|

市场调查报告书

商品编码

1477282

二手车市场、按车辆类型、按燃料类型、按配销通路、按最终用途、按地理位置Used Car Market, By Vehicle Type, By Fuel Type, By Distribution Channel, By End-Use, By Geography |

||||||

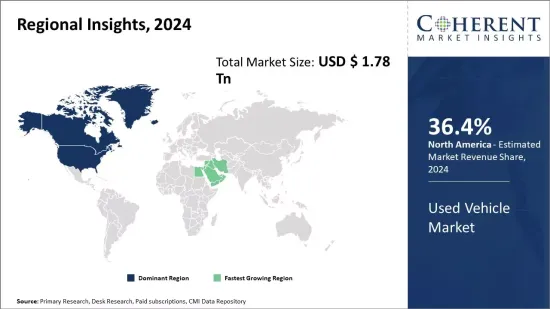

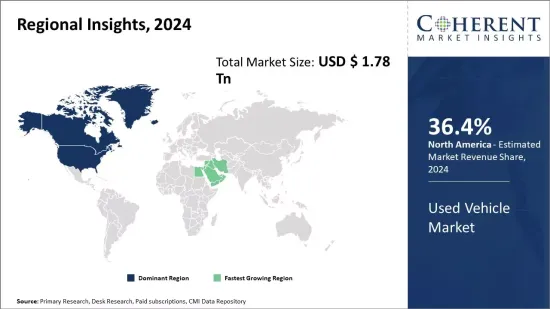

预计 2024 年二手车市值为 1.78 兆美元,预计到 2031 年将达到 2.73 兆美元,2024 年至 2031 年年复合成长率(CAGR) 为 6.3%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年: | 2023年 | 2024 年市场规模: | 1.78 美元 |

| 历史数据: | 2019年至2023年 | 预测期: | 2024年至2031年 |

| 预测 2024 年至 2031 年复合年增长率: | 6.30% | 2031 年价值预测: | $2.73 田纳西 |

北美的二手车市场在整个汽车产业中占有重要份额。每年有数百万辆二手车易手,这是一个价值数十亿美元的经济部门。道路上车辆平均车龄增加、更换週期缩短以及负担得起的融资选择等因素推动了这一领域的需求。目前美国汽车的平均车龄超过11年,凸显消费者更愿意延长车辆保有时间,而不是承担高昂的新车成本。此外,随着越来越多的人选择以具有竞争力的价格提供保固的经过认证的二手豪华车,预计二手豪华车销售将强劲增长。儘管互联网提高了二手车交易的透明度,但买家在确保车辆状况和品质方面仍然存在挑战。总体而言,二手车市场在为不同收入群体提供无障碍车辆所有权方面发挥着重要作用。

市场动态:

二手车市场。受到多种驱动因素、限制因素和机会的影响。随着车辆平均车龄的增加,驾驶者的强劲需求是刺激销售的关键因素。此外,银行提供的廉价贷款计划和灵活的融资选择使购车更加实惠。这进一步刺激了市场成长。然而,市场潜力受到一些州不明确的里程认证和所有权转让问题等监管挑战的阻碍。严格的检验标准和排放法规也起到了约束作用。此外,线上市场的激增在一定程度上威胁了线下经销商的获利能力。在机会方面,对经过认证的二手豪华车和混合动力汽车和电动车(EV)等绿色二手车的需求不断增长,为未来的扩张铺平了道路。同样,实施区块链技术可以帮助解决所有权和里程表问题,从而增强消费者购买二手车的信心。

研究的主要特点:

