|

市场调查报告书

商品编码

1532444

动画和视觉特效市场,按动画平台,按地区Animation and VFX Market, By Animation Platform (Television and OTT, Films, Advertisement, Gaming, and Other (Ed-tech, etc.)), By Geography (North America, Latin America, Asia Pacific, Europe, Middle East, and Africa) |

||||||

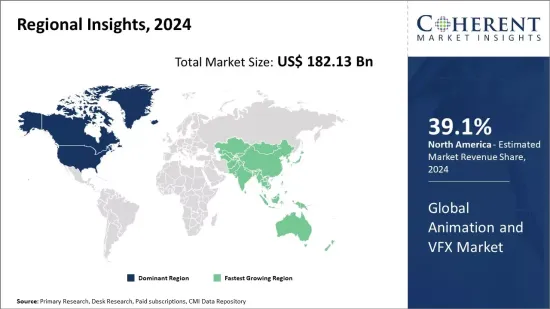

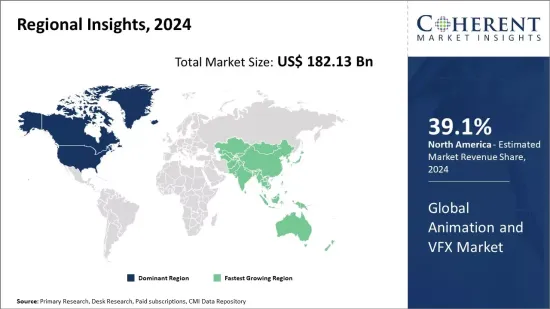

全球动画和视觉特效市场预计到2024年将达到1,821.3亿美元,预计2031年将达到3,482.4亿美元,2024年至2031年的复合年增长率为9.7%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年 | 2023年 | 2024年市场规模 | 1821.3亿美元 |

| 实际资料 | 2019年至2023年 | 预测期 | 2024年至2031年 |

| 预测 2024-2031 年复合年增长率: | 9.70% | 2031年价值预测 | 3482.4亿美元 |

近年来,全球动画和视觉特效市场经历了快速成长。娱乐和媒体产业对高品质动画内容的需求不断增长、线上串流平台的激增、行动游戏产业的成长以及真人电影中视觉效果的日益采用等因素正在推动市场成长。动画和视觉特效广泛应用于各种类型,包括电影、电视、电玩、网路剧和广告。随着动画和视觉特效技术的进步,现在可以以更低的成本製作高清内容,支援这些技术的更广泛应用。由于虚拟实境和扩增实境等领域的新兴机会,预计动画和视觉特效市场将在预测期内进一步显着成长。

市场动态:

推动全球动画和视觉特效市场成长的关键因素是动画和基于视觉特效的电影和电视节目在全球范围内的日益普及以及媒体和娱乐公司对动画和视觉特效内容的投资不断增加。此外,线上影片串流平台以及真人电影和电影预告片行业的激增为动画和视觉特效技术的应用开闢了新的途径。然而,动画和视觉特效的製作需要较高的初始投资和製作成本,这对市场相关人员构成了重大挑战。免费和盗版影像内容的出现也影响企业收益。同时,行动游戏、虚拟实境和扩增实境等产业对动画和视觉特效重内容的需求不断增长,预计将为市场进一步成长创造新的机会。

本研究的主要特点

本报告对全球动画和视觉特效市场进行了详细分析,并提供了以2023年为基准年的预测期(2024-2031)的市场规模和年复合成长率(CAGR%)。

它还强调了各个细分市场的潜在商机,并说明了该市场有吸引力的投资提案矩阵。

它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景、主要企业采取的竞争策略等的主要考察。

根据公司亮点、产品系列、主要亮点、财务表现和策略等参数对全球动画和视觉特效市场的主要企业进行了介绍。

主要企业包括AdAdobe Inc.、Animal Logic、Digital Domain、Framestore、工业光魔(ILM)、Luma Pictures、Method Studios、MPC(运动图片公司)、皮克斯动画工作室、Rhythm &Hues、Sony Pictures Imageworks、 Technicolor Creative Studios、 The Mill、Weta Digital、Worldwide FX 等。

该报告的见解使负责人和公司经营团队能够就未来的产品发布、类型升级、市场扩张和行销策略做出明智的决策。

全球动画和视觉特效市场报告迎合了该行业的各种相关人员,如投资者、供应商、产品製造商、经销商、新进业者和财务分析师。

相关人员可以透过用于分析全球动画和视觉特效市场的各种策略矩阵来促进他们的决策。

目录

第一章 研究目的与前提

- 研究目的

- 先决条件

- 简称

第二章 市场展望

- 报告说明

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map(COM)

第三章市场动态、法规及趋势分析

- 市场动态

- 促进因素

- 抑制因素

- 市场机会

- 监管场景

- 产业动态

- 併购

- 新系统的引入/核准

- COVID-19 大流行的影响

第 4 章 全球动画与视觉特效市场,依动画平台划分,2019-2031 年

- 电视和 OTT

- 电影

- 广告

- 游戏

- 其他(教育科技等)

第五章2019-2031年全球动画与视觉特效市场(按地区)

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争状况

- 公司简介

- Adobe Inc.

