|

市场调查报告书

商品编码

1838158

中口径弹药的全球市场(2025年~2035年)Global Medium Caliber Ammunition Market 2025-2035 |

||||||

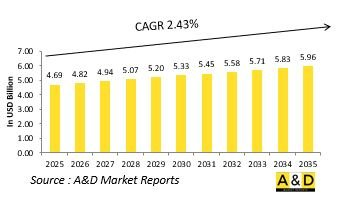

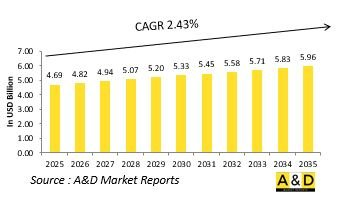

预计2025年全球中口径弹药市场规模将达到46.9亿美元,到2035年将达到59.6亿美元,2025年至2035年的复合年增长率为2.43%。

技术对中口径弹药市场的影响

技术创新正在改变国防中口径弹药市场,设计、材料和製造技术的进步提高了弹药的性能、安全性和操作灵活性。现代弹药采用智慧引信机制和可编程功能,让操作员可以根据作战需求选择空爆、点撞击和延迟引爆等起爆方式。这种适应性提高了对陆地和空中目标的打击精度和有效性。轻质合金和复合材料壳体等先进材料的加入,在保持结构完整性和能源效率的同时,减轻了系统重量。精密工程和数位模拟工具能够优化弹丸的空气动力学和弹道性能,提高命中率并减少附带损伤。自动化和积层製造也正在影响生产,使其能够以更低的成本更快、更稳定地进行生产。弹药管理系统与数位化火控架构的整合正在改善战场后勤、可追溯性和即时态势追踪。此外,对环保推进剂和无毒底火的研究正在塑造下一代环境永续弹药。这些技术进步正在重新定义作战准备状态,使现代军队能够在多种作战环境中以更高的效率、精度和战术灵活性部署中口径弹药。

中口径弹药市场的关键驱动因素

国防中口径弹药市场的发展动力源自于对可靠、适应性强且有效火力的持续需求,以应对现代战争的挑战。对装甲车辆现代化、海上防御和空对地攻击能力的投资不断增长,推动了对先进弹药系统的持续需求。对精确瞄准和远程作战的重视推动了智慧可编程弹药的发展,这与致力于最大限度地提高杀伤力并最大限度地减少附带损害的国防战略相一致。日益加剧的地缘政治紧张局势、领土争端以及维和行动的不断扩大,不断要求各国加强弹药储备。此外,常规威胁和非对称威胁并存的混合战争的出现,凸显了中口径弹药对于快速反应和持续作战的重要性。国防组织也优先考虑互通性和标准化,以使多国部队能够在盟军平台上无缝部署相容弹药。另一个关键驱动因素是用旨在提高安全性、可靠性和恶劣条件下性能的新型弹药替换老化的库存弹药。持续的研发投入以及国防工业和政府机构之间的合作确保了稳定的技术创新,使中口径弹药成为在不断变化的全球国防形势中取得战术优势的关键推动因素。

中口径弹药市场的区域趋势

受军事现代化优先事项、工业能力和安全环境的影响,国防中口径弹药市场的区域趋势呈现出多样化的模式。大型国防国家优先使用精确导引弹药和可编程弹药升级其现有的弹药库存,以保持其技术优势。相较之下,发展中地区则优先考虑本地生产和具有成本效益的采购,以提高自力更生能力并减少对进口的依赖。沿海国家和岛国正在投资海军防御弹药以加强海上安全,而陆基国家则正在透过改进中口径火力来增强其装甲车和步兵的作战能力。联合防御计划和多边训练促进了盟军使用标准化口径和可互操作弹药系统。这种协调一致有助于提高联合行动中的后勤效率和作战协调。此外,该地区的国防工业正在建立公私合作伙伴关係,以促进创新并维持长期供应链。新兴市场的经济成长和国防预算的增加进一步刺激了生产和出口潜力。同时,技术转移协议和联合发展策略使当地工业能够获得製造高品质弹药的专业知识。总体而言,区域战略体现了现代化、可用性和战备状态的平衡方法,确保中口径弹药在全球防御态势中仍然至关重要。

