|

市场调查报告书

商品编码

1814238

亚太地区的办公室家具市场The Office Furniture Market in Asia and the Pacific |

|||||||

本报告重点在于10个市场:澳洲、中国、印度、日本、马来西亚、新加坡、韩国、中国台湾、泰国和越南。报告提供了全面的概述,包括关键趋势、生产和消费数据、国际贸易数据以及2025年和2026年办公家具需求预测。报告还介绍了主要的製造商和公司,并按细分市场对办公家具行业进行了分析。

|

|

办公室家具的供给系统与产品市场区隔

亚太地区及特定国家/地区(澳洲、中国、印度、日本、韩国)办公家具主要细分领域的生产与消费:

|

|

特别关注以下领域产品:

- 办公座椅:按类型和内装划分的产量明细,部分样本公司的座椅类型明细,以及各国办公家具(不包括办公座椅和椅子)的生产和消费数据。

- 办公桌和高度可调办公桌 (HAT):亚太地区高度可调办公桌在办公桌总产量中的占比;澳大利亚、中国、印度、日本和韩国的占有率和产值;按机械类型划分的高度可调办公桌分类;部分样本公司的固定办公桌和高度可调办公桌的供应明细。

- 隔间、隔音舱和电话亭:按细分市场和类型划分的隔间、隔音舱和电话亭产量;澳大利亚、中国、印度、日本和韩国按类型(单层、双层、多层)划分的电话亭和隔音舱的预估产量和明细。

主要企业

调查对象企业:

|

|

|

亮点

亚太地区:办公室家具贸易收支

2019-2024年·美金 (一百万)

儘管近期国际局势紧张,贸易保护主义措施频繁,但亚太地区办公家具贸易顺差持续成长。这一成长主要由中国和越南推动,不同产品领域的趋势有所不同。

就消费而言,中国、印度和日本是最大的办公家具市场。其中,印度已稳步成为该地区最具活力的市场之一,预计将超过整个地区的平均预期成长率。

目录 (摘要)

调查手法

摘要整理

第1章 Scenario

- 亚太地区的办公室家具市场:各国的趋势和资料

- 办公家具基础与市场开放度

- 主要国家办公家俱生产价格

- 各国办公家俱生产、消费、进出口状况

- 亚太办公家具市场:发展与展望

- 宏观经济指标

- 各国办公家具消费预测

- 亚太主要集团及其市场占有率

- 亚太地区最大办公家具企业概览公司

第2章 事业实际成果

- 澳洲

- 中国

- 印度

- 日本

- 马来西亚

- 新加坡

- 韩国

- 台湾 (中国)

- 泰国

- 越南

关于各对象国:

- 办公室家具的生产,消费,国际贸易

- 除去宏观经济指标及预测 (不包括台湾)

第3章 办公室家具的国际贸易

- 贸易收支:市场区隔·各国

- 办公室家具的出口

- 办公室家具出口前5个国家

- 办公室家具的出口 (各市场区隔·各国)

- 办公室家具的出口:各出口对象

- 办公室家具进口

- 办公室家具进口前5个国家

- 办公室家具的进口 (各市场区隔·各国)

- 办公室家具的进口:不同供应商

第4章 供应结构:办公家具产品细分及趋势

- 产品细分(办公座椅、办公桌、行政家具、文件系统、墙壁、隔间、隔音产品、电话亭和隔音舱以及公共区域家具)

- 办公家具产量:按细分市场)

- 按国家/地区划分的办公座椅和办公家俱生产和消费

- 部分国家(澳洲、中国、印度、日本和韩国)的细分市场

办公室座位

- 生产明细:各类型·填补

- 所选公司样本的座椅供应情况:依类型划分

办公室办公桌与升降式办公桌 (HAT)

- 按主要国家/地区划分的 HAT 在办公桌总产量中的百分比;主要国家/地区(澳洲、中国、印度、日本和韩国)的 HAT 产量和占有率

- 高度可调办公桌:以机制划分

- 所选公司样本的固定办公桌和 HAT 供应情况

隔间、隔音产品与电话亭/电话间

- 隔间、隔音产品及电话亭/电话间製造

- 隔间与隔音产品生产:依细分市场划分

- 主要国家(澳洲、中国、印度、日本和韩国)

- 电话亭和隔音舱细分:按类型

第5章 亚太地区的办公室家具的流通

- 办公室家具的流通管道

第6章 企业占有率:各产品

各市场区隔企业销售额及市场占有率:

- 办公座椅

- 办公桌

- 行政家具

- 檔案系统

- 墙壁、房间隔间和隔音设备

- 电话亭与隔音舱

- 公共区域家具

第7章 企业占有率:各国

各国竞争情形:

- 澳洲

- 中国

- 印度

- 日本

- 马来西亚

- 新加坡

- 韩国

- 台湾 (中国)

- 泰国

- 越南

附录1:国际贸易表

附录2:提及的公司名单

The CSIL Market Research Report 'The Office Furniture Market in Asia and the Pacific' offers a comprehensive overview with a focus on ten countries (Australia, China, India, Japan, Malaysia, Singapore, South Korea, Taiwan-China, Thailand, and Vietnam), including key trends, production and consumption figures, international trade data, and forecasts for the office furniture demand in 2025 and 2026. It also highlights the leading manufacturers and players and analyses the office furniture sector by sub-segment.

