|

市场调查报告书

商品编码

1716555

永磁市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Permanent Magnet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

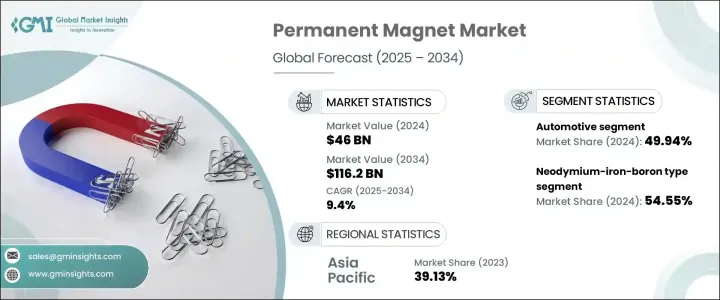

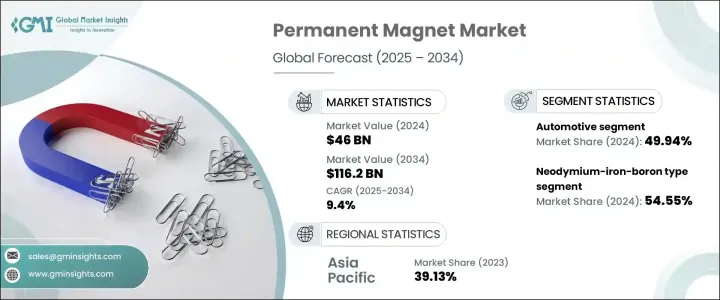

2024 年全球永磁市场规模达 460 亿美元,预计 2025 年至 2034 年期间复合年增长率将达 9.4%,这主要得益于电动车 (EV) 普及率的提高以及各行各业对节能技术的需求不断增长。永久磁铁是现代工程中不可或缺的一部分,在从电动马达和风力涡轮机到医疗设备和消费性电子产品等各种产品中发挥着至关重要的作用。随着各行各业继续优先考虑可持续和节能的解决方案,对无需持续能量输入即可提供卓越强度和可靠性的高性能磁铁的需求变得更加突出。

它们无需外部电源即可维持持续磁场,这使得它们成为各种机械和电子应用的首选,尤其是在效率和节省空间的设计至关重要的场合。交通运输和工业自动化向电气化的加速转变,以及机器人、航太和医疗设备领域的持续创新,进一步提升了对先进永久磁铁的需求。智慧科技和物联网设备在日常生活中的快速整合也促进了这些磁铁更广泛的应用前景。此外,政府推动风能和太阳能等再生能源的措施也间接增强了对能源生产和储存设备所需的高性能磁铁的需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 460亿美元 |

| 预测值 | 1162亿美元 |

| 复合年增长率 | 9.4% |

永久磁性市场依产品类型分为铁氧体、钕铁硼(NdFeB)、钐钴和铝镍钴。其中,钕铁硼 (NdFeB) 磁铁在 2024 年占据市场主导地位,占有 54.55% 的份额,这主要归功于其卓越的磁性能。这些磁铁因其高磁能、稳定的性能和高饱和感应而受到青睐,这使得它们成为电动机、发电机、音讯系统和各种马达驱动电子设备的必备材料。材料科学和磁铁技术的不断进步使得钕铁硼磁体在各行各业得到更广泛的应用,超越了传统的使用场景,并在航太和先进机器人等领域开闢了新的机会,而轻巧而强大的磁铁在这些领域至关重要。

从应用角度来看,汽车领域在 2024 年占据了永磁市场 49.94% 的份额,预计到 2034 年将以 9.5% 的复合年增长率成长。随着汽车产业急剧转向电动车,高效能马达、先进动力系统和精密感测器的整合正在加速。钕铁硼磁铁由于体积小、性能优越,已成为电动车(EV)马达、再生煞车系统和其他核心汽车电子设备的关键部件,进一步推动了市场扩张。

从区域来看,2023 年亚太永磁市场占 39.13% 的主导份额,中国凭藉其强大的稀土生产能力占据领先地位。中国控制全球大部分稀土供应,包括对钕铁硼和钐钴磁铁至关重要的材料,确保了具有竞争力的价格和供应链的稳定性。此外,在不断扩大的电动车市场、再生能源项目和消费性电子产品生产的支持下,印度、日本和韩国等国家的工业化进程不断加快和需求强劲,继续加强亚太地区在全球永磁产业中的地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 电动车需求不断成长

- 全球向永续能源生产转变

- 製造技术的进步

- 产业陷阱与挑战

- 价格高且原料有限

- 稀土金属造成的危害

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 铁氧体

- 钕铁硼

- 钹

- 铝镍钴

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 电子产品

- 能源生产

- 其他的

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- Hitachi Metals, Ltd.

