|

市场调查报告书

商品编码

1068663

中国厨房家具市场The Kitchen Furniture Market in China |

||||||

本报告分析了中国厨房家具市场,分析了整体市场规模(产量、消费量、出口量/进口量)和价格水平趋势(2016-2021)、产品详细趋势等信息按类型/分销渠道/价格区间和地区/主要城市,主要公司概况(总共60家或更多公司),相关市场(家电市场)趋势,市场背景,我会交付。

亮点

2021年中国厨房家具产量达到87.57亿美元(564.89亿元人民币),以美元计录得+24.5%(人民币+16.3%)的年增长率。中国厨房家具製造商生产了约410万套厨具,其中出口约28万套,国内市场约390万套。大部分厨房家俱生产由前50强企业控制,占总市值的近75%。

在销售渠道中,厨房专卖店占据较大份额,但承包商和承包商的销售门店也占据第二大份额。

欧洲人占据了 30% 的高价市场和 80% 的奢侈品市场。

代表公司

Aisen、Akani、Amblem、Aodu 、Arrow、Baineng、Beigeer、Bigtime、Borcci (Fotile)、Borlonclan、Cacar、Canbo、Daeshin、Debao、Deson、Dicano、Doton、Elabor、Eueasa、Euromax Neuvelle、Haier、Hanex、Haozhaotou、Homtor、Ikea、Jiaci、Joydar、Kangjie、Kenner、Macess、Macro、Mekea、Mkxy、Nbmin、Olo Home、Oppein、Oulin、Oupu、Ouyi、Pianor、Rebon、Schmidt、Siples、Nobilia、Vidas、Vifa Kitchen、Wanjia、Welon、Yalig、Häcker Küchen、ZBOM Cabinets

调查领域及调查方法

基本资料

- 概述:生产、国际贸易、消费

- 家具消费:按细分市场

- 全球厨房家具市场:生产/消费,主要国家分析

活动趋势

- 生产/国际贸易/消费(单位:100万美元/100万人民币,1000台,均价(美元/台),2016-2021年)

- 消费预测(单位:1,000 辆,2022-2025 年)

- 厨房家具市场开放度(2016-2021)

国际贸易

- 中国/香港厨房家具进出口:按国家/地区分列(2016-2021)

- 全球厨房家具市场:主要国家的主要进口商

- 白色家电贸易:按国家/地区划分的进出口(主要产品为 2016-2021 年)

- 食物

- 冰箱/冰柜

- 洗碗机

- 炊具

- 洗衣机

厨房家具供应结构

- 生产集群和就业

- 厨房家具/家电製造商:100家样本公司所在地,分省

- 样本公司成立时间、员工人数、厂区面积

- 样本公司的员工人数和每位员工的平均销售额

- 厨房家具分类:按风格分类

- 供应明细:按款式分类 (2017/2019/2021)

- 样本公司供应明细:按风格分类

- 橱柜门供应细分:按材质和颜色

- 橱柜门供应明细:按材料、配色方案、漆面分类(2017、2019、2021)

- 样本公司橱柜门的细分:按材质和颜色

- 样品公司橱柜门最常用的颜色

- 样本公司橱柜门使用最多的木材类型

- 檯面供应明细:按材质

- 檯面供应明细数据:按材料分类 (2017/2019/2021)

- 样本公司檯面供应明细:按材质分

- 橱柜门等零件製造商

分布

- 样本公司的分布模式

- 室内厨房销售:按分销渠道划分的细分数据(2017/2019/2021)

- 样本公司室内厨房销售:按分销渠道细分

- 样本公司门店数量及单店平均销售额

- 厨房家具主要零售商:广州、成都、西安、东莞、北京、青岛、杭州、上海、沉阳、深圳、福州

- 主营家具连锁

- 主要的DIY和百货商店

- 中国城市样本企业对厨房的需求

- 厨房家具和家电参考价格

- 厨房家具和嵌入式家电的联合销售

- 嵌入式家电占厨房消费总量的比例(2017/2019/2021)

