|

市场调查报告书

商品编码

1715447

全球边界扫瞄测试系统市场(2025-2035)Global Boundary Scan Test Systems Market 2025-2035 |

||||||

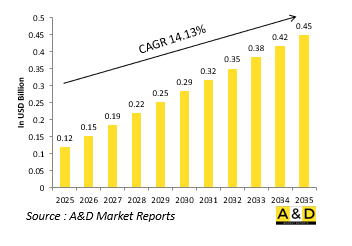

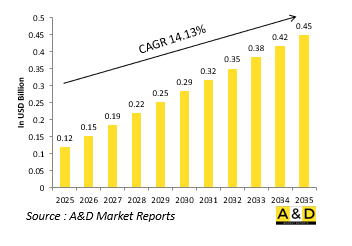

全球边界扫瞄测试系统市场规模预计在 2025 年为 1.2 亿美元,预计到 2035 年将达到 4.5 亿美元,预测期内(2025-2035 年)的复合年增长率为 14.13%。

边界扫瞄测试系统市场简介

对于全球的军事部署,边界扫瞄测试系统是用于验证复杂电子组件的结构完整性和功能性而无需物理接触每个组件的关键工具。边界扫瞄技术基于 IEEE 1149.1 标准,利用积体电路内建的扫瞄路径对互连、逻辑元件和储存元件进行测试。这种方法在军用电子产品中特别有用,因为高密度板和多层系统通常被封装或部署在传统基于探针的存取受到限制的恶劣环境中。边界扫瞄系统有助于在製造、整合和现场维护过程中进行有效的故障检测和诊断,提高系统可靠性和生命週期性能。由于其非侵入性,它非常适合现代防御平台,例如导弹系统、雷达装置、航空电子模组和安全通信设备,因为返工或拆卸不切实际或可能造成损坏。随着战术和战略系统中电子复杂性的增加,边界扫瞄测试成为性能保证的关键手段。该技术支援单元测试以及嵌入式测试策略,有助于预测性维护和营运准备。边界扫瞄系统在全球国防供应链中得到越来越广泛的应用,为军用电子设备提供了高水准的品质控制和运作保证。

技术对边界扫瞄测试系统市场的影响

技术的进步大大扩展了军用边界扫瞄测试系统的功能和应用,使其成为现代国防电子设备必不可少的先进诊断工具。扫瞄链管理、模式产生和故障隔离演算法的增强提高了诊断的准确性和速度,即使在高度整合的系统单晶片 (SoC) 和基于现场可编程闸阵列 (FPGA) 的设计中也是如此。边界扫瞄系统越来越多地被整合到自动化测试设备中或作为内建测试功能嵌入到系统中,因为它们支援持续的健康监测并减少对外部测试环境的需求。将边界扫瞄与其他测试协议(如线上测试和功能测试)相结合,可以产生混合解决方案,提供全面的诊断,同时最大限度地减少物理入侵。现代边界扫瞄工具现在透过 GUI 和 API 提供自动化,使工程师和技术人员都可以使用它们。系统级模组 (SoM) 测试的进步使得使用最少的附加硬体实现整个子系统的边界扫瞄覆盖成为可能。此外,与网路安全框架的整合可以实现安全且经过认证的测试方法,以保护敏感军事环境中的资料完整性。这些技术进步将边界扫瞄从以製造为中心的过程提升为国防电子产品长期可靠性和运作效率的战略推动因素。

边界扫瞄测试系统市场的关键推动因素

边界扫瞄测试系统在军事电子领域的应用日益广泛,这归因于多种因素。随着电子元件变得越来越小、越来越复杂,印刷电路板变得越来越密集、层次越来越多,传统的基于存取的测试变得越来越无效或根本不切实际。边界扫瞄技术透过提供对嵌入式组件的非侵入式存取来应对这项课题,使其成为测试现代国防电子设备的必需技术。需要更快、更准确的诊断来减少平均修復时间(MTTR)并确保操作准备就绪也是关键推动因素。

