|

市场调查报告书

商品编码

1773251

家庭办公家具市场机会、成长动力、产业趋势分析及2025-2034年预测Home Office Furniture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

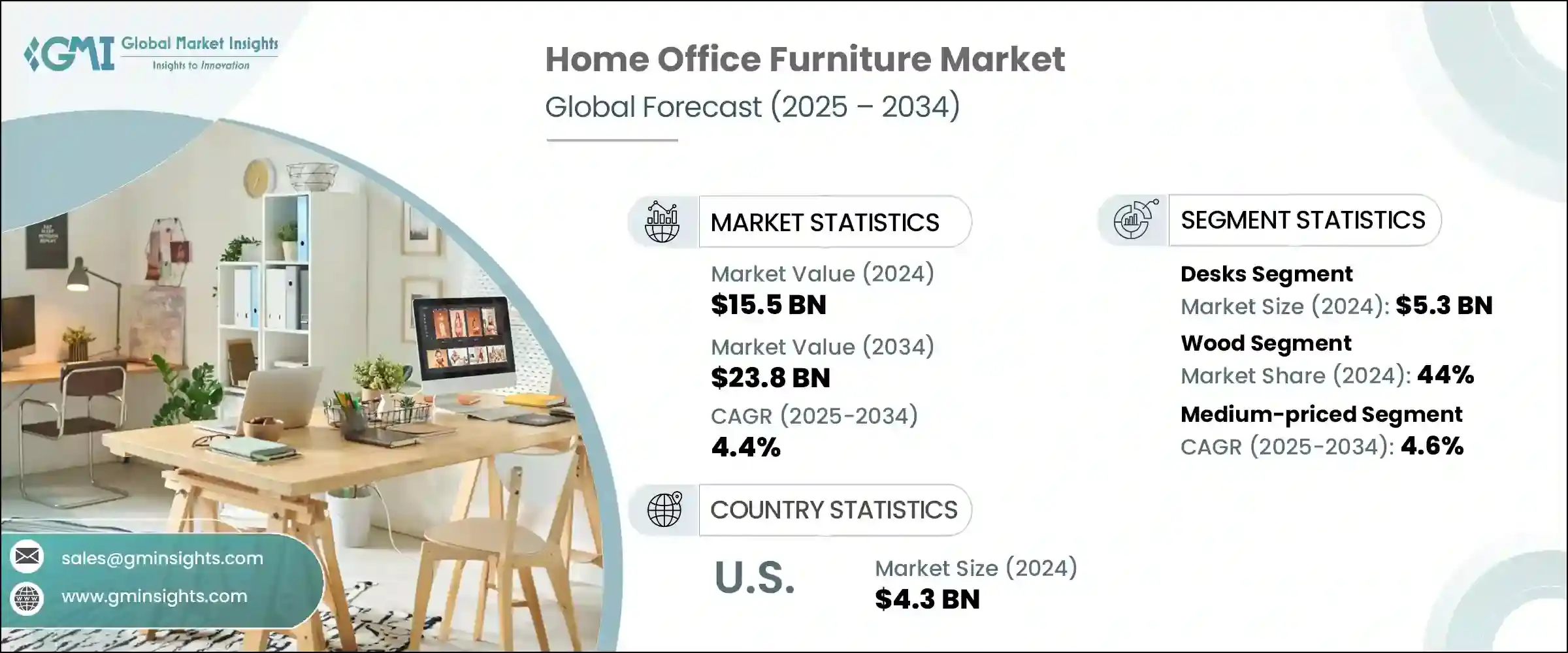

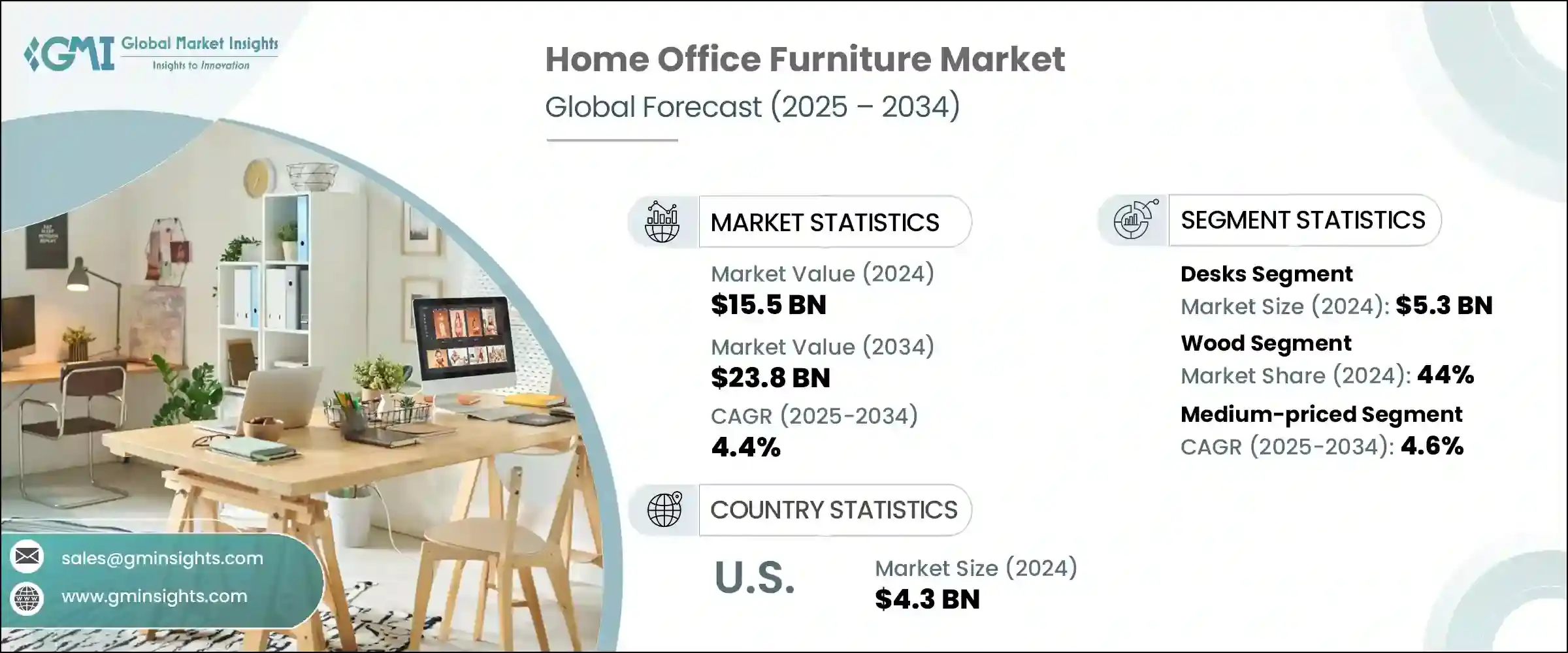

2024 年全球家庭办公家具市场价值为 155 亿美元,预计到 2034 年将以 4.4% 的复合年增长率增长至 238 亿美元。主要成长催化剂包括向远距办公的广泛转变和持续的城市生活趋势,这增加了对紧凑型多功能家庭办公室设置的需求。随着美国和德国等国家越来越多的专业人士转向混合或完全远端工作,对功能性、人体工学和时尚的办公家具的需求持续增长。城市住房占地面积的缩小进一步加速了对模组化和节省空间的办公家具的需求。随着设计不断发展以满足不断变化的生活水平,消费者对兼具美观与可用性的选择的兴趣日益浓厚。虽然这种趋势支持市场扩张,但原材料价格上涨和森林砍伐导致的木材短缺正在给利润带来压力。

