|

市场调查报告书

商品编码

1673897

演算法交易市场按类型、部署、组织规模和地区划分Algorithmic Trading Market, By Type, By Deployment, By Organization Size, By Geography |

||||||

2025 年全球演算法交易市场规模估计为 32.8 亿美元,预计到 2032 年将达到 60.5 亿美元,2025 年至 2032 年的复合年增长率为 9.1%。

| 报告范围 | 报告详细信息 | ||

|---|---|---|---|

| 基准年 | 2024 | 2025年的市场规模 | 32.8亿美元 |

| 效能资料 | 从2020年到2024年 | 预测期 | 2025年至2032年 |

| 预测期:2025-2032年复合年增长率: | 9.10% | 2032年价值预测 | 60.5亿美元 |

全球演算法交易市场的成长受到金融领域日益增强的自动化和资料分析的推动。演算法交易利用定量和定性因素来分析市场趋势并据此执行交易。它能够根据预先定义的规则和变数实现高频、自动化的交易执行。这减少了人为错误并最大限度地降低了边际交易成本。金融科技解决方案的成长进一步推动了更复杂的交易演算法的发展,这些演算法可以以超越人类能力的速度处理大量资料。领先的公司正在大力投资研发基于人工智慧和机器学习的先进演算法,以进行预测分析和最佳交易执行。由于自动化是交易业务的核心,全球演算法交易市场可能会成长。

市场动态:

全球演算法交易市场的成长是由资本市场对速度、效率和准确性的需求所驱动的。不断增长的市场资料和即时交易需要自动化系统来实现最佳的订单执行。然而,高额的初始投资和监管合规性可能会阻碍市场成长。在新兴经济体中,金融科技和线上交易的采用正在增加,这可以为市场成长提供机会。人工智慧和云端处理的日益普及将透过对非传统资料来源的分析使演算法策略更加强大。这促使供应商提供云端基础的演算法解决方案。然而,网路安全风险和与人类判断的不相容性可能会阻碍市场成长。

本研究的主要特点

- 本报告对全球演算法交易市场进行了详细分析,并以 2024 年为基准年,展示了预测期(2025-2032 年)的市场规模和复合年增长率。

- 它还强调了各个领域的潜在商机,并说明了该市场的有吸引力的投资提案矩阵。

- 它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、市场趋势、区域前景和主要企业采用的竞争策略的重要见解。

- 全球演算法交易市场的主要企业是根据公司亮点、产品系列、关键亮点、财务绩效和策略等参数进行的分析。

- 本报告的见解将使负责人和企业经营团队能够就未来的产品发布、新兴车型、市场扩张和行销策略做出明智的决策。

- 全球演算法交易市场报告迎合了该行业的各个相关人员,例如投资者、供应商、产品製造商、经销商、新进入者和金融分析师。

- 相关人员将透过用于分析全球演算法交易市场的各种策略矩阵更轻鬆地做出决策。

目录

第一章 调查目的与前提条件

- 研究目标

- 先决条件

- 简称

第二章 市场展望

- 报告描述

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map(COM)

第三章市场动态、法规与趋势分析

- 市场动态

- 驱动程式

- 限制因素

- 市场机会

- 监管情景

- 产业趋势

- 合併与收购

- 新系统实施/核准

- COVID-19疫情的影响

4. 2020 年至 2032 年全球演算法交易市场(按类型)

- 机构投资者

- 私人投资者

- 长期交易者

- 短期交易者

5. 全球演算法交易市场(按部署),2020-2032 年

- 云端基础

- 本地

6. 2020 年至 2032 年全球演算法交易市场(依组织规模)

- 中小企业

- 大型企业

7. 2020-2032 年全球演算法交易市场(按地区)

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第八章竞争格局

- 公司简介

- 63 moons technologies limited

- AlgoTrader

- Argo Software Engineering

- Citadel LLC

- FlexTrade Systems, Inc.

- Hudson River Trading

- InfoReach, Inc.

- Lime Trading Corp.

