|

市场调查报告书

商品编码

1532407

技术线圈涂布市场:依材料、依技术、依产品种类、依最终用途产业、按地区Technical Coil Coatings Market, By Material, By Technology, By Product Type, By End-use Industry, By Geography |

||||||

技术线圈涂布市场预计到 2024 年将达到 46 亿美元,预计到 2031 年将达到 62.6 亿美元,2024 年至 2031 年复合年增长率为 4.5%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年 | 2023年 | 2024年市场规模 | 46亿美元 |

| 实际资料 | 2019-2023 | 预测期 | 2024年至2031年 |

| 预测 2024-2031 年复合年增长率: | 4.50% | 2031年价值预测 | 62.6亿美元 |

技术线圈涂布是指一种用于建筑、汽车和消费性电子行业的薄金属板(例如钢和铝)的涂层方法。这些涂层为涂层金属表面提供卓越的耐腐蚀和美观性。建筑和汽车行业的成长以及有关油漆和被覆剂中使用挥发性有机化合物 (VOC) 的严格环境法规正在推动对技术线圈涂布的需求。涂料技术的进步,以及满足各种最终用途产业需求的新产品创新,可能在未来几年继续支持市场成长。

市场动态:.

主要国家住宅和非住宅建设活动的活性化是工业线圈涂布市场的关键成长要素。快速都市化和可支配收入的增加透过增加耐用消费品和家用电器的销售使市场受益。然而,COVID-19 大流行后供应链中断导致原物料价格波动,限制了市场成长。从积极的一面来看,全球汽车产量的扩张为市场参与者提供了有利可图的机会。此外,生物基和低挥发性有机化合物涂料产品的推出预计将进一步推动市场扩张。

本研究的主要特点

- 该报告详细分析了全球技术线圈涂布市场,并提供了以2023年为基准年的预测期(2024-2031)的市场规模和年复合成长率(CAGR%)。

- 它还强调了各个细分市场的潜在收益成长机会,并说明了该市场有吸引力的投资提案矩阵。

- 它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景、主要企业采取的竞争策略等的重要见解。

- 本报告根据公司亮点、产品系列、主要亮点、绩效和策略等参数,介绍了全球技术线圈涂布市场的主要企业。

- 该报告的见解使负责人和公司经营团队能够就未来的产品发布、类型升级、市场扩张和行销策略做出明智的决策。

- 全球技术线圈涂布市场报告针对该行业的各个相关人员,如投资者、供应商、产品製造商、经销商、新进入者和财务分析师。

- 透过用于分析全球技术线圈涂布市场的各种策略矩阵,将促进相关人员的决策。

目录

第一章 研究目的与前提

- 研究目的

- 先决条件

- 简称

第二章 市场展望

- 报告说明

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map(COM)

第三章市场动态、法规及趋势分析

- 市场动态

- 促进因素

- 抑制因素

- PEST分析

- 波特的五力分析

- 市场机会

- 监管场景

- 产业动态

- 併购

第四章全球技术线圈涂布市场 - 冠状病毒 (COVID-19) 大流行的影响

- 影响全球工业线圈涂布市场的因素

- 影响分析

第五章全球技术线圈涂布市场(依材料),2019-2031

- 聚酯纤维

- 塑性溶胶

- 聚二氟亚乙烯(PVDF)

- 硅

- 其他的

第六章 全球技术线圈涂布市场(依技术),2019-2031

- 液体涂料

- 水系统

- 溶剂型

- 粉末涂料

第七章全球技术线圈涂布市场,依产品类型,2019-2031

- 面漆

- 介绍性书籍

- 内衬外套

- 其他的

第 8 章 全球技术线圈涂布市场,依最终用途产业,2019-2031 年

- 建造

- 车

- 家具

- 其他的

第9章2019-2031年全球技术线圈涂布市场(按地区)

- 北美洲

- 拉丁美洲

- 欧洲

- 亚太地区

- 中东/非洲

第10章竞争格局

- 市场占有率分析

- 公司简介

- PPG Industries Inc.