不断变化的消费者品味也带来了挑战,他们的需求转向适应性强、舒适且可持续的家庭办公室解决方案,以支持灵活的工作习惯。随着远距办公和混合办公成为日常生活的常态,使用者正在寻求能够无缝融入生活空间且不影响表现的多功能家具。人们对符合人体工学的设计越来越感兴趣,这些设计有利于身心健康,包括腰部支撑、可调节高度和整合技术增强等功能。美感偏好也发生了变化,人们更青睐简约、模组化的风格,既能体现个人品味,又能兼顾功能性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 155亿美元 |

| 预测值 | 238亿美元 |

| 复合年增长率 | 4.4% |

2024年,办公桌市场规模达53亿美元,预计到2034年将以4.5%的复合年增长率成长。办公桌的崛起源于全球居家办公模式的普及以及人们对共享办公环境日益增长的偏好。现代办公桌具备可调节高度和模组化附加组件等功能,可提升舒适度和效率。此外,人工智慧办公桌等新兴创新技术也日益受到青睐。这些智慧型系统可以根据用户活动调整办公桌设置,连接多种设备,并整合无线充电板和智慧感测器等技术,可优化性能并即时追踪人体工学。

2024年,木製家具市场占据44%的市场份额,预计到2034年将以4.8%的复合年增长率成长。木材因其耐用性、美观度以及与各种室内风格的相容性,仍然是人们青睐的材料。具有环保意识的消费者越来越多地选择再生木材和再生金属,其中约40%的人在购买决策中寻求永续材料。设计趋势正在演变,融入柔和圆润的元素,营造宁静宜人的工作空间。灵活的家具可以重新布置或实现多种功能(例如从办公桌变成餐桌),因其在节省空间的同时又不影响风格或功能而越来越受欢迎。

美国家庭办公家具市场占77%的市场份额,2024年市场规模达43亿美元。这一领先地位主要归功于混合办公和远距办公模式的兴起、消费者对个人化家庭办公室配置日益增长的兴趣以及强劲的购买力。美国买家愿意投资高品质、科技整合的家具解决方案,以满足舒适性、性能和耐用性的需求。与许多其他地区价格敏感度会抑制创新不同,美国市场的需求促使製造商开发专门针对远距办公文化的先进产品。

家庭办公家具市场的领导者包括 Knoll、Kokuyo、Product Depot International、Godrej Interio、HON、Williams-Sonoma、Sunon Furniture、La-Z-Boy、Steelcase、Vitra International、Haworth、Humanscale、Virco、Herman Miller 和 HNI Corporation。为了增强市场韧性并扩大影响力,家庭办公家具公司正专注于多种策略。这些措施包括引入模组化和人体工学设计,以适应不同的工作方式和空间限制。许多公司正在将智慧技术融入其产品线,实现无线充电、坐站自动化和数位健康追踪等功能。永续性仍然是一个主要关注点,公司采用再生材料并促进对环境负责的采购。此外,强大的全通路零售策略,包括沉浸式线上体验和虚拟房间规划器,正在帮助品牌更有效地吸引客户。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 机会

- 成长潜力分析

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 依产品类型

- 监理框架

- 标准和认证

- 环境法规

- 进出口法规

- 波特五力分析

- PESTEL分析

- 消费者行为分析

- 购买模式

- 偏好分析

- 消费者行为的区域差异

- 电子商务对购买决策的影响

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 书桌

- 椅子

- 置物柜和橱柜

- 表格

- 配件

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 木头

- 金属

- 玻璃

- 塑胶

- 其他(布料等)

第七章:市场估计与预测:按价格,2021 - 2034 年

- 主要趋势

- 低的

- 中等的

- 高的

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市/大卖场

- 专业零售店

- 其他(独立零售商等)

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Godrej Interio

- Haworth

- Herman Miller

- HNI Corporation

- HON

- Humanscale

- Knoll

- Kokuyo

- La-Z-Boy

- Product Depot International

- Steelcase

- Sunon Furniture

- Virco

- Vitra International

- Williams-Sonoma

The Global Home Office Furniture Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 23.8 billion by 2034. Key growth catalysts include the widespread shift toward remote working and the ongoing trend of urban living, which increases demand for compact and versatile home office setups. As more professionals in countries like the United States and Germany transition to hybrid or fully remote roles, the demand for functional, ergonomic, and stylish workspace furniture continues to rise. Shrinking urban housing footprints further accelerate the demand for modular and space-saving office furniture. As designs evolve to meet changing living standards, consumer interest grows in options that blend aesthetics with usability. While this trend supports market expansion, rising raw material prices and deforestation-induced timber shortages are putting pressure on margins.