- 该报告对全球二手车市场进行了深入分析,并提供了预测期(2024-2031年,以2023年为基准年)的市场规模和年复合成长率(CAGR%)。

- 它阐明了不同细分市场的潜在收入成长机会,并解释了该市场有吸引力的投资主张矩阵。

- 这项研究还提供了有关市场驱动因素、限制因素、机会、新产品发布或批准、市场趋势、区域前景以及主要参与者采取的竞争策略的重要见解。

- 它根据以下参数描述了全球二手车市场的主要参与者——公司亮点、产品组合、主要亮点、财务表现和策略。

- 该报告的见解将使行销人员和公司管理当局能够就未来的产品发布、类型升级、市场扩张和行销策略做出明智的决策。

- 全球二手车市场报告迎合了该行业的各个利益相关者,包括投资者、供应商、产品製造商、分销商、新进业者和金融分析师。

- 利害关係人可以透过用于分析全球二手车市场的各种策略矩阵轻鬆做出决策。

目录

第一章:研究目标与假设

- 研究目标

- 假设

- 缩写

第 2 章:市场范围

- 报告说明

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map (COM)

第 3 章:市场动态、法规与趋势分析

- 市场动态

- 司机

- 限制

- 机会

- 监管场景

- 产业动态

- 併购

- 新系统启动/批准

- COVID-19 大流行的影响

第 4 章:2019-2031 年全球二手车市场(按车辆类型)

- 介绍

- 掀背车

- 轿车

- 运动型多用途车

- 其他的

第 5 章:2019-2031 年全球二手车市场(按燃料类型)

- 介绍

- 汽油

- 柴油引擎

- 混合动力/电动

- 其他的

第 6 章:全球二手车市场(依配销通路),2019-2031

- 介绍

- 特约经销商

- 独立经销商

- 其他的

第 7 章:2019-2031 年全球二手车市场(依最终用途)

- 介绍

- 个人的

- 商业的

第 8 章:2019-2031 年全球二手车市场(按地区)

- 介绍

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 东协

- 澳洲

- 韩国

- 日本

- 亚太地区其他地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 中东和非洲其他地区

第 9 章:竞争格局

- 公司简介

- Arnold Clark Automobiles Ltd.

- Asbury Automotive Group Inc.

- AutoNation Inc.

- Autotrader

- AutoScout24

- Universal Motor Agencies

- CarMax Inc.

- Carvana

- Cox Automotive Inc. (Autotrader)

- Emil Frey AG

- Group 1 Automotive Inc.

- Inchcape Group

- Lithia Motors Inc. CarMax Business Service LLC

- Asbury Automotive Group

- AutoNation Inc.

- eBay Inc.

- Big Boy toyz

- VROOM

第10章:命运之轮

- 命运之轮

- 分析师观点

- 连贯的机会图

第 11 章:部分

- 参考

- 研究方法论

The used car market is estimated to be valued at US$ 1.78 Trillion in 2024 and is expected to reach US$ 2.73 Trillion by 2031, growing at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 1.78 Tn |

| Historical Data for: | 2019 To 2023 | Forecast Period: | 2024 To 2031 |

| Forecast Period 2024 to 2031 CAGR: | 6.30% | 2031 Value Projection: | US$ 2.73 Tn |

The used car market in the North America holds a significant share of the overall automotive industry. With millions of used cars changing hands every year, it is a multi-billion dollar sector of the economy. Factors, such as increasing average age of vehicles on the road, shorter replacement cycles, and availability of affordable financing options, drive demand in this space. The average age of vehicles in the U.S. is over 11 years currently, highlighting consumers' preference to retain vehicles longer instead of bearing high costs of new vehicles. Furthermore, robust growth is expected in used luxury car sales as more people opt for certified pre-owned luxury vehicles that come with warranty at competitive prices. While the internet has enabled greater transparency in used car transactions, challenges around ensuring vehicle condition and quality still exist for buyers. Overall, the used car market plays an important role in providing accessible vehicle ownership across different income segments.

