|

市场调查报告书

商品编码

1664822

建筑玩具市场机会、成长动力、产业趋势分析与 2024 - 2032 年预测Construction Toys Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2024 - 2032 |

||||||

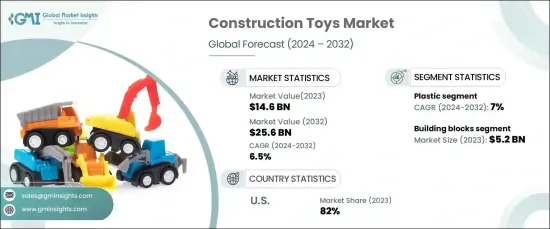

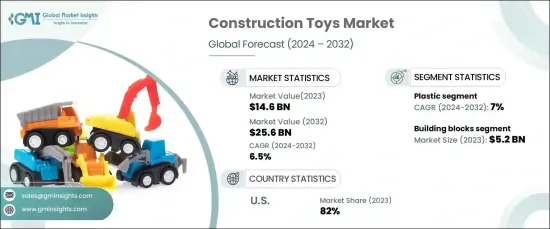

2023 年全球建筑玩具市场价值为 146 亿美元,预计将经历强劲增长,2024 年至 2032 年的复合年增长率为 6.5%。

建筑玩具市场分为几种主要产品类型,包括积木、建筑套装、主题建筑玩具、磁性建筑玩具等。其中,建构模组占据市场主导地位,2023 年的估值为 52 亿美元。积木因其能够增强空间意识、激发解决问题的能力和激发创造力而受到重视。这些玩具已被证明有助于儿童的认知发展,因此继续受到家长和教育工作者的喜爱。

| 市场范围 | |

|---|---|

| 起始年份 | 2023 |

| 预测年份 | 2024-2032 |

| 起始值 | 146亿美元 |

| 预测值 | 256亿美元 |

| 复合年增长率 | 6.5% |

就材质而言,市场分为塑胶、金属、木材和其他材料。 2023 年,塑胶部分占据了 41% 的市场份额,预计 2024 年至 2032 年期间将以 7% 的复合年增长率稳步增长。这种材料可以延长玩耍时间而不必担心损坏,是父母和孩子的理想选择。

美国仍然是建筑玩具的最大市场,2023 年的市场份额高达 82%。消费者可以比较各种产品、阅读评论,并在舒适的家中做出明智的决定。此外,订阅式玩具服务的日益普及进一步刺激了市场需求。这些服务为家长提供了方便,可以定期送货上门,获得包括建筑套件在内的益智玩具,确保孩子们无需到店就能获得有趣的、具有发展性的游戏体验。

目录

第 1 章:方法论与范围

- 市场范围和定义

- 基础估算与计算

- 预测计算。

- 资料来源

- 基本的

- 次要

- 付费来源

- 公共资源

第 2 章:执行摘要

第 3 章:产业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商概况

- 利润率分析。

- 重要新闻及倡议

- 监管格局

- 衝击力

- 成长动力

- 对益智玩具的兴趣增加

- 可支配所得和玩具支出增加

- 产业陷阱与挑战

- 市场饱和且竞争激烈

- 永续性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第 5 章:市场估计与预测:按产品类型,2021-2032 年

- 主要趋势

- 建构块

- 建筑套件

- 主题建筑玩具

- 磁性建筑玩具

- 其他(磁力砖等)

第 6 章:市场估计与预测:按材料,2021-2032 年

- 主要趋势

- 塑胶

- 木头

- 金属

- 其他(磁性等)

第七章:市场估计与预测:依年龄组,2021-2032 年

- 主要趋势

- 婴儿(0-2 岁)

- 幼儿(2-4 岁)

- 学龄前(4-6岁)

- 学龄前(6-8岁)

- 中童期(8-10岁)

第 8 章:市场估计与预测:按价格范围,2021 年至 2032 年

- 主要趋势

- 低的

- 中

- 高的

第九章:市场估计与预测:依性别,2021-2032 年

- 主要趋势

- 男孩们

- 女孩们

第 10 章:市场估计与预测:按配销通路,2021-2032 年

- 主要趋势

- 在线的

- 电子商务

- 公司网站

- 离线

- 超市

- 专卖店

- 其他(百货商场等)