- Marquee by Goldman Sachs

- MetaQuotes Ltd

- Optiver

- Quanthouse

- Refinitiv Limited

- Software AG

- Symphony

第九章分析师建议

- 机会

- 分析师观点

- Coherent Opportunity Map

第十章调查方法

- 参考

- 调查方法

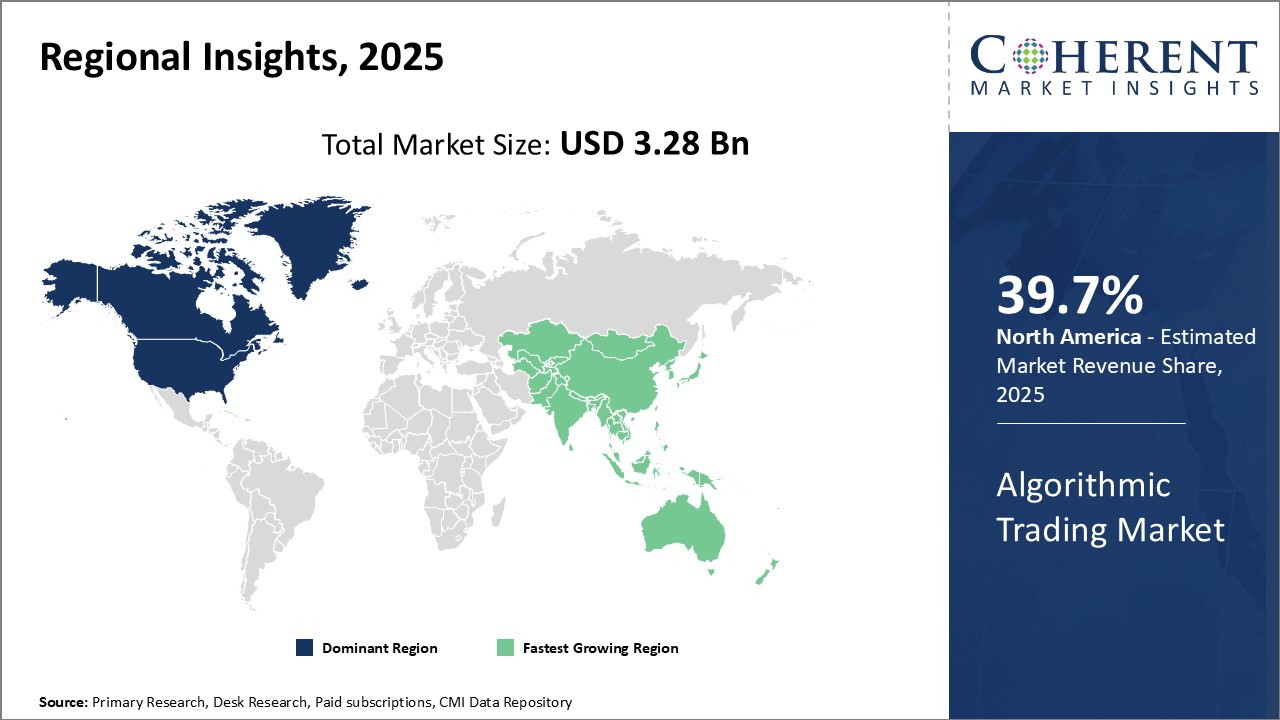

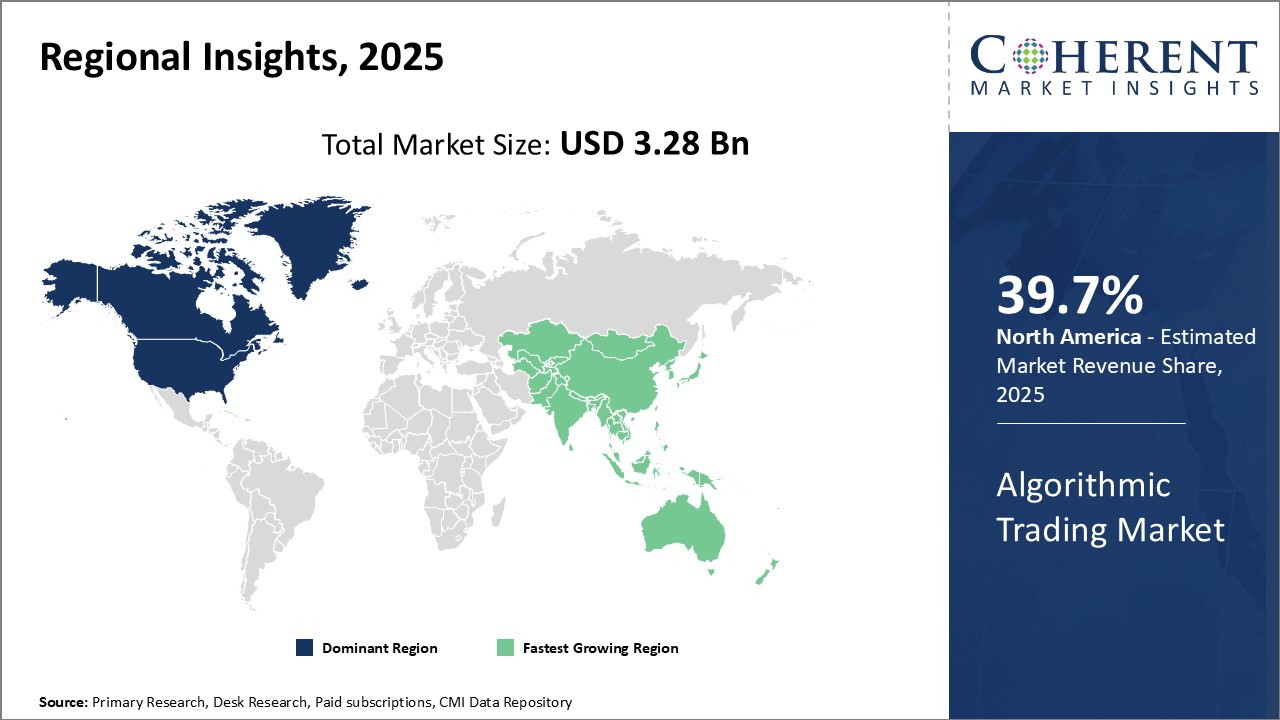

Global Algorithmic Trading Market is estimated to be valued at USD 3.28 Bn in 2025 and is expected to reach USD 6.05 Bn by 2032, growing at a compound annual growth rate (CAGR) of 9.1% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 3.28 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 9.10% | 2032 Value Projection: | USD 6.05 Bn |

Global algorithmic trading market growth is driven by increasing automation and data analytics in the financial sector. Algorithmic trading utilizes quantitative and qualitative factors to analyze market behavior and execute trades accordingly. It allows for high-frequency and automated execution of transactions based on pre-defined rules and variables. This reduces human errors and minimizes marginal transaction costs. The growth of FinTech solutions further boosts the development of more sophisticated trading algorithms capable of processing huge volumes of data at speeds exceeding human capabilities. Major players are investing heavily in R&D to develop AI and machine learning based advanced algorithms for predictive analysis and optimal trade execution. Global algorithmic trading market can witness growth as automation is core to trading operations.

Market Dynamics:

Global algorithmic trading market growth is driven by the need for speed, efficiency and accuracy in capital markets. Growing volumes of market data and real-time trading necessitate automated systems for optimal order execution. However, high initial investment and regulatory compliances can hamper the market growth. Developing economies experiencing increase in financial technology adoption and online trading can offer market growth opportunities. Increasing popularity of AI and cloud computing makes algorithmic strategies more powerful by enabling analysis of unconventional data sources. This prompt vendors to offer cloud-based algorithmic solutions. However, cybersecurity risks and inability to match human judgment can hamper the market growth.

Key features of the study:

- This report provides in-depth analysis of the global algorithmic trading market, and provides market size (US$ Bn) and compound annual growth rate (CAGR%) for the forecast period (2025-2032), considering 2024 as the base year.

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players.

- It profiles key players in the global algorithmic trading market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies.

- Key companies covered as a part of this study include 63 moons technologies limited, AlgoTrader, Argo Software Engineering, Citadel LLC, FlexTrade Systems, Inc., Hudson River Trading, InfoReach, Inc., Lime Trading Corp., Marquee by Goldman Sachs, MetaQuotes Ltd, Optiver, Quanthouse, Refinitiv Limited, Software AG, Symphony.

- Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics.

- Global algorithmic trading market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global algorithmic trading market.

Detailed Segmentation:

- By Type

- Institutional Investors

- Retail Investors

- Long-term Traders

- Short-term Traders

- By Deployment

- Cloud-based

- On-premises

- By Organization Size

- Small and Medium Enterprises