本报告对全球边界扫瞄测试系统市场进行了深入分析,包括成长动力、未来 10 年的预测和区域趋势。

目录

全球航空航太与国防边界扫瞄测试系统市场报告定义

全球航空航太与国防边界扫瞄测试系统市场细分

按地区

按元件

依科技

依用途

未来 10 年航空航太与国防边界扫瞄测试系统市场分析

全球航空航太与国防边界扫瞄测试系统市场技术

全球航空航太与国防边界扫瞄测试系统市场预测

全球航空航太与国防边界扫瞄测试系统市场趋势与预测

北美

促进因素、阻碍因素与课题

害虫

市场预测与情境分析

主要公司

供应商层级状况

企业基准

欧洲

中东

亚太地区

南美洲

全球航空航太与国防边界扫瞄测试系统市场国家分析

美国

国防计画

最新消息

专利

市场预测与情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

全球航空航太与国防边界扫瞄测试系统市场机会矩阵

全球航空航太与国防边界扫瞄测试系统市场报告专家意见

结论

关于航空和国防市场报告

The Global Boundary Scan Test Systems market is estimated at USD 0.12 billion in 2025, projected to grow to USD 0.45 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 14.13% over the forecast period 2025-2035.

Introduction to Boundary Scan Test Systems Market:

Global military boundary scan test systems are critical tools used in verifying the structural integrity and functionality of complex electronic assemblies without requiring physical access to every component. Based on the IEEE 1149.1 standard, boundary scan technology enables testing of interconnections, logic devices, and memory elements by using built-in scan paths within integrated circuits. This approach is especially valuable in military electronics, where high-density boards and multi-layered systems are often encapsulated or deployed in rugged environments that limit traditional probe-based access. Boundary scan systems facilitate efficient fault detection and diagnostics during manufacturing, integration, and field maintenance stages, improving system reliability and lifecycle performance. Their non-invasive nature is well-suited for modern defense platforms, including missile systems, radar units, avionics modules, and secure communication equipment, where rework or teardown can be impractical or damaging. As electronic complexity grows within tactical and strategic systems, boundary scan testing becomes a key enabler of performance assurance. The technology supports not only standalone tests but also embedded test strategies, contributing to predictive maintenance and mission readiness. Increasing adoption across global defense supply chains highlights the role of boundary scan systems in elevating the standard of quality control and operational assurance in military electronics.

Technology Impact in Boundary Scan Test Systems Market:

Technological progress has significantly expanded the capabilities and applications of military boundary scan test systems, transforming them into advanced diagnostic tools essential for modern defense electronics. Enhancements in scan chain management, pattern generation, and fault isolation algorithms have improved the accuracy and speed of diagnostics, even in highly integrated system-on-chip (SoC) and field-programmable gate array (FPGA)-based designs. Boundary scan systems are increasingly being integrated into automated test equipment and embedded within systems as built-in test capabilities, supporting continuous health monitoring and reducing the need for external test setups. The combination of boundary scan with other test protocols-such as in-circuit testing and functional testing-has created hybrid solutions that offer comprehensive diagnostics with minimal physical intrusion. Modern boundary scan tools now offer graphical user interfaces and API-driven automation, making them accessible to both engineers and technicians. Advances in system-on-module (SoM) testing have enabled boundary scan coverage across subsystems with minimal additional hardware. Furthermore, integration with cybersecurity frameworks allows secure, authenticated test procedures, safeguarding data integrity in sensitive military environments. These technological strides have elevated boundary scan from a manufacturing-focused process to a strategic enabler of long-term reliability and operational efficiency in defense electronics.