- BASF SE

- Akzo Nobel NV

- The Valspar Corporation

- DowDuPont Inc.

- The Sherwin-Williams Company

- Backers Group

- Kansai Nerolac Paints Limited

- ArcelorMittal

- Arconic

- BDM Coil Coaters

- CENTRIA

- Chemcoaters

- Dura Coat Products

- Goldin Metals Inc.

- Jupiter Aluminum Corporation

- Norsk Hydro ASA

- Novelis

- Ralco Steels

- Rautaruukki Corporation

第十一章分析师建议

- 命运之轮

- 分析师观点

- 一致的机会图

第12章 章节

- 参考

- 调查方法

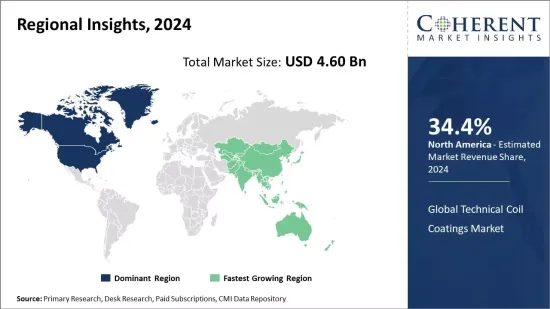

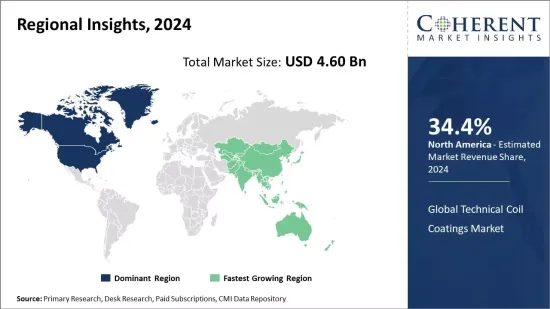

The technical coil coatings market is estimated to be valued at USD 4.60 Bn in 2024 and is expected to reach USD 6.26 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 4.5% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 4.60 Bn |

| Historical Data for: | 2019 to 2023 | Forecast Period: | 2024 to 2031 |

| Forecast Period 2024 to 2031 CAGR: | 4.50% | 2031 Value Projection: | US$ 6.26 Bn |

Technical coil coatings refer to the method of coating thin gauge metal sheets such as steel and aluminum used in the construction, automotive, and appliance industries. These coatings provide superior corrosion protection and aesthetics to the coated metal surfaces. The growing construction and automotive sectors along with stringent environmental regulations regarding the usage of volatile organic compounds (VOCs) in paints and coatings have been driving the demand for technical coil coatings. New product innovations catering to the requirements of different end-use industries along with advancements in coating technologies will continue to support the market growth in the coming years.

Market Dynamics:

Rising residential and non-residential construction activities across major economies have been a key growth driver for technical coil coatings market. Rapid urbanization along with increasing disposable income has augmented the sales of durables and appliances, benefiting the market. However, fluctuating raw material prices owing to supply chain disruptions post COVID-19 pandemic can restraint the market growth. On the positive side, growing automobile production worldwide presents lucrative opportunity for market players. Additionally, the introduction of bio-based and low VOC coating products will further aid in market expansion.

Key Features of the Study:

- This report provides in-depth analysis of the global technical coil coatings market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2024-2031), considering 2023 as the base year.

- It elucidates potential revenue growth opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global technical coil coatings market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include PPG Industries Inc., BASF S.E., Akzo Nobel N.V., The Valspar Corporation, DowDuPont Inc., The Sherwin-Williams Company, Backers Group, Kansai Nerolac Paints Limited, ArcelorMittal, Arconic, BDM Coil Coaters, CENTRIA, Chemcoaters, Dura Coat Products, Goldin Metals Inc., Jupiter Aluminum Corporation, Norsk Hydro ASA, Novelis, Ralco Steels, and Rautaruukki Corporation.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- The global technical coil coatings market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global technical coil coatings market.

