|

市场调查报告书

商品编码

1744371

坦克弹药(120mm·125mm)的全球市场:2025年~2035年Global Tank Ammunition (120mm & 125mm) Market 2025-2035 |

||||||

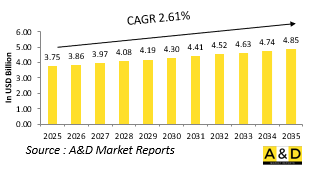

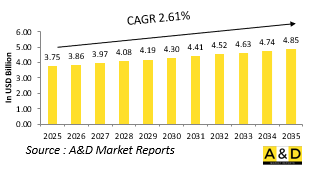

2025年全球战车弹药(120毫米和125毫米)市场规模估计为37.5亿美元,预计到2035年将增长至48.5亿美元,2025-2035年预测期内的复合年增长率(CAGR)为2.61%。

战车弹药(120毫米和125毫米)市场介绍:

120毫米和125毫米口径的坦克弹药是世界各地主战坦克的主要武器。这些弹药专门用于击败重装甲威胁,增强火力优势,并在攻防作战中支援机械化部队。 120毫米口径被北约成员国军队广泛使用,而125毫米口径则在遵循俄罗斯或苏联式装甲理论的国家中较为常见。两种口径都经过调整,可提供高能量,平衡破坏力、射程和多功能性。弹药类型包括穿甲弹尾翼稳定处理脱壳穿甲弹 (APFSDS)、高能量反战车弹 (HEAT) 和多用途弹,能够攻击战场上的各种目标。由于坦克现代化计划、装甲战争的增加以及陆地作战车辆在混合战争中的持续重要性,全球对此类弹药的需求保持稳定。这些弹药对于传统战场优势以及维持衝突地区的威慑至关重要。随着地缘政治动态的变化和陆战重新获得战略优势,120 毫米和 125 毫米坦克弹药对于维持战术均势和为装甲部队和防御阵地可能发生的高强度衝突做准备仍然至关重要。

科技对战车弹药(120毫米和125毫米)市场的影响:

近期的技术进步显着提升了120毫米和125毫米坦克弹药的性能和战术价值。其中最显着的进展之一是动能穿甲弹的改进,贫铀合金和先进钨复合材料等新材料的使用提高了穿甲效率。精密工程也有助于提高炮口初速和稳定的弹道性能,从而提高精度和远距离穿透力。智慧弹药正开始在该领域兴起,其特点是可编程引信,可以根据特定任务情况定制爆炸效果,例如对步兵进行空爆或在建筑物内部延时引爆。此外,火控整合使弹药能够与先进的瞄准系统无缝对接,从而提高首发杀伤力。钝感弹药的研发降低了射击过程中意外爆炸的可能性,提高了战场生存能力。热屏蔽和电子屏蔽技术也正在研究中,以对抗部署在对手装甲平台上的主动防护系统。因此,新一代坦克弹药不仅杀伤力更强,而且适应性更强,使用安全性更高。这些技术创新正在塑造装甲战争的未来,增强坦克在应对常规和非对称威胁方面的实用性。

战车弹药(120毫米和125毫米)市场关键推动因素:

多种因素正在影响120毫米和125毫米坦克弹药在全球国防领域持续的重要性及其发展。其中最重要的是装甲舰队的现代化,许多国家正在寻求增强其主战坦克的有效火力。随着新型坦克投入使用以及旧平台升级,为匹配增强型火炮系统和火控能力,对弹药的需求也同步成长。此外,不断变化的威胁环境要求提高反装甲效能,尤其是针对配备反应装甲和先进对抗措施的强化车辆。城市和混合作战场景激发了人们对能够在复杂地形(从开阔战场到狭窄城区)有效作战的多用途弹药的兴趣。训练和战备进一步促进了需求,军队正在寻求既经济高效又能模拟实战情况的训练弹药。工业基础的考虑,例如需要保持国内生产能力并减少对外国供应商的依赖,也在推动对弹药製造和创新的投资。此外,各地区日益加剧的地缘政治紧张局势使得战略储备和快速补给能力至关重要。综合考虑这些因素,120毫米和125毫米弹药的作战、战略和后勤考量成为地面部队战斗的关键组成部分。

