|

市场调查报告书

商品编码

1709972

全球 INS 自动测试设备市场(2025-2035 年)Global INS Automated Test Equipment Market 2025-2035 |

||||||

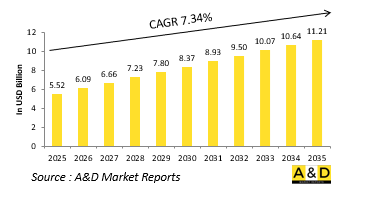

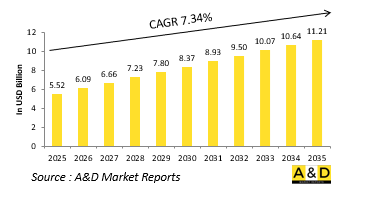

2025 年全球 INS 自动化测试设备市场规模估计为 55.2 亿美元,预计到 2035 年将达到 112.1 亿美元,在 2025-2035 年预测期内的复合年增长率为 7.34%。

全球 INS 自动测试设备市场简介

全球国防 INS 自动化测试设备市场是一个重要的细分市场,它支援军事平台上使用的惯性导航系统的开发、校准和维护。这些系统无需依赖外部讯号即可提供精确的导航和定位,因此在衝突或其他无法使用 GPS 的环境中至关重要。随着战斗机、潜舰、飞弹和无人机系统等国防平台变得越来越复杂,对高精度和高弹性导航系统的需求也日益增加。为国防级 INS 量身定制的自动化测试设备可确保这些复杂系统在快速加速、振动和温度变化等恶劣条件下可靠运作。该设备在识别系统故障、验证性能标准和维持战备状态方面发挥着至关重要的作用。此外,国防采购策略越来越重视降低生命週期成本、提高效率和延长系统寿命——所有这些都由自动化测试支援。鑑于国防行动的重要性,世界各国都在大力投资能够处理高吞吐量、安全和高度准确验证的测试能力。国防特定要求也会影响自动化测试设备架构和合规标准,推动技术创新以满足关键任务的期望。随着军队对其舰队进行现代化改造,INS 测试设备市场对于实现作战效能和技术优势仍然至关重要。

科技对 INS 自动测试设备市场的影响

技术进步正在实现更高的准确性、可靠性和操作灵活性,从而改变国防 INS 自动化测试设备的模式。复杂的平台需要能够高精度复製真实操作条件的测试系统。动态运动分析和环境复製等先进的模拟功能使测试设备能够模拟战斗和恶劣操作场景中遇到的压力。人工智慧开始支援自适应测试演算法,可以即时检测异常并优化校准,显着改善故障检测并减少人为干预。安全资料协定、加密和网路安全层整合到测试平台中,以确保敏感军事评估期间资讯的完整性和机密性。模组化软体定义测试系统正在成为标准,提供在空中、陆地和海上平台的多种配置中测试导航系统的可扩展性。此外,数位孪生的整合可以实现预测诊断和生命週期管理,提供 INS 随时间推移效能的虚拟表示。这些进步不仅提高了测试系统的能力,而且还支援缩短测试时间、提高操作信心并更快地部署新系统。总体而言,技术正在推动国防 INS 测试解决方案向更聪明、更强大的工具演变,以满足现代军事力量的需求。

INS 自动测试设备市场的关键推动因素

有几个因素推动了国防 INS 自动化测试设备市场的成长。其中一个主要因素是现代惯性导航系统日益复杂和小型化,这需要高度专业化的测试解决方案来验证其在特定操作参数下的性能。随着军事行动越来越依赖精确导引弹药、自动驾驶汽车和多领域整合,对准确可靠的导航系统的需求变得至关重要。此类系统必须在 GPS 讯号可能减弱甚至被拒绝的环境中完美运行,因此严格的自动化测试对于成功运行至关重要。

