|

市场调查报告书

商品编码

1834222

水力压裂用中水的美国市场:市场趋势,机会,预测(2025年~2030年)U.S. Midstream Water for Hydraulic Fracturing: Market Trends, Opportunities, and Forecasts, 2025-2030 |

||||||

过去十年,水力压裂技术彻底改变了美国的能源格局,使美国成为全球最大的油气生产国。从宾州到德州,水力压裂技术开采页岩油气资源,已成为全球能源安全的基石。目前,美国石油产量占全球近40%,天然气产量占全球37%。

灰水管理,包括供水、处理、回收、再利用和处置,对于这项转型至关重要。水平井的长度可达五英里,用水量超过1200万加仑,产生前所未有的大量采出水。预计到 2030 年,油井采出水日产量将达到 5000 万桶,这将给处理设施带来更大压力,并加剧监管审查,尤其是在像横跨德克萨斯州和新墨西哥州的二迭纪盆地这样的高产量地区。

随着这一格局的演变,勘探和生产公司以及中水管理公司正在寻求更全面的水资源解决方案。供水和采出水管正成为卡车运输的可行替代方案,而采出水回收则预计在 2030 年前满足超过 77% 的压裂用水需求。这种转变,以及水资源价值链上的併购和合作等整合活动,正在重塑竞争格局。

本报告研究了美国水力压裂中水市场,全面分析了主要参与者的策略、市场驱动因素和预测,以及影响油田水资源管理未来的盆地层面动态。

报告+资料选择

范例资料仪表板

拿起的企业

|

|

目录

章节1 - 石油、天然气形势定义

- 研究方法与资料来源

- 影响中游管理的主要因素

- 耗水量庞大的水力压裂使美国成为世界最大的石油生产国

- 美国巩固其作为全球天然气供应国的地位天然气

- 自愿性油气价格影响策略

- 水平钻井和水力压裂

- 水平钻机能力:深度与长度

- 水平井长度增加导致含水量增加

- 钻机数量下降,产量持续成长

- 美国主要页岩盆地与地层分布图

- 二迭纪盆地支撑钻机数量及钻井活动

- 二迭纪盆地非常规天然气产量激增

- 随着钻井效率下降,新井完井数量略有下降

- 美国液化天然气出口增加推动用水需求

章节2 - 中水市场的促进因素,趋势,课题

- 灰水驱动因素与影响

- 单井水力压裂用水量

- 完井总用水量持续成长

- 主要盆地井水供应总量持续成长

- 美国西部和南部水资源压力成长最为严重

- 废弃物处理地震促进了水资源再利用政策的扩展

- 联邦政策基本上不变

- 州和地方政策概述

章节3 - 中水的市场规模与预测

- 市场预测方法概述

- 中水价值链

- 中水价值链趋势

- 预测细分市场

- 各盆地油气水管理服务支出

- 单井用水量持续成长至2030年

- 再生水供应日益满足用水需求采出水

- 预计美国各盆地采出水量将增加

- 预计盆地循环利用率将温和成长,抵销部分处置量

- 资本支出增加表示基础设施正在扩张

- 灰水资本支出细分

- 按类型和规模划分的循环利用设施资本支出

- 未来水解决方案与服务创新与投资的驱动因素

- 各盆地和州的主要机会(2025-2030 年)

章节4 - 流域和页岩层的简介

- Anadarko

- Appalachia

- Bakken

- Eagle Ford

- Haynesville

- Niobrara-DJ (Denver-Julesburg)

- Permian

章节5 - 竞争情形

- 中水的竞争套组

- 中水的竞争定位

- M&A趋势:竞争各市场区隔(2020年~2025年)

- 水专门业者的M&A活动:各拥有类型

- 市场占有率:开发平台(管线)基础设施的扩大继续

- 水相关的收购(2020年~2025年)

- Antero Midstream Corporation

- Aqua Terra Water Management

- Bison Water Midstream

- Blackbuck Resources

- Bosque Systems

- CNX Water

- Dalbo Holdings Inc

- Deep Blue Midland Basin

- Delek Logistics Partners, LP

- Dresser Utility Solutions

- EQT Corporation

- Freestone Midstream

- Goodnight Midstream

- Hess Midstream

- NGL Water Solutions

- Layne Water Midstream

- Martin Water Midstream

- Pilot Water Solutions

- RRIG Water Solutions

- Select Water Solutions

- Stonehill Environmental Partners

- Tallgrass Water

- Texas Pacific Land Corporation

- WaterBridge

- Western Midstream

- XRI Water

Over the last decade, hydraulic fracturing has transformed the U.S. energy landscape, establishing the country as the world's largest producer of oil and gas. By tapping into shale reserves across regions from Pennsylvania to Texas, fracking has become a cornerstone of global energy security. The U.S. now contributes nearly 40% of global oil production and 37% of natural gas production.

Midstream water management, which involves the supply, treatment, recycling, reuse, and disposal of water, is critical to this transformation. Horizontal well completions can extend up to five miles and require over 12 million gallons of water, resulting in unprecedented volumes of produced water. By 2030, the volume of produced water at wellheads is projected to reach 50 million barrels per day, placing additional stress on disposal facilities and fueling regulatory scrutiny, particularly in high-activity regions like the Permian Basin, which spans Texas and New Mexico.