Detailed Segmentation-

- By Material:

- Polyester

- Plastisol

- Polyvinylidene fluoride (PVDF)

- Silicon

- Others

- By Technology:

- Liquid Coating

- Water-borne

- Solvent-borne

- Powder Coating

- By Product Type:

- Top Coat

- Primer

- Backing Coat

- Others

- By End-use Industry:

- Construction

- Automotive

- Furniture

- Others

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Company Profiles:

- PPG Industries Inc.

- BASF S.E.

- Akzo Nobel N.V.

- The Valspar Corporation

- DowDuPont Inc.

- The Sherwin-Williams Company

- Backers Group

- Kansai Nerolac Paints Limited

- ArcelorMittal

- Arconic

- BDM Coil Coaters

- CENTRIA

- Chemcoaters

- Dura Coat Products

- Goldin Metals Inc.

- Jupiter Aluminum Corporation

- Norsk Hydro ASA

- Novelis

- Ralco Steels

- Rautaruukki Corporation

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Material

- Market Snippet, By Technology

- Market Snippet, By Product Type

- Market Snippet, By End-use Industry

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- PEST Analysis

- PORTER's Five Forces Analysis

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Mergers and Acquisitions

4. Global Technical Coil Coatings Market - Impact of Coronavirus (COVID-19) Pandemic

- Overview

- Factors Affecting the Global Technical Coil Coatings Market

- Impact Analysis

5. Global Technical Coil Coatings Market, By Material, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024, 2027 and 2031 (%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Polyester

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Plastisol

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Polyvinylidene fluoride (PVDF)

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Silicon

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

6. Global Technical Coil Coatings Market, By Technology, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024, 2027 and 2031 (%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Liquid Coating

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Water-borne

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Solvent-borne

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Powder Coating

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

7. Global Technical Coil Coatings Market, By Product Type, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024, 2027 and 2031 (%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Top Coat

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Primer

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Backing Coat

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

8. Global Technical Coil Coatings Market, By End-use Industry, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, 2024, 2027 and 2031 (%)

- Y-o-Y Growth Analysis, 2019 - 2031

- Segment Trends

- Construction

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Automotive

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Furniture

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

- Others

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019 - 2031, (US$ Bn)

- Segment Trends

9. Global Technical Coil Coatings Market, By Region, 2019-2031, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2024, 2027 and 2031 (%)

- Y-o-Y Growth Analysis, For Region, 2019-2031

- North America

- Introduction

- Market Size and Forecast, By Material, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Technology, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Material, 2019 - 2031, (US$ Bn))

- Market Size and Forecast, By Technology, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Material, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Technology, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Material, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Technology, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, By Material, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Technology, 2019 - 2031 (US$ Bn)

- Market Size and Forecast, By Product Type, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By End-use Industry, 2019 - 2031, (US$ Bn)

- Market Size and Forecast, By Country, 2019 - 2031, (US$ Bn)

- GCC Countries

- Israel

- Rest of Middle East & Africa

10. Competitive Landscape

- Market Share Analysis

- Company Profiles

- PPG Industries Inc.

- Company Overview

- Material Portfolio

- Recent Developments/Updates

- BASF S.E.

- Company Overview

- Material Portfolio

- Recent Developments/Updates

- Akzo Nobel N.V.

- The Valspar Corporation

- DowDuPont Inc.

- The Sherwin-Williams Company

- Backers Group

- Kansai Nerolac Paints Limited

- ArcelorMittal

- Arconic

- BDM Coil Coaters

- CENTRIA

- Chemcoaters

- Dura Coat Products

- Goldin Metals Inc.

- Jupiter Aluminum Corporation

- Norsk Hydro ASA

- Novelis

- Ralco Steels

- Rautaruukki Corporation

- PPG Industries Inc.

11. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

12. Section

- References

- Research Methodology

- About Us and Sales Contact

- Browse 25 market data tables* and 20 figures* on "Global Technical Coil Coatings Market" - Global forecast to 2031.