|

市场调查报告书

商品编码

1432327

建筑涂料:市场占有率分析、产业趋势、成长预测(2024-2029)Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

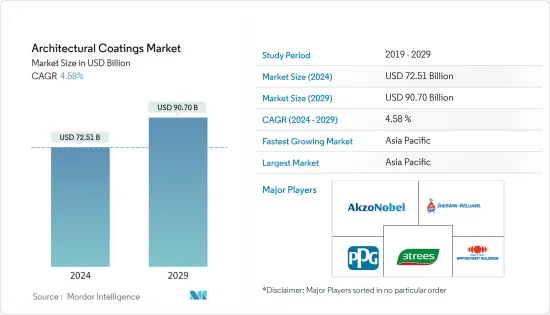

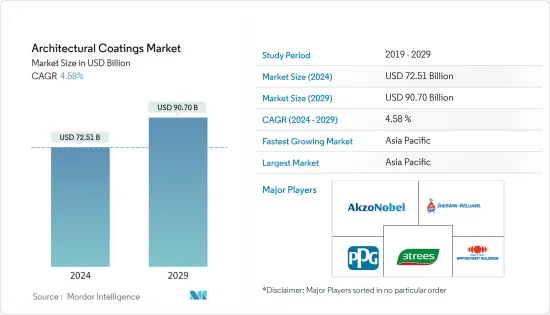

建筑涂料市场规模预计到2024年为725.1亿美元,预计到2029年将达到907亿美元,在预测期内(2024-2029年)复合年增长率为4.58%。

建筑业是建筑涂料市场的主要驱动力。这些涂层具有多种优点,包括耐腐蚀和防紫外线。醋酸乙烯酯是一种常用的建筑涂料。基础设施建设的需求预计将会增加。

主要亮点

- 对低挥发性有机化合物涂料的需求不断增长,为该市场创造了各种机会。

- 随着世界各地对全球暖化的担忧加剧,办公大楼、住宅和其他区域需要安全节能的涂料。

- 预计亚太地区将在预测期内主导全球市场。

建筑涂料市场趋势

住宅部门的需求增加

- 在最终用户细分市场中,住宅细分市场在 2021 年建筑领域占据主导地位,对全球市场的建筑涂料产生了最高的需求。

- 近年来,中国的住宅需求大幅增加。随着住宅创历史新低,住宅需求大幅增加,导致建筑涂料需求增加。

- 同样,在美国,住宅涂料消费量在2022年呈现高成长。根据美国Cnesus委员会和美国住房和城市发展部的数据,2022年8月私人住宅建设较2022年7月的165.5万套增长了1.1%。

- 由于俄罗斯和乌克兰最近爆发战争,明年对住宅和商业建筑的需求预计将增加。

- 预计上述因素将在预测期内推动建筑油漆和涂料的需求。

中国主导亚太地区

- 近年来,我国建筑涂料的消费量呈现上升趋势。住宅占地面积将从2022年6月的66,423,470平方公尺增加到2022年7月的76,066,760平方公尺。这直接影响了国内建筑涂料消费的不断成长。

- 从2022年3月起,取消进口油漆和涂料的申请和测试要求等政府倡议,增强了涂料企业对国内建筑涂料积极未来性的信心,从而增加了消费和销售。预计在2022年期间将扩大。预测期。

- 由于中国政府长期采用VOC法规,水性涂料在中国所有建筑涂料消费中所占份额最大,约79%。此外,中国承诺在2050年实现碳中和,这进一步推动了水性涂料等环保产品的发展。

- 在我国,2016-2021年建筑涂料消费量总量中,用于外墙主要部位涂装的丙烯酸涂料在树脂品种中占有较大份额。

- 丙烯酸涂料约占这段期间所有建筑涂料消耗量的一半以上。中国政府法规正在推动低挥发性有机化合物建筑涂料的采用,迫使建筑涂料製造商降低其涂料的挥发性有机化合物含量,并将其作为安全产品销售。

建筑涂料行业概况

建筑涂料市场较为分散。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 东欧国家占地面积中位数成长

- 住宅和商业基础设施的增加

- 抑制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 规定

第五章市场区隔

- 科技

- 水性的

- 溶剂型

- 树脂型

- 丙烯酸纤维

- 醇酸

- 聚氨酯

- 环氧树脂

- 聚酯纤维

- 其他的

- 最终用途子区隔

- 商业的

- 住宅

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 印尼

- 马来西亚

- 菲律宾

- 新加坡

- 越南

- 澳洲/纽西兰

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 波兰

- 北欧国家

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业的招募策略

- 公司简介

- 3 Trees

- AkzoNobel NV

- Asian paints

- BASF SE

- Benjamin Moore

- Berger Paints India

- Brillux GmbH & Co. KG

- CIN, SA

- Cloverdale Paint Inc.

- DAW SE

- Flugger group AS

- Hempel A/S

- Kansai Paint Co.,Ltd.

