|

市场调查报告书

商品编码

1822618

铁粉市场机会、成长动力、产业趋势分析及2025-2034年预测Iron Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

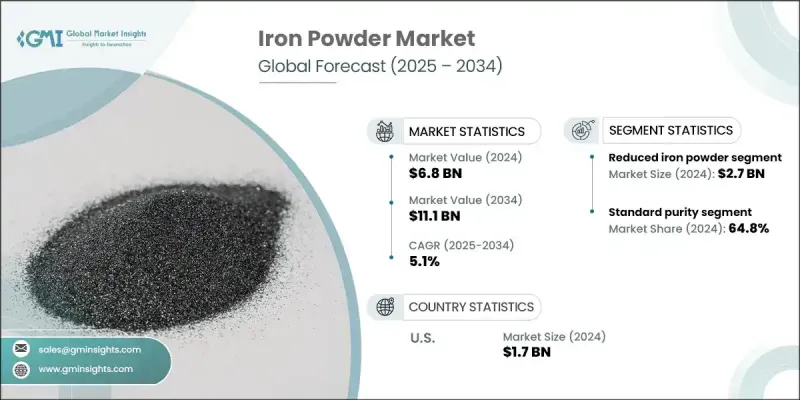

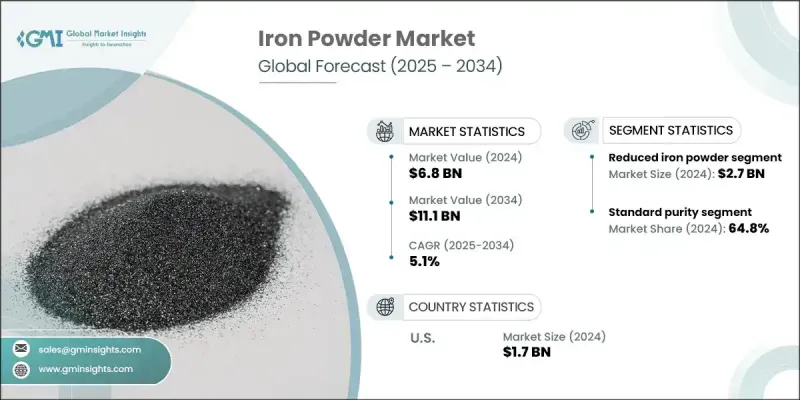

全球铁粉市场价值 68 亿美元,预计到 2034 年将以 5.1% 的复合年增长率成长,达到 111 亿美元,这得益于生产流程的技术进步。包括精炼粉末生产技术和增强的品质控制标准在内的创新正在提升铁粉的性能。这些改进使其能够用于从汽车到电子产品的更广泛的应用领域。此外,粉末冶金技术的进步和积层製造的兴起使生产更加精确和高效。大量使用铁粉的建筑和电子产业也在促进市场成长。根据世界钢铁协会的报告,建筑业对铁粉的需求预计每年将增加 4%。生产方法的创新,例如改进的加工技术和专门的牌号,正在进一步推动市场活力。

整个铁粉市场按类型、纯度、最终用途行业和地区进行分类。到2032年,雾化铁粉市场将实现可观的复合年增长率,这得益于其优于其他类型铁粉的优异性能。雾化铁粉的粒度和形状均匀性极佳,从而提高了其在精密应用中的性能。其一致的品质对于需要高精度和高可靠性的行业至关重要,例如航太和高科技製造。此外,雾化技术的进步提高了生产效率,进一步提高了该领域的收入。到2032年,高纯度铁粉将占据显着的市场份额,因为它在要求最低污染的先进製造流程中发挥重要作用。高纯度铁粉对于生产具有精确特性和卓越性能的零件至关重要,尤其是在电子和製药等高科技行业。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 68亿美元 |

| 预测值 | 111亿美元 |

| 复合年增长率 | 5.1% |

此外,严格的行业标准和法规也大幅推高了对高纯度材料的需求,因为它们对于实现最佳性能和安全性至关重要。由于工业活动的增加和各行业的技术进步,北美铁粉市场将在2024年至2032年期间呈现强劲的复合年增长率。该地区不断扩张的汽车和航太工业正在推动製造过程中对高品质材料的需求。此外,对基础设施建设和再生能源项目的关注,正在推动该地区建筑和能源应用对铁粉的需求增加。对积层製造创新和进步的推动也促进了对铁粉需求的成长,从而支撑了北美市场的成长。

