|

市场调查报告书

商品编码

1698510

介面 IC 市场机会、成长动力、产业趋势分析及 2025-2034 年预测Interface IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

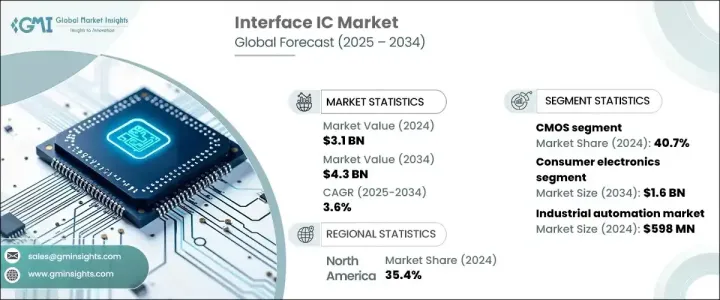

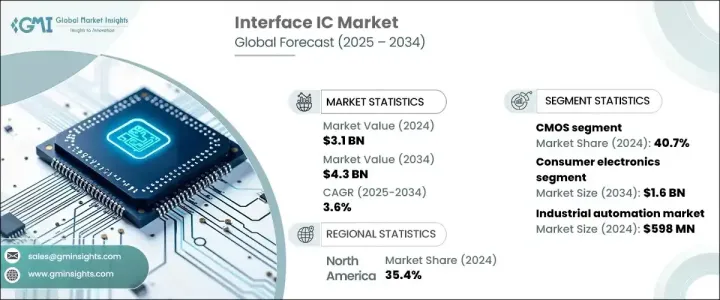

全球介面 IC 市场规模在 2024 年将持续达到 31 亿美元的估值,预计在 2025 年至 2034 年期间的复合年增长率为 3.6%。对无缝连接、高速资料传输和节能电子系统的需求不断增长,正在推动主要行业的扩张。随着技术进步的加速,介面 IC 正在成为下一代设备中必不可少的组件,优化即时资料交换并提高整体系统效能。数位转型、自动化和连网设备的日益普及进一步推动了对先进介面 IC 解决方案的需求。

介面 IC 在汽车应用中的渗透率不断提高是一个重要的成长因素,尤其是随着向电动车 (EV) 和自动驾驶技术的快速转变。这些组件在管理电子通讯和安全系统方面发挥关键作用,确保车辆网路内可靠、高效的资料传输。先进驾驶辅助系统(ADAS)的扩展和高性能资讯娱乐解决方案的整合进一步凸显了介面IC在汽车领域日益增长的重要性。此外,随着企业寻求提高营运效率和降低能源消耗,工业自动化和智慧製造流程继续推动需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 31亿美元 |

| 预测值 | 43亿美元 |

| 复合年增长率 | 3.6% |

影响介面 IC 市场的另一个主要驱动因素是对高速资料传输技术的日益依赖。随着智慧家庭自动化、物联网 (IoT) 设备和高解析度显示器的普及,对高效能讯号完整性和低功耗解决方案的需求也越来越大。电信、消费性电子和工业自动化等产业严重依赖介面 IC 来确保跨多个系统的资料顺畅流动,从而实现先进的功能和增强的连接性。随着产业向 5G 网路和人工智慧系统转型,高效能介面 IC 的采用率将大幅上升。

从技术面来看,市场分为CMOS、双极和BiCMOS介面IC。 CMOS 技术在 2024 年占据该领域的首位,占有 40.7% 的市场份额,这主要归功于其在消费性电子、汽车和工业自动化领域的广泛应用。该细分市场在 2023 年的价值达到 12 亿美元,这得益于其成本效益、低功耗和高速资料传输能力。随着製造商优先考虑能源效率和紧凑设计,对基于 CMOS 的介面 IC 的需求持续激增。

根据最终用户,市场分为消费性电子、汽车、工业自动化、电信和其他。预计到 2034 年,消费性电子产品将创造 16 亿美元的产值,并继续保持其作为市场成长主要驱动力的强劲地位。 2024年,该细分市场占全球介面IC市场的36.2%。智慧家庭自动化的日益普及、对高解析度 OLED 和 AMOLED 显示器的需求不断增长以及连网设备的广泛使用促进了该领域的扩张。随着穿戴式装置、无线充电解决方案和下一代显示技术的普及,介面 IC 在消费性电子产品中的作用仍然至关重要。

受配备 ADAS 的汽车和电动车强劲需求的推动,美国介面 IC 市场规模到 2024 年将达到 8.431 亿美元。数位转型和工业自动化领域的投资不断增加,正在加速市场扩张。随着电子系统的快速发展和对高效能资料传输的需求不断增长,介面 IC 在多个行业的采用率持续上升。半导体製造商的强大影响力和通讯技术的不断进步进一步加强了该地区市场的成长轨迹。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 消费性电子产品的扩张

- 汽车技术的进步

- 工业自动化的成长

- 电信基础设施的扩展

- 产业陷阱与挑战

- 科技快速进步

- 整合和相容性问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按介面类型,2021 年至 2034 年

- 主要趋势

- 模拟

- 数位的

- 混合讯号

第六章:市场估计与预测:依介面标准,2021 年至 2034 年

- 主要趋势

- 序列

- 平行线

- 高速

第七章:市场估计与预测:按技术,2021 年至 2034 年

- 主要趋势

- 互补金属氧化物半导体

- 双极

- BiCMOS

第八章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 消费性电子产品

- 汽车

- 工业自动化

- 电信

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Allegro Microsystems

- Analog Devices, Inc.