Evolving consumer tastes also present challenges, with demand shifting toward adaptable, comfortable, and sustainable home office solutions that support flexible work habits. As remote and hybrid work become permanent fixtures in daily life, users are seeking multifunctional furniture that blends seamlessly into living spaces without compromising on performance. There's growing interest in ergonomic designs that promote health and well-being, including features like lumbar support, adjustable heights, and integrated tech enhancements. Aesthetic preferences have also changed, favoring minimalistic, modular styles that reflect personal taste while offering functionality.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $23.8 Billion |

| CAGR | 4.4% |

The desks segment generated USD 5.3 billion in 2024 and is expected to grow at a CAGR of 4.5% through 2034. Their prominence stems from the global adoption of work-from-home arrangements and the growing preference for co-working-style environments. Modern desks offer features like adjustable heights and modular add-ons, enhancing both comfort and efficiency. In addition, emerging innovations such as AI-enabled desks are gaining traction. These intelligent systems can adjust desk settings based on user activity, connect with multiple devices, and include integrated technology like wireless charging pads and smart sensors that optimize performance and track ergonomics in real time.

In 2024, the wood furniture segment held a 44% share and is anticipated to grow at a CAGR of 4.8% through 2034. Wood remains a preferred material due to its durability, aesthetic appeal, and adaptability across various interior styles. Eco-conscious customers are increasingly choosing reclaimed wood and recycled metals, with approximately 40% of them seeking sustainable materials in their purchasing decisions. Design trends are evolving to incorporate soft, rounded features that foster calm and inviting workspaces. Flexible furniture pieces that can be rearranged or serve multiple functions-such as transforming from a work desk into a dining table-are gaining popularity for their ability to conserve space without compromising style or functionality.

United States Home Office Furniture Market held a 77% share and generated USD 4.3 billion in 2024. This leadership position is largely attributed to the rise of hybrid and remote work models, growing consumer interest in personalized home office setups, and robust purchasing power. US buyers are willing to invest in high-quality, tech-integrated furniture solutions that cater to comfort, performance, and longevity. Unlike many other regions where price sensitivity can curb innovation, the US market demand has propelled manufacturers to develop advanced offerings tailored specifically to the remote work culture.

Leading players in the Home Office Furniture Market include Knoll, Kokuyo, Product Depot International, Godrej Interio, HON, Williams-Sonoma, Sunon Furniture, La-Z-Boy, Steelcase, Vitra International, Haworth, Humanscale, Virco, Herman Miller, and HNI Corporation. To build market resilience and expand their footprint, home office furniture companies are focusing on multiple strategies. These include introducing modular and ergonomic designs that accommodate diverse work styles and spatial constraints. Many firms are integrating smart technology into their product lines, enabling features such as wireless charging, sit-stand automation, and digital health tracking. Sustainability remains a major focus, with companies incorporating recycled materials and promoting environmentally responsible sourcing. In addition, strong omnichannel retail strategies, including immersive online experiences and virtual room planners, are helping brands engage customers more effectively.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Price

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Middle East and Africa

- 4.2.1.5 Latin America

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Desks

- 5.3 Chairs

- 5.4 Storage units & cabinets

- 5.5 Tables

- 5.6 Accessories

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Wood

- 6.3 Metal

- 6.4 Glass

- 6.5 Plastic

- 6.6 Others (fabrics etc.)

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company websites

- 8.3 Offline

- 8.3.1 Supermarkets/hypermarket

- 8.3.2 Specialty retail stores

- 8.3.3 Others (independent retailer etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Godrej Interio

- 10.2 Haworth

- 10.3 Herman Miller

- 10.4 HNI Corporation

- 10.5 HON

- 10.6 Humanscale

- 10.7 Knoll

- 10.8 Kokuyo

- 10.9 La-Z-Boy

- 10.10 Product Depot International

- 10.11 Steelcase

- 10.12 Sunon Furniture

- 10.13 Virco

- 10.14 Vitra International

- 10.15 Williams-Sonoma