|

市场调查报告书

商品编码

1858963

人工智慧在药物发现领域的市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Artificial Intelligence in Drug Discovery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

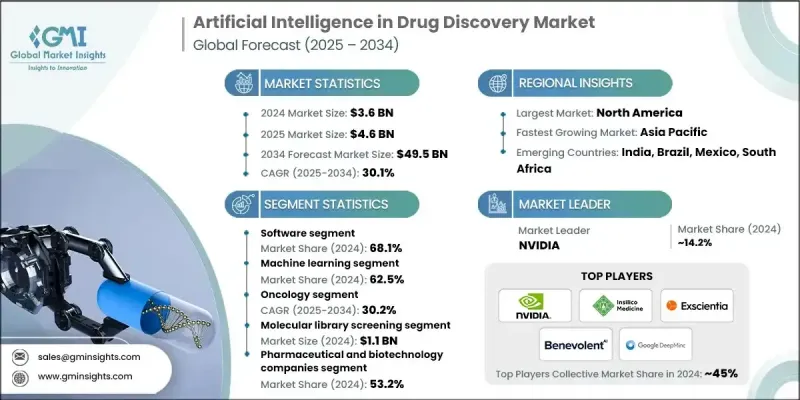

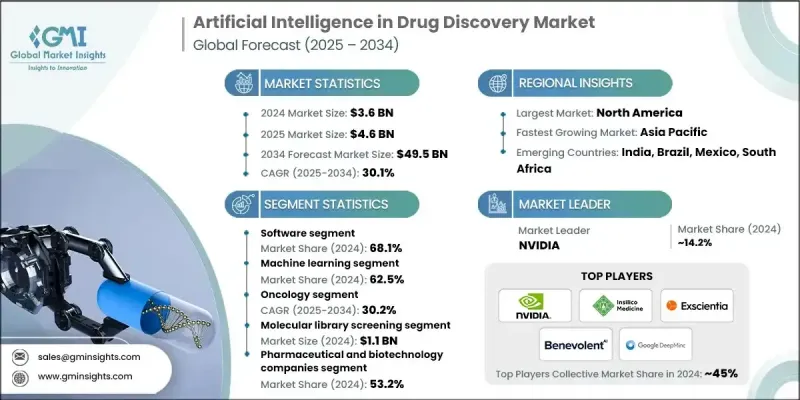

2024 年全球人工智慧药物发现市场价值为 36 亿美元,预计到 2034 年将以 30.1% 的复合年增长率增长至 495 亿美元。

这一非凡的成长是由复杂慢性疾病发病率的上升以及製药公司对利用人工智慧驱动平台简化药物研发流程日益浓厚的兴趣共同推动的。对更快、更精准的药物发现流程的需求正促使生物技术公司和研究机构将深度学习和预测分析等先进技术整合到其研发工作流程中。此外,资料整合的持续创新、不断完善的数位基础设施以及利害关係人意识的提高也加速了这些技术的应用。人工智慧新创公司与製药企业之间日益密切的合作,尤其是在技术先进的地区,正在重塑治疗药物的发现和开发方式,为整个医疗保健生态系统开闢了新的可能性。人工智慧在药物发现领域的作用在于利用自然语言处理、生成演算法和深度学习工具等尖端技术来增强标靶验证、优化先导化合物并支援高效的临床试验计划。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 36亿美元 |

| 预测值 | 495亿美元 |

| 复合年增长率 | 30.1% |

到了2024年,软体领域占68.1%的市场。这一主导地位主要归功于其在早期药物研发阶段(例如化合物筛选和构效关係预测)的广泛应用。基于软体的人工智慧工具如今已成为实现自动化、提高准确性和可扩展性的关键,满足了製药公司对高效研发工作流程日益增长的需求。自然语言处理(NLP)和神经网路等核心技术的快速发展,正持续拓展软体在精准医疗领域的应用范围。

由于机器学习在药物研发的各个阶段都具有广泛的应用前景,预计到2024年,其市占率将达到62.5%。该领域涵盖监督学习和非监督学习模型以及其他机器学习演算法。云端运算技术的进步和开源框架的普及,使得模型训练和部署更加灵活、快速且可扩展。製药巨头与人工智慧公司之间的持续合作,不断激发模型设计的创新,并加速预测工具和即时分析技术在药物研发流程中的应用。

