|

市场调查报告书

商品编码

1904992

全球国防光电市场(2026-2036)Global Defense Optronics Market 2026-2036 |

||||||

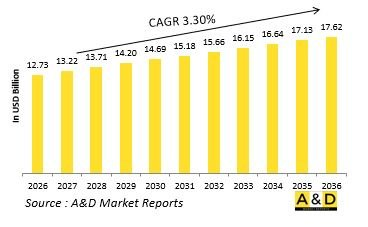

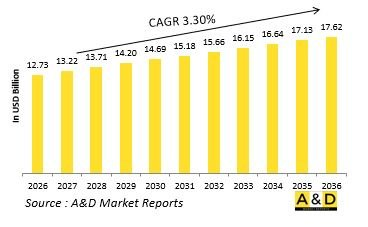

据估计,2026年全球国防光电市场规模为127.3亿美元,预计到2036年将达到176.2亿美元,2026年至2036年的复合年增长率(CAGR)为3.30%。

国防光电市场简介

全球国防光电市场涵盖了将人类视觉扩展到整个电磁波谱的电光红外线系统,其用途包括监视、目标捕获、导航和威胁探测。这些系统将光子转换为可处理、显示和分析的电子讯号,从而在黑暗、低能见度和远距离作战中提供关键能力。光电组件包括热成像仪、增强器、雷射测距仪、目标指示器和高光谱感测器,并部署在所有军事领域,从单兵瞄准镜到卫星监视系统。这项技术能够在能见度降低的情况下实现隐蔽瞄准、精确目标捕获和导航。随着战争扩展到全天候作战和视觉观察受限的环境,光电技术正在成为一种力量倍增器,从根本上改变战术、作战和战略层面的态势感知和交战动态。

科技对国防光电市场的影响

光电技术的进步主要集中在感测器融合、解析度提升和认知处理方面。具有较小像素间距的高解析度热感光元件能够在远距离提供清晰影像,同时缩小系统尺寸和功耗。多光谱/高光谱成像技术整合了多个光谱波段的信息,能够探测伪装目标并识别材料。先进的影像处理演算法利用人工智慧自动侦测、分类和追踪目标,同时减轻操作员的工作负荷。将热成像、低光源和雷射数据融合到单一整合显示器中,可提供全面的态势感知。基于量子技术的感测技术有望在灵敏度和识别能力方面带来突破性提升。小型化持续推动光电技术在小型平台上的部署,包括无人系统和个人武器。这些创新正在将光电技术从单纯的视觉辅助工具转变为能够自动提取和优先处理关键战场资讯的智慧感测系统。

国防光电市场的主要驱动因素

由于夜间和恶劣天气不再能提供战术喘息之机,因此在任何环境下全天候作战能力的需求正在推动光电技术的持续发展。针对采用隐蔽和欺骗战术的敌人的非对称战争,推动了对先进探测和识别能力的需求。平台生存能力要求在更远的距离上及早探测威胁,以便进行先发制人的反击。精确打击的必要性要求无论能见度如何,都必须拥有高度精确的目标数据。世界各地的士兵现代化计画都在优先发展个人光电技术,以提高班组级态势感知和火力精度。此外,反无人机和周界安全行动也对使用连网光电阵列进行广域持续监视提出了新的要求。这些因素共同促使国防现代化週期内对所有光电技术和平台类型进行持续投资。

国防光电市场区域趋势

各区域的光电技术发展反映了威胁认知、工业能力和作战理论的差异。北美地区的计划专注于具有先进处理和联网能力的多光谱系统,旨在整合到数位化战场中。欧洲的发展重点是用于下一代装甲车辆和飞机的高性能热成像仪和目标瞄准系统。亚太地区的本土化生产正在显着增长,尤其是在非製冷热成像技术领域,这些技术旨在广泛部署到步兵部队。中东地区的采购重点是针对极端温度的沙漠环境和远程观测而最佳化的系统。以色列工业在创新光电解决方案方面实力雄厚,并凭藉持续的实战经验不断改进。发展中国家越来越多透过技术转移协议,在大规模平台采购中取得高性能光电技术,但往往面临维护和保障这些先进系统的挑战。 本报告分析了全球国防光电市场,提供了影响该市场的技术资讯、未来十年的市场预测以及区域市场趋势。