坦克弹药(120 毫米和 125 毫米)市场的区域趋势:

区域防御动态在塑造 120 毫米和 125 毫米坦克弹药的生产、部署和发展方面发挥着重要作用。在欧洲,常规威慑的復苏和对领土防御的日益重视,推动了对 120 毫米弹药的新投资,尤其是在北约成员国,它们正在对豹式坦克和艾布拉姆斯坦克等平台进行标准化。东欧国家(其中一些仍在使用老式苏联坦克)正在维护和现代化其 125 毫米弹药库存,同时采用新的製造技术。在亚洲,陆地和边境安全问题日益紧张,推动了对这两种口径弹药的强劲需求,主要地区大国正在投资国内生产以确保其战略独立性。中东地区作战节奏快,装甲车辆种类繁多,目前正持续采购120毫米和125毫米口径的火炮,这些火炮通常用于城市和开阔地形的混合作战环境。北美地区专注于品质和创新,专注于先进的120毫米弹药,以匹配其下一代坦克平台的性能。同时,非洲和拉丁美洲等地区通常采用混合车队作战,在剩余物资和本地合作伙伴之间平衡采购。在每个地区,战略需求和战场经验都会影响这些坦克弹药的采购、改进和部署方式。

主要国防战车弹药(120毫米和125毫米)计画:

埃尔比特系统有限公司今日宣布,已获得一份价值约1.15亿美元的合同,为北约成员国供应坦克弹药。该合约为期三年,并可选择续约。 Elbit Systems Land 的坦克弹药系列符合北约 (NATO) 和 MIL-STD 标准,显着增强了装甲部队的火力和作战能力。 105 毫米弹药系列经认证可用于所有北约标准 105 毫米火炮,包括 M68、L7、F1 和类似系统。 120 毫米系列经认证可用于梅卡瓦 3 和 4、豹 2A4/A5/A6、M1A1/A2 艾布拉姆斯坦克、K1A1/A2、K2、ARIETE、M60A3 坦克等平台上使用的北约 120 毫米滑膛炮,并与 L44/L55 滑膛炮系统。此外,125 毫米弹药经认证可用于 T-72 和 T-90 主战坦克,而 100 毫米系列则专为 T-54、T-54B 和 T-55 平台设计。 Elbit Systems Rand 强调其所提供弹药的高安全性、可靠性和高品质标准。

本报告提供全球坦克弹药(120mm·125mm)市场相关调查,彙整10年的各分类市场预测,技术趋势,机会分析,企业简介,各国资料等资讯。

目录

坦克弹药市场报告定义

坦克弹药市场区隔

按指导

各类型

各地区

未来 10 年战车弹药市场分析

本章详细概述了坦克弹药市场的成长、变化趋势、技术采用概况和市场吸引力,并进行了 10 年的坦克弹药市场分析。

战车弹药市场技术

本部分涵盖了预计将影响该市场的十大技术,以及这些技术可能对整体市场产生的影响。

全球战车弹药市场预测

本部分详细介绍了该市场未来10年的坦克弹药市场预测,涵盖了上述各个细分市场。

战车弹药市场趋势及各地区预测

本部分涵盖了各地区坦克弹药市场的趋势、推动因素、限制、课题以及政治、经济、社会和技术层面。此外,也详细涵盖了各地区的市场预测和情境分析。区域分析的最后一部分包括主要公司概况、供应商格局和公司基准分析。当前市场规模是基于正常情况下的估算。

北美

促进因素,阻碍因素,课题

PEST

市场预测与情势分析

主要企业

供应商阶层的形势

企业基准

欧洲

中东

亚太地区

南美

战车弹药市场国家分析

本章涵盖该市场的主要国防项目,以及该市场的最新新闻和专利申请。此外,也涵盖了各国未来10年的市场预测与情境分析。

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与情势分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

坦克弹药市场机会矩阵

坦克弹药市场报告相关专家的意见

结论

关于航空·国防市场报告

The Global Tank Ammunition (120mm & 125mm) market is estimated at USD 3.75 billion in 2025, projected to grow to USD 4.85 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.61% over the forecast period 2025-2035.