- 样本公司销售的厨房家具:内置电器比例

- 主要电子产品商店:概览

竞争系统

- 50 强企业

- 中国厨房家具製造商 50 强:销售额、市场份额、概览

- 主要出口商

- 中国厨房家具样品製造商的出口销售

- 中国厨房家具样品厂家出口销售额:按国家/地区分

- 在中国的销售

- 中国厨房家具市场50强企业:销售额与市场占有率

- 销售:出厂均价

- 厨房家具市场:各大低价企业

- 厨房家具市场:主要中低价位企业

- 厨房家具市场:主要中价企业

- 厨房家具市场:主要中高价企业

- 厨房家具市场:各大高价企业

- 厨房家具市场:主要奢侈品公司

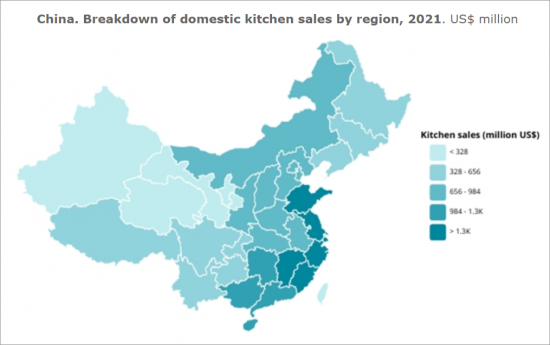

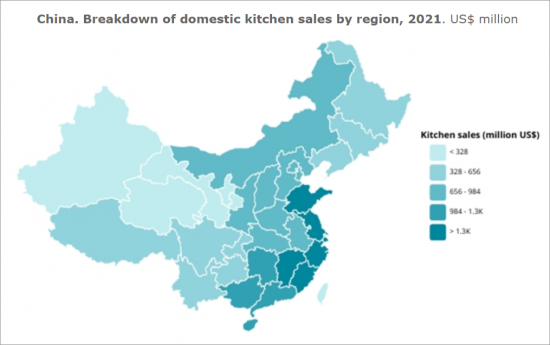

- 各地区销售额

- 样本公司的国内厨房销售额:按地区细分

- 中国的外资厨房家具公司

- 国外品牌在中国的厨房家具销售情况

经济趋势和需求决定因素

- 宏观经济数据

- 人口与城市化进程

- 建筑和房地产

附录 I:建筑师和室内设计师

附录二:提及/调查的中国公司名单

This report provides a comprehensive picture of the kitchen furniture industry in China , enhanced by historical trends on production, consumption and international trade, analysis of the production and distribution systems and information on major players. The study also includes forecasts of the real growth of the market for the years 2020 and 2025 . The research was carried out via direct interviews with Chinese and international kitchen furniture manufacturers operating in China.

Kitchen furniture exports and imports are broken down by country and by geographical region of origin/destination. Historical data are provided for the time frame 2016-2021. A similar analysis was conducted for the international trade of a list of selected appliances (refrigerator and freezers, cooking appliances, clothes washers and driers, dishwashing machines, hoods) relevant for the kitchen industry for the period 2016-2021.

Chinese kitchen production is analysed by including historical series of kitchen production in value and volume for the years 2016-2021. Kitchen production in China is broken down according to:

- style (classic, country, modern basic, modern, design, high tech);

- cabinet door material (solid wood, veneer, laminated, decorative paper, thermoplastics, lacquered, melamine, aluminium, glass);

- cabinet door colour (white, bright, neutral) and lacquering (bright, opaque);

- worktop material (solid surface materials, natural and engineered stone, laminated, tiles, steel and aluminium, wood, glass).

The chapter on the distribution system offers an analysis of the major sales channels (contract/building trade, kitchen specialists, furniture shops, furniture chains, and DIY) for kitchen and their 2014-2019 trends, including a list of the main kitchen furniture retailers in the major Chinese provinces and short profiles of the leading furniture chains. Reference prices for kitchen furniture and the weight of built-in appliances on the value of the kitchen market are also considered. The analysis also includes the profiles of 22 Chinese cities , which include economic and demographic statistics, kitchen demands, an indicator that ranks the cities according to their business attractiveness, and the analysis of the commercial areas of each city through the geolocation of over 65 brands.

An in-depth analysis of the competitive system identifies the leading Chinese manufacturers by kitchen production, sales, price range and exports. Updated company profiles of the top manufacturers provide data on the company's total turnover, number of employees, export share, location of manufacturing plants and distribution channels. The competitive system analysis also identifies a selection of leading international kitchen manufacturers operating on the Chinese market, providing descriptions of their distribution strategies and short company profiles.

The final chapter tries to identify the major domestic demand determinants , which includes macro-economic indicators (country indicators, real growth of GDP and inflation up to 2025, population indicators, data on disposable income and wealth, data on construction sector and real estate); population dynamics (population, urbanization, analysis of the top cities); consumers' trends and preferences; real estate and construction sector development (investments in residential building, data on the construction sector).

A list of more than 60 major players in the kitchen furniture industry in China is also included.

Highlights:

In 2021, kitchen production in China reached a value of US$ 8,757 million (RMB 56,489 million), registering an annual growth of +24.5% in US$ (+16.3% in RMB). Approximately 4.1 million kitchen sets were produced by Chinese kitchen furniture firms, of which around 280 thousand were addressed to exports and almost 3.9 million to the domestic market. Most of the production of kitchen furniture is managed by the top 50 players, which accounts for almost 75% of its total value. In fact, over the last few years, the industry has undergone a process of consolidation, including several IPO and M&A. Oppein confirmed as the largest player.