第 11 章:市场估计与预测:按地区,2021-2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中东及非洲

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 12 章:公司简介

- Brio

- Bristle Blocks

- Fisher-Price

- Haba

- Hasbro

- Jakks Pacific

- K'NEX

- LeapFrog

- LEGO

- Lincoln Logs

- Mattel

- Melissa & Doug

- Playmobil

- Schleich

- Toysmith

The Global Construction Toys Market, valued at USD 14.6 billion in 2023, is expected to experience robust growth, with a CAGR of 6.5% from 2024 to 2032. As parents become more conscious of the developmental benefits that toys can offer, the demand for construction toys that foster learning, creativity, and cognitive growth is surging.

The construction toys market is divided into several key product types, including building blocks, construction sets, themed construction toys, magnetic construction toys, and others. Among these, building blocks dominate the market, with a valuation of USD 5.2 billion in 2023. This segment is anticipated to grow at an impressive CAGR of 6.9% during 2024-2032. Building blocks are cherished for their ability to enhance spatial awareness, stimulate problem-solving skills, and ignite creativity. These toys continue to be a favorite choice for parents and educators alike due to their proven contributions to children's cognitive development.

| Market Scope | |

|---|---|

| Start Year | 2023 |

| Forecast Year | 2024-2032 |

| Start Value | $14.6 Billion |

| Forecast Value | $25.6 Billion |

| CAGR | 6.5% |

In terms of material, the market is categorized into plastic, metal, wood, and other materials. The plastic segment accounted for 41% of the market share in 2023 and is projected to grow at a steady CAGR of 7% from 2024 to 2032. Plastic construction toys are particularly favored for their durability, lightweight design, and resistance to breakage, making them perfect for active play. This material allows for extended play sessions without worrying about damage, making it an ideal choice for both parents and children.

The United States remains the largest market for construction toys, holding a significant 82% market share in 2023. The demand in the U.S. is fueled by the easy accessibility of construction toys through online platforms and specialized toy retailers. Consumers can compare various products, read reviews, and make informed decisions from the comfort of their homes. Additionally, the growing popularity of subscription-based toy services has further boosted market demand. These services offer parents convenient access to regular deliveries of educational toys, including construction kits, ensuring children have engaging and developmental play experiences without the need for in-store visits.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increased interest in developmental toys

- 3.6.1.2 Rising disposable income and spending on toys

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2032 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Building blocks

- 5.3 Construction sets

- 5.4 Themed construction toys

- 5.5 Magnetic construction toys

- 5.6 Others (magnetic tiles, etc.)

Chapter 6 Market Estimates & Forecast, By Material, 2021-2032 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Wood

- 6.4 Metal

- 6.5 Others (magnetic, etc.)

Chapter 7 Market Estimates & Forecast, By Age Group, 2021-2032 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Infants (0-2 years)

- 7.3 Toddlers (2-4 years)

- 7.4 Preschool (4-6 years)

- 7.5 Early school age (6-8 years)

- 7.6 Middle childhood (8-10 years)

Chapter 8 Market Estimates & Forecast, By Price Range, 2021-2032 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Mid

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Gender, 2021-2032 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Boys

- 9.3 Girls

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2032 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline

- 10.3.1 Supermarkets

- 10.3.2 Specialty stores

- 10.3.3 Others (departmental stores, etc.)

Chapter 11 Market Estimates & Forecast, By Region, 2021-2032 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Brio

- 12.2 Bristle Blocks

- 12.3 Fisher-Price

- 12.4 Haba

- 12.5 Hasbro

- 12.6 Jakks Pacific

- 12.7 K'NEX

- 12.8 LeapFrog

- 12.9 LEGO

- 12.10 Lincoln Logs

- 12.11 Mattel

- 12.12 Melissa & Doug

- 12.13 Playmobil

- 12.14 Schleich

- 12.15 Toysmith