- Jiangmen Magsource New Material Co. Ltd.

- Adams Magnetic Products Co.

- Arnold Magnetic Technologies

- Anhui Earth-Panda Advance Magnetic Material Co. Ltd.

- Ningbo Yunsheng Co. Ltd.

- Daido Steel Co. Ltd.

- Molycorp Magnequench

- Thomas & Skinner Inc.

- Vacuumschmelze GmbH & Co. KG

- Electron Energy Corporation

- Hangzhou Permanent Magnet Group

- Goudsmit Magnetics Group

- TDK Corporation

The Global Permanent Magnet Market generated USD 46 billion in 2024 and is projected to expand at a 9.4% CAGR from 2025 to 2034, fueled largely by the increasing penetration of electric vehicles (EVs) and the rising demand for energy-efficient technologies across industries. Permanent magnets are indispensable in modern engineering, playing a vital role in a wide array of products ranging from electric motors and wind turbines to medical devices and consumer electronics. As industries continue to prioritize sustainable and energy-efficient solutions, the need for high-performance magnets that deliver superior strength and reliability without continuous energy input is becoming even more prominent.

Their ability to maintain a persistent magnetic field without external power makes them a preferred choice for various mechanical and electronic applications, especially where efficiency and space-saving designs are critical. The accelerating shift toward electrification in transportation and industrial automation, along with ongoing innovations in robotics, aerospace, and healthcare equipment, further elevates the demand for advanced permanent magnets. The rapid integration of smart technologies and IoT-enabled devices in daily life has also contributed to the broader application landscape of these magnets. Moreover, government initiatives promoting renewable energy sources such as wind and solar power are indirectly bolstering the need for high-performance magnets essential for energy generation and storage equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46 Billion |

| Forecast Value | $116.2 Billion |

| CAGR | 9.4% |

The permanent magnet market is categorized by product type into ferrite, neodymium-iron-boron (NdFeB), samarium-cobalt, and aluminum-nickel-cobalt. Among these, neodymium-iron-boron (NdFeB) magnets dominated the market with a commanding 54.55% share in 2024, primarily due to their exceptional magnetic properties. These magnets are favored for their high magnetic energy, stable performance, and high saturation induction, which make them essential for use in electric motors, generators, audio systems, and various motor-driven electronics. The ongoing advancements in material science and magnet technology have led to broader adoption of NdFeB magnets across industries, surpassing traditional use cases and opening new opportunities in sectors like aerospace and advanced robotics, where lightweight yet powerful magnets are crucial.

From an application standpoint, the automotive segment accounted for a substantial 49.94% share of the permanent magnet market in 2024 and is anticipated to grow at a 9.5% CAGR through 2034. As the automotive industry pivots sharply toward electric mobility, the integration of high-efficiency motors, advanced powertrain systems, and precision sensors is accelerating. Neodymium-iron-boron magnets, given their compact size and superior performance, have become critical components in electric vehicle (EV) motors, regenerative braking systems, and other core automotive electronics, further driving market expansion.

Regionally, the Asia Pacific Permanent Magnet Market held a dominant 39.13% share in 2023, with China spearheading this leadership position due to its extensive rare earth production capabilities. China's control over a large portion of the global rare earth supply, including materials crucial for neodymium-iron-boron and samarium-cobalt magnets, ensures competitive pricing and supply chain stability. Additionally, growing industrialization and robust demand from countries like India, Japan, and South Korea continue to strengthen Asia Pacific's standing in the global permanent magnet industry, supported by expanding EV markets, renewable energy projects, and consumer electronics production.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand of electric vehicle

- 3.6.1.2 Global shift towards sustainable energy generation

- 3.6.1.3 Advancements in manufacturing technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High price and limited availability of raw materials

- 3.6.2.2 Hazards caused by rare earth metals

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Ferrite

- 5.3 Neo (NdFeB)

- 5.4 SmCO

- 5.5 Alnico

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Electronics

- 6.4 Energy generation

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Hitachi Metals, Ltd.

- 8.2 Jiangmen Magsource New Material Co. Ltd.

- 8.3 Adams Magnetic Products Co.

- 8.4 Arnold Magnetic Technologies

- 8.5 Anhui Earth-Panda Advance Magnetic Material Co. Ltd.

- 8.6 Ningbo Yunsheng Co. Ltd.

- 8.7 Daido Steel Co. Ltd.

- 8.8 Molycorp Magnequench

- 8.9 Thomas & Skinner Inc.

- 8.10 Vacuumschmelze GmbH & Co. KG

- 8.11 Electron Energy Corporation

- 8.12 Hangzhou Permanent Magnet Group

- 8.13 Goudsmit Magnetics Group

- 8.14 TDK Corporation