- Large Enterprises

- By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Key Players Insights

- 63 moons technologies limited

- AlgoTrader

- Argo Software Engineering

- Citadel LLC

- FlexTrade Systems, Inc.

- Hudson River Trading

- InfoReach, Inc.

- Lime Trading Corp.

- Marquee by Goldman Sachs

- MetaQuotes Ltd

- Optiver

- Quanthouse

- Refinitiv Limited

- Software AG

- Symphony

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Type

- Market Snippet, By Deployment

- Market Snippet, By Organization Size

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New System Launches/Approvals

- Impact of COVID-19 Pandemic

4. Global Algorithmic Trading Market, By Type, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Institutional Investors

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Retail Investors

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Long-term Traders

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Short-term Traders

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

5. Global Algorithmic Trading Market, By Deployment, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Cloud-based

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- On-premises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

6. Global Algorithmic Trading Market, By Organization Size, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Small and Medium Enterprises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

- Large Enterprises

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Bn)

7. Global Algorithmic Trading Market, By Region, 2020-2032, (US$ Bn)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- North America

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- U.K.

- Germany

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa

- Regional Trends

- Market Size and Forecast, By Type, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Deployment, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Organization Size, 2020-2032, (US$ Bn)

- Market Size and Forecast, By Country, 2020-2032, (US$ Bn)

- South Africa

- GCC Countries

- Rest of the Middle East & Africa

8. Competitive Landscape

- Company Profiles

- 63 moons technologies limited

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- AlgoTrader

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Argo Software Engineering

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Citadel LLC

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- FlexTrade Systems, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Hudson River Trading

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- InfoReach, Inc.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Lime Trading Corp.

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Marquee by Goldman Sachs

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- MetaQuotes Ltd

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Optiver

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Quanthouse

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Refinitiv Limited

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Software AG

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Symphony

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- 63 moons technologies limited

9. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

10. Research Methodology

- References

- Research Methodology

- About us and Sales Contact