- Broadcom Inc.

- Cirrus Logic, Inc.

- Diodes Incorporated

- Elmos Semiconductor SE

- IBS Electronic Group

- Ivelta

- Mouser Electronics, Inc.

- Nuvoton Technology Corporation

- NXP Semiconductors NV

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- ROHM Semiconductor

- SEIKO Epson Corporation

- Silicon Labs

- STMicroelectronics NV

- Symmetry Electronics

- Texas Instruments Incorporated

- Toshiba Corporation

The Global Interface IC Market continues to reach a valuation of USD 3.1 billion in 2024 and is projected to grow at a CAGR of 3.6% between 2025 and 2034. Increasing demand for seamless connectivity, high-speed data transmission, and energy-efficient electronic systems is driving expansion across key industries. As technological advancements accelerate, interface ICs are becoming essential components in next-generation devices, optimizing real-time data exchange and enhancing overall system performance. The increasing adoption of digital transformation, automation, and connected devices is further fueling the need for advanced interface IC solutions.

The rising penetration of interface ICs in automotive applications is a significant growth factor, particularly with the rapid shift toward electric vehicles (EVs) and autonomous driving technology. These components play a critical role in managing electronic communication and safety systems, ensuring reliable and efficient data transmission within vehicle networks. The expansion of advanced driver assistance systems (ADAS) and the integration of high-performance infotainment solutions further underscore the growing importance of interface ICs in the automotive sector. Additionally, industrial automation and smart manufacturing processes continue to drive demand as businesses seek to improve operational efficiency and reduce energy consumption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $4.3 Billion |

| CAGR | 3.6% |

Another major driver shaping the interface IC market is the increasing reliance on high-speed data transmission technologies. With the proliferation of smart home automation, Internet of Things (IoT) devices, and high-resolution displays, there is a greater need for efficient signal integrity and low-power consumption solutions. Industries such as telecommunications, consumer electronics, and industrial automation rely heavily on interface ICs to ensure smooth data flow across multiple systems, enabling advanced functionalities and enhanced connectivity. As industries transition toward 5G networks and AI-powered systems, the adoption of high-performance interface ICs is set to rise significantly.

In terms of technology, the market is segmented into CMOS, Bipolar, and BiCMOS interface ICs. CMOS technology led the segment in 2024, holding a 40.7% market share, primarily due to its widespread application in consumer electronics, automotive, and industrial automation. The segment accounted for USD 1.2 billion in 2023, driven by its cost-effectiveness, low power consumption, and high-speed data transfer capabilities. As manufacturers prioritize energy efficiency and compact design, the demand for CMOS-based interface ICs continues to surge.

By end-user, the market is categorized into consumer electronics, automotive, industrial automation, telecommunications, and others. Consumer electronics is anticipated to generate USD 1.6 billion by 2034, maintaining its strong position as a key driver of market growth. In 2024, this segment accounted for 36.2% of the global interface IC market. The increasing adoption of smart home automation, growing demand for high-resolution OLED and AMOLED displays, and the expanding use of connected devices contribute to the segment's expansion. With the proliferation of wearables, wireless charging solutions, and next-generation display technologies, the role of interface ICs in consumer electronics remains pivotal.

The United States interface IC market reached USD 843.1 million in 2024, driven by robust demand for ADAS-equipped vehicles and EVs. Increased investment in digital transformation and industrial automation is accelerating market expansion. With the rapid evolution of electronic systems and the growing need for efficient data transfer, the adoption of interface ICs continues to rise across multiple industries. The strong presence of semiconductor manufacturers and continuous advancements in communication technologies further reinforce the market growth trajectory in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of consumer electronics

- 3.2.1.2 Advancements in automotive technology

- 3.2.1.3 Growth in industrial automation

- 3.2.1.4 Expansion of telecommunication infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Rapid technological advancements

- 3.2.2.2 Integration and compatibility issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type of Interface, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Analog

- 5.3 Digital

- 5.4 Mixed-Signal

Chapter 6 Market Estimates and Forecast, By Interface Standard, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Serial

- 6.3 Parallel

- 6.4 High-Speed

Chapter 7 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 CMOS

- 7.3 Bipolar

- 7.4 BiCMOS

Chapter 8 Market Estimates and Forecast, By End-Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Industrial automation

- 8.5 Telecommunications

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Allegro Microsystems

- 10.2 Analog Devices, Inc.

- 10.3 Broadcom Inc.

- 10.4 Cirrus Logic, Inc.

- 10.5 Diodes Incorporated

- 10.6 Elmos Semiconductor SE

- 10.7 IBS Electronic Group

- 10.8 Ivelta

- 10.9 Mouser Electronics, Inc.

- 10.10 Nuvoton Technology Corporation

- 10.11 NXP Semiconductors N.V.

- 10.12 ON Semiconductor Corporation

- 10.13 Renesas Electronics Corporation

- 10.14 ROHM Semiconductor

- 10.15 SEIKO Epson Corporation

- 10.16 Silicon Labs

- 10.17 STMicroelectronics N.V.

- 10.18 Symmetry Electronics

- 10.19 Texas Instruments Incorporated

- 10.20 Toshiba Corporation