|

市场调查报告书

商品编码

1156137

家具行业电子商务E-Commerce for the Furniture Industry |

||||||

电子商务家具市场将在 2019-2022 年期间以每年 18% 的速度增长,近年来发展迅速,增长速度快于整体家具市场。在全球电子商务市场中,美国的渗透率最高,其次是中国。

瞬息万变的全球形势正在强烈影响着电子商务渠道的发展。市场受到乌克兰战争、能源和食品短缺以及大流行期间强大的通胀压力的影响。电子商务竞争领域也出现了混乱。在线家具销售正在下滑,对市场低迷具有弹性的全渠道零售商(实体店)正在占据上风。

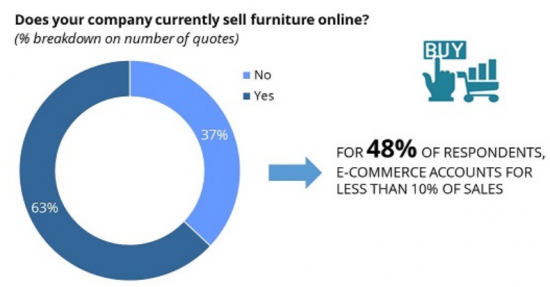

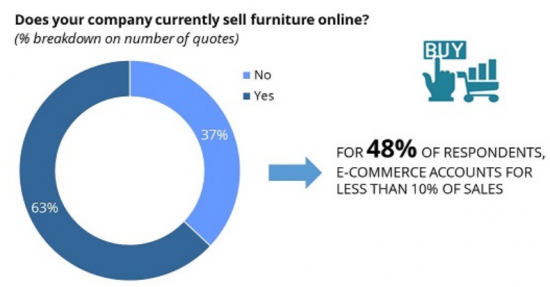

电子商务在整体家具销售中的使用和发生率(2022 年)

CSIL 调查受访者占总样本的比例 /p>

本报告探讨了全球家具行业的电子商务,概述了全球家具行业、当前大型市场的家具消费情况,以及主要地区和国家家具行业电子商务领先企业的表现. 它提供分析、收益和趋势等信息。

本报告中的主要公司

亚马逊、Ambientedirect、Anthropologie、Bygghemma Group、C Discount、Coupang、Crate and Barrel、Dunhelm、Hayneedle、Harvey Norman、Home Depot、Home 24、宜家、京东、John Lewis、Lowe's、Otto、Overstock、Pepperfry、Restoration硬件、苏宁、天猫、沃尔玛、Wayfair、Westwing、Williams-Sonoma.com等

内容

简介:研究工具、公司样本、术语和方法说明

执行摘要:家具行业电子商务概览

第一章:家具行业的电子商务

- 家具市场概览:消费和进口

- 电子商务行业的 EC:基本数据

- 电子商务占家具总消费的比例

- 按地理区域划分的家具消费和电子商务销售额

- 按产品细分分类的家具消费和电子商务销售额(软垫家具、户外家具、厨房家具、办公家具、其他家具)

- 按渠道划分的电子商务家具销售额(网上商店的电子零售商、家具专业人士、非专业人士/生活方式/DIY 和家具製造商)

- 示例公司的电子商务销售业绩

- 电子商务商业模式:家具製造商、批发商和 B2B 企业、电子零售商、实体企业、非家具专业连锁店、开放平台

第 2 章活动趋势

- 家具销售额和电子商务家具销售额的增长

- 前 10 个国家/地区的电子商务家具销售额(按地区和电子商务家具消费量)