2024年,北美人工智慧药物研发市场预计将占据47.6%的份额,这主要得益于强劲的研发投入、广泛的数位基础设施以及有利于人工智慧整合的监管框架。政府支持的措施和数位疗法监管政策的明朗化也推动了市场成长。美国和加拿大的科技公司与製药公司之间的重要合作,正在推动先进药物研发解决方案的开发,并深化人工智慧平台在该地区的业务布局。

全球人工智慧药物研发市场的主要参与者包括Exscientia、BenevolentAI、Orakl Oncology、AVAYL、Atomwise、Aevai Health、Cyclica、Examol、IBM Corporation、NVIDIA Corporation、Microsoft、Insilico Medicine、Deep Genomics、DenovAI Biotech、NVIDIA Corporation、Microsoft、Insilico Medicine、Deep Genomics. Therapeutics、Helical、Google(DeepMind)和Deargen。为了在全球人工智慧药物研发市场中保持竞争优势,各公司正专注于技术创新、策略合作和数据驱动的产品开发。领先企业正在投资开发专有的人工智慧演算法,以提高标靶识别、分子生成和临床成功率。生物技术新创公司与製药巨头之间的合作日益普遍,从而能够获取大型数据集、领域知识和可扩展的计算资源。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 每个阶段的价值增加

- 影响价值链的因素

- 产业影响因素

- 成长驱动因素

- 复杂慢性疾病盛行率不断上升

- 医疗保健领域的数据爆炸和数位化

- 人工智慧演算法和运算能力的进步

- 科技公司与製药公司日益密切的合作

- 产业陷阱与挑战

- 数据品质和整合问题

- 监理和伦理问题

- 市场机会

- 个性化和精准医疗的扩展

- 生成式人工智慧在分子设计中的兴起

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 未来市场趋势

- 技术格局

- 目前技术

- 新兴技术

- 专利分析

- 投资和融资环境

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 全球的

- 北美洲

- 欧洲

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依组件划分,2021-2034年

- 主要趋势

- 软体

- 现场

- 基于云端的

- 服务

第六章:市场估计与预测:依技术划分,2021-2034年

- 主要趋势

- 机器学习

- 深度学习

- 监督式学习

- 无监督学习

- 其他机器学习技术

- 其他技术

第七章:市场估算与预测:依应用类型划分,2021-2034年

- 主要趋势

- 分子库筛选

- 目标识别

- 药物优化和再利用

- 从头开始的药物设计

- 临床前试验

- 其他应用

第八章:市场估计与预测:依治疗领域划分,2021-2034年

- 主要趋势

- 肿瘤学

- 神经退化性疾病

- 发炎

- 传染病

- 代谢性疾病

- 罕见疾病

- 心血管疾病

- 其他治疗领域

第九章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 製药和生物技术公司

- 合约研究组织(CRO)

- 其他用途

第十章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十一章:公司简介

- 9Bio Therapeutics

- Aevai Health

- Atomwise

- Aureka Biotechnologies

- AVAYL

- BenevolentAI

- chAIron

- Cyclica

- Deargen

- Deep Genomics

- DenovAI Biotech

- Examol

- Exscientia

- Google (DeepMind)

- Helical

- IBM Corporation

- Insilico Medicine

- LinkGevity

- Microsoft

- NVIDIA Corporation

- Orakl Oncology

The Global Artificial Intelligence in Drug Discovery Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 30.1% to reach USD 49.5 billion by 2034.

This exceptional growth is being driven by the rising incidence of complex and chronic health conditions, combined with increasing interest from pharmaceutical companies in streamlining the drug development process using AI-driven platforms. The demand for faster, more accurate discovery processes is pushing biotech firms and research institutions to integrate advanced technologies like deep learning and predictive analytics into their R&D workflows. Additionally, ongoing innovation in data integration, growing digital infrastructure, and greater awareness among stakeholders are accelerating adoption. Expanding collaboration between AI startups and pharmaceutical manufacturers, particularly in technologically advanced regions, is reshaping how therapeutics are identified and developed, opening new possibilities across the healthcare ecosystem. AI's role in the drug discovery space involves using sophisticated technologies such as natural language processing, generative algorithms, and deep learning tools to enhance target validation, optimize lead compounds, and support efficient clinical trial planning.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $49.5 Billion |

| CAGR | 30.1% |

The software segment held 68.1% share in 2024. This dominance is primarily due to widespread adoption during early drug development stages such as compound screening and structure-activity predictions. Software-based AI tools are now integral in providing automation, accuracy, and scalability, meeting the growing demand among pharma companies for efficient R&D workflows. Rapid advancements in core technologies like NLP and neural networks are pushing the boundaries of what software can deliver in precision medicine.

