|

市场调查报告书

商品编码

1522209

美国的照明设备市场The Lighting Fixtures Market in the United States |

||||||

经过两年的显着成长,美国照明灯具市场已开始放缓至 COVID-19 之前的水平。根据CSIL估计,预计2025年和2026年投资和市场扩张将强劲復苏。非住宅领域的建筑活动预计将回升,而住房领域预计将温和发展。

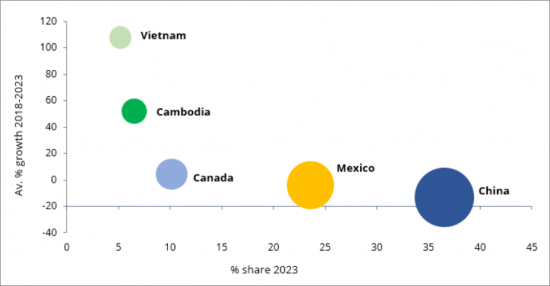

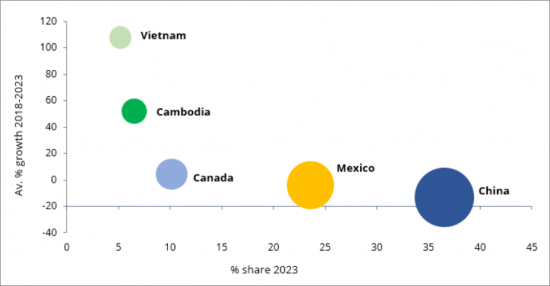

美国国内照明设备消费的大约35%是进口的,中国仍然是迄今为止最大的合作伙伴国,但从中国进口的照明设备的占有率正在逐渐减少。柬埔寨和越南是近年来最强劲的亚洲供应国。来自加拿大和墨西哥的进口也很重要。

本报告调查了美国照明灯具市场,并提供了照明灯俱生产、消费和国际贸易、主要细分市场(住宅/消费、商业、工业、户外)、目的地/规格的趋势和预测,它总结了细分:土地入驻、主要宏观经济指标及市场影响因素分析、竞争状况、公司占有率等多种类别。

主要企业

Acuity Brands,Artemide,Cree Lighting,Current,Fagerhult,Flos,Home Depot,Kichler,Leedarson,Ledvance,Lowe's,LSI Industries,Lumenpulse,RAB Lighting,Satco,Signify,Tospo,Wac Lighting,Yankon,Zumtobel

亮点:

美国:照明设备进口前五名公司

市场规模 (100万美元)·年平均变化率 (2018~2023年)·2023年的占有率

出处:CSIL

目录(概要)

调查手法,调查工具,用语

摘要整理:美国的照明产业概要

第1章 情势:美国的照明产业,基本资料和趋势

- 照明市场演进和市场区隔

- 美国的主要群组和那个市场占有率

- 企业资料:关联的M&A·契约

第2章 美国的照明设备市场业绩·预测

- 目前趋势与预测:2024年·2025年·2026年

- 价格趋势

第3章 照明设备的国际贸易

- 照明设备的进出口趋势:各国·目的地/进货地

- 美国企业的照明设备出口

- 对中国企业的美国的照明设备的出口

第4章 美国的照明设备:市场结构

- 市场区隔,产品,用途

- 住宅照明:风格·各产品的销售额明细

- 商业用照明:产品·目的地的销售额明细

- 产业用照明:产品·目的地的销售额明细

- 室外照明:产品·目的地的销售额明细

- 各市场区隔预测

- LED照明

- 智慧连网型照明

- 照明控制·通讯协定

- 连网型应用

第5章 流通管道

- 美国的照明设备的流通:概要

- 契约,计划,建设业者

- 照明的专家

- 家具连锁,家具店,百货商店

- 贩卖代理店及代理店

- DIY·家居装修及园艺中心

- 电子商务

- 照明设备的各区域销售额

- 杂誌

- 博览会

- 产业团体

第6章 竞争:各用途的企业占有率

- 主要企业:美国市场的照明设备的销售

- 美国的竞争系统:市场部门别 (住宅/消费者室内,饭店,办公室,零售,艺术会场,娱乐,基础设施,工业厂房,危险条件,海洋,医疗保健,紧急,园艺,住宅室外,城市形势,马路,隧道,圣诞节,区域照明)

第7章 需求决定要素

- 主要的宏观经济指标·社会趋势·建筑活动的主要资料

附录

The CSIL Report 'The lighting fixtures market in the United States', which is now in its 18th edition, provides a detailed analysis of the lighting fixtures industry in the Country and it is structured as follows:

Chapter 1. Scenario presents an overview of the US lighting fixtures sector through tables and graphs, data on lighting fixtures production, consumption, and international trade are analysed, highlighting the main market segments for lighting fixtures: residential/consumer, commercial, industrial, and outdoor.

A panorama of the leading North American groups and their market shares is also provided.