- 按产品细分划分的电子商务家具销售额

- 按类别划分的在线家具卖家:规模、市场份额和平均增长率

- 业务发展和组织:全渠道方法、动态购物、可持续性

区域分析:欧洲、北美、亚太

第三章:欧洲的家具电子商务

- 欧洲的零售和电子商务销售:概述和需求驱动因素

- 欧洲家具市场:行业概览

- 按国家/地区(奥地利、比利时、丹麦、芬兰、法国、德国、意大利、荷兰、挪威、西班牙、瑞典、瑞士、英国)按欧洲最终用户价格计算的家具消费和电子商务家具销售额

- 在欧洲销售家具的领先电子商务网站:估计的电子商务家具销售额和电子商务总收入

第 4 章:北美家具电子商务

- 北美零售和电子商务销售:概览和需求驱动因素

- 北美家具市场:行业概览

- 按国家/地区(美国、加拿大、墨西哥)划分的北美最终用户价格家具消费和电子商务家具销售额

- 在线销售的家具製造商

- 在北美销售家具的领先电子商务网站:估算的电子商务销售额和电子商务总收入

第五章亚太地区的家具电子商务

- 亚太地区零售和电子商务销售:概览和需求驱动因素

- 亚太家具市场:行业概览

- 按国家/地区(澳大利亚、中国、印度、日本、韩国)划分的亚太地区按最终用户价格计算的家具消费和电子商务家具销售额

- 亚太地区销售家具的领先电子商务网站:电子商务总收入

第 6 章家具行业的电子商务:调查结果

- 公司样本

- 收益结果

- 使用电子商务

- 电子商务渠道

- 产品和促销工具

This report analyses e-commerce for the furniture industry on a global level and it is mainly divided into two parts:

PART I. E-COMMERCE FOR THE FURNITURE INDUSTRY deals with the features and the incidence of the online channel in the furniture market with a focus on key geographical areas (Europe, North America, Asia Pacific) and key countries, and analyses the different e-commerce business models and the performance of the leading players.

An overview of the world furniture industry, with current furniture consumption in large markets, introduces this part.

Trends in furniture e-commerce sales, 2022 (preliminary estimates) compared to 2019, are provided by segment (upholstered furniture, outdoor furniture, office furniture, kitchen furniture, other furniture), by geographical area and by kind of distributor (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers selling online)

The different E-commerce business models (Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms) and their evolution and organization (the omnichannel approach, the 'dynamic shopping' through a mixture of live-streaming and online shopping, and strategies and investments toward sustainable and responsible growth) are discussed in light of companies' experience.

ANALYSIS BY GEOGRAPHICAL AREAS: The furniture e-commerce business in Europe, North America, and Asia Pacific: for each considered region, the report analyses demand drivers, the online furniture market performance and sales of the leading furniture e-commerce players. E-commerce furniture sales are also provided for the most relevant markets (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom - the United States, Canada, Mexico - Australia, China, India, Japan, South Korea).

Online sales are presented for around 190 leading players based in North America, Europe, and Asia Pacific, with profiles highlighting their e-commerce policies. Profiles of the major companies are also provided. E-commerce furniture sales are provided both for European and North American companies.

PART II. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS provides results of a CSIL survey conducted in the period October-November 2022 to a sample of around 150 furniture manufacturers from all over the world, aiming at understanding their approach to the web channel, their strategies, their future expectations, and the most-demanded products in the web channel.

This survey mainly focus on:

- Companies revenues and performance

- The use of e-commerce/ Intentions to invest in e-commerce

- Features of the companies' e-commerce channels

- Products sold online, strategies and promotion tools

Highlights:

The use of e-commerce and incidence of total furniture sales, 2022.

Percentage shares on the total sample of respondents to the CSIL survey

With a +18% yearly growth in the period 2019-2022, the e-commerce furniture market has evolved rapidly in recent years, growing faster than the whole furniture market. The United States is the largest world e-commerce marketplace, with the highest penetration rate, followed by China.

The swiftly changing worldwide scenario strongly influences the e-commerce channel evolution. Following the booming performance during the pandemic, the market has been impacted by the consequences of the war in Ukraine, energy and food shortages, and strong inflationary pressures.