目录

国防光电市场报告定义

国防光电市场细分

按地区

依科技

按平台

未来十年国防光电市场分析

国防光电市场技术

全球国防光电市场预测

区域国防光电市场趋势及预测

北美

驱动因素、限制因素与挑战

PEST分析

市场预测及情境分析

主要公司

供应商层级现况

公司基准分析

欧洲

中东

亚太地区

南美洲

国防光电市场分析中的国家

美国

国防项目

最新消息

专利

当前市场技术成熟度

市场预测及情境分析

加拿大

义大利

法国

德国

荷兰

比利时

西班牙

瑞典

希腊

澳洲

南非

印度

中国

俄罗斯

韩国

日本

马来西亚

新加坡

巴西

国防光电市场机会矩阵

国防光电市场专家观点报告

结论

关于航空和国防市场报告

The Global Defense Optronics market is estimated at USD 12.73 billion in 2026, projected to grow to USD 17.62 billion by 2036 at a Compound Annual Growth Rate (CAGR) of 3.30% over the forecast period 2026-2036.

Introduction to Defense Optronics Market:

The Global Defense Optronics Market encompasses electro-optical and infrared systems that extend human vision capabilities across the electromagnetic spectrum for surveillance, targeting, navigation, and threat detection. These systems convert photons into electronic signals that can be processed, displayed, and analyzed, providing critical capabilities in darkness, through obscurants, and at extended ranges. Optronics components include thermal imagers, image intensifiers, laser rangefinders, target designators, and hyperspectral sensors deployed across all military domains-from individual soldier sights to satellite surveillance systems. The technology enables seeing without being seen, targeting with precision, and navigating in degraded visual environments. As warfare extends into around-the-clock operations and environments where visual observation is limited, optronics have become force multipliers that fundamentally alter situational awareness and engagement dynamics across tactical, operational, and strategic levels.

Technology Impact in Defense Optronics Market:

Technological advancement in optronics focuses on sensor fusion, resolution enhancement, and cognitive processing. High-definition thermal sensors with smaller pixel pitches deliver sharper imagery at longer ranges while reducing system size and power requirements. Multispectral and hyperspectral imaging combines information across numerous spectral bands to detect camouflaged objects and identify material composition. Advanced image processing algorithms employ artificial intelligence to automatically detect, classify, and track targets while reducing operator workload. Fusion of thermal, low-light, and laser data into single integrated displays provides comprehensive situational pictures. Quantum-based sensing technologies promise revolutionary improvements in sensitivity and discrimination capabilities. Miniaturization continues to drive deployment on smaller platforms including unmanned systems and individual weapons. These innovations transform optronics from simple vision enhancement tools into intelligent sensing systems that automatically extract and prioritize critical battlefield information.

Key Drivers in Defense Optronics Market:

The imperative for 24/7 operational capability across all environments drives continuous optronics enhancement, as night and adverse weather no longer provide tactical respite. Asymmetric warfare against adversaries employing concealment and deception tactics increases demand for advanced detection and identification capabilities. Platform survivability requirements push for earlier threat detection at greater distances to enable proactive countermeasures. Precision engagement mandates necessitate highly accurate targeting data regardless of visibility conditions. Soldier modernization programs worldwide prioritize individual optronics to enhance squad-level situational awareness and marksmanship. Additionally, counter-drone and perimeter protection missions create new requirements for wide-area persistent surveillance using networked optronics arrays. The convergence of these drivers ensures sustained investment across all optronics categories and platform types throughout defense modernization cycles.

Regional Trends in Defense Optronics Market:

Regional optronics development reflects differing threat perceptions, industrial capabilities, and operational doctrines. North American programs emphasize multi-spectral systems with advanced processing and networking for integration into digitized battlespaces. European development focuses on high-performance thermal imagers and targeting systems for next-generation armored vehicles and aircraft. The Asia-Pacific region shows strong growth in indigenous production, particularly in uncooled thermal technology for widespread infantry deployment. Middle Eastern procurement prioritizes systems optimized for desert environments with extreme temperature ranges and long observation distances. Israeli industry maintains particular strength in innovative optronics solutions refined through continuous operational experience. Developing nations increasingly access capable optronics through technology transfer arrangements as part of larger platform acquisitions, though often facing challenges with maintenance and sustainment of sophisticated systems.