Kitchen specialists hold the major share as distribution channel, but Contract and Building Trade hold the second position.

European players hold 30% of the upper-end market, and a huge 80% of the luxury market.

Selected companies mentioned:

Aisen, Akani, Amblem, Aodu , Arrow, Baineng, Beigeer, Bigtime, Borcci (Fotile), Borlonclan, Cacar, Canbo, Daeshin, Debao, Deson, Dicano, Doton, Elabor, Eueasa, Euromax Neuvelle, Haier, Hanex, Haozhaotou, Homtor, Ikea, Jiaci, Joydar, Kangjie, Kenner, Macess, Macro, Mekea, Mkxy, Nbmin, Olo Home, Oppein, Oulin, Oupu, Ouyi, Pianor, Rebon, Schmidt, Siples, Nobilia, Vidas, Vifa Kitchen, Wanjia, Welon, Yalig, Häcker Küchen, ZBOM Cabinets.

Research field and methodology

Basic Data

- Overview: Production, International trade, Consumption

- Furniture consumption by segment

- World market of kitchen furniture: production and consumption. Focus on selected countries

The activity trend

- Production, International trade, Consumption, 2016-2021. US$ Million, RMB Million, Thousand units , Prices US$ per unit

- Consumption, forecasts 2022-2025. Thousand units

- The openness of the kitchen furniture market, 2016-2021

International trade

- China and Hong Kong. Exports and Imports of kitchen furniture by country and by geographical area, 2016-2021

- World market of kitchen furniture. Main origin of imports for selected countries

- Trade of major appliances (focus on selected products). Exports and Imports by country and by geographical area, 2016-2021

- Hoods

- Refrigerators and Freezers

- Dishwashers

- Cooking Appliances

- Washing machines

Kitchen furniture supply structure

- Productive clusters and Employment

- Location of a sample of 100 kitchen furniture and appliance manufacturers, by Province

- Year of establishment, number of employees and covered plant surface in sqm in a sample of companies

- Number of employees and average turnover per employee in a sample of companies

- Breakdown of kitchen furniture by style

- Breakdown of supply by style. Data 2017-2019-2021

- Breakdown of supply by style in a sample of companies

- Breakdown of supply by cabinet door material and colour

- Breakdown of supply by cabinet door material, colour, lacquering. Data 2017-2019-2021

- Breakdown of supply by cabinet door material and colour in a sample of companies

- Most used colours for cabinet doors in a sample of companies

- Most used types of wood for cabinet doors in a sample of companies

- Breakdown of supply by worktop material

- Breakdown of supply by worktop material. Data 2017-2019-2021

- Breakdown of supply by worktop material in a sample of companies

- Manufacturers of cabinet doors and other components

Distribution

- Distribution pattern in a sample of companies

- Breakdown of domestic kitchen sales by distribution channel. Data 2017-2019-2021

- Breakdown of domestic kitchen sales by distribution channel in a sample of companies

- Number of outlets and average turnover per outlet in a sample of companies

- Main Kitchen furniture retailers in: Guangzhou; Chengdu; Xian; Donguan; Beijing; Qingdao; Hangzhou; Shanghai; Shengyang; Shenzen; Fuzhou

- Main furniture chains

- Main DIY and Department Stores

- Kitchen demand in a selected sample of Chinese cities

- Reference prices for kitchen furniture and appliances

- Jointed sales of kitchen furniture and built-in appliances

- Incidence of built-in appliances on the total value of kitchen consumption. Data 2017-2019-2021

- Incidence of built-in appliances on total kitchen sold in a sample of companies.

- Leading Electronics-Appliances Stores: Short Profiles.

The Competitive System

- Top 50 players

- Top 50 Chinese kitchen furniture manufacturers: sales, market shares and short profiles

- Main exporters

- Export sales in a sample of Chinese kitchen furniture manufacturers

- Export sales in a sample of Chinese kitchen furniture manufacturers by Country/Area

- Sales in China

- Top 50 players in the Chinese kitchen furniture market: Sales and market shares

- Sales by average factory price

- Kitchen furniture market. Top players in the low price range

- Kitchen furniture market. Top players in the middle-low price range

- Kitchen furniture market. Top players in the middle price range

- Kitchen furniture market. Top players in the upper-middle price range

- Kitchen furniture market. Top players in the upper price range

- Kitchen furniture market. Top players in the luxory

- Sales by region

- Breakdown of domestic kitchen sales by region in a sample of companies

- Foreign kitchen furniture players in China

- Kitchen furniture sales in China from foreign brands

Economic trend and demand determinants

- Macroeconomic data

- Population and urbanization process

- Construction sector and real estate