|

市场调查报告书

商品编码

1250853

越南家具业The Furniture Industry in Vietnam |

||||||

本报告对越南家具行业进行研究和分析,提供前景和预测、生产和消费数据、进出口数据、製造商概况等。

亮点

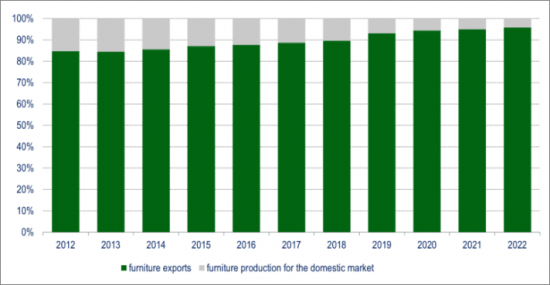

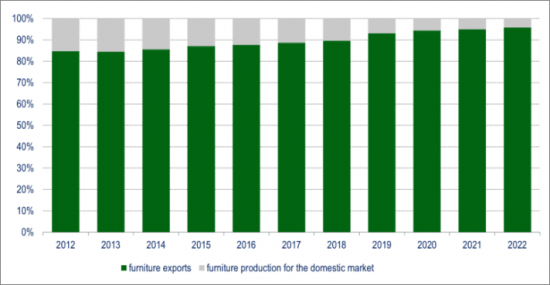

越南家具出口/生产比例(2012-2022,%)/字体>

来源:CSIL,2022:暂定

内容

第 1 章总结:越南家具行业的主要事实

第二章越南家具市场潜力

- 家具市场概览(2012-2022 年)

- 经济环境和家具市场预测(2023 年至 2024 年)

第三章营商环境指标

第 4 章需求决定因素

第五章越南家具消费

- 越南家具市场和消费趋势:按细分

第六章越南家具进口

- 家具进口增长、家具消费、进口/消费比率(按细分市场)

- 家具进口商、进口商:按细分

- 家具配件进出口

第七章越南生产要素

第八章越南家具

- 家俱生产(2012-2022 年),生产:按部门分类

第9章越南家具出口

- 家具出口增长、家俱生产、出口/生产比率(按细分市场)

- 家具出口目的地和出口:按细分

第10章越南家具竞赛制度

- 总销售额排名前 50 位的家具製造商(外国直接投资、越南独资企业)

- 在越南开展业务的主要外国家具公司

第11章越南主要家具製造商

第十二章越南的主要外国直接投资和外国公司

第十三章越南其他家具企业

附录:国家排名、家具数据、家具进出口

CSIL's Research Report ‘The furniture industry in Vietnam’ offers an up-to-date and detailed analysis of the Vietnamese furniture sector and its prospects , through tables, graphs, illustrated maps, and further information processed from direct interviews with top furniture companies and sector experts.

The Furniture market outline part provides data for furniture production, consumption, imports, and exports for the time series 2012-2022 with furniture market forecasts for 2023 and 2024.

At a supply side, the Vietnam furniture productive system is analysed through selected productive factors (forest area and resources, the structure of land by land use, consumption of wood-based panels, imports of wood-based panels, employment) and a breakdown of furniture production by segment (upholstered furniture, kitchen furniture, office furniture, bedroom, dining and living room furniture, other furniture).

The competitive system includes a ranking of the top 50 manufacturers by furniture turnover, providing detailed profiles including the following information:

- Company name

- Address, website, email, year of establishment

- Ownership and type of company (FDI, Joint Venture, Vietnamese capital)

- Activity

- Product Portfolio

- Turnover and number of employees (last available year, typically 2022 or 2021)

- Export share and key export markets

- Manufacturing facilities (number and location)

The above information is available also in the detailed profiles of the top 128 Vietnamese and FDI furniture manufacturers.

Further 140 short profiles of Vietnamese furniture companies, are provided with turnover and number of employees range.

The report overall considers a total of around 270 furniture companies.

The analysis of the Vietnamese furniture market includes:

- Selected demand determinants (population, main cities, housing floors by region and by types of house, dwelling area per capita, international tourism, expenditure per capita, income per capita and expenditure per capita by type of expenditure);

- A breakdown of furniture consumption by segment (upholstered furniture, kitchen furniture, office furniture, bedroom, dining and living room furniture, and other furniture).

- Furniture market forecasts up to 2024.

The international trade of furniture is analysed from and to Vietnam: countries of destination/origin, furniture trade by segment (upholstered furniture, non-upholstered seats, bedroom furniture, kitchen furniture, office furniture, parts of furniture, parts of seats) and furniture trade by country/area.

The study is further enriched by:

- Prospects of the furniture industry in the country;

- CSIL's assessment of market potential;

- A cross-country comparison.

CSIL's Research Report 'The furniture industry in Vietnam' is part of the Country Furniture Outlook Series, that currently covers 100 markets.

SELECTED COMPANIES

Among the selected mentioned companies: An Cuong, Bassett Furniture, Henglin Chair, HHC Corpotarion, Motomotion Vietnam, ScanCom International, Timberland, Truong Thanh Furniture, UE Furniture, Wanek Ashley Furniture.

Highlights:

Vietnam. Furniture export/production ratio, 2012-2022, %

Source: CSIL, 2022: preliminary estimate

In recent years, Vietnam has become the 6th largest furniture producer and the 2nd largest furniture exporter worldwide. Exports have been the country's furniture industry's major driver, increasing from USD 5 billion to nearly USD 20 billion during the last decade.

Vietnam has emerged not only as a hub for domestic production sourcing but also as an attractive option for offshore manufacturing for overseas companies. The number of direct foreign investment companies (FDI) is growing year after year and typically with a larger average size in terms of turnover and workforce.

Table of Contents

1. Summary: Key facts about the furniture sector in Vietnam

2. Vietnam furniture market potential

- Furniture market outline, 2012-2022

- Economic environment and furniture market forecasts, 2023-2024

3. Business climate indicators

4. Demand Determinants

5. Furniture Consumption in Vietnam

- Trends in the Vietnamese furniture market and consumption by segment

6. Vietnam furniture Imports

- Furniture imports growth, furniture consumption and imports/consumption ratio by segment

- Origin of furniture imports and imports by segment

- Imports and exports of furniture parts

7. Vietnam productive factors

8. Vietnam. Furniture Production

- Furniture production, 2012-2022 and production by segment

9. Vietnam Furniture Exports

- Furniture exports growth furniture production and exports/production ratio by segment

- Destination of furniture exports and exports by segment

10. Furniture competitive system in Vietnam

- Top 50 furniture manufacturers (FDI and Vietnamese owned companies) by total turnover.

- Major foreign furniture companies with business activity in Vietnam