本报告对全球 INS 自动化测试设备市场进行了深入分析,包括市场推动因素、未来 10 年的市场前景和区域趋势。

目录

全球航空航太与国防 INS 自动测试设备报告定义

全球航空航太与国防 INS 自动测试设备细分

按类型

按最终使用者

依用途

按地区

未来 10 年全球航空航太与国防 INS 自动化测试设备分析

全球航空航太与国防 INS 自动测试设备市场技术

全球航空航太与国防 INS 自动测试设备预测

北美

促进因素、阻碍因素与课题

害虫

市场预测与情境分析

主要公司

供应商层级状况

企业基准

欧洲

中东

亚太地区

南美洲

全球航空航太与国防 INS 自动测试设备国家分析

美国

国防计画

最新消息

专利

目前该市场的技术成熟度

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

全球航空航太与国防 INS 自动化测试设备机会矩阵

专家对全球航空航太与国防 INS 自动测试设备报告的看法

结论

关于航空和国防市场报告

The global INS Automated Test Equipment market is estimated at USD 5.52 billion in 2025, projected to grow o USD 11.21 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 7.34% over the forecast period 2025-2035.

Introduction to Global INS Automated Test Equipment market:

The global defense INS automated test equipment market is a crucial segment supporting the development, calibration, and maintenance of inertial navigation systems used in military platforms. These systems provide accurate navigation and positioning without reliance on external signals, making them essential in contested or GPS-denied environments. As defense platforms such as fighter jets, submarines, guided missiles, and unmanned aerial systems become more advanced, the demand for precise, resilient navigation systems continues to grow. Automated test equipment tailored for defense-grade INS ensures that these complex systems function reliably under extreme conditions, including rapid acceleration, vibration, and thermal variation. The equipment plays a vital role in identifying system faults, validating performance standards, and maintaining combat readiness. Furthermore, defense procurement strategies increasingly emphasize lifecycle cost savings, efficiency, and system longevity, all of which are supported by automated testing. Given the critical nature of defense operations, nations across the globe are investing heavily in test capabilities that can handle high-throughput, secure, and highly accurate validation. The defense-specific requirements also influence the architecture and compliance standards of automated test equipment, driving innovation to meet mission-critical expectations. As militaries modernize their fleets, the INS test equipment market remains an indispensable enabler of operational effectiveness and technological superiority.

Technology Impact in INS Automated Test Equipment Market:

Technological advancement is transforming the defense INS automated test equipment landscape, enabling greater accuracy, reliability, and operational flexibility. Sophisticated platforms now require test systems capable of replicating real-world mission conditions with a high degree of precision. Advanced simulation capabilities, including dynamic motion profiling and environmental replication, allow test equipment to mimic the stressors encountered in combat or harsh operational scenarios. Artificial intelligence is beginning to support adaptive testing algorithms that can detect anomalies and optimize calibration in real time, significantly improving fault detection and reducing human intervention. Secure data protocols, encryption, and cybersecurity layers are being integrated into test platforms to ensure information integrity and confidentiality during sensitive military evaluations. Modular, software-defined test systems are becoming standard, offering scalability to test multiple configurations of navigation systems across air, land, and sea platforms. In addition, the integration of digital twins enables predictive diagnostics and lifecycle management, offering a virtual representation of INS performance over time. These advancements are not only enhancing the capability of test systems but also reducing testing time, increasing mission assurance, and supporting rapid deployment of new systems. Overall, technology is driving the evolution of defense INS test solutions into more intelligent, robust, and mission-aligned tools for modern military needs.