本报告研究并分析了全球中口径弹药市场,提供了成长动力、10 年展望以及区域市场趋势和预测的资讯。

目录

中口径弹药市场报告定义

中口径弹药市场区隔

按诱导

各类型

各地区

今后10年的中口径弹药市场分析

中口径弹药市场技术

全球中口径弹药市场

预测

中口径弹药的市场趋势与预测:各地区

北美

促进因素,阻碍因素,课题

PEST

市场预测与Scenario分析

主要企业

供应商层级格局

企业基准

欧洲

中东

亚太地区

南美

中口径弹药市场国的分析

美国

防卫计划

最新消息

专利

这个市场上目前技术成熟度

市场预测与Scenario分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

中口径弹药市场机会矩阵

中口径弹药市场报告相关专家的意见

结论

关于Aviation and Defense Market Reports

The Global Medium Caliber Ammunition market is estimated at USD 4.69 billion in 2025, projected to grow to USD 5.96 billion by 2035 at a Compound Annual Growth Rate (CAGR) of 2.43% over the forecast period 2025-2035.

Introduction to Medium Caliber Ammunition Market:

The defense medium caliber ammunition market occupies a critical position within global military supply chains, supporting a wide array of platforms ranging from armored vehicles and naval guns to aircraft-mounted and infantry weapon systems. Medium caliber ammunition, typically used for automatic cannons and autocannons, bridges the gap between small arms and large artillery, providing armed forces with flexible firepower for both offensive and defensive operations. This segment is essential for modern warfare due to its effectiveness in countering lightly armored targets, suppressing enemy positions, and defending against aerial threats. The market continues to evolve as defense forces seek ammunition with improved range, precision, and lethality. Ongoing modernization of military fleets and the growing need for interoperability across land, naval, and air domains have elevated the strategic value of medium caliber munitions. Increasing focus on cost-effective yet technologically advanced solutions has encouraged manufacturers to enhance performance characteristics such as ballistic stability, penetration capability, and modularity. Moreover, the market benefits from the global trend of upgrading legacy platforms with next-generation weapon systems that rely heavily on refined ammunition standards. As militaries prepare for high-intensity combat and hybrid warfare scenarios, the demand for reliable, efficient, and adaptable medium caliber ammunition remains robust.

Technology Impact in Medium Caliber Ammunition Market:

Technological innovation is transforming the defense medium caliber ammunition market by advancing design, materials, and manufacturing techniques to improve performance, safety, and operational flexibility. Modern ammunition is being engineered with smart fusing mechanisms and programmable capabilities that allow operators to select detonation modes-such as airburst, point impact, or delayed explosion-depending on mission requirements. This adaptability enhances accuracy and effectiveness against both ground and aerial targets. Advanced materials, including lightweight alloys and composite casings, are being incorporated to reduce system weight while maintaining structural integrity and energy efficiency. Precision engineering and digital simulation tools now enable optimization of projectile aerodynamics and ballistic performance, resulting in higher hit probability and reduced collateral damage. Automation and additive manufacturing are also influencing production, allowing faster and more consistent output at lower costs. The integration of ammunition management systems into digital fire-control architectures is improving logistics, traceability, and real-time status tracking on the battlefield. Additionally, research in green propellants and non-toxic primers is shaping the next generation of environmentally sustainable ammunition. Collectively, these technological advancements are redefining operational readiness, ensuring that modern forces can deploy medium caliber ammunition with greater efficiency, precision, and tactical versatility across multiple combat environments.

Key Drivers in Medium Caliber Ammunition Market:

The defense medium caliber ammunition market is driven by the constant need for reliable, adaptable, and effective firepower to meet the challenges of modern warfare. Growing investments in armored vehicle modernization, naval defense, and air-to-ground strike capabilities have led to sustained demand for advanced ammunition systems. The emphasis on precision targeting and extended-range engagement has encouraged the development of smart and programmable ammunition, aligning with defense strategies focused on minimizing collateral damage while maximizing lethality. Rising geopolitical tensions, territorial disputes, and the expansion of peacekeeping operations continue to push nations to maintain robust ammunition stockpiles. Moreover, the emergence of hybrid warfare, where conventional and asymmetric threats coexist, underscores the importance of medium caliber rounds for both rapid-response and sustained operations. Defense agencies are also prioritizing interoperability and standardization, enabling multinational forces to deploy compatible munitions seamlessly across allied platforms. Another significant driver is the replacement of aging ammunition inventories with new variants designed for enhanced safety, reliability, and performance under extreme conditions. Continuous R&D investment and partnerships between defense industries and government agencies ensure steady innovation, positioning medium caliber ammunition as a vital enabler of tactical superiority in evolving global defense scenarios.

