|

市场调查报告书

商品编码

1461285

建筑涂料市场:依树脂类型、依功能、依技术、依最终用途产业、按地区Architectural Coatings Market, By Resin Type, By Function, By Technology, By End-use Industry, By Geography . |

||||||

建筑涂料市场预计到2024年将达到790.1亿美元,预计2024年至2031年复合年增长率为5.7%,到2031年将达到1164.7亿美元。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年 | 2023年 | 2023/2024年市场规模 | 790.1亿美元 |

| 实际资料 | 2019-2023 | 预测期 | 2024-2031 |

| 预测期2023/2024~2030/2031年复合成长率: | 5.70% | 2030/2031 年预测值 | 1164.7亿美元 |

建筑涂料市场是指用于住宅和非住宅建筑内部和外部的涂料和被覆剂。建筑涂料可以保护建筑物免受热、雨和污染等环境因素的影响,并有助于装饰建筑物的内部和外部。世界各地住宅和商业建筑的不断建设正在推动对建筑涂料的需求。此外,为应对不断变化的设计趋势而频繁翻新旧建筑也推动了市场成长。然而,有关涂料挥发性有机化合物排放的严格环境法规可能会稍微阻碍预测期内的市场成长。

市场动态:

由于全球新住宅和商业建筑建设的增加等因素,全球建筑涂料市场正在健康成长。快速的都市化、人口成长、可支配收入的增加和生活方式的改变是导致新建设活动的一些主要社会经济因素。据测算,2021年全球建筑业成长超过3%。此外,重新粉刷和维修旧建筑的需求也大大增加了对建筑涂料的经常性需求。然而,有关涂料和被覆剂VOC排放的严格环境法规给市场相关人员带来了挑战。从积极的一面来看,加强研发力度以开发永续的涂料技术为进一步扩大市场提供了有利可图的机会。

本研究的主要特点

- 该研究报告对全球建筑涂料市场进行了详细分析,并提供了以2023年为基准年的预测期(2024-2031年)的市场规模和年复合成长率(CAGR%) 。

- 它还说明了各个细分市场的潜在商机,并为该市场提供了一系列有吸引力的投资提案。

- 它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景、主要企业采取的竞争策略等的重要见解。

- 它根据公司亮点、产品系列、主要亮点、财务表现和策略等参数,介绍了全球建筑涂料市场的主要企业。

- 该报告的见解将使负责人和公司经营团队能够就未来的产品发布、产品升级、市场扩张和行销策略做出明智的决策。

- 全球建筑涂料市场报告针对该行业的各个相关人员,如投资者、供应商、产品製造商、经销商、新进业者和财务分析师。

- 透过用于分析全球建筑被覆剂市场的各种策略矩阵,将有助于相关人员做出决策。

目录

第一章 研究目的与前提

- 研究目标

- 先决条件

第二章 市场概况

- 报告说明

- 市场定义和范围

- 执行摘要

第 3 章主要见解

- 市场动态

- 促进因素

- 抑制因素

- 机会

- 主要市场趋势

- 市场动态影响分析

- 使用 PESTEL 分析进行市场评估

- 波特分析

- 监管场景

- 市场吸引力分析

- 增量商机评估

第四章全球建筑涂料市场,依树脂类型,2019-2031

- 介绍

- 丙烯酸纤维

- 醇酸

- 环氧树脂

- 聚氨酯

- 聚酯纤维

- 胺甲酸乙酯

- 其他(聚四氟乙烯、聚偏氟乙烯)

第五章全球建筑涂料市场(依功能),2019-2031

- 介绍

- 陶器

- 墨水

- 漆

- 涂层

- 粉末涂料

- 底漆

- 密封剂

- 弄脏

- 其他(清漆等)

第六章 全球建筑涂料市场(按技术),2019-2031

- 介绍

- 溶剂型

- 水性的

第七章 全球建筑涂料市场,依最终用途产业,2019-2031

- 介绍

- 住宅

- 非住宅

第八章2019-2031年全球建筑涂料市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 西班牙

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚国协

- 其他亚太地区

- 中东/非洲

- 波湾合作理事会

- 以色列

- 其他中东地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第九章公司简介-全球建筑涂料市场

- PPG Industries

- 最新动态/更新

- Asian Paints

- Nippon Paints

- The Sherwin-Williams Company

- Axalta Coatings

- RPM International Inc.