目录

第一章:方法论与范围

第 2 章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考虑

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 多边环境协定

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:按类型,2021-2034

- 主要趋势

- 还原铁粉

- 雾化铁粉

- 电解铁粉

第六章:市场估计与预测:依纯度,2021-2034

- 主要趋势

- 高纯度

- 标准纯度

第七章:市场估计与预测:依最终用途产业,2021-2034

- 主要趋势

- 汽车

- 电子的

- 一般工业

- 消费产业

- 建造

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- American Element

- BASF SE

- Belmont Metals

- CNPC Powder

- Hoganas

- Industrial Metal Powders (India) Pvt. Ltd.

- JFE Steel Corporation

- Pometon

- Reade

- Rio Tinto Metal Powder

- SAGWELL USA INC.

- Serena Nutrition

The Global Iron Powder Market was valued at USD 6.8 billion and is estimated to grow at a CAGR of 5.1% to reach USD 11.1 billion by 2034, backed by the technological advancements in production processes. Innovations, including refined powder production techniques and enhanced quality control standards, are advancing the properties of iron powder. These improvements enable its use in a wider array of applications, from automotive to electronics. Additionally, advancements in powder metallurgy and the rise of additive manufacturing are making production more precise and efficient. The construction and electronics sectors, which heavily utilize iron powder, are also contributing to market growth. According to a report by the World Steel Association, the demand for iron powder in construction is expected to rise by 4% annually. Innovations in production methods, such as improved processing techniques and specialized grades, are further driving market dynamics.

The overall iron powder market is sorted based on type, purity, End Use industry, and region. The atomized iron powder segment will register decent CAGR through 2032, driven by its superior properties compared to other types. Atomized iron powder offers excellent uniformity in particle size and shape, which enhances performance in precision applications. Its consistent quality is crucial for industries requiring high levels of accuracy and reliability, such as aerospace and high-tech manufacturing. Additionally, advancements in atomization technology have made the production process more efficient, further boosting the segment revenues. By 2032, the high-purity segment will clutch a noticeable market share, because of its role in advanced manufacturing processes that require minimal contamination. High-purity iron powder is essential for producing components with precise characteristics and superior performance, particularly in high-tech industries such as electronics and pharmaceuticals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.8 Billion |

| Forecast Value | $11.1 Billion |

| CAGR | 5.1% |

Additionally, stringent industry standards and regulations are catapulting the need for high-purity materials, as they are crucial for achieving optimal performance and safety. North America iron powder market will showcase a strong CAGR from 2024 to 2032, owing to increased industrial activity and technological advancements across various sectors. The region's expanding automotive and aerospace industries are driving the need for high-quality materials in manufacturing processes. Additionally, the focus on infrastructure development and renewable energy projects is creating a higher demand for iron powder in construction and energy applications across the region. The push for innovation and advancements in additive manufacturing also contributes to the rising demand for iron powder, bolstering the market growth in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Purity trends

- 2.2.3 End use industry trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Reduced iron powder

- 5.3 Atomised iron powder

- 5.4 Electrolytic iron powder

Chapter 6 Market Estimates and Forecast, By Purity, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 High purity

- 6.3 Standard purity

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Electronic

- 7.4 General industries

- 7.5 Consumer industries

- 7.6 Construction

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 American Element

- 9.2 BASF SE

- 9.3 Belmont Metals

- 9.4 CNPC Powder

- 9.5 Hoganas

- 9.6 Industrial Metal Powders (India) Pvt. Ltd.

- 9.7 JFE Steel Corporation

- 9.8 Pometon

- 9.9 Reade

- 9.10 Rio Tinto Metal Powder

- 9.11 SAGWELL USA INC.

- 9.12 Serena Nutrition