Regional Trends in Medium Caliber Ammunition Market:

Regional trends in the defense medium caliber ammunition market reveal diverse patterns influenced by military modernization priorities, industrial capacity, and security environments. Established defense powers emphasize upgrading existing ammunition inventories with precision-guided and programmable variants to maintain technological superiority. In contrast, developing regions are focusing on localized production and cost-efficient procurement to enhance self-reliance and reduce dependency on imports. Coastal and island nations are investing in naval defense ammunition to strengthen maritime security, while land-centric countries are expanding armored and infantry capabilities supported by improved medium caliber firepower. Collaborative defense programs and multinational training exercises are promoting the use of standardized calibers and interoperable ammunition systems across allied forces. This harmonization facilitates logistics efficiency and operational coordination during joint missions. Additionally, regional defense industries are fostering public-private partnerships to boost innovation and sustain long-term supply chains. Economic growth and increased defense budgets in emerging markets are further stimulating production and export potential. Meanwhile, technological transfer agreements and co-development initiatives are allowing local industries to gain expertise in manufacturing high-quality ammunition. Overall, regional strategies reflect a balanced approach between modernization, affordability, and operational readiness, ensuring that medium caliber ammunition remains integral to global defense preparedness.

Key Medium Caliber Ammunition Program:

MESKO S.A. and the Armament Agency have signed a contract to supply medium-caliber ammunition in 23X152 mm and 30X173 mm calibers to the Polish Armed Forces. Valued at nearly PLN 100 million, the agreement covers deliveries scheduled for 2024-2026 and was finalized on 7 September during the 31st International Defence Industry Exhibition (MSPO) in Kielce. This award continues MESKO's series of orders from the Polish Army for this ammunition type. The 23X152 mm rounds, equipped with BZT armor-piercing incendiary tracer projectiles, are intended for use in ZU-23-2 and ZSU-23-4 family anti-aircraft guns and their variants, as well as in the anti-aircraft components of ZUR-23-2 and ZSU-23-4MP systems. These cartridges are designed to engage low-flying aerial threats such as fixed-wing aircraft and helicopters, and to be effective against lightly armored ground and surface targets.

Table of Contents

Medium Caliber Ammunition Market Report Definition

Medium Caliber Ammunition Market Segmentation

By Guidance

By Type

By Region

Medium Caliber Ammunition Market Analysis for next 10 Years

The 10-year Medium Caliber Ammunition Market analysis would give a detailed overview of Medium Caliber Ammunition Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Medium Caliber Ammunition Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Medium Caliber Ammunition Market

Forecast

The 10-year Medium Caliber Ammunition Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Medium Caliber Ammunition Market Trends & Forecast

The regional Medium Caliber Ammunition Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Access Control Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Medium Caliber Ammunition Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Medium Caliber Ammunition Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Type, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Guidance, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Type, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Guidance, 2025-2035

List of Figures

- Figure 1: Global Medium Caliber Ammunition Market Forecast, 2025-2035

- Figure 2: Global Medium Caliber Ammunition Market Forecast, By Region, 2025-2035

- Figure 3: Global Medium Caliber Ammunition Market Forecast, By Type, 2025-2035

- Figure 4: Global Medium Caliber Ammunition Market Forecast, By Guidance, 2025-2035

- Figure 5: North America, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 6: Europe, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 8: APAC, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 9: South America, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 10: United States, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 11: United States, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 12: Canada, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 14: Italy, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 16: France, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 17: France, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 18: Germany, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 20: Netherlands, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 21: Netherlands, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 24: Spain, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 30: Australia, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 32: India, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 33: India, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 34: China, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 35: China, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 40: Japan, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Medium Caliber Ammunition Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Medium Caliber Ammunition Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Medium Caliber Ammunition Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Medium Caliber Ammunition Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Medium Caliber Ammunition Market, By Type (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Medium Caliber Ammunition Market, By Type (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Medium Caliber Ammunition Market, By Guidance (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Medium Caliber Ammunition Market, By Guidance (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Medium Caliber Ammunition Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Medium Caliber Ammunition Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Medium Caliber Ammunition Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Medium Caliber Ammunition Market, By Region, 2025-2035

- Figure 58: Scenario 1, Medium Caliber Ammunition Market, By Type, 2025-2035

- Figure 59: Scenario 1, Medium Caliber Ammunition Market, By Guidance, 2025-2035

- Figure 60: Scenario 2, Medium Caliber Ammunition Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Medium Caliber Ammunition Market, By Region, 2025-2035

- Figure 62: Scenario 2, Medium Caliber Ammunition Market, By Type, 2025-2035

- Figure 63: Scenario 2, Medium Caliber Ammunition Market, By Guidance, 2025-2035

- Figure 64: Company Benchmark, Medium Caliber Ammunition Market, 2025-2035