Key Defense Optronics Program:

MKU Limited has been awarded a major contract by the Indian Army for the supply of 29,762 units of its advanced Netro NW 3000 Night Vision Weapon Sights, with the order valued at approximately ₹660 crore. Finalized under the special procurement powers of the Raksha Mantri, the agreement represents one of the largest electro-optics acquisitions undertaken by the Indian Army to date. The contract underscores the growing emphasis on equipping frontline forces with domestically developed, high-performance technologies tailored for modern combat environments. The Netro NW 3000 systems are designed to enhance night-time operational capability by enabling accurate target acquisition and engagement under low-visibility conditions, thereby improving soldier effectiveness and battlefield survivability. This procurement further reflects India's broader strategic focus on strengthening indigenous defense manufacturing under the Make in India and Atmanirbhar Bharat initiatives. By sourcing a significant volume of critical electro-optical equipment from a domestic supplier, the Indian Army is reducing reliance on imports while fostering the growth of local design, engineering, and production capabilities. Beyond its immediate operational impact, the contract reinforces MKU's position as a key contributor to India's defense technology ecosystem. It also signals continued momentum in the Army's modernization efforts, particularly in enhancing infantry lethality and situational awareness through locally developed, mission-ready solutions.

Table of Contents

Defense Optronics Market Report Definition

Defense Optronics Market Segmentation

By Region

By Technology

By Platform

Defense Optronics Market Analysis for next 10 Years

The 10-year Defense Optronics Market analysis would give a detailed overview of Defense Optronics Market growth, changing dynamics, technology adoption overviews and the overall market attractiveness is covered in this chapter.

Market Technologies of Defense Optronics Market

This segment covers the top 10 technologies that is expected to impact this market and the possible implications these technologies would have on the overall market.

Global Defense Optronics Market Forecast

The 10-year Defense Optronics Market forecast of this market is covered in detailed across the segments which are mentioned above.

Regional Defense Optronics Market Trends & Forecast

The regional Defense Optronics Market trends, drivers, restraints and Challenges of this market, the Political, Economic, Social and Technology aspects are covered in this segment. The market forecast and scenario analysis across regions are also covered in detailed in this segment. The last part of the regional analysis includes profiling of the key companies, supplier landscape and company benchmarking. The current market size is estimated based on the normal scenario.

North America

Drivers, Restraints and Challenges

PEST

Market Forecast & Scenario Analysis

Key Companies

Supplier Tier Landscape

Company Benchmarking

Europe

Middle East

APAC

South America

Country Analysis of Defense Optronics Market

This chapter deals with the key defense programs in this market, it also covers the latest news and patents which have been filed in this market. Country level 10 year market forecast and scenario analysis are also covered in this chapter.

US

Defense Programs

Latest News

Patents

Current levels of technology maturation in this market

Market Forecast & Scenario Analysis

Canada

Italy

France

Germany

Netherlands

Belgium

Spain

Sweden

Greece

Australia

South Africa

India

China

Russia

South Korea

Japan

Malaysia

Singapore

Brazil

Opportunity Matrix for Defense Optronics Market

The opportunity matrix helps the readers understand the high opportunity segments in this market.

Expert Opinions on Defense Optronics Market Report

Hear from our experts their opinion of the possible analysis for this market.