Introduction to Tank Ammunition (120mm & 125mm) Market:

Tank ammunition in the 120mm and 125mm calibers serves as the primary armament for main battle tanks around the world. These rounds are specifically designed to defeat heavily armored threats, reinforce fire superiority, and support mechanized forces in both offensive and defensive operations. The 120mm caliber is widely used by NATO-aligned forces, while the 125mm variant is more common among countries that follow Russian or Soviet-style armor doctrines. Both calibers are tailored for high-energy delivery, offering a balance between destructive power, range, and versatility. Ammunition types include armor-piercing fin-stabilized discarding sabot (APFSDS), high-explosive anti-tank (HEAT), and multi-purpose rounds capable of engaging various battlefield targets. The global demand for such ammunition remains steady, driven by tank modernization programs, increased armored engagements, and the continued relevance of land combat vehicles in hybrid warfare. These rounds are integral not only for traditional battlefield dominance but also for maintaining deterrent capabilities in contested regions. As geopolitical dynamics shift and land warfare regains strategic prominence, 120mm and 125mm tank ammunition remain essential for maintaining tactical parity and preparing for potential high-intensity conflicts involving armored units and fortified positions.

Technology Impact in Tank Ammunition (120mm & 125mm) Market:

Recent technological advancements have significantly enhanced the performance and tactical value of 120mm and 125mm tank ammunition. One of the most notable developments is the improvement in kinetic energy penetrators, where new materials such as depleted uranium alloys and advanced tungsten composites offer greater armor-piercing efficiency. Precision engineering has also contributed to increased muzzle velocity and more consistent ballistic performance, which in turn improves accuracy and penetration at longer ranges. Smart munitions are beginning to emerge in this domain, featuring programmable fuses that allow crews to tailor explosive effects for specific mission profiles, such as airburst over infantry or delayed detonation inside structures. Additionally, fire control integration now enables ammunition to interface seamlessly with advanced targeting systems, improving first-shot lethality. The development of insensitive munitions has increased battlefield survivability by reducing the likelihood of accidental detonation under fire. Thermal and electronic shielding technologies are also being explored to counter active protection systems deployed on opposing armor platforms. The result is a new generation of tank rounds that are not only more lethal but also more adaptable and safer to use. These innovations are shaping the future of armored warfare by extending tank relevance against both conventional and asymmetric threats.

Key Drivers in Tank Ammunition (120mm & 125mm) market:

Several underlying factors are shaping the sustained importance and development of 120mm and 125mm tank ammunition across global defense sectors. Foremost among these is the modernization of armored fleets, as many nations seek to enhance their main battle tanks with more effective firepower. As newer tank designs enter service or older platforms undergo upgrades, there is a parallel demand for ammunition that matches enhanced gun systems and fire control capabilities. Evolving threat environments also necessitate greater anti-armor effectiveness, particularly against fortified vehicles equipped with reactive armor and advanced defensive measures. Urban and hybrid warfare scenarios drive interest in multi-role ammunition capable of operating effectively in complex terrains, from open battlefields to confined cityscapes. Training and readiness further contribute to demand, with militaries seeking cost-effective yet realistic practice rounds that simulate combat conditions. Industrial base concerns-such as the need to maintain domestic production capabilities or reduce reliance on foreign suppliers-also push investment in ammunition manufacturing and innovation. Moreover, as geopolitical tensions escalate in various regions, strategic stockpiling and rapid replenishment capabilities become essential. Collectively, these drivers reflect a blend of operational, strategic, and logistical considerations that make 120mm and 125mm ammunition a critical component of ground force preparedness.