In this evolving context, exploration and production companies and midstream water management players are pursuing more integrated water solutions. Water supply and produced water pipelines are becoming viable alternatives to trucking and produced water recycling is on track to meet over 77% of fracking water demand by 2030. These shifts, accompanied by consolidation efforts such as mergers and acquisitions and partnerships across the water value chain, are reshaping the competitive landscape.

This Insight Report provides a comprehensive analysis of U.S. midstream water management, encompassing market drivers and forecasts, basin-level dynamics, and the strategies of leading players that are influencing the future of oilfield water management.

Report+Data Option

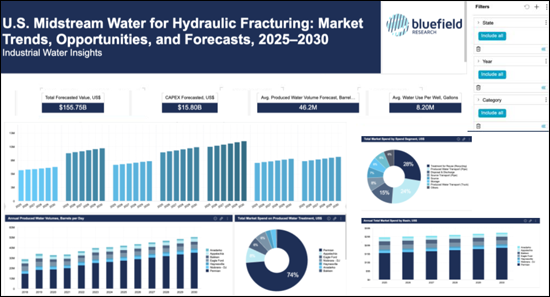

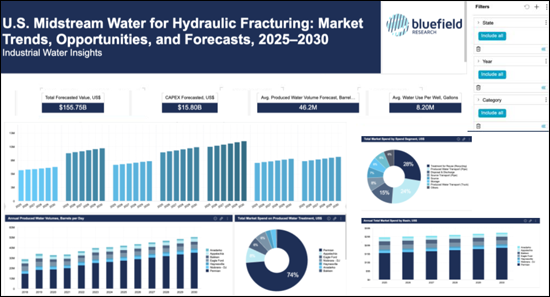

SAMPLE DATA DASHBOARD

Data is a key component to this analysis. Our team has compiled relevant data dashboards.

Industrial Water Market Corporate Subscription seat holders can access related dashboards.

Companies Mentioned:

|

|

Table of Contents

Section 1 - Defining the Oil & Gas Landscape

- Research Methodology and Data Sources

- Key Factors Influencing Midstream Water Management

- Water-Intensive Fracking Makes U.S. the Leading Global Oil Producer

- U.S. Secures Role as Global Supplier of Natural Gas

- Swings in Oil & Gas Prices Shape Strategies

- Horizontal Drilling and Hydraulic Fracturing

- Horizontal Rig Capabilities: Depths and Lengths

- Horizontal Wellbore Lengths Increase Water Intensity

- Rig Counts Decline, Production Continues to Climb

- Mapping the Key U.S. Shale Basins and Plays

- Permian Basin Underpins Drill Rig Counts and Activity

- Permian Basin Surges in Unconventional Gas Production

- New Well Completions Decline Slightly With Drilling Efficiencies

- Increase in U.S. LNG Exports Drives Water Demand

Section 2 - Midstream Water Market Drivers, Trends, and Challenges

- Midstream Water Drivers and Impacts

- Hydraulic Fracturing Water Use per Well

- Total Water Use for Well Completions Grew Steadily

- Total Well Water Supply Volumes Continue to Grow Across Top Basins

- Water Stress to Increase Most Acutely in Western and Southern U.S.

- Seismic Events from Disposal Push Policy for Expanded Water Reuse

- Federal Policy Remains Largely Unchanged

- State & Local Policy Overview

Section 3 - Midstream Water Market Size and Forecasts

- Market Forecast Methodology Overview

- The Midstream Water Value Chain

- Midstream Water Trends Across the Value Chain

- Forecasted Segments

- Oil & Gas Sector Spend on Water Management Services by Basin

- Increasing Water Usage per Well Continues Through 2030

- Water Demand Increasingly Supplied by Recycled Produced Water

- Produced Water Volumes Set to Increase Across U.S. Basins

- Basin Recycling Rates Projected to Grow Modestly, Offset Disposal

- CAPEX Growth Signals Infrastructure Expansion

- Segmenting Capital Expenditures for Midstream Water

- CAPEX Recycling Facility Growth by Type and Size

- Drivers of Innovation and Investment for Future Water Solutions & Services

- Top Opportunities by Basin and State (2025-2030)

Section 4 - Basin & Shale Play Profiles

- Anadarko

- Appalachia

- Bakken

- Eagle Ford

- Haynesville

- Niobrara-DJ (Denver-Julesburg)

- Permian

Section 5 - Competitive Landscape

- Midstream Water Competitive Set

- Midstream Water Competitive Positioning

- M&A Trends by Competitive Segment (2020-2025)

- Water Pure-Play M&A Activity by Ownership Type

- Market Share: Pipeline Infrastructure Expansion to Continue

- Water-Related Acquisitions (2020-2025)

- Antero Midstream Corporation

- Aqua Terra Water Management

- Bison Water Midstream

- Blackbuck Resources

- Bosque Systems

- CNX Water

- Dalbo Holdings Inc

- Deep Blue Midland Basin

- Delek Logistics Partners, LP

- Dresser Utility Solutions

- EQT Corporation

- Freestone Midstream

- Goodnight Midstream

- Hess Midstream

- NGL Water Solutions

- Layne Water Midstream

- Martin Water Midstream

- Pilot Water Solutions

- RRIG Water Solutions

- Select Water Solutions

- Stonehill Environmental Partners

- Tallgrass Water

- Texas Pacific Land Corporation

- WaterBridge

- Western Midstream

- XRI Water