Key Drivers in INS Automated Test Equipment Market:

Several critical factors are driving the growth of the defense INS automated test equipment market. One major driver is the increased complexity and miniaturization of modern inertial navigation systems, which demand highly specialized testing solutions to verify performance under mission-specific parameters. As military operations rely more heavily on precision-guided munitions, autonomous vehicles, and multi-domain integration, the need for accurate, dependable navigation systems is paramount. These systems must operate flawlessly in environments where GPS may be degraded or denied, making rigorous automated testing essential for mission success. Another key driver is the global trend of defense modernization, with militaries replacing or upgrading aging platforms with advanced systems that include next-generation INS technologies. Governments are placing greater emphasis on rapid deployment and lifecycle sustainment, both of which require automated and reliable test processes. Additionally, there is growing demand for reduced system downtime and faster diagnostics, particularly in high-readiness or combat situations. Compliance with stringent military standards and interoperability across allied forces further amplifies the need for standardized, high-fidelity testing equipment. Collectively, these drivers are shaping a defense ecosystem that prioritizes automation, efficiency, and resilience, making INS automated test equipment an essential component of future-ready military infrastructure.

Regional Trends in INS Automated Test Equipment Market:

The defense INS automated test equipment market reflects distinct regional priorities and capabilities shaped by geopolitical considerations, defense budgets, and technological infrastructure. In North America, especially in the United States, the market is propelled by sustained investment in defense modernization, advanced aerospace programs, and unmanned systems. The presence of leading defense contractors and government-funded research accelerates innovation in both INS and associated test equipment. Europe continues to maintain a strong presence, with countries emphasizing NATO interoperability, precision defense technologies, and joint programs that necessitate robust testing solutions. Nations such as France, Germany, and the United Kingdom are also investing in indigenous development of high-precision INS and supporting test frameworks. In the Asia-Pacific region, growing regional tensions and a push for military self-reliance are driving countries like China, India, South Korea, and Japan to strengthen their defense capabilities. These efforts include expanding their capacity for INS development and ensuring rigorous testing infrastructure is in place. The Middle East, with its emphasis on high-tech military acquisitions and regional security preparedness, is also contributing to demand for sophisticated test solutions. While Latin America and Africa are emerging at a slower pace, they are increasingly exploring advanced defense technologies, including the adoption of automated INS testing platforms as part of broader modernization initiatives.

Key INS Automated Test Equipment Program:

General Atomics has partnered with Israel's Rafael Advanced Defense Systems to develop a long-range precision-guided missile tailored for the U.S. market. The new weapon system was unveiled during the Sea-Air-Space 2025 conference in Maryland. Named the Bullseye missile, the system appears to be based on Rafael's Ice Breaker platform, which boasts a range of 300 kilometers (186 miles). However, unlike the original Ice Breaker, Bullseye will feature modular capabilities, allowing it to accommodate different warheads and propulsion systems, according to information shared on General Atomics' product page.

Table of Contents

Global INS Automated Test Equipment in aerospace and Defense - Table of Contents

Global INS Automated Test Equipment in aerospace and Defense Report Definition

Global INS Automated Test Equipment in aerospace and Defense Segmentation

By Type

By End User

By Application

By Region

Global INS Automated Test Equipment in aerospace and Defense Analysis for next 10 Years

The 10-year Global INS Automated Test Equipment in aerospace and Defense analysis would give a detailed overview of Global INS Automated Test Equipment in aerospace and Defense growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global INS Automated Test Equipment in aerospace and Defense

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global INS Automated Test Equipment in aerospace and Defense Forecast

The 10-year Global INS Automated Test Equipment in aerospace and Defense forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global INS Automated Test Equipment in aerospace and Defense Trends & Forecast

The regional counter drone market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global INS Automated Test Equipment in aerospace and Defense

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global INS Automated Test Equipment in aerospace and Defense

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global INS Automated Test Equipment in aerospace and Defense Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2022-2032

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2022-2032

- Table 18: Scenario Analysis, Scenario 1, By End User, 2022-2032

- Table 19: Scenario Analysis, Scenario 1, By Application, 2022-2032

- Table 20: Scenario Analysis, Scenario 1, By Type, 2022-2032

- Table 21: Scenario Analysis, Scenario 2, By Region, 2022-2032

- Table 22: Scenario Analysis, Scenario 2, By End User, 2022-2032

- Table 23: Scenario Analysis, Scenario 2, By Application, 2022-2032

- Table 24: Scenario Analysis, Scenario 2, By Type, 2022-2032

List of Figures

- Figure 1: Global Defense INS Automated Test Equipment Forecast, 2022-2032

- Figure 2: Global Defense INS Automated Test Equipment Forecast, By Region, 2022-2032