- The Valspar Corporation

- Midwest Industrial Coatings Inc.

- Sumter Coatings

- BASF SE

- JSW

- Jotun

- AkzoNobel NV

- Chemours Company

- Arcat

- FUJIKURA KASEI CO.,LTD.

- Syensqo

- Metcon Coatings &Chemicals India Private Limited.

- Acro Paints

- Varuna Paints Private Limited

第10章 参考文献与调查方法

- 参考

- 调查方法

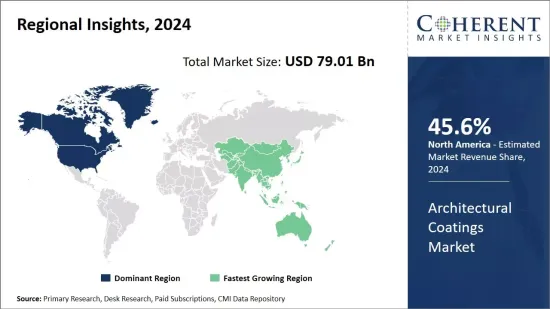

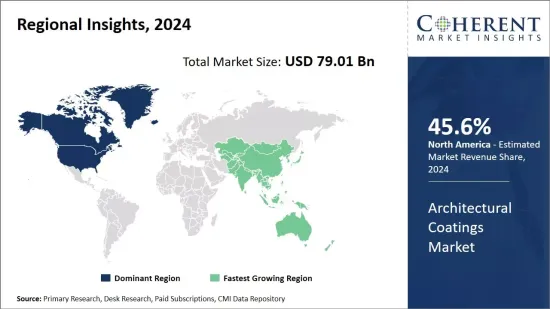

The architectural coatings market is estimated to be valued at USD 79.01 Bn in 2024 and is expected to reach USD 116.47 Bn by 2031, growing at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2023/2024: | US$ 79.01 Bn |

| Historical Data for: | 2019 to 2023 | Forecast Period: | 2024 to 2031 |

| Forecast Period 2023/2024 to 2030/2031 CAGR: | 5.70% | 2030/2031 Value Projection: | US$ 116.47 Bn |

The architectural coatings market refers to paints and coatings used in residential and non-residential buildings for interior as well as exterior applications. Architectural paints help protect buildings from environmental factors like heat, rain, pollution, and also help in decorating the interiors and exteriors of structures. The rising construction of both residential and commercial buildings across the globe is fueling the demand for architectural coatings. Furthermore, frequent repainting of older structures as per changing design trends is also driving the market growth. However, stringent environmental regulations regarding VOCs emissions from paints may slightly hamper the market during the forecast period.

Market Dynamics:

The global architectural coatings market is witnessing healthy growth driven by factors such as increasing construction of new residential and commercial buildings worldwide. Rapid urbanization, growing population, rising disposable income, and changing lifestyles are some of the key socio-economic drivers leading to new construction activities. According to estimates, the global construction industry grew by over 3% in 2021. Additionally, the need for repainting and refurbishing of older structures also contributes significantly to the recurring demand for architectural coatings. However, strict environmental norms pertaining to VOCs emissions from paints and coatings pose a challenge for market players. On the positive side, rising R&D efforts towards developing eco-friendly and sustainable coating technologies present lucrative opportunities for further market expansion.

Key features of the study:

- This report provides in-depth analysis of the global architectural coatings market, and provides market size (US$ Bn & KT) and compound annual growth rate (CAGR%) for the forecast period (2024-2031), considering 2023 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global architectural coatings market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include PPG Industries, Asian Paints, Nippon Paints, The Sherwin-Williams Company, Axalta Coatings, RPM International Inc., The Valspar Corporation, Midwest Industrial Coatings Inc., Sumter Coatings, BASF SE, JSW, Jotun, AkzoNobel N.V., Chemours Company, Arcat, FUJIKURA KASEI CO.,LTD., Syensqo, Metcon Coatings & Chemicals India Private Limited., Acro Paints, and Varuna Paints Private Limited

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

- The global architectural coatings market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global architectural coatings market

Market Segmentation

- By Resin Type:

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Polyester

- Urethane

- Others (PTFE & PVDF)

- By Function:

- Ceramics

- Inks

- Lacquers

- Paints

- Powder Coatings

- Primers

- Sealers

- Stains

- Others (Varnishes, etc.)