Key Drivers in Boundary Scan Test Systems Market:

Several key factors are propelling the increasing adoption of boundary scan test systems in military electronics. The miniaturization and increased complexity of electronic components, coupled with the shift toward densely populated, multi-layer printed circuit boards, make traditional access-based testing less effective or entirely impractical. Boundary scan technology addresses this challenge by enabling non-intrusive access to embedded components, making it indispensable for testing modern defense electronics. The need for faster, more accurate diagnostics to reduce mean time to repair (MTTR) and ensure mission readiness is also a significant driver. As military systems become more interconnected and software-defined, early and precise detection of interconnect faults is essential to prevent cascading failures. Additionally, the defense sector's push toward embedded diagnostics and condition-based maintenance aligns well with boundary scan's capability to support built-in self-test and continuous monitoring features. Increasing global standards compliance and lifecycle cost reduction goals further encourage investment in boundary scan infrastructure. Finally, the demand for high-reliability electronics in mission-critical applications, such as avionics, unmanned systems, and secure communications, underscores the importance of adopting test methods that provide comprehensive fault coverage without physical intrusion or system disassembly.

Regional Trends in Boundary Scan Test Systems Market:

Regional trends in military boundary scan test systems reflect the global nature of defense electronics manufacturing and the push for increased testing sophistication. In North America, particularly the United States, boundary scan is widely utilized in aerospace and defense sectors to support high-reliability standards in embedded systems, avionics, and command-control platforms. Its integration into automated test equipment used by prime contractors and tier-one suppliers reflects a mature ecosystem focused on lifecycle assurance and rapid diagnostics. In Europe, defense organizations are adopting boundary scan as part of broader digitalization and modular open systems approaches, emphasizing interoperability and in-field supportability across multinational programs. The Asia-Pacific region is experiencing strong growth, driven by indigenous platform development in countries such as China, India, South Korea, and Japan. These nations are incorporating boundary scan into their production and maintenance workflows to improve yield rates, lower defect risks, and reduce dependency on traditional test methods. In the Middle East, the deployment of modern electronics in new air defense and communications systems is increasing the need for reliable, automated test solutions that boundary scan technology offers. Latin America and Africa, while slower in adoption, are gradually integrating boundary scan into local defense manufacturing as part of modernization efforts and collaborative programs with global defense technology providers.

Key Boundary Scan Test Systems Program:

The European Commission has announced €60 million in funding for the Common Armoured Vehicle System (CAVS) project under the EDIRPA program (European Defense Industry Reinforcement Instrument through Joint Procurement). This ambitious initiative seeks to develop a modern, standardized armored vehicle to strengthen the operational capabilities of the armed forces in Finland, Latvia, Sweden, and Germany. The CAVS project aims to meet increasing demands for troop mobility and protection, while promoting defense collaboration and equipment standardization among European nations.

Table of Contents

Global Aerospace and Defense Boundary Scan Test Systems Market - Table of Contents

Global Aerospace and Defense Boundary Scan Test Systems Market Report Definition

Global Aerospace and Defense Boundary Scan Test Systems Market Segmentation

By Region

By Component

By Technology

By Application

Global Aerospace and Defense Boundary Scan Test Systems Market Analysis for next 10 Years

The 10-year Global Aerospace and Defense Boundary Scan Test Systems market analysis would give a detailed overview of Global Aerospace and Defense Boundary Scan Test Systems market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Global Aerospace and Defense Boundary Scan Test Systems Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Global Aerospace and Defense Boundary Scan Test Systems Market Forecast

The 10-year Global Aerospace and Defense Boundary Scan Test Systems market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Global Aerospace and Defense Boundary Scan Test Systems Market Trends & Forecast

The regional Global Aerospace and Defense Boundary Scan Test Systems market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Global Aerospace and Defense Boundary Scan Test Systems Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Global Aerospace and Defense Boundary Scan Test Systems Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Global Aerospace and Defense Boundary Scan Test Systems Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Technology, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 20: Scenario Analysis, Scenario 1, By Component, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Technology, 2025-2035

- Table 23: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 24: Scenario Analysis, Scenario 2, By Component, 2025-2035