- Animal Logic

- Digital Domain

- Framestore

- Industrial Light &Magic(ILM)

- Luma Pictures

- Method Studios

- MPC(Moving Picture Company)

- Pixar Animation Studios

- Rhythm &Hues

- Sony Pictures Imageworks

- Technicolor Creative Studios

- The Mill

- Weta Digital

- Worldwide FX

第7章 命运之轮

- 命运之轮

- 分析师观点

- 一致的机会图

第8章 参考文献与调查方法

- 参考

- 调查方法

The global animation and VFX market is estimated to be valued at US$ 182.13 Bn in 2024 and is expected to reach US$ 348.24 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 9.7% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 182.13 Bn |

| Historical Data for: | 2019 To 2023 | Forecast Period: | 2024 to 2031 |

| Forecast Period 2024 to 2031 CAGR: | 9.70% | 2031 Value Projection: | US$ 348.24 Bn |

The global animation and VFX market is witnessing rapid growth in recent years. Factors such as rising demand for high-quality animated content from entertainment and media industries, proliferation of online streaming platforms, growth of mobile gaming industry, and increasing adoption of visual effects in live-action films are fueling the growth of the market. Animation and VFX are widely used in various genres including movies, television, video games, web series, and advertisements. With increasing innovations in animation and VFX technologies, it is becoming possible to create high-definition content at lower costs which is supporting wider application of these technologies. The animation and VFX market is expected to further grow significantly during the forecast period on account of emerging opportunities in areas such as virtual reality and augmented reality.

Market Dynamics:

The key drivers propelling the growth of the global animation and VFX market are growing popularity of animation and VFX-based movies and television shows across the world and increasing investments by media and entertainment companies in animated and VFX content. In addition, proliferation of online video streaming platforms and the live-action/movie trailer industry has opened new avenues for the application of animation and VFX technologies. However, high initial investment and production costs involved in animation and VFX production is a major challenge for market players. In addition, availability of free and pirated video content affects the revenue generation of companies. On the bright side, increasing demand for animated and VFX-rich content from industries, such as mobile gaming, virtual reality, and augmented reality, is expected to create new opportunities for further growth of the market.

Key Features of the Study:

This report provides in-depth analysis of the global animation and VFX market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2024-2031), considering 2023 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global animation and VFX market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Adobe Inc., Animal Logic, Digital Domain, Framestore, Industrial Light & Magic (ILM), Luma Pictures, Method Studios, MPC (Moving Picture Company), Pixar Animation Studios, Rhythm & Hues, Sony Pictures Imageworks, Technicolor Creative Studios, The Mill, Weta Digital, and Worldwide FX

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global animation and VFX market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global animation and VFX market

Detailed Segmentation:

- By Animation Platform

- Television and OTT

- Films

- Advertisement

- Gaming

- Other (Ed-tech, etc.)

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Key Players Insights

- Adobe Inc.

- Animal Logic

- Digital Domain

- Framestore

- Industrial Light & Magic (ILM)

- Luma Pictures

- Method Studios

- MPC (Moving Picture Company)

- Pixar Animation Studios

- Rhythm & Hues

- Sony Pictures Imageworks

- Technicolor Creative Studios

- The Mill

- Weta Digital

- Worldwide FX

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Animation Platform

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New System Launches/Approvals

- Impact of COVID-19 Pandemic

4. Global Animation and VFX Market, By Animation Platform, 2019-2031 (US$ Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- Segment Trends

- Television and OTT

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Bn)

- Films

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Bn)

- Advertisement

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Bn)

- Gaming

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Bn)

- Other (Ed-tech, etc.)

- Introduction

- Market Size and Forecast, 2019-2031, (US$ Bn)

5. Global Animation and VFX Market, By Region, 2019-2031 (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020-2031

- North America

- Regional Trends

- Market Size and Forecast, By Animation Platform, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Animation Platform, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Animation Platform, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Animation Platform, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Animation Platform, 2019-2031 (US$ Bn)

- Market Share Analysis, By Country, 2024 and 2031 (%)

- South Africa

- Israel

- GCC Countries

- Rest of the Middle East & Africa

6. Competitive Landscape

- Company Profiles

- Adobe Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Animal Logic

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Digital Domain

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Framestore

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Industrial Light & Magic (ILM)

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Luma Pictures

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Method Studios

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- MPC (Moving Picture Company)

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Pixar Animation Studios

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Rhythm & Hues

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Sony Pictures Imageworks

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Technicolor Creative Studios

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- The Mill

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Weta Digital

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Worldwide FX

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Adobe Inc.

7. Wheel of Fortune

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

8. Reference and Research Methodology

- References

- Research Methodology

- About us and Sales Contact