanned aerial vehicles (UAVs) for combat operations. Combat drones enhance situational awareness, enable precision strikes, and reduce operational risks, fueling their demand among defense forces worldwide.

Introduction to Combat Drone Market

The combat drone market has emerged as a critical segment of modern warfare, revolutionizing military operations with advanced unmanned aerial capabilities. Combat drones, also known as Unmanned Combat Aerial Vehicles (UCAVs), are designed for intelligence, surveillance, reconnaissance (ISR), and offensive operations, reducing the need for direct human involvement in high-risk combat zones. These drones have proven their effectiveness in asymmetric warfare, counterterrorism operations, and conventional military engagements, leading to a surge in global demand.

With military forces increasingly relying on autonomous systems for precision strikes and battlefield awareness, the combat drone industry is witnessing rapid technological advancements and significant investments. The integration of artificial intelligence, stealth technology, and enhanced payload capacities has further expanded their operational utility. Nations across the world are developing and acquiring combat drones to strengthen their defense capabilities and achieve strategic superiority in modern warfare scenarios.

Technology Impact in Combat Drone Market

Technological innovation is a key driving force in the evolution of combat drones, shaping their capabilities and expanding their roles on the battlefield. Advancements in artificial intelligence (AI) and machine learning have enabled drones to operate with greater autonomy, enhancing decision-making and reducing the reliance on remote human operators. AI-driven target recognition and automated navigation systems allow combat drones to execute missions with increased precision and efficiency.

The integration of stealth technology has significantly improved the survivability of combat drones in contested airspace. Modern UCAVs are equipped with radar-evading designs, low-observable coatings, and reduced infrared signatures, making them harder to detect by enemy air defense systems. This has made them highly effective in deep-strike operations and high-risk combat environments.

Another major technological advancement is the development of loitering munitions, also known as suicide drones. These drones combine the capabilities of reconnaissance UAVs with precision-strike weapons, allowing them to hover over a target area and engage high-value assets when needed. Loitering munitions have been extensively used in recent conflicts, demonstrating their tactical effectiveness in modern warfare.

The integration of next-generation propulsion systems, such as hybrid-electric engines and solar-powered designs, has extended the endurance and operational range of combat drones. Some high-end models can remain airborne for over 24 hours, providing continuous surveillance and strike capabilities. Additionally, swarm drone technology, where multiple drones operate in a coordinated manner to overwhelm enemy defenses, is becoming a game-changer in future military strategies.

Furthermore, advancements in communication systems have enabled real-time data transmission between combat drones and command centers, enhancing situational awareness and mission effectiveness. Secure satellite-based communication links and encrypted data-sharing capabilities ensure seamless coordination between drones and other military assets, reinforcing their role in network-centric warfare.

Key Drivers in Combat Drone Market

Several factors are fueling the expansion of the combat drone market, making it one of the fastest-growing segments in the defense industry. One of the primary drivers is the increasing reliance on unmanned systems to reduce casualties and minimize the risk to human personnel. Combat drones provide military forces with the ability to conduct high-risk operations, such as targeted strikes and reconnaissance missions, without endangering pilots.

Geopolitical tensions and the evolving nature of warfare have accelerated drone procurements worldwide. Nations facing security threats and territorial disputes are investing in advanced UCAVs to enhance their deterrence capabilities. Recent conflicts have demonstrated the effectiveness of combat drones in modern warfare, leading to heightened interest from both state and non-state actors.

The cost-effectiveness of combat drones compared to traditional manned aircraft is another major factor driving their adoption. While fighter jets require extensive training, maintenance, and operational costs, UCAVs offer a more affordable alternative with lower sustainment requirements. This affordability has made combat drones attractive to both developed and developing nations seeking to strengthen their air power.

The proliferation of drone technology among non-state actors and insurgent groups has also influenced military investments in counter-drone measures and advanced UCAVs. As adversaries increasingly employ drones for asymmetric warfare and terrorist activities, defense forces are prioritizing the development of counter-UAV systems and electronic warfare solutions to mitigate potential threats.

Additionally, the increasing integration of combat drones with artificial intelligence and autonomous capabilities is reshaping military doctrines. The ability to conduct networked operations, where drones coordinate with ground, naval, and air assets, has become a crucial element in modern military strategies. Defense forces are actively seeking to enhance their drone fleets with AI-driven capabilities to stay ahead of emerging threats.

Regional Trends in Combat Drone Market

The combat drone market is expanding across various regions, driven by strategic requirements, defense budgets, and technological capabilities. Each region exhibits unique trends based on its security landscape and military objectives.

In North America, the United States remains the dominant player in the combat drone market, with extensive investments in UCAV development and deployment. The U.S. military operates an advanced fleet of combat drones, including the MQ-9 Reaper, MQ-1C Gray Eagle, and RQ-170 Sentinel, which have been extensively used in counterterrorism and surveillance missions. The U.S. Department of Defense is continuously investing in next-generation drone technologies, including autonomous swarm drones, hypersonic UAVs, and AI-driven reconnaissance systems.

Europe is also witnessing significant growth in the combat drone sector, with countries such as France, the United Kingdom, and Germany investing in indigenous drone programs. The European MALE RPAS (Medium Altitude Long Endurance Remotely Piloted Aircraft System), also known as the Eurodrone, is a collaborative effort among several European nations to develop a strategic UCAV. Additionally, Turkey has emerged as a key player in the global drone market, with its Bayraktar TB2 and Akinci drones gaining international recognition for their effectiveness in recent conflicts.