Chapter 2. Business performance offers lighting fixtures statistics and the main macroeconomic indicators necessary to analyse the performance of the sector for the last 6 years (2018-2023). The chapter closes with the lighting fixtures consumption forecasts for the years 2024 and 2025-2026.

Chapter 3. International trade provides an overview of the international trade of lighting fixtures exports and imports in the United States, for the last 6 years.

Chapter 4. Market structure offers an analysis of the lighting fixtures market by segments and applications (Residential-consumer, architectural-commercial, industrial, outdoor lighting), by types of products manufactured, by light sources used by the North American lighting fixtures manufacturers and an overview on new technologies.

Chapter 5. Distribution channels gives an overview of the main distribution channels active on the North American lighting fixtures market through tables showing the breakdown of lighting fixtures sales by distribution channel for most of the leading companies and largest markets. It also provides an estimation of the lighting fixtures breakdown by States.

Chapter 6. Competitive System offers an insight into the leading local and foreign players present in each segment and in each market. Through detailed tables sales data and market shares of the top lighting fixtures companies are shown, and short profiles of the main players are also available.

Chapter 7. Demand Drivers offers the main macroeconomic indicators, social trends, and economic forecasts necessary to analyse the performance of the sector; in addition, a focus on building activities in the country is also provided.

Annex 1: List of top Retail Design Firms, selected lighting stores, and home improvement stores in a sample of US cities.

Annex 2: Directory of lighting companies mentioned in this report.

Selected companies

Among the considered companies: Acuity Brands, Artemide, Cree Lighting, Current, Fagerhult, Flos, Home Depot, Kichler, Leedarson, Ledvance, Lowe's, LSI Industries, Lumenpulse, RAB Lighting, Satco, Signify, Tospo, Wac Lighting, Yankon, Zumtobel.

Highlights:

United States. Top 5 lighting fixtures importers.

Market size (US$ Million), average percentage change

per year 2018-2023 and % share 2023

Source: CSIL

After two years of significant growth, the US lighting fixtures market started to slow back to pre-pandemic levels. According to CSIL estimates, market expansion is expected in 2025 and 2026 as investments will recover significantly. Construction activity is expected to be vigorous in the non-residential segment, while residential buildings will develop moderately.

Imports account for about 35% of domestic consumption of lighting fixtures in the United States, and China remains by far the largest partner, although lighting fixtures imports from this country are progressively losing share. Cambodia and Vietnam are the two best-performing Asian supplying countries in recent years. Imports from Canada and Mexico are also relevant.

Table of Contents (SUMMARY)

Methodology, Research Tools and Terminology

Executive Summary. The US lighting sector at a glance

1. Scenario: The lighting industry in the US, basic data and trends

- 1.1. Lighting Market evolution and market segments

- 1.2. Leading groups in the United States and their market shares

- 1.3. Company facts: relevant mergers, acquisitions and agreements

2. Business performance and forecasts in the US lighting fixtures market

- 2.1. Current trends and forecasts 2024, 2025 and 2026

- 2.2. Price trends

3. International trade of lighting fixtures

- 3.1. Exports and imports of lighting fixtures by country and by geographical area of destination/origin

- 3.2. Lighting fixtures exports of US companies

- 3.3. Chinese companies exporting lighting fixtures to the United States

4. Lighting Fixtures in the US: Market structure

- 4.1. Market segments, products and applications

- 4.1.1. Residential lighting: sales breakdown by style and products

- 4.1.2. Commercial lighting: sales breakdown by products and destinations

- 4.1.3. Industrial lighting: sales breakdown by products and destinations

- 4.1.4. Outdoor lighting: sales breakdown by products and destinations

- 4.2. Forecasts by segment

- 4.3. LED lighting

- 4.4. Smart connected lighting

- 4.5. Lighting controls and protocols

- 4.6. Connected applications

5. Distribution channels

- 5.1. Overview of lighting fixtures distribution in the US

- 5.1.1. Contract, Projects and Builders

- 5.1.2. Lighting specialists

- 5.1.3. Furniture chains, furniture stores, department stores

- 5.1.4. Distributors and Reps

- 5.1.5. DIY and Home Centers

- 5.1.6. E-commerce

- 5.2. Sales of lighting fixtures by geographical area

- 5.3. Magazines

- 5.4. Fairs

- 5.5. Trade Associations

6. Competition: company market shares by application

- 6.1. Top players. Lighting fixtures sales on the US market

- 6.2. The US competitive system by market segment (Residential/consumer indoor, Hospitality, Office, Retail, Art venues, Entertainment, Infrastructures, Industrial plants, Hazardous conditions, Marine, Healthcare, Emergency, Horticulture, Residential outdoor, Urban Landscape, Street, Tunnel, Christmas, and Area Lighting)

7. Demand determinants

- Selected macroeconomic indicators, social trends and building activity key data.

Annexes

- Annex 1: Selected retail design firms, lighting fixtures stores and home improvement stores in a sample of US cities.

- Annex 2: List of mentioned lighting companies