|

市场调查报告书

商品编码

1750566

线性家用电压调节器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Linear Residential Voltage Regulator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

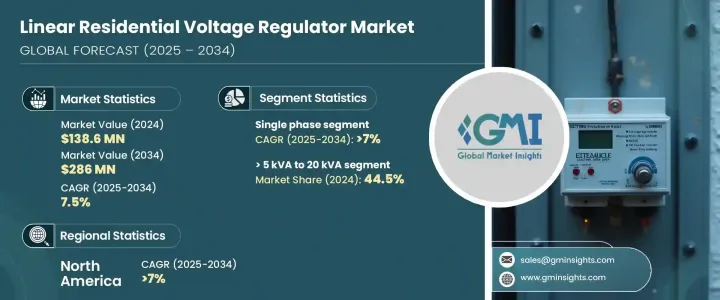

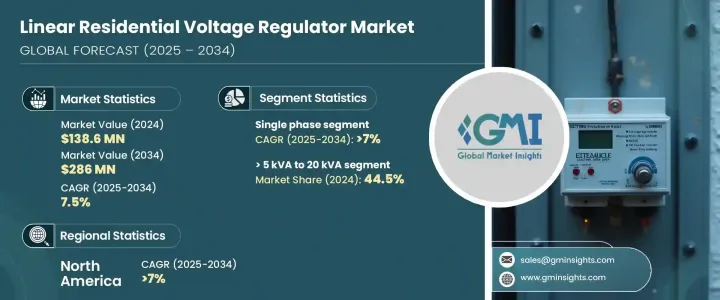

2024年,全球线性家用电压调节器市场规模达1.386亿美元,预计到2034年将以7.5%的复合年增长率成长,达到2.86亿美元。这主要得益于对可靠高效配电系统日益增长的需求,尤其是在住宅环境中,智慧型设备和家庭管理系统的普及需要稳定的电压等级。电子家用设备的普及以及郊区住宅计画的扩张进一步促进了市场的扩张。此外,将太阳能和风能等再生能源併入电网,也增加了对先进电压控制解决方案的需求,从而推动了产业成长。数位化等技术进步提高了产品效率,激发了商业潜力。

此外,降低住宅能源消耗的监管支援正在加速推动电压调节系统的发展,以确保稳定且有效率的电力传输。随着越来越多的家庭整合智慧型设备,保护敏感电子设备免受电涌和电压波动的影响变得越来越重要。政府机构不仅鼓励向更智慧的电网技术转型,而且还优先考虑在住宅开发项目中强制执行更高能源效率标准的政策。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.386亿美元 |

| 预测值 | 2.86亿美元 |

| 复合年增长率 | 7.5% |

预计到2034年,线性家用稳压器市场的单相部分将以7%的复合年增长率成长。这一增长主要源于高耗电电子设备的日益普及,以及对稳定电压水平以维持电器寿命和性能的需求。製造商正在积极响应这一趋势,开发旨在与智慧家庭系统无缝整合的下一代稳压器,进一步提升其吸引力。

同时,受新建筑活动和老化基础设施改造力度加大的推动,5千伏安市场预计在2034年前创造8,500万美元的市场价值。能源效率规范的加强执行,尤其是在城市和多户住宅领域,正促使业主采用紧凑高效的电压管理解决方案。

2024年,美国线性家用稳压器市场规模达1,520万美元。政府的节能激励措施、不断增长的居民用电需求以及数位电源管理技术的持续创新,预计将加速该技术在城郊社区的普及。随着消费者寻求更好地控製家庭能源使用,以及保护日益复杂的家用电子产品,该市场预计将持续成长并呈现多元化发展。

全球线性家用电压调节器产业的主要参与者包括 ADI 公司、BTRAC、伊顿、英飞凌科技、罗格朗、莱茵豪森机械製造厂、MaxLinear、微芯科技、恩智浦半导体、瑞萨电子株式会社、理光美国、罗姆、SEMTECH、Sollat、TTek、义大利株式会社、理光美国、罗姆、SEMTECH、Sollat、TTek、分析装置工业装置、复合科技区Intertechnology。线性家用电压调节器市场的公司正在采取多种策略来巩固其市场地位。研发投资是重中之重,专注于创造先进、节能和紧凑的电压调节解决方案,以满足智慧电网、电动车和再生能源系统日益增长的需求。将数位化和物联网 (IoT) 融入产品可实现即时监控和控制功能,增强产品吸引力。正在寻求策略合作伙伴关係、收购和合资企业,以扩大全球影响力并提高技术能力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率分析