In the Asia-Pacific region, rapid militarization and regional tensions are driving combat drone acquisitions. China has made significant advancements in UCAV technology, developing stealth drones like the GJ-11 and Wing Loong series, which are actively exported to various countries. India is also enhancing its drone capabilities through domestic development and procurement of advanced UAVs from global partners. South Korea and Japan are investing in indigenous drone programs to strengthen their defense capabilities and maintain regional security.

The Middle East has become a hotspot for combat drone usage, with several nations acquiring and deploying UCAVs in ongoing conflicts. Countries like Israel, the UAE, and Saudi Arabia have invested heavily in drone technology for surveillance, precision strikes, and border security operations. Israel, in particular, is a leading exporter of combat drones, supplying advanced UAVs to various international clients.

Latin America and Africa are gradually expanding their combat drone capabilities, primarily for counter-insurgency and border surveillance missions. While the adoption of UCAVs in these regions remains relatively limited compared to other parts of the world, increasing security challenges are prompting governments to invest in drone technology to enhance their defense preparedness.

The combat drone market is poised for continued growth, driven by technological innovation, geopolitical dynamics, and evolving military strategies. As nations seek to enhance their aerial combat capabilities with advanced unmanned systems, the market will witness further advancements in AI integration, stealth technology, and autonomous operations. With increasing competition among defense manufacturers and rising demand for multi-role UCAVs, the future of combat drones will be shaped by continuous innovation and strategic collaborations.

Key Combat Drones Program

Teledyne FLIR Defense has secured an order from the German Army to supply its Black Hornet(R) 4 nano-drone system to German armed forces. The $15 million contract was arranged through Teledyne FLIR's regional partner, European Logistic Partners (ELP) GmbH, based in Wuppertal, Germany. The Black Hornet 4 is the latest advancement in lightweight nano-drones, designed to enhance covert situational awareness for small combat units. It provides operators with high-resolution thermal and visual imagery. Weighing just 70 grams, the Black Hornet 4 boasts a flight time of over 30 minutes, a range exceeding two kilometers, and the ability to operate in 25-knot winds and rainy conditions.

India signed an agreement with the United States to procure 31 Predator high-altitude, long-endurance drones from American defense firm General Atomics under the foreign military sales program. The nearly $4 billion deal aims to bolster the combat capabilities of the Indian military, particularly along its contested borders with China.Finalized in the presence of senior defense and strategic officials in the national capital, the agreement marks a significant milestone in the defense partnership between the two nations. Additionally, the Indian Ministry of Defence and General Atomics Global India signed a contract for performance-based logistics, ensuring depot-level maintenance, repair, and overhaul of the drones within India.

Table of Contents

Combat Drone Market Report Definition

Combat Drone Market Segmentation

By propulsion

By Region

By End User

Combat Drone Market Analysis for next 10 Years

The 10-year Combat Drone Market analysis would give a detailed overview of Combat Drone Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Combat Drone Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Combat Drone Market Forecast

The 10-year Combat Drone Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Combat Drone Market Trends & Forecast

The regional Combat Drone Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Combat Drone Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Combat Drone Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Combat Drone Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Propulsion, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By End User, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Propulsion, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By End User, 2025-2035

List of Figures

- Figure 1: Global Combat Drone Market Forecast, 2025-2035

- Figure 2: Global Combat Drone Market Forecast, By Region, 2025-2035

- Figure 3: Global Combat Drone Market Forecast, By Propulsion, 2025-2035

- Figure 4: Global Combat Drone Market Forecast, By End User, 2025-2035

- Figure 5: North America, Combat Drone Market, Market Forecast, 2025-2035

- Figure 6: Europe, Combat Drone Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Combat Drone Market, Market Forecast, 2025-2035

- Figure 8: APAC, Combat Drone Market, Market Forecast, 2025-2035

- Figure 9: South America, Combat Drone Market, Market Forecast, 2025-2035

- Figure 10: United States, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 11: United States, Combat Drone Market, Market Forecast, 2025-2035

- Figure 12: Canada, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Combat Drone Market, Market Forecast, 2025-2035

- Figure 14: Italy, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Combat Drone Market, Market Forecast, 2025-2035

- Figure 16: France, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 17: France, Combat Drone Market, Market Forecast, 2025-2035

- Figure 18: Germany, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Combat Drone Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Combat Drone Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Combat Drone Market, Market Forecast, 2025-2035

- Figure 24: Spain, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Combat Drone Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Combat Drone Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Combat Drone Market, Market Forecast, 2025-2035

- Figure 30: Australia, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Combat Drone Market, Market Forecast, 2025-2035

- Figure 32: India, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 33: India, Combat Drone Market, Market Forecast, 2025-2035

- Figure 34: China, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 35: China, Combat Drone Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Combat Drone Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Combat Drone Market, Market Forecast, 2025-2035

- Figure 40: Japan, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Combat Drone Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Combat Drone Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Combat Drone Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Combat Drone Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Combat Drone Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Combat Drone Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Combat Drone Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Combat Drone Market, By Propulsion (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Combat Drone Market, By Propulsion (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Combat Drone Market, By End User (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Combat Drone Market, By End User (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Combat Drone Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Combat Drone Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Combat Drone Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Combat Drone Market, By Region, 2025-2035

- Figure 58: Scenario 1, Combat Drone Market, By Propulsion, 2025-2035

- Figure 59: Scenario 1, Combat Drone Market, By End User, 2025-2035

- Figure 60: Scenario 2, Combat Drone Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Combat Drone Market, By Region, 2025-2035

- Figure 62: Scenario 2, Combat Drone Market, By Propulsion, 2025-2035

- Figure 63: Scenario 2, Combat Drone Market, By End User, 2025-2035

- Figure 64: Company Benchmark, Combat Drone Market, 2025-2035