|

市场调查报告书

商品编码

1894893

欧洲床垫零售市场Mattress Retailing in Europe |

||||||

本报告对欧洲床垫零售市场进行了全面分析。报告探讨了市场发展(历史数据和预测)、宏观经济指标、国际贸易趋势、零售结构以及主要零售商和製造商,并重点关注欧洲十大市场和其他相关国家的基本数据。

本报告旨在支援策略决策,并解答以下关键问题:

- 欧洲床垫市场有哪些商机?

- 欧洲床垫零售市场的当前规模和未来趋势如何?

- 哪些国家在欧洲床垫市场处于领先地位并维持成长?

- 欧洲床垫的通路分销结构如何?

- 欧洲床垫电子商务的现况如何?

- 欧洲领先的床垫零售商和製造商有哪些?

- 不同价格区间的竞争格局如何改变?

- 进口床垫的主要来源是什么?

- 床垫品牌在定价和填充材料方面如何定位自己?

- 2026 年和 2027 年欧洲床垫市场有哪些发展趋势?

主要特点:

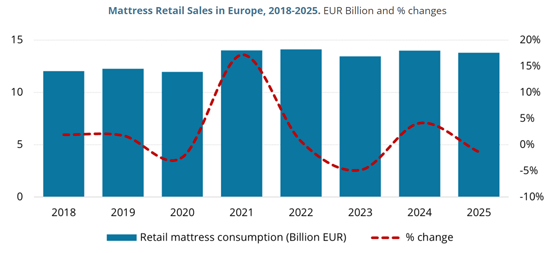

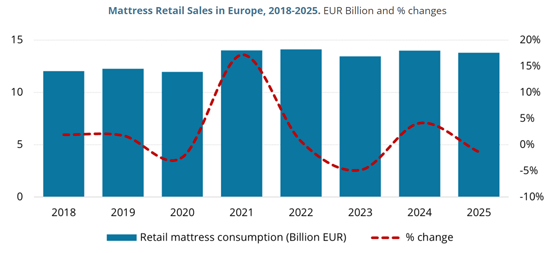

欧洲床垫市场仍是全球最大的市场之一,约占全球消费量的 15%。以零售价计算,该市场规模估计约 140 亿欧元,目前已超过疫情前的水准。儘管存在持续的不确定性,但预计欧洲在中期内仍将是一个具有重要战略意义的地区。作为一个规模庞大且相对稳定的市场,以及多元化出口的重要目的地,欧洲正吸引欧洲製造商和寻求重新平衡其国际销售组合的国际公司的注意。

历史上,欧盟市场从非欧盟国家进口的床垫数量一直非常有限。虽然该市场仍然高度依赖欧洲本土生产,但近年来这种情况正在改变。在主要市场中,德国和英国的非欧盟供应商进口渗透率最高。同时,法国、义大利和西班牙的非欧盟供应商进口渗透率则显着较低(通常低于5%),这显示这些国家的竞争环境更加稳定,结构也更加一体化。