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依阶段,2021 - 2034

- 主要趋势

- 单相

- 三相

第六章:市场规模及预测:按电压,2021 - 2034

- 主要趋势

- ≤5千伏安

- > 5 kVA 至 20 kVA

- > 20 千伏安至 40 千伏安

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 俄罗斯

- 英国

- 义大利

- 西班牙

- 荷兰

- 奥地利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 马来西亚

- 印尼

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 卡达

- 埃及

- 南非

- 奈及利亚

- 科威特

- 阿曼

- 拉丁美洲

- 巴西

- 秘鲁

- 阿根廷

第八章:公司简介

- Analog Devices

- BTRAC

- Eaton

- Infineon Technologies

- Legrand

- Maschinenfabrik Reinhausen

- MaxLinear

- Microchip Technology

- NXP Semiconductors

- Renesas Electronics Corporation

- Ricoh USA

- ROHM

- SEMTECH

- Sollatek

- STMicroelectronics

- TTM Technologies

- TOREX SEMICONDUCTOR

- Toshiba Electronic Devices & Storage Corporation

- Vicor

- Vishay Intertechnology

The Global Linear Residential Voltage Regulator Market was valued at USD 138.6 million in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 286 million by 2034 driven by the increasing demand for reliable and efficient power distribution systems, particularly in residential settings where the proliferation of smart devices and home management systems necessitates stable voltage levels. The rising adoption of electronic home devices and the expansion of suburban housing projects further contribute to the market's expansion. Additionally, integrating renewable energy sources like solar and wind into the power grid has heightened the need for advanced voltage control solutions, propelling industry growth. Technological advancements, including digitalization, have improved product efficiency, stimulating business potential.

In addition, regulatory support for reducing residential energy consumption is accelerating the push for voltage regulation systems that ensure stable and efficient power delivery. As more homes integrate smart devices, protecting sensitive electronics from power surges and voltage fluctuations has become increasingly critical. Government agencies are not only encouraging the transition to smarter grid technologies but are also prioritizing policies that mandate higher energy performance standards in residential developments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $138.6 Million |

| Forecast Value | $286 Million |

| CAGR | 7.5% |

The single-phase segment in the linear residential voltage regulator market is projected to grow at a CAGR of 7% through 2034. This growth is driven by the expanding use of power-hungry electronic devices and the need for consistent voltage levels to maintain appliance longevity and performance. Manufacturers are responding by developing next-generation regulators designed for seamless integration with smart home systems, further enhancing their appeal.

Meanwhile, the ? 5 kVA segment is poised to generate USD 85 million by 2034, supported by new construction activities and increased retrofitting of aging infrastructure. Heightened enforcement of efficiency codes, particularly in urban and multi-dwelling units, is pushing property owners to adopt compact, efficient voltage management solutions.

United States Linear Residential Voltage Regulator Market was valued at USD 15.2 million in 2024. A combination of pro-efficiency government incentives, growing residential electricity demands, and continued innovation in digital power management technologies is expected to accelerate adoption across suburban and urban neighborhoods. As consumers seek greater control over household energy use and protection for increasingly complex home electronics, the market is set to experience continued growth and diversification.

Key players operating in the Global Linear Residential Voltage Regulator Industry include Analog Devices, BTRAC, Eaton, Infineon Technologies, Legrand, Maschinenfabrik Reinhausen, MaxLinear, Microchip Technology, NXP Semiconductors, Renesas Electronics Corporation, Ricoh USA, ROHM, SEMTECH, Sollatek, STMicroelectronics, TTM Technologies, TOREX SEMICONDUCTOR, Toshiba Electronic Devices & Storage Corporation, Vicor, and Vishay Intertechnology. Companies in the linear residential voltage regulator market are adopting several strategies to strengthen their market position. Investments in research and development are a priority, focusing on creating advanced, energy-efficient, and compact voltage regulation solutions that cater to the growing needs of smart grids, electric vehicles, and renewable energy systems. Integrating digitalization and the Internet of Things (IoT) into product offerings enables real-time monitoring and control capabilities, enhancing product appeal. Strategic partnerships, acquisitions, and joint ventures are being pursued to expand global reach and improve technological capabilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Phase, 2021 - 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Three phase

Chapter 6 Market Size and Forecast, By Voltage, 2021 - 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 ≤ 5 kVA

- 6.3 > 5 kVA to 20 kVA

- 6.4 > 20 kVA to 40 kVA

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Russia

- 7.3.4 UK

- 7.3.5 Italy

- 7.3.6 Spain

- 7.3.7 Netherlands

- 7.3.8 Austria

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 South Korea

- 7.4.4 India

- 7.4.5 Australia

- 7.4.6 New Zealand

- 7.4.7 Malaysia

- 7.4.8 Indonesia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Qatar

- 7.5.4 Egypt

- 7.5.5 South Africa

- 7.5.6 Nigeria

- 7.5.7 Kuwait

- 7.5.8 Oman

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Peru

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 Analog Devices

- 8.2 BTRAC

- 8.3 Eaton

- 8.4 Infineon Technologies

- 8.5 Legrand

- 8.6 Maschinenfabrik Reinhausen

- 8.7 MaxLinear

- 8.8 Microchip Technology

- 8.9 NXP Semiconductors

- 8.10 Renesas Electronics Corporation

- 8.11 Ricoh USA

- 8.12 ROHM

- 8.13 SEMTECH

- 8.14 Sollatek

- 8.15 STMicroelectronics

- 8.16 TTM Technologies

- 8.17 TOREX SEMICONDUCTOR

- 8.18 Toshiba Electronic Devices & Storage Corporation

- 8.19 Vicor

- 8.20 Vishay Intertechnology