Market Dynamics:

The used car market. is influenced by several drivers, restraints, and opportunities. Strong driver demand amid the rising average age of vehicles acts as a key factor spurring sales. Additionally, the availability of inexpensive loan schemes and flexible financing options from banks has made vehicle purchase more affordable. This has further stimulated market growth. However, market potential is hindered by regulatory challenges involving unclear mileage certification and title transfer issues in some states. Stringent inspection standards and emission regulations also act as a restraint. Moreover, the proliferation of online marketplaces has threatened offline dealer profitability to some extent. On the opportunity side, the burgeoning demand for certified pre-owned luxury cars and green used vehicles like hybrids and Electric Vehicles (EVs) is paving the way for future expansion. Similarly, implementing Blockchain technology can help address title and odometer problems, thereby boosting consumer confidence in used car buying.

Key Features of the Study:

- This report provides an in-depth analysis of the global used car market., and provides market size (US$ Trillion) and compound annual growth rate (CAGR %) for the forecast period (2024-2031, considering 2023 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global used car market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include Arnold Clark Automobiles Ltd., Asbury Automotive Group Inc., AutoNation Inc., Autotrader, AutoScout24, Universal Motor Agencies, CarMax Inc., Carvana, Cox Automotive Inc. (Autotrader), Emil Frey AG, Group 1 Automotive Inc., Inchcape Group, Lithia Motors Inc.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The global used car market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global used car market.

Market Segmentation

- Vehicle Type

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

- Fuel Type

- Petrol

- Diesel

- Hybrid/Electric

- Others

- Distribution Channel

- Franchised dealer

- Independent dealer

- Others

- End-use

- Personal

- Commercial

- Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Key Players Insights

- Arnold Clark Automobiles Ltd.

- Asbury Automotive Group Inc.

- AutoNation Inc.

- Autotrader

- AutoScout24

- Universal Motor Agencies

- CarMax Inc.

- Carvana

- Cox Automotive Inc. (Autotrader)

- Emil Frey AG

- Group 1 Automotive Inc.

- Inchcape Group

- Lithia Motors Inc.

- CarMax Business Service LLC

- Asbury Automotive Group

- AutoNation Inc.

- eBay Inc.

- Big Boy toyz

- VROOM

- Others

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Vehicle Type

- Market Snippet, By Fuel Type

- Market Snippet, By Distribution Channel

- Market Snippet, By End-use

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New system Launch/Approvals

- Impact of the COVID-19 Pandemic

4. Global Used Car Market, By Vehicle Type, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Segment Trends

- Hatchbacks

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Sedan

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Sports Utility Vehicle

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Others

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

5. Global Used Car Market, By Fuel Type, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Segment Trends

- Petrol

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Diesel

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Hybrid/Electric

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Others

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

6. Global Used Car Market, By Distribution Channel, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Segment Trends

- Franchised dealer

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Independent dealer

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Others

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

7. Global Used Car Market, By End-use, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Segment Trends

- Personal

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

- Commercial

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Trillion)

8. Global Used Car Market, By Region, 2019-2031 (US$ Trillion)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- North America

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- China

- India

- ASEAN

- Australia

- South Korea

- Japan

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Vehicle Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Fuel Type, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By Distribution Channel, 2019-2031 (US$ Trillion)

- Market Size and Forecast, By End-use, 2019-2031 (US$ Trillion)

- Market Share Analysis, By Country, 2019 and 2031 (%)

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

9. Competitive Landscape

- Company Profiles

- Arnold Clark Automobiles Ltd.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Asbury Automotive Group Inc.

- AutoNation Inc.

- Autotrader

- AutoScout24

- Universal Motor Agencies

- CarMax Inc.

- Carvana

- Cox Automotive Inc. (Autotrader)

- Emil Frey AG

- Group 1 Automotive Inc.

- Inchcape Group

- Lithia Motors Inc. CarMax Business Service LLC

- Asbury Automotive Group

- AutoNation Inc.

- eBay Inc.

- Big Boy toyz

- VROOM

10. Wheel of Fortune

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Section

- References

- Research Methodology

- About us and Sales Contact