目录

研究方法

摘要整理

- 主要亮点与市场洞察

第一章情境分析

欧洲床垫零售市场发展—国家数据

- 欧洲:床垫零售额

- 床垫消费量

- 价格趋势

- 各国床垫销售

宏观经济状况

- 宏观经济指标

- 私人最终消费支出

- 人均GDP

- 各行业建筑投资

床垫市场预测

进口渗透率

- 国内床垫生产与非欧盟进口

- 按地区划分的床垫进口构成

- 主要非欧洲供应商

- 在欧盟主要市场与非欧盟国家的竞争

非欧盟进口床垫的特点

- 主要供应商的价格和填充物构成

第二章 床垫零售通路

专业零售商组成

零售通路趋势

- 欧洲及各国依零售通路划分的床垫消费量

- 欧洲主要床垫零售商及其市场占有率

- 市场集中度

- 顶级床垫零售商

- 併购交易2019-2025

主要床垫零售商简介

第三章 市场竞争

欧盟市场中的欧洲床垫製造商和外国公司

- 欧盟市场主要床垫製造商的销售和市场占有率

依价格区间划分的床垫市场

床垫品牌定位

- 以价格区间划分的床垫品牌定位

- 主要零售商以填充物划分的床垫价格

第四章 欧洲床垫零售市场:前十大国家

涵盖国家:比利时、法国、德国、义大利、荷兰、波兰、西班牙、瑞典、瑞士和美国

- 零售额及与欧洲平均的比较

- 宏观经济指标

- 床垫消费预测

- 床垫进口及主要目的地

- 依零售通路划分的床垫消费量

- 主要床垫零售商及业绩

- 以价格划分的品牌定位

第五章:其他国家基本资料:奥地利、保加利亚、克罗埃西亚、捷克、丹麦、爱沙尼亚、芬兰、希腊、匈牙利、爱尔兰、拉脱维亚、立陶宛、挪威、葡萄牙、罗马尼亚和斯洛伐克

- 床垫零售额

- 宏观经济指标

- 床垫消费预测

- 床垫进口及主要目的地

CSIL's Research Report, Mattress Retailing in Europe, offers a comprehensive analysis of the European mattress retail market, exploring market evolution -historical data and forecasts- macroeconomic indicators, international trade dynamics, retail structure, the leading retailers and manufacturers, with a focus on the top 10 European mattress markets and basic data for further relevant countries.

RESEARCH FEATURES AND STRUCTURE

The report is based on CSIL's long-standing expertise in Mattress Industry analysis, and it is structured as follows.

An Executive Summary introduces the analysis offering a first overview of the mattress retail market in Europe with CSIL's assessments regarding the structure, the evolution and the prospects of the European mattress market.

The Mattress Market Scenario in Europe

This section analyses key factors shaping the European mattress sector, providing market performance and demand evolution across Europe, with CSIL's forecasts:

- Retail sales of mattresses by country and at European level

- Mattress consumption volumes (units) in Europe

- Price trends and evolution

- Mattress retail sales by Country

- Macroeconomic background (private consumption, GDP trends, construction investments)

- Forecasts for the European mattress market and by country for 2026 and 2027, in real terms

- Import penetration and the role of extra-EU suppliers

- Imports by area of origin and filling materials (Foam, Latex, Innersprings, Others) by main sources

- Comparison analysis for the competition from extra-European countries in the leading EU markets

Mattress Retail Channels in Europe

This part focuses on the mattress distribution landscape, analysing the retail structure across Europe and highlighting models and players driving the market, with a focus on:

- Business demography of specialised furniture and household goods retailers

- Retail channel trends, mattress sales by channel, with country-level analysis

- Leading retailers' analysis, sales of mattresses and market shares for the Top 50. A sample of selected 370 companies has been analysed.

- Mergers and acquisitions activity (2019-2025)

- Profiles of leading mattress retailers in Europe

Mattress Market Competitive Landscape

The competitive system analysis identifies the leading mattress manufacturers operating in the EU market and examines their performance and sales breakdown by retail channel, extending to prices and brand positioning.

Key insights include:

- Leading European mattress manufacturers and foreign companies: sales and market share for 50 players. A sample of 500 manufacturers (European and foreign companies) has been analysed.

- Mattress market by price ranges (entry, medium, medium-high, high, luxury)

- Mattress brands positioning by price ranges

- Prices by filling materials across selected retailers

Country Analysis: The Top 10 Mattress Markets in Europe

The report offers an in-depth analysis of ten major European mattress markets (Belgium, France, Germany, Italy, the Netherlands, Poland, Spain, Sweden, Switzerland, and the United Kingdom), offering data on retail sales, macroeconomic indicators, consumption forecasts, import sources, distribution, leading retailers, and brand positioning.

For each country, the study provides:

- Total mattress retail sales (2018-2025) compared with the European average

- Macroeconomic indicators

- Mattress consumption forecasts for 2026 and 2027

- Imports of mattresses, sourcing areas and main partner countries

- Mattress consumption by retail channels (Furniture specialist retail chains, Mattress/Bedding specialist retail chains, E-commerce, Mattress/Bedding specialist independent stores, Furniture specialist independent stores, Non-specialist furniture stores and Other)

- Leading retailers by mattress sales

A further section offers market indicators for a wider group of European countries, including Austria, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Ireland, Latvia, Lithuania, Norway, Portugal, Romania and Slovakia, allowing for broader market comparison.