Conclusions

About Aviation and Defense Market Reports

List of Tables

- Table 1: 10 Year Market Outlook, 2025-2035

- Table 2: Drivers, Impact Analysis, North America

- Table 3: Restraints, Impact Analysis, North America

- Table 4: Challenges, Impact Analysis, North America

- Table 5: Drivers, Impact Analysis, Europe

- Table 6: Restraints, Impact Analysis, Europe

- Table 7: Challenges, Impact Analysis, Europe

- Table 8: Drivers, Impact Analysis, Middle East

- Table 9: Restraints, Impact Analysis, Middle East

- Table 10: Challenges, Impact Analysis, Middle East

- Table 11: Drivers, Impact Analysis, APAC

- Table 12: Restraints, Impact Analysis, APAC

- Table 13: Challenges, Impact Analysis, APAC

- Table 14: Drivers, Impact Analysis, South America

- Table 15: Restraints, Impact Analysis, South America

- Table 16: Challenges, Impact Analysis, South America

- Table 17: Scenario Analysis, Scenario 1, By Region, 2025-2035

- Table 18: Scenario Analysis, Scenario 1, By Application, 2025-2035

- Table 19: Scenario Analysis, Scenario 1, By Platform, 2025-2035

- Table 20: Scenario Analysis, Scenario 2, By Region, 2025-2035

- Table 21: Scenario Analysis, Scenario 2, By Application, 2025-2035

- Table 22: Scenario Analysis, Scenario 2, By Platform, 2025-2035

List of Figures

- Figure 1: Global Defense Optronics Market Forecast, 2025-2035

- Figure 2: Global Defense Optronics Market Forecast, By Region, 2025-2035

- Figure 3: Global Defense Optronics Market Forecast, By Application, 2025-2035

- Figure 4: Global Defense Optronics Market Forecast, By Platform, 2025-2035

- Figure 5: North America, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 6: Europe, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 7: Middle East, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 8: APAC, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 9: South America, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 10: United States, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 11: United States, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 12: Canada, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 13: Canada, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 14: Italy, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 15: Italy, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 16: France, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 17: France, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 18: Germany, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 19: Germany, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 20: Netherland, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 21: Netherland, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 22: Belgium, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 23: Belgium, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 24: Spain, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 25: Spain, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 26: Sweden, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 27: Sweden, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 28: Brazil, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 29: Brazil, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 30: Australia, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 31: Australia, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 32: India, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 33: India, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 34: China, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 35: China, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 36: Saudi Arabia, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 37: Saudi Arabia, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 38: South Korea, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 39: South Korea, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 40: Japan, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 41: Japan, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 42: Malaysia, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 43: Malaysia, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 44: Singapore, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 45: Singapore, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 46: United Kingdom, Defense Optronics Market, Technology Maturation, 2025-2035

- Figure 47: United Kingdom, Defense Optronics Market, Market Forecast, 2025-2035

- Figure 48: Opportunity Analysis, Defense Optronics Market, By Region (Cumulative Market), 2025-2035

- Figure 49: Opportunity Analysis, Defense Optronics Market, By Region (CAGR), 2025-2035

- Figure 50: Opportunity Analysis, Defense Optronics Market, By Application (Cumulative Market), 2025-2035

- Figure 51: Opportunity Analysis, Defense Optronics Market, By Application (CAGR), 2025-2035

- Figure 52: Opportunity Analysis, Defense Optronics Market, By Platform (Cumulative Market), 2025-2035

- Figure 53: Opportunity Analysis, Defense Optronics Market, By Platform (CAGR), 2025-2035

- Figure 54: Scenario Analysis, Defense Optronics Market, Cumulative Market, 2025-2035

- Figure 55: Scenario Analysis, Defense Optronics Market, Global Market, 2025-2035

- Figure 56: Scenario 1, Defense Optronics Market, Total Market, 2025-2035

- Figure 57: Scenario 1, Defense Optronics Market, By Region, 2025-2035

- Figure 58: Scenario 1, Defense Optronics Market, By Application, 2025-2035

- Figure 59: Scenario 1, Defense Optronics Market, By Platform, 2025-2035

- Figure 60: Scenario 2, Defense Optronics Market, Total Market, 2025-2035

- Figure 61: Scenario 2, Defense Optronics Market, By Region, 2025-2035

- Figure 62: Scenario 2, Defense Optronics Market, By Application, 2025-2035

- Figure 63: Scenario 2, Defense Optronics Market, By Platform, 2025-2035

- Figure 64: Company Benchmark, Defense Optronics Market, 2025-2035