- By Technology:

- Solvent Borne

- Water Borne

- By End-Use Industry:

- Residential

- Non-Residential

- By Regional:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

- Company Profiles:

- PPG Industries

- Asian Paints

- Nippon Paints

- The Sherwin-Williams Company

- Axalta Coatings

- RPM International Inc.

- The Valspar Corporation

- Midwest Industrial Coatings Inc.

- Sumter Coatings

- BASF SE

- JSW

- Jotun

- AkzoNobel N.V.

- Chemours Company

- Arcat

- FUJIKURA KASEI CO., LTD.

- Syensqo

- Metcon Coatings & Chemicals India Private Limited.

- Acro Paints

- Varuna Paints Private Limited

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

2. Market Overview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot By Resin Type

- Market Snapshot By Function

- Market Snapshot By Technology

- Market Snapshot By End-Use Industry

- Market Snapshot By Region

- Market Scenario - Conservative, Like, Opportunistic

- Market Opportunity Map

3. Key Insights

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Key Market Trends

- Impact Analysis of Market Dynamics

- Market Assessment By PESTEL Analysis

- PORTER Analysis

- Regulatory Scenario

- Market Attractiveness Analysis

- Incremental $ Opportunity Assessment

4. Global Architectural Coatings Market, By Resin Type, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Share (%) Analysis, 2024, 2027 & 2031

- Market Y-o-Y Growth Comparison (%), 2019 - 2031

- Segment Trends

- Acrylic, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Alkyd, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Epoxy, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Polyurethane, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Polyester, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Urethane, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Others (PTFE & PVDF), 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

5. Global Architectural Coatings Market, By Function, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Share (%) Analysis, 2024, 2027 & 2031

- Market Y-o-Y Growth Comparison (%), 2019 - 2031

- Segment Trends

- Ceramics, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Inks, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Lacquers, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Paints, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Powder Coatings, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Primers, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Sealers, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Stains, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Others (Varnishes, etc.), 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

6. Global Architectural Coatings Market, By Technology, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Share (%) Analysis, 2024, 2027 & 2031

- Market Y-o-Y Growth Comparison (%), 2019 - 2031

- Segment Trends

- Solvent Borne, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Water Borne, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

7. Global Architectural Coatings Market, By End-Use Industry, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Share (%) Analysis, 2024, 2027 & 2031

- Market Y-o-Y Growth Comparison (%), 2019 - 2031

- Segment Trends

- Residential, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

- Non-Residential, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Size and Forecast, 2019 - 2031, (US$ Bn & KT)

8. Global Architectural Coatings Market, By Region, 2019 - 2031 (US$ Bn & KT)

- Introduction

- Market Share (%) Analysis, 2024, 2027 & 2031, (US$ Bn & KT)

- Market Y-o-Y Growth Comparison (%), 2024 - 2031, (US$ Bn & KT)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Resin Type, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Function, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Technology, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By End-Use Industry, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn & KT)

- U.S.

- Canada

- Europe

- Introduction

- Market Size and Forecast, By Resin Type, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Function, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Technology, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By End-Use Industry, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn & KT)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest Of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Resin Type, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Function, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Technology, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By End-Use Industry, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn & KT)

- China

- India

- Japan

- Australia

- South Korea

- Asean

- Rest Of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, By Resin Type, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Function, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Technology, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By End-Use Industry, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn & KT)

- GCC

- Israel

- Rest Of Middle East

- Latin America

- Introduction

- Market Size and Forecast, By Resin Type, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Function, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Technology, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By End-Use Industry, 2019 - 2031, (US$ Bn & KT)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn & KT)

- Brazil

- Mexico

- Argentina

9. Company Profiles - Global Architectural Coatings Market

- PPG Industries*

- Company Overview

- Product/Service Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- Asian Paints

- Nippon Paints

- The Sherwin-Williams Company

- Axalta Coatings

- RPM International Inc.

- The Valspar Corporation

- Midwest Industrial Coatings Inc.

- Sumter Coatings

- BASF SE

- JSW

- Jotun

- AkzoNobel N.V.

- Chemours Company

- Arcat

- FUJIKURA KASEI CO.,LTD.

- Syensqo

- Metcon Coatings & Chemicals India Private Limited.

- Acro Paints

- Varuna Paints Private Limited

10. References and Research Methodology

- References

- Research Methodology

- About us and Sales Contact