List of Figures

- Figure 1: Global Boundary Scan Test Systems Market Forecast, 2025-2035

- Figure 2: Global Boundary Scan Test Systems Market Forecast, By Region, 2025-2035

- Figure 3: Global Boundary Scan Test Systems Market Forecast, By Technology, 2025-2035

- Figure 4: Global Boundary Scan Test Systems Market Forecast, By Application, 2025-2035

- Figure 5: Global Boundary Scan Test Systems Market Forecast, By Component, 2025-2035

- Figure 6: North America, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 7: Europe, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 8: Middle East, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 9: APAC, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 10: South America, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 11: United States, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 12: United States, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 13: Canada, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 14: Canada, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 15: Italy, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 16: Italy, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 17: France, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 18: France, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 19: Germany, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 20: Germany, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 21: Netherlands, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 22: Netherlands, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 23: Belgium, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 24: Belgium, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 25: Spain, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 26: Spain, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 27: Sweden, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 28: Sweden, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 29: Brazil, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 30: Brazil, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 31: Australia, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 32: Australia, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 33: India, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 34: India, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 35: China, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 36: China, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 37: Saudi Arabia, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 38: Saudi Arabia, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 39: South Korea, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 40: South Korea, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 41: Japan, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 42: Japan, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 43: Malaysia, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 44: Malaysia, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 45: Singapore, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 46: Singapore, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 47: United Kingdom, Boundary Scan Test Systems Market, Technology Maturation, 2025-2035

- Figure 48: United Kingdom, Boundary Scan Test Systems Market, Market Forecast, 2025-2035

- Figure 49: Opportunity Analysis, Boundary Scan Test Systems Market, By Region (Cumulative Market), 2025-2035

- Figure 50: Opportunity Analysis, Boundary Scan Test Systems Market, By Region (CAGR), 2025-2035

- Figure 51: Opportunity Analysis, Boundary Scan Test Systems Market, By Technology (Cumulative Market), 2025-2035

- Figure 52: Opportunity Analysis, Boundary Scan Test Systems Market, By Technology (CAGR), 2025-2035

- Figure 53: Opportunity Analysis, Boundary Scan Test Systems Market, By Application (Cumulative Market), 2025-2035

- Figure 54: Opportunity Analysis, Boundary Scan Test Systems Market, By Application (CAGR), 2025-2035

- Figure 55: Opportunity Analysis, Boundary Scan Test Systems Market, By Component (Cumulative Market), 2025-2035

- Figure 56: Opportunity Analysis, Boundary Scan Test Systems Market, By Component (CAGR), 2025-2035

- Figure 57: Scenario Analysis, Boundary Scan Test Systems Market, Cumulative Market, 2025-2035

- Figure 58: Scenario Analysis, Boundary Scan Test Systems Market, Global Market, 2025-2035

- Figure 59: Scenario 1, Boundary Scan Test Systems Market, Total Market, 2025-2035

- Figure 60: Scenario 1, Boundary Scan Test Systems Market, By Region, 2025-2035

- Figure 61: Scenario 1, Boundary Scan Test Systems Market, By Technology, 2025-2035

- Figure 62: Scenario 1, Boundary Scan Test Systems Market, By Application, 2025-2035

- Figure 63: Scenario 1, Boundary Scan Test Systems Market, By Component, 2025-2035

- Figure 64: Scenario 2, Boundary Scan Test Systems Market, Total Market, 2025-2035

- Figure 65: Scenario 2, Boundary Scan Test Systems Market, By Region, 2025-2035

- Figure 66: Scenario 2, Boundary Scan Test Systems Market, By Technology, 2025-2035

- Figure 67: Scenario 2, Boundary Scan Test Systems Market, By Application, 2025-2035

- Figure 68: Scenario 2, Boundary Scan Test Systems Market, By Component, 2025-2035

- Figure 69: Company Benchmark, Boundary Scan Test Systems Market, 2025-2035