ASIA PACIFIC: OFFICE FURNITURE MARKET OVERVIEW

The first section offers basic data on production, consumption, and international trade of office furniture, in Asia and the Pacific and by country, highlighting trade dynamics, market openness and prices.

OFFICE FURNITURE MARKET TRENDS AND FORECASTS FOR 2025-2026

Looking ahead, the report outlines expected market developments according to CSIL, with forecasts for office furniture consumption in 2025 and 2026. Factors influencing the market include macroeconomic trends and workplace transformations.

LEADING GROUPS IN ASIA AND THE PACIFIC AND THEIR MARKET SHARES

The competitive environment and the leading office furniture manufacturers operating in the Asia-Pacific market are outlined through information on their performance, the market concentration and the latest M&A operations.

BUSINESS PERFORMANCE: OFFICE FURNITURE MARKET IN THE ASIA PACIFIC COUNTRIES

Production, consumption, international trade of office furniture for the years 2019-2024, macroeconomic indicators and office furniture market forecasts 2025-2026 for:

|

|

OFFICE FURNITURE TRADE DYNAMICS: EXPORTS AND IMPORTS

This section provides a deep look at key export and import flows, identifying the main importers and exporters of office furniture in the area, with trade partners.

OFFICE FURNITURE SUPPLY SYSTEM AND PRODUCT SEGMENTS

Production and consumption of office furniture in the Asia Pacific and for selected countries (Australia, China, India, Japan, and South Korea) are provided for the main sub-segments:

|

|

A special focus is provided for:

- Office seating: Breakdown of office seating production by type and by covering, and seating breakdown by type in a sample of companies. Production and consumption of office seating / office furniture excluding seating, are also provided by country.

- Office desking & Height-Adjustable Desks (HAT): Incidence of HAT on total desk production in the Asia Pacific, with incidence and production value also for Australia, China, India, Japan, and South Korea; Height Adjustable Tables by kind of mechanism; Breakdown of desking supply between fixed and HAT in a sample of companies

- Partitions, Acoustic Pods & Phone Booths: Production of partitions, acoustic pods, and phone booths in Asia Pacific, by segment, by kind; production of phone booths and acoustic pods for Australia, China, India, Japan, and South Korea and estimates of breakdown by type (single, double, multiple)

DISTRIBUTION OF OFFICE FURNITURE IN THE ASIA PACIFIC

The report analyses the structure of the distribution landscape in the Asia Pacific region through the evolution of distribution channels:

- Direct sales

- Indirect sales (specialist dealers, non-specialist dealers, e-commerce)

The incidence of the distribution channels is also provided for Australia, China, India, Japan, and South Korea.

COMPETITION IN THE ASIA PACIFIC OFFICE FURNITURE MARKET: LEADING MANUFACTURERS AND MARKET SHARES BY PRODUCT AND BY COUNTRY

In this section, the report analyses the key players in the office furniture market with an overview of market shares and data for office seating, desking, executive, storage, walls/partitions, acoustic pods/phone booths, and communal furniture.

Finally, the report outlines the office furniture market competitive landscape across the Asia Pacific region, exploring the largest players in Australia, China, India, Japan, Malaysia, Singapore, South Korea, Taiwan (China), Thailand, and Vietnam, with selected company profiles.

A list of around 165 of the most important players operating in the office furniture sector in the Asia Pacific completes the research.

THIS REPORT OFFERS AN IN-DEPTH ANALYSIS WHICH HELPS TO RESPOND TO THE FOLLOWING QUESTIONS:

- 1. What is the current size and structure of the office furniture market in Asia and the Pacific?

- 2. Which are the top and fastest-growing office furniture markets in the Asia-Pacific region?

- 3. What are the key trends driving the office furniture market in Asia and the Pacific?

- 4. What are the office furniture demand forecasts for 2025 and 2026 in Asia-Pacific countries?

- 5. Which are the leading office furniture manufacturers in Asia and the Pacific?

- 6. What are the main import and export flows of office furniture in the Asia-Pacific region?

- 7. What product segments make up the office furniture market in Asia-Pacific?

- 8. How is the distribution of office furniture structured in the Asia Pacific region?