For each country the report includes:

- Total mattress retail sales, 2018-2025

- Macroeconomic indicators

- Mattress consumption forecasts for 2026 and 2027

- Imports of mattresses, sourcing areas and main partner countries

CSIL's 'Mattress Retailing in Europe' Report is designed to support strategic decisions, answering key questions such as:

- What are the opportunities in the European mattress market?

- What is the current size and the evolution of the European mattress retail market?

- Which countries lead and are developing within the European Mattress Market?

- How is the European mattress distribution structured by channels?

- What is the incidence of ecommerce for mattresses in Europe?

- Who are the leading retailers and manufacturers of mattresses in Europe?

- How is competition evolving across different price ranges?

- What are the main sources of imported mattresses?

- What are mattress brands positioning in terms of pricing and filling materials?

- What is expected in the European mattress market for 2026 and 2027?

Selected companies

Among the largest considered companies: ADOVA, Aquinos Bedding /Matrafoam, Aramis Invest, Bensons for Beds, Beter Bed Holding, Correct, Dreams, Emma, EON Living, Eurocomfort, Flex, Pikolin, Hilding Anders Holding, Ikano, IKEA, JYSK, Maison de la Literie, Matratzen Concord, Mlily, Silentnight, Swiss Sense, Xilinmen, XXXLutz

Key Features:

The European mattress market remains one of the largest worldwide, accounting for around 15% of global consumption. At retail prices, the market is estimated at nearly EUR 14 billion, now above pre-pandemic levels. Against a backdrop of persistent uncertainty, Europe is expected to remain a strategically important region in the medium term, both as a large and relatively stable market and as a key destination for diversified export flows, attracting interest from both European manufacturers and foreign players seeking to rebalance their international sales exposure.

The import of mattresses from Extra-European countries into the EU market has traditionally remained very limited. Although the market continues to be largely supplied by European production, the situation has been changing in recent years. Among leading markets, Germany and the UK show the highest import penetration from extra-EU suppliers. By contrast, France, Italy and Spain display much lower extra-EU import penetration (generally below 5%), pointing to a more protected and structurally integrated competitive environment.

Table of Contents

Methodology:

- Scope, structure, and research tools

Executive Summary:

- Key highlights and market insights

1. SCENARIO

Mattress Retail Market evolution in Europe and figures by country

- Europe: Mattress Retail sales 2018-2025

- Mattress consumption volume 2018-2024

- Price trends

- Mattress sales by country

The Macroeconomic context

- Macroeconomic indicators

- Private final consumption expenditure

- Per capita GDP

- Construction investment by sector

Mattress Market Forecasts for 2026 and 2027

Import penetration

- National production of Mattresses vs extra-EU imports

- Mattress Imports breakdown by area

- Top extra-European suppliers

- Competition from extra-European countries on the leading EU markets

Features of imported mattresses from extra-EU countries

- Prices and filling materials by main sources

2. MATTRESS RETAIL CHANNELS

Business demography of specialised retail stores

Trends in retail channels

- Mattress consumption by retail channel in Europe and by Country

- Leading mattress retailers in Europe and market shares

- Market concentration

- Leading retailers by mattress sales

- M&A deals 2019-2025

Profiles of leading mattress retailers

3. MARKET COMPETITION

European mattress manufacturers and foreign companies on the EU market

- Leading mattress manufacturers on the EU market, sales and market shares

Mattress market by price ranges

Mattress brand positioning

- Mattress brands positioning by price ranges

- Mattress prices by filling materials across selected retailers

4. TOP 10 COUNTRIES IN THE EUROPEAN MATTRESS RETAIL MARKET

For each (Belgium, France, Germany, Italy, Netherlands, Poland, Spain, Sweden, Switzerland, United Kingdom):

- Market retail market sales (2018-2025) compared with the European average

- Macroeconomic indicators

- Mattress consumption forecasts for 2026 and 2027

- Imports of mattresses and main partner countries

- Mattress consumption by retail channels

- Leading mattress retailers and performance

- Brand positioning by prices

5. BASIC DATA FOR ADDITIONAL COUNTRIES (Austria, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Ireland, Latvia, Lithuania, Norway, Portugal, Romania and Slovakia)

- Total mattress retail sales, 2018-2025

- Macroeconomic indicators

- Mattress consumption forecasts for 2026 and 2027

- Imports of mattresses and main partner countries