Also, the e-commerce competitive arena is showing some turbulence. Online sales of furniture are downgrading giving an advantage to the omnichannel retailers (brick&click) which are showing resilience to the weak market conditions, maximising physical stores' potential in combination with the virtual experience.

Selected companies mentioned:

Amazon, Ambientedirect, Anthropologie, Bygghemma Group, C Discount, Coupang, Crate and Barrel, Dunhelm, Hayneedle, Harvey Norman, Home Depot, Home 24, Ikea, Jingdong, John Lewis, Lowe's, Otto, Overstock, Pepperfry, Restoration Hardware,Suning, Tmall, Wal-Mart, Wayfair, Westwing, Williams-Sonoma.

TABLE OF CONTENTS

INTRODUCTION: Research Tools, Sample of companies, Terminology and methodological notes

EXECUTIVE SUMMARY: E-commerce for the furniture sector at a glance

1. E-COMMERCE FOR THE FURNITURE INDUSTRY

- 1.1. An overview of the furniture market: Consumption and Imports

- 1.2. E-commerce for the furniture industry: basic data

- incidence of e-commerce on total furniture consumption

- furniture consumption and e-commerce sales by geographical region

- furniture consumption and e-commerce sales by product segment (Upholstered furniture, Outdoor furniture, Kitchen furniture, Office furniture, Other furniture)

- e-commerce furniture sales by channel (E-tailers, Furniture specialists, Non-specialists/Lifestyle/DIY and Furniture manufacturers through webstores)

- 1.3. E-commerce sales performance in a sample of companies

- 1.4. Models of e-commerce business: Furniture manufacturers, Wholesalers and B2B business, E-tailers, Brick-and-Click companies, Non-furniture specialist chains, Open Platforms

2. ACTIVITY TRENDS

- 2.1. Furniture sales and e-commerce furniture sales growth

- E-commerce furniture sales by geographical region and E-commerce furniture consumption in the top 10 countries

- E-commerce furniture sales by product segment

- Online furniture distributors by category: dimension, market share and average growth

- 2.2. The business evolution and organisation: the Omnichannel approach, Dynamic shopping and Sustainability

ANALYSIS BY GEOGRAPHICAL AREA: Europe, North America, Asia Pacific

3. FURNITURE E-COMMERCE IN EUROPE

- 3.1. Retail and e-commerce sales in Europe: overview and demand drivers

- 3.2. The furniture market in Europe: Sector overview

- Furniture consumption at end-user prices in Europe and e-commerce furniture sales by country (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden, Switzerland, United Kingdom)

- 3.3. The leading e-commerce websites selling furniture in Europe: Estimated e-commerce furniture sales and Total e-commerce revenues

4. FURNITURE E-COMMERCE IN NORTH AMERICA

- 4.1. Retail and e-commerce sales in North America: overview and demand drivers

- 4.2. The furniture market in North America: Sector overview

- Furniture consumption at end-user prices in North America and e-commerce furniture sales by country (United States, Canada and Mexico)

- 4.3. Furniture manufacturers selling on-line

- 4.4. The leading e-commerce websites selling furniture in North America: Estimated e-commerce furniture sales and Total e-commerce revenues

5. FURNITURE E-COMMERCE IN ASIA PACIFIC

- 5.1. Retail and e-commerce sales in Asia Pacific: overview and demand drivers

- 5.2. The furniture market in Asia Pacific: Sector overview

- Furniture consumption at end-user prices in Asia Pacific and e-commerce furniture sales by country (Australia, China, India, Japan, South Korea)

- 5.3. The leading e-commerce websites selling furniture in Asia Pacific: Total e-commerce revenues

6. E-COMMERCE FOR THE FURNITURE INDUSTRY: SURVEY RESULTS

- 6.1. The sample of companies

- 6.2. Revenue performance

- 6.3. The use of e-commerce

- 6.4. E-commerce channels

- 6.5. Products and promotion tools