Regional Trends in Tank Ammunition (120mm & 125mm) Market:

Regional defense dynamics play a major role in shaping the production, deployment, and evolution of 120mm and 125mm tank ammunition. In Europe, the resurgence of conventional deterrence and increased focus on territorial defense have prompted renewed investment in 120mm ammunition, particularly among NATO members standardizing across platforms like the Leopard and Abrams tanks. Countries in Eastern Europe, some of which still operate legacy Soviet-era tanks, continue to maintain and modernize 125mm stockpiles while integrating newer manufacturing techniques. In Asia, rising land-based tensions and border security priorities drive robust demand for both calibers, with major regional powers investing in domestic production to ensure strategic independence. The Middle East, characterized by high operational tempo and diverse armored fleets, has seen ongoing procurement of both 120mm and 125mm rounds, often tailored for combat environments involving a mix of urban and open terrain. North America emphasizes quality and innovation, focusing on advanced 120mm munitions to match the capabilities of next-generation tank platforms. Meanwhile, regions like Africa and Latin America often operate mixed fleets, balancing procurement between surplus supplies and local partnerships. Across all regions, strategic needs and battlefield experiences shape how these tank munitions are sourced, improved, and deployed.

Key Defense Tank Ammunition (120mm & 125mm) Program:

Elbit Systems Ltd. announced today that it has secured a contract valued at approximately $115 million to supply tank ammunition to a NATO member state. The contract will be executed over a three-year period, with options for extension. Elbit Systems Land's range of tank ammunition meets both NATO and MIL-STD standards and significantly enhances the firepower and operational capabilities of armored units. The 105mm ammunition series is certified for use with all NATO-standard 105mm guns, including the M68, L7, F1, and similar systems. The 120mm series is approved for NATO 120mm smoothbore guns used on platforms such as the Merkava 3 and 4, Leopard 2A4/A5/A6, M1A1/A2 Abrams, K1A1/A2, K2, ARIETE, and M60A3 tanks, and is compatible with L44/L55 smoothbore gun systems. Additionally, the 125mm ammunition is certified for use with T-72 and T-90 main battle tanks, while the 100mm series is designed for T-54, T-54B, and T-55 platforms. Elbit Systems Land emphasizes the high safety, reliability, and quality standards of its ammunition offerings.

Table of Contents

Tank Ammunition Market Report Definition

Tank Ammunition Market Segmentation

By Guidance

By Type

By Region

Tank Ammunition Market Analysis for next 10 Years

The 10-year tank ammunition market analysis would give a detailed overview of tank ammunition market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Access Control Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Access Control Market Forecast

The 10-year access control market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Access Control Market Trends & Forecast

The regional access control market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Access Control Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Access Control Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Guidance, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Guidance, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Type, 2025-2035

List of Figures

- Figure 1: Global Tank Ammunition Market Forecast, 2025-2035

- Figure 2: Global Tank Ammunition Market Forecast, By Region, 2025-2035

- Figure 3: Global Tank Ammunition Market Forecast, By Guidance, 2025-2035

- Figure 4: Global Tank Ammunition Market Forecast, By Type, 2025-2035

- Figure 5: North America, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 6: Europe, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 8: APAC, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 9: South America, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 10: United States, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 11: United States, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 12: Canada, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 14: Italy, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 16: France, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 17: France, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 18: Germany, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 24: Spain, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 30: Australia, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 32: India, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 33: India, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 34: China, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 35: China, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 40: Japan, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Tank Ammunition Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Tank Ammunition Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Tank Ammunition Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Tank Ammunition Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Tank Ammunition Market, By Guidance (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Tank Ammunition Market, By Guidance (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Tank Ammunition Market, By Type (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Tank Ammunition Market, By Type (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Tank Ammunition Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Tank Ammunition Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Tank Ammunition Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Tank Ammunition Market, By Region, 2025-2035

- Figure 58: Scenario 1, Tank Ammunition Market, By Guidance, 2025-2035

- Figure 59: Scenario 1, Tank Ammunition Market, By Type, 2025-2035

- Figure 60: Scenario 2, Tank Ammunition Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Tank Ammunition Market, By Region, 2025-2035

- Figure 62: Scenario 2, Tank Ammunition Market, By Guidance, 2025-2035

- Figure 63: Scenario 2, Tank Ammunition Market, By Type, 2025-2035

- Figure 64: Company Benchmark, Tank Ammunition Market, 2025-2035