The machine learning segment held a 62.5% share in 2024, owing to its extensive utility across various stages of drug discovery. This segment encompasses supervised and unsupervised learning models along with other ML algorithms. Cloud computing improvements and the availability of open-source frameworks are enabling more flexible, fast, and scalable model training and deployment. Ongoing collaborations between pharmaceutical giants and AI-focused firms continue to spark innovation in model design and accelerate the development of predictive tools and real-time analytics across discovery pipelines.

North America Artificial Intelligence in Drug Discovery Market held 47.6% share in 2024, propelled by strong R&D investments, broad digital infrastructure, and favorable regulatory frameworks supporting AI integration. Government-backed initiatives and regulatory clarity around digital therapeutics are encouraging market growth. Major collaborations between tech firms and pharma companies in the U.S. and Canada are driving progress in the creation of advanced drug discovery solutions and deepening the regional footprint of AI platforms.

Key players in the Global Artificial Intelligence in Drug Discovery Market are Exscientia, BenevolentAI, Orakl Oncology, AVAYL, Atomwise, Aevai Health, Cyclica, Examol, IBM Corporation, NVIDIA Corporation, Microsoft, Insilico Medicine, Deep Genomics, DenovAI Biotech, chAIron, Aureka Biotechnologies, LinkGevity, 9Bio Therapeutics, Helical, Google (DeepMind), and Deargen. To secure a competitive edge in the Global Artificial Intelligence in Drug Discovery Market, companies are focusing on technology innovation, strategic collaborations, and data-driven product development. Leading players are investing in the development of proprietary AI algorithms that enhance target identification, molecule generation, and clinical success rates. Partnerships between biotech startups and pharma leaders are becoming more prevalent, enabling access to large datasets, domain knowledge, and scalable computing resources.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Technology trends

- 2.2.4 Application type trends

- 2.2.5 Therapeutic area trends

- 2.2.6 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of complex and chronic diseases

- 3.2.1.2 Data explosion and digitization in healthcare

- 3.2.1.3 Advancements in AI algorithms and computing power

- 3.2.1.4 Growing collaboration between tech and pharma companies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data quality and integration issues

- 3.2.2.2 Regulatory and ethical concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of personalized and precision medicine

- 3.2.3.2 Emergence of generative AI in molecule design

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Investment and funding landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 On-premises

- 5.2.2 Cloud-based

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Machine learning

- 6.3 Deep learning

- 6.3.1 Supervised learning

- 6.3.2 Unsupervised learning

- 6.3.3 Other machine learning technologies

- 6.4 Other technology

Chapter 7 Market Estimates and Forecast, By Application Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Molecular library screening

- 7.3 Target Identification

- 7.4 Drug optimization and repurposing

- 7.5 De novo drug designing

- 7.6 Preclinical testing

- 7.7 Other applications

Chapter 8 Market Estimates and Forecast, By Therapeutic Area, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Neurodegenerative diseases

- 8.4 Inflammatory

- 8.5 Infectious diseases

- 8.6 Metabolic diseases

- 8.7 Rare diseases

- 8.8 Cardiovascular diseases

- 8.9 Other therapeutic areas

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Pharmaceutical and biotechnology companies

- 9.3 Contract research organization (CROs)

- 9.4 Other End uses

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 9Bio Therapeutics

- 11.2 Aevai Health

- 11.3 Atomwise

- 11.4 Aureka Biotechnologies

- 11.5 AVAYL

- 11.6 BenevolentAI

- 11.7 chAIron

- 11.8 Cyclica

- 11.9 Deargen

- 11.10 Deep Genomics

- 11.11 DenovAI Biotech

- 11.12 Examol

- 11.13 Exscientia

- 11.14 Google (DeepMind)

- 11.15 Helical

- 11.16 IBM Corporation

- 11.17 Insilico Medicine

- 11.18 LinkGevity

- 11.19 Microsoft

- 11.20 NVIDIA Corporation

- 11.21 Orakl Oncology