- Figure 3: Global Defense INS Automated Test Equipment Forecast, By End User, 2022-2032

- Figure 4: Global Defense INS Automated Test Equipment Forecast, By Application, 2022-2032

- Figure 5: Global Defense INS Automated Test Equipment Forecast, By Type, 2022-2032

- Figure 6: North America, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 7: Europe, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 8: Middle East, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 9: APAC, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 10: South America, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 11: United States, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 12: United States, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 13: Canada, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 14: Canada, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 15: Italy, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 16: Italy, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 17: France, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 18: France, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 19: Germany, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 20: Germany, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 21: Netherlands, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 22: Netherlands, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 23: Belgium, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 24: Belgium, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 25: Spain, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 26: Spain, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 27: Sweden, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 28: Sweden, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 29: Brazil, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 30: Brazil, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 31: Australia, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 32: Australia, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 33: India, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 34: India, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 35: China, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 36: China, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 37: Saudi Arabia, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 38: Saudi Arabia, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 39: South Korea, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 40: South Korea, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 41: Japan, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 42: Japan, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 43: Malaysia, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 44: Malaysia, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 45: Singapore, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 46: Singapore, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 47: United Kingdom, Defense INS Automated Test Equipment, Technology Maturation, 2022-2032

- Figure 48: United Kingdom, Defense INS Automated Test Equipment, Market Forecast, 2022-2032

- Figure 49: Opportunity Analysis, Defense INS Automated Test Equipment, By Region (Cumulative Market), 2022-2032

- Figure 50: Opportunity Analysis, Defense INS Automated Test Equipment, By Region (CAGR), 2022-2032

- Figure 51: Opportunity Analysis, Defense INS Automated Test Equipment, By End User (Cumulative Market), 2022-2032

- Figure 52: Opportunity Analysis, Defense INS Automated Test Equipment, By End User (CAGR), 2022-2032

- Figure 53: Opportunity Analysis, Defense INS Automated Test Equipment, By Application (Cumulative Market), 2022-2032

- Figure 54: Opportunity Analysis, Defense INS Automated Test Equipment, By Application (CAGR), 2022-2032

- Figure 55: Opportunity Analysis, Defense INS Automated Test Equipment, By Type (Cumulative Market), 2022-2032

- Figure 56: Opportunity Analysis, Defense INS Automated Test Equipment, By Type (CAGR), 2022-2032

- Figure 57: Scenario Analysis, Defense INS Automated Test Equipment, Cumulative Market, 2022-2032

- Figure 58: Scenario Analysis, Defense INS Automated Test Equipment, Global Market, 2022-2032

- Figure 59: Scenario 1, Defense INS Automated Test Equipment, Total Market, 2022-2032

- Figure 60: Scenario 1, Defense INS Automated Test Equipment, By Region, 2022-2032

- Figure 61: Scenario 1, Defense INS Automated Test Equipment, By End User, 2022-2032

- Figure 62: Scenario 1, Defense INS Automated Test Equipment, By Application, 2022-2032

- Figure 63: Scenario 1, Defense INS Automated Test Equipment, By Type, 2022-2032

- Figure 64: Scenario 2, Defense INS Automated Test Equipment, Total Market, 2022-2032

- Figure 65: Scenario 2, Defense INS Automated Test Equipment, By Region, 2022-2032

- Figure 66: Scenario 2, Defense INS Automated Test Equipment, By End User, 2022-2032

- Figure 67: Scenario 2, Defense INS Automated Test Equipment, By Application, 2022-2032

- Figure 68: Scenario 2, Defense INS Automated Test Equipment, By Type, 2022-2032

- Figure 69: Company Benchmark, Defense INS Automated Test Equipment, 2022-2032