Selected companies

Among the largest companies analysed in this study:

|

|

|

Highlights:

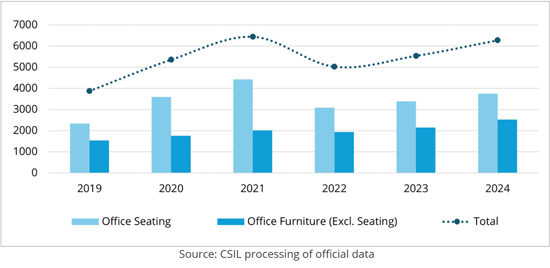

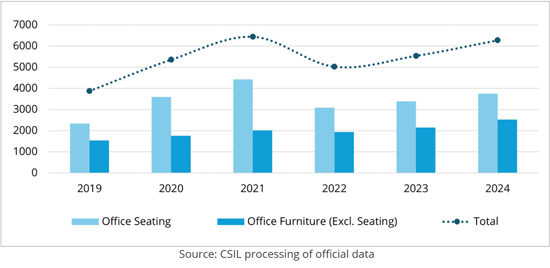

Asia-Pacific. Office Furniture Trade Balance.

Seating/Office furniture excluding seating.

2019-2024. US$ Million

According to CSIL, the office furniture trade balance in Asia-Pacific has continued to show a growing surplus despite international tensions and protectionist measures implemented in recent years. This growth is mainly supported by China and Vietnam, with varying trends corresponding to different product segments.

On the consumption side, the largest office furniture markets are China, India, and Japan. Among them, India is steadily emerging as one of the most dynamic ones in the area, projected to exceed the average forecasted growth for the whole region.

TABLE OF CONTENTS (ABSTRACT)

METHODOLOGY

- Research tools, geographical area, samples and notes

EXECUTIVE SUMMARY

- The office furniture market in Asia Pacific

1. SCENARIO

- 1.1. The Asia Pacific Office Furniture Market: Evolution and figures by country

- Office furniture basic data and market openness

- Producer prices for office furniture in the main countries

- Production, consumption, imports, and exports of office furniture by country

- 1.2. Office Furniture Market in Asia Pacific: Development and perspectives

- Macroeconomic indicators

- Office furniture consumption by country. Forecasts, 2025-2026

- 1.3. Leading groups in Asia-Pacific and their market shares

- Overview of the largest Office Furniture companies in the Asia Pacific

2. BUSINESS PERFORMANCE:

- Australia

- China

- India

- Japan

- Malaysia

- Singapore

- South Korea

- Taiwan (China)

- Thailand

- Vietnam

For each considered country:

- Production, consumption, international trade of office furniture, 2019-2024

- Macroeconomic indicators. Forecasts, 2025-2026 (except Taiwan)

3. INTERNATIONAL TRADE OF OFFICE FURNITURE

- 3.1. Trade balance by segment and by country

- 3.2. Asia Pacific. Exports of office furniture 2019-2024

- Top five exporters of office furniture in Asia Pacific

- Exports of office furniture by segment and by country

- Office furniture Exports by destination (Office seating and Office furniture excluding seating)

- 3.3. Imports of office furniture, 2019-2024

- Top five importers of office furniture in Asia Pacific

- Imports of office furniture by segment and by country

- Office furniture. Imports by origin (Office seating and Office furniture excluding seating)

4. THE SUPPLY STRUCTURE: OFFICE FURNITURE PRODUCT SEGMENTS AND TRENDS

- 4.1. Product segments (Office seating, Office desking, Executive furniture, Filing systems, Walls, partitions and acoustic, Phone booths and acoustic pods, Furniture for communal areas)

- Office furniture production in Asia Pacific by segment, 2019-2024

- Office seating and office furniture, excluding seating. Production and consumption by country

- Office furniture segments breakdown for selected countries (Australia, China, India, Japan, and South Korea)

Office seating

- Breakdown of office seating production by type and by covering

- Seating supply by type in a sample of companies

Office desking & Height-Adjustable Desks (HAT)

- Incidence of HAT on total desk production in the Asia Pacific and HAT production and incidence in selected countries (Australia, China, India, Japan, and South Korea)

- Height Adjustable Tables by kind of mechanism

- Breakdown of desking supply between fixed and HAT in a sample of companies

Partitions, Acoustic Products, and Phone Booths/Pods

- Production of partitions, acoustic products, phone booths/pods in the Asia Pacific

- Production of partitions, acoustic products by segment

- Phone booths and acoustic pods production in selected countries (Australia, China, India, Japan, and South Korea)

- Breakdown of phone booths and acoustic pods by kind

5. DISTRIBUTION OF OFFICE FURNITURE IN ASIA PACIFIC

- 5.1. Office Furniture Distribution Channels

- Evolution of distribution channels 2020-2024

- Incidence of the distribution channels in the major markets (Australia, China, India, Japan, and South Korea)

6. COMPANY MARKET SHARES BY PRODUCT

Total sales of office furniture by the largest office furniture companies in the Asia Pacific

Company sales and market shares by segment:

- Office seating

- Office desking

- Executive furniture

- Filing systems

- Walls, partitions and acoustic

- Phone booths and acoustic pods

- Furniture for communal areas

7. COMPANY MARKET SHARES BY COUNTRY

Competition by country:

- Australia

- China

- India

- Japan

- Malaysia

- Singapore

- South Korea

- Taiwan (China)

- Thailand

- Vietnam