- Masco Coporation

- Nippon Paint

- PPG

- RPM International

- Sniezka SA

- The Sherwin-Williams Company

第七章 市场机会及未来趋势

The Architectural Coatings Market size is estimated at USD 72.51 billion in 2024, and is expected to reach USD 90.70 billion by 2029, growing at a CAGR of 4.58% during the forecast period (2024-2029).

The construction sector is a major driver of the Architecture Coatings Market. These coatings have several advantages including corrosion resistance, UV rays protection, etc. Vinyl Acetate is the common type of Architecture coating in use. Architecture Infrastructure is expected to see a rise in demand for Market Studied.

Key Highlights

- Increasing demand for Low VOC Coatings is creating various opportunities in this Market.

- Increasing Global Warming Concern across the globe is demanding safe and energy-saving coatings for office buildings, residential homes, etc.

- Asia-Pacific is expected to dominate the global market, during the forecast period.

Architectural Coatings Market Trends

Increasing Demand from Residential Sector

- Among the end-user segments, the residential segment dominated the construction sector in 2021, generating the highest demand for architectural coatings in the global market.

- In China, there has been a significant increase in demand for residential houses in the recent past. With the prices of the residential houses at an all time low when compared to the previous years the demand for the residential houses has increased to a greater extent there by increasing the demand for architectural coatings.

- Similarly, in the United States, residential paint consumption saw high growth in 2022. According to the United States Cnesus Board and United States Department of Housing and Urban Development the number of private houses construction increased by 1.1% in August 2022 compared to 1,655,000 houses in July 2022.

- In the coming year it is projected that there would be a high demand of residential and commercial buildings in Russia and Ukraine due to the recent outbreak of the war.

- All the above mentioned factors are expected to drive the demand for the architectural paints and coatings in the forecast period.

China to Dominate the Asia-Pacific Region

- Architectural coating consumption in China has been on rising in the recent past. There has been an increase in the floor space of the residential houses from 66,423.47 thousand Square metres in June 2022 to 76,066.76 thousand Square metres in July 2022. This has a direct impact on the increase in the consumption of Architectural coatings in the country.

- The increase in consumption and sales is expected to grow in the forecasted period due to the government initiatives such as revoking filing and mandatory testing requirements of imported paint and coatings in the country from march, 2022 grows the confidence of coating companies in the positive future of architectural coating in the country.

- The waterborne coating holds the largest share of around 79% of the total architectural coating consumed in the country due to the long adoption of VOC regulations set by the Chinese government. Furthermore, the country's commitment toward carbon neutrality by 2050, will further drive the eco-friendly product like waterborne coatings in the country.

- In China, acrylic coatings holds the major share amongst resin type, in terms of the total consumption volume of architectural coatings during 2016-2021, as it is used to coat the major part of the exterior walls.

- Acrylic coatings accounted for about ore than half of the total architectural coatings consumed during this period. The Chinese government regulations are majorly driving the adoption of low VOC architectural coatings and forces architectural coating manufacturers to reduce the VOC content in their coatings and market it as a safe product.

Architectural Coatings Industry Overview

The architectural coatings market is fragmented in nature. Some of the major players of the market studied include (not in particular order) Akzo Nobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., 3 Trees and Nippon Paint Holdings Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMEREY

4 MARKET DNAMICS

- 4.1 Drivers

- 4.1.1 Growth in Median Floor Area of Eastern European Countries

- 4.1.2 Increasing Residential and Commertial Infrastructure

- 4.2 Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulations

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Water-borne

- 5.1.2 Solvent-borne

- 5.2 Resin Type

- 5.2.1 Acrylic

- 5.2.2 Alkyd

- 5.2.3 Polyurethane

- 5.2.4 Epoxy

- 5.2.5 Polyester

- 5.2.6 Other Resin Types

- 5.3 End-use sub segment

- 5.3.1 Commercial

- 5.3.2 Residential

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Indonesia

- 5.4.1.7 Malaysia

- 5.4.1.8 Philippines

- 5.4.1.9 Singapore

- 5.4.1.10 Vietnam

- 5.4.1.11 Australia & Newzealand

- 5.4.1.12 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Poland

- 5.4.3.7 Nordic Countries

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Stratergies Adopted by Leading players

- 6.4 Company Profiles

- 6.4.1 3 Trees

- 6.4.2 AkzoNobel N.V.

- 6.4.3 Asian paints

- 6.4.4 BASF SE

- 6.4.5 Benjamin Moore

- 6.4.6 Berger Paints India

- 6.4.7 Brillux GmbH & Co. KG

- 6.4.8 CIN, S.A.

- 6.4.9 Cloverdale Paint Inc.

- 6.4.10 DAW SE

- 6.4.11 Flugger group A S

- 6.4.12 Hempel A/S

- 6.4.13 Kansai Paint Co.,Ltd.

- 6.4.14 Masco Coporation

- 6.4.15 Nippon Paint

- 6.4.16 PPG

- 6.4.17 RPM International

- 6.4.18 Sniezka SA

- 